Offering Details

Back

Undeveloped Land / A2N Energy Corporation

A2N Energy Corporation

Property Divestiture

Property DivestitureBid Deadline: October 19, 2023

12:00 PM

Download Full PDF - Printable

OVERVIEW

A2N'S MINERAL INTERESTS AT JUDY CREEK HAVE EXPIRED.

A2N Energy Corporation (“A2N” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of its oil and natural gas interests located in the Calling Lake West, Judy Creek and Therien areas of Alberta (the “Properties”).

The Properties consist of 100% working interests in Crown mineral rights with prospective drilling locations for oil and natural gas primarily in the Mannville Group, Grand Rapids, Wabiskaw, McMurray and Wabamun formations.

A2N believes there is potential to drill vertical and horizontal wells on its lands. Further details on the Properties are available in the virtual data room for parties that execute a confidentiality agreement.

At Calling Lake West, A2N has a 100% working interest in an oilsands lease from the top of the Viking to the base of the Woodbend Group in two sections of land. Calling Lake West is located within the Athabasca oilsands deposit.

At Judy Creek, A2N has a 100% working interest in one section of land. On the east half of Section 05-064-11W5, A2N owns the P&NG rights from surface to basement. On the west half of Section 05-064-11W5, A2N owns the P&NG rights from the base of the Beaverhill Lake Group to basement.

At Therien, A2N has a 100% working interest in an oilsands lease in the Mannville zone in 12 sections of land.

LMR Summary

A2N does not own an interest in any wells or facilities.

Seismic Overview

The Company does not have ownership in any seismic data.

Reserves Overview

A2N does not have a third-party reserve report.

A2N Energy Corporation (“A2N” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of its oil and natural gas interests located in the Calling Lake West, Judy Creek and Therien areas of Alberta (the “Properties”).

The Properties consist of 100% working interests in Crown mineral rights with prospective drilling locations for oil and natural gas primarily in the Mannville Group, Grand Rapids, Wabiskaw, McMurray and Wabamun formations.

A2N believes there is potential to drill vertical and horizontal wells on its lands. Further details on the Properties are available in the virtual data room for parties that execute a confidentiality agreement.

At Calling Lake West, A2N has a 100% working interest in an oilsands lease from the top of the Viking to the base of the Woodbend Group in two sections of land. Calling Lake West is located within the Athabasca oilsands deposit.

At Judy Creek, A2N has a 100% working interest in one section of land. On the east half of Section 05-064-11W5, A2N owns the P&NG rights from surface to basement. On the west half of Section 05-064-11W5, A2N owns the P&NG rights from the base of the Beaverhill Lake Group to basement.

At Therien, A2N has a 100% working interest in an oilsands lease in the Mannville zone in 12 sections of land.

LMR Summary

A2N does not own an interest in any wells or facilities.

Seismic Overview

The Company does not have ownership in any seismic data.

Reserves Overview

A2N does not have a third-party reserve report.

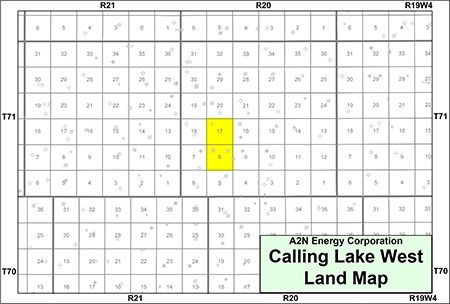

CALLING LAKE WEST

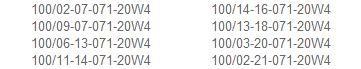

Township 71, Range 20 W4At Calling Lake West, A2N has a 100% working interest in an oilsands lease from the top of the Viking to the base of the Woodbend Group in two sections of land. Calling Lake West is located within the Athabasca oilsands deposit.

Previously, there were three wells drilled and tested in the Wabamun Formation on the Company’s lands. A2N does not have an interest in these wells. The oilsands lease is valid until June 2029.

At Calling Lake West, the Company is targeting bitumen in the Lower Cretaceous Viking and Grand Rapids formations as well as the Upper Devonian Wabamun Group. There has been crude bitumen production from wells targeting Grand Rapids Formation in the area.

