Offering Details

Back

Under Review / Vermilion Energy Inc.

Vermilion Energy Inc.

Property Divestiture

Property DivestitureBid Deadline: November 23, 2023

12:00 PM

Download Full PDF - Printable

OVERVIEW

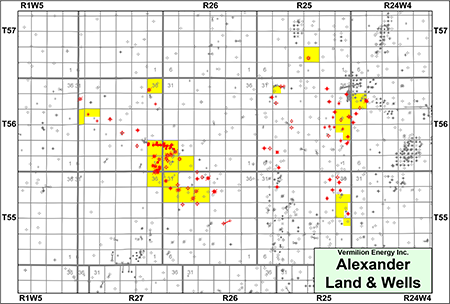

At Alexander, Vermilion holds primarily operated working interests in approximately 17.25 sections of land. Production from the Alexander property is primarily from the Wabamun, Detrital and Alexander formations. Additional targets include the Mannville Group.

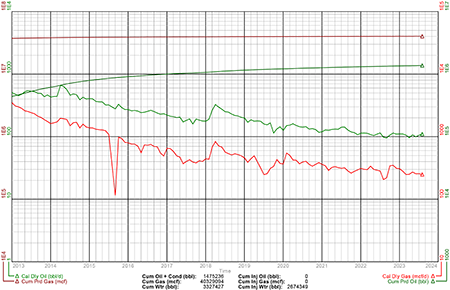

Average daily sales production net to Vermilion from Alexander for the first quarter of 2023 was approximately 149 boe/d, consisting of 110 bbl/d of oil and natural gas liquids and 231 Mcf/d of natural gas.

Operating income net to Vermilion from Alexander for the first quarter of 2023 was approximately $127,500 per month, or $1.5 million on an annualized basis.

ALEXANDER

At Alexander, Vermilion holds primarily operated working interests in approximately 17.25 sections of land.

Production from the Alexander property is primarily from the Wabamun, Detrital and Alexander formations. Additional targets include the Mannville Group.

Average daily sales production net to Vermilion from Alexander for the first quarter of 2023 was approximately 149 boe/d, consisting of 110 bbl/d of oil and natural gas liquids and 231 Mcf/d of natural gas.

Operating income net to Vermilion from Alexander for the first quarter of 2023 was approximately $127,500 per month, or $1.5 million on an annualized basis.

At Alexander, Vermilion has identified additional development targets in the Mannville Group which include recompletions and up to 20 potential new horizontal drilling locations.

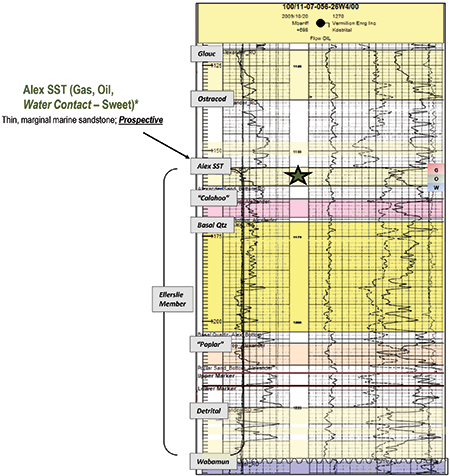

The Detrital and Basal Quartz are the lowermost target zones of the Ellerslie Member which are prospective for oil and natural gas. The Alexander Sands, or Alex, of the uppermost zone is also prospective for oil and natural gas.

The Alex sandstone is found at a depth of approximately 1,150 metres and was deposited in a marginal marine setting. The sand consists of approximately 2-6 metres of pay with an underlying water contact. The Alex is the uppermost Cretaceous sand of the Ellerslie Member. The Alex is a fine-grained, moderately to well-sorted silica cemented quartzose with high intergranular porosity.

The play is defined by a stratigraphic trap with an oil/water contact at approximately 466 metres and a gas cap at 457 metres. Porosity ranges from 12-18% and permeability of up to 100 mD.

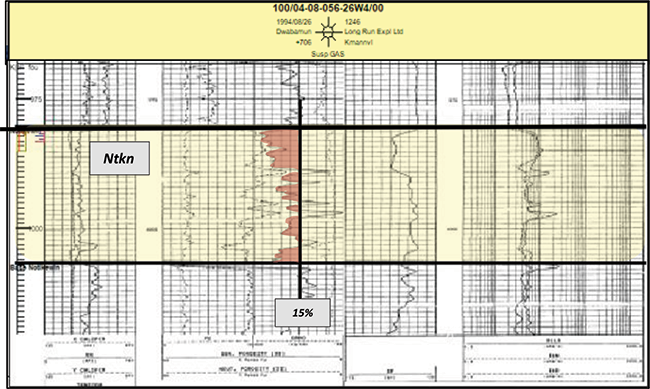

Vermilion has also identified an opportunity to develop conventional natural gas in the Notikewin Formation as shown in the following type log.