The well 100/09-08-071-20W4 owned by Cenovus Energy Inc. has an oil pay zone in the lower sub layer of the Wabamun Formation on A2N’s lands between 524-529 metres.

The Company has also identified oil and natural gas pipelines and facilities within and surrounding the property, 10 kilometres to the southeast and 15 kilometres to the southwest.

A2N has analyzed the wells in the area to understand the thickness of oil-bearing sands. The key wells studied by A2N were:

Further details of the analysis will be made available to parties that execute a confidentiality agreement.

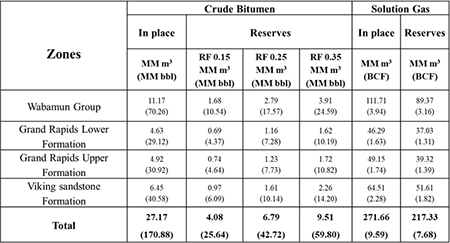

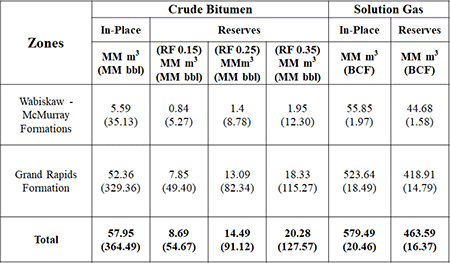

The following table summarizes A2N’s estimates of the bitumen in place for all zones on its lands at Calling Lake West.

The Company has identified three initial drilling locations in the Grand Rapids as shown on the following map.

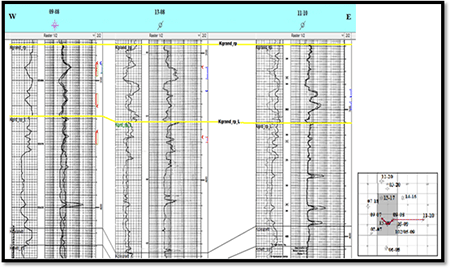

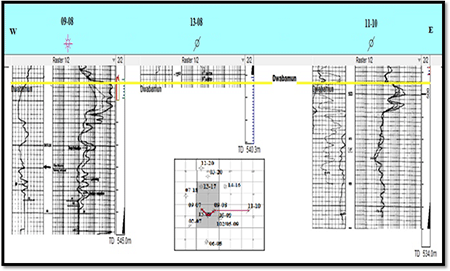

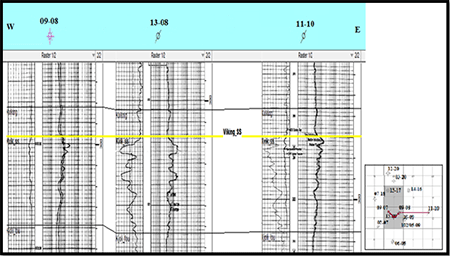

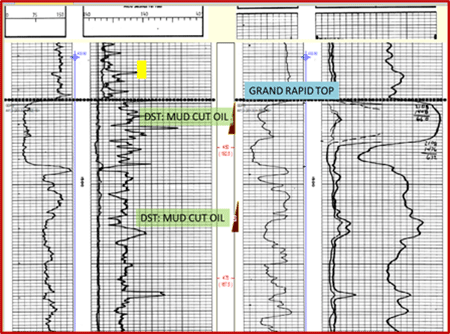

The following stratigraphic cross section from E-W shows the Grand Rapids Formation at Calling Lake West.

The following stratigraphic cross section from E-W shows the Wabamun Formation at Calling Lake West.

The following stratigraphic cross section from E-W shows the Viking Formation at Calling Lake West.

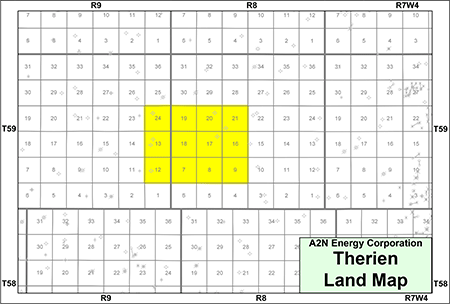

THERIEN

Township 59, Range 8-9 W4A2N has a 100% working interest in an oilsands lease in the Mannville zone in 12 sections of land at Therien. Therien is located within the Cold Lake oilsands deposit.

Previously, there were seven wells drilled on the Company’s lands. A2N does not have an interest in these wells. The oilsands lease is valid until October 2029.

At Therien, the Company is targeting bitumen in the Lower Cretaceous Grand Rapids and Wabiskaw-McMurray formations of the Mannville Group. In the area there has been crude bitumen production from wells targeting the Grand Rapids and Wabiskaw-McMurray formations.

The Company has also identified oil and natural gas pipelines and facilities available in close proximity to the property.

A2N has analyzed the wells in the area to understand the thickness of oil-bearing sands and determined a minimum thickness of four metres with porosity of approximately 30%. The key wells studied by A2N were:

The well 100/11-24-059-09W4 on the Company’s lands showed oil cut mud in the DST at 10.3° API and the well log indicates oil pay of eight metres. There is no evidence of a gas cap at Therien but the oil/water contact is evident.

The well 100/09-23-059-09W4 to the west of Therien showed oil cut mud in the DST. The well 100/10-20-059-08W4 well log indicates oil pay of four metres.

Additionally, there is third-party 2D seismic data coverage over the Company’s lands and in the area.

Canadian Natural Resources Limited has operations offsetting the property to the east with production from the Grand Rapids Formation. The Company has correlated the Grand Rapids production held by Canadian Natural and believes the area is similar A2N’s lands.

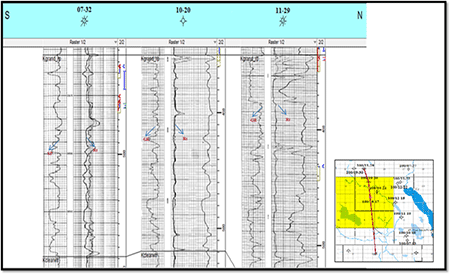

The following stratigraphic cross section from N-S shows the Grand Rapids Formation at Therien.

The following table summarizes A2N’s estimates of the bitumen in place for all zones on the Company’s lands.

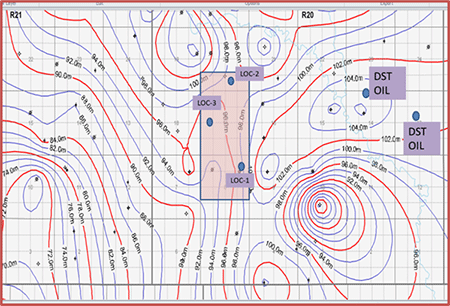

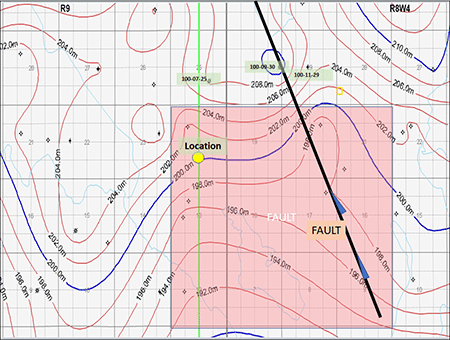

The Company has determined the gas/oil contact is at 202 metres subsea and the oil/water contact is at 193 metres subsea as shown on the following structure map. A2N believes the eastern boundary will be limited by a fault as shown below.

The Company has identified an initial drilling location in the Grand Rapids as shown in yellow in the following map.

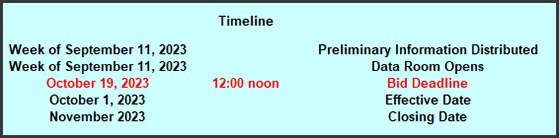

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Properties until 12:00 pm on Thursday, October 19, 2023.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties

until noon on Thursday, October 19, 2023.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Property with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).Included in the confidential information is the following: mineral property reports, geological presentations and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.