Long Run Alexander 100/04-08-56-26W4/0

Notikewin Formation Type Log

The Notikewin is a sandstone-rich channel system with up to 15% porosity. The Notikewin development in the area to date has been predominantly vertical. There have been two wells completed in the Notikewin reservoir with small perforation jobs.

The 100/04-08-056-26W4/0 well has produced over two Bcf of cumulative natural gas and the 100/15-18-056-26W4/0 well has produced approximately 400 MMcf of cumulative natural gas.

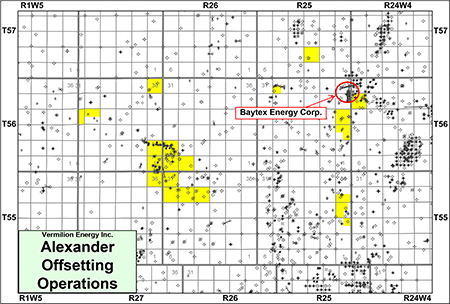

As shown on the following plat, Baytex Energy Corp. drilled the horizontal multi-leg well BAYTEX HZ MORINV 00/08-25-056-25W4/05 just offsetting Vermilion’s land at Alexander in November 2022. The well was drilled to a true vertical depth of approximately 1,000 metres and came on production in February 2023. The well has produced approximately 28,000 barrels (130 bbl/d) of oil as of August 31, 2023.

Alexander Seismic

In the Alexander area, Vermilion has an interest in various 2D and 3D seismic data. More details relating to the seismic will be available in the virtual data room for parties that execute a confidentiality agreement.

Alexander Marketing

Oil production from Alexander is trucked to Secure Energy Services Inc.’s Buck Creek/Drayton Valley facilities. Volumes are set up as a buy/sell where Secure returns the volumes to Vermilion at Edmonton.

Natural gas from Alexander goes through the ATCO-connected Sturgeon APN meter and included in TC Energy Corporation’s NGTL system. Natural gas from Alexander is sold at AECO daily or monthly price.

Alexander Facilities

At Alexander, Vermilion owns and operates the Spartan Alexander Gas Plant and natural gas gathering system located at 03-07-056-26W4, natural gas gathering system at 03/08-01-056-27W4, an injection plant located at 08-01-056-27W4, and a compressor station located at 05-31-055-26W4 as well as several single and multi-well batteries. Further details on the Company’s facilities are available in the virtual data room for parties that execute a confidentiality agreement.

Alexander Reserves

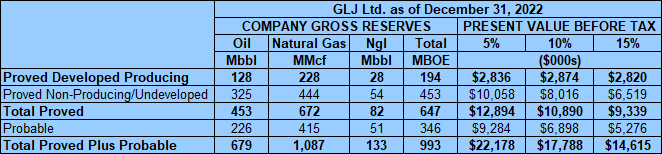

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Property as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2022 using an average of GLJ, McDaniel & Associates Consultants Ltd. and Sproule Associates Limited’s January 1, 2023 forecast pricing (“3C Average”).

GLJ estimated that, as of December 31, 2022, the Alexander property contained remaining proved plus probable reserves of 812,000 barrels of oil and natural gas liquids and 1.1 Bcf of natural gas (993,000 boe), with an estimated net present value of $17.8 million using forecast pricing at a 10% discount.

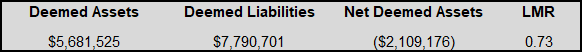

Alexander LMR

As of October 7, 2023, the Alexander property had a deemed net asset value of ($2.1 million) (deemed assets of $5.7 million and deemed liabilities of $7.8 million), with an LMR ratio of 0.73.

Alexander Well List

Click here to download the complete well list in Excel.

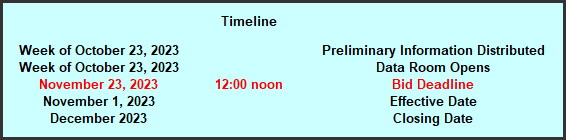

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Property until 12:00 pm on Thursday November 23, 2023.

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday November 23, 2023.

NOTE REGARDING A SAYER PROCESS

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).Included in the confidential information is the following: summary land information, the GLJ Report, LMR information, most recent net operations summary and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Property please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.