Offering Details

Back

Under Review / Corex Resources Ltd.

Corex Resources Ltd.

Property Divestiture

Property DivestitureBid Deadline: December 14, 2023

12:00 PM

Download Full PDF - Printable

OVERVIEW

Corex Resources Ltd. (“Corex” or the “Company”) has engaged Sayer Energy Advisors to assist it with the sale of its working interests located in the Cecil area of Alberta (the “Property”).

At Cecil, Corex holds predominantly operated working interests ranging from 40%-100% in 3.25 sections of land. Production from the Cecil property is primarily from the Charlie Lake Formation.

Average daily sales production net to Corex from Cecil for the months of July and August of 2023 was approximately 65 boe/d, consisting of 58 bbl/d of oil and natural gas liquids and 40 Mcf/d of natural gas.

Operating income net to Corex from Cecil for the months of July and August 2023 was approximately $112,000 per month, or $1.3 million on an annualized basis.

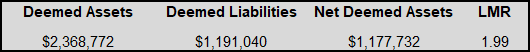

As of October 7, 2023, the Cecil property had a deemed net asset value of $1.2 million (deemed assets of $2.4 million and deemed liabilities of $1.2 million), with an LMR ratio of 1.99.

At Cecil, Corex holds predominantly operated working interests ranging from 40%-100% in 3.25 sections of land. Production from the Cecil property is primarily from the Charlie Lake Formation.

Average daily sales production net to Corex from Cecil for the months of July and August of 2023 was approximately 65 boe/d, consisting of 58 bbl/d of oil and natural gas liquids and 40 Mcf/d of natural gas.

Operating income net to Corex from Cecil for the months of July and August 2023 was approximately $112,000 per month, or $1.3 million on an annualized basis.

As of October 7, 2023, the Cecil property had a deemed net asset value of $1.2 million (deemed assets of $2.4 million and deemed liabilities of $1.2 million), with an LMR ratio of 1.99.

CECIL

Township 83-84, Range 7-8 W6

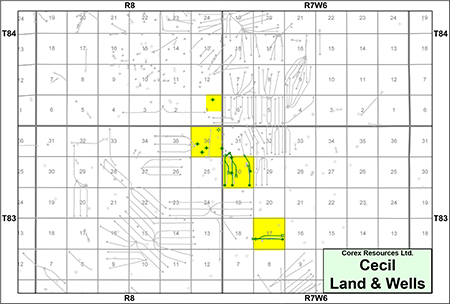

At Cecil, Corex holds predominantly operated working interests ranging from 40%-100% in 3.25 sections of land. Production from Cecil is primarily from the Charlie Lake Formation.

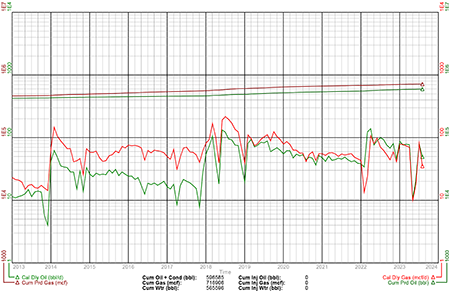

Average daily sales production net to Corex from Cecil for the months of July and August of 2023 was approximately 65 boe/d, consisting of 58 bbl/d of oil and natural gas liquids and 40 Mcf/d of natural gas.

Operating income net to Corex from Cecil for the months of July and August 2023 was approximately $112,000 per month, or $1.3 million on an annualized basis.

At Cecil, Corex holds predominantly operated working interests ranging from 40%-100% in 3.25 sections of land. Production from Cecil is primarily from the Charlie Lake Formation.

Average daily sales production net to Corex from Cecil for the months of July and August of 2023 was approximately 65 boe/d, consisting of 58 bbl/d of oil and natural gas liquids and 40 Mcf/d of natural gas.

Operating income net to Corex from Cecil for the months of July and August 2023 was approximately $112,000 per month, or $1.3 million on an annualized basis.

The production decline in the second quarter of 2023 was attributed to the wildfires which occurred in May and June.

Offsetting Operations

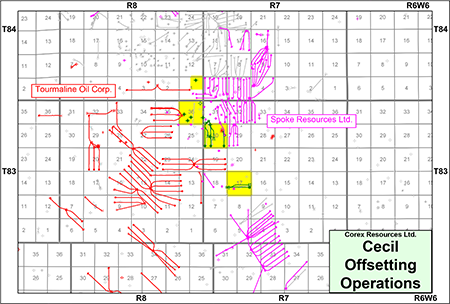

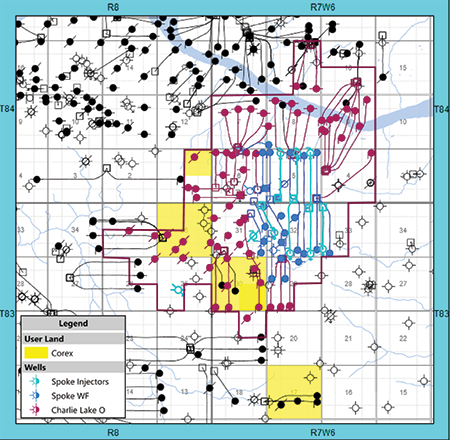

At Cecil, there is extensive development surrounding Corex’s lands as shown on the following map. Tourmaline Oil Corp. has developed the Charlie Lake UU Pool directly offsetting Corex’s lands to the west with horizontal drilling (shown in red) and Spoke Resources Ltd. is developing the Charlie Lake O Pool to the east of Corex’s lands in the north portion of the Property (shown in pink) which is under waterflood.

Offsetting Operations

At Cecil, there is extensive development surrounding Corex’s lands as shown on the following map. Tourmaline Oil Corp. has developed the Charlie Lake UU Pool directly offsetting Corex’s lands to the west with horizontal drilling (shown in red) and Spoke Resources Ltd. is developing the Charlie Lake O Pool to the east of Corex’s lands in the north portion of the Property (shown in pink) which is under waterflood.

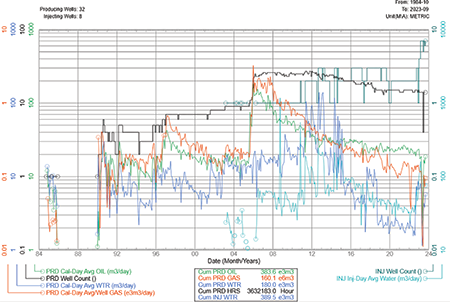

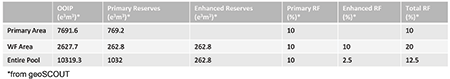

The following map shows the Charlie Lake O Pool currently under waterflood development by Spoke.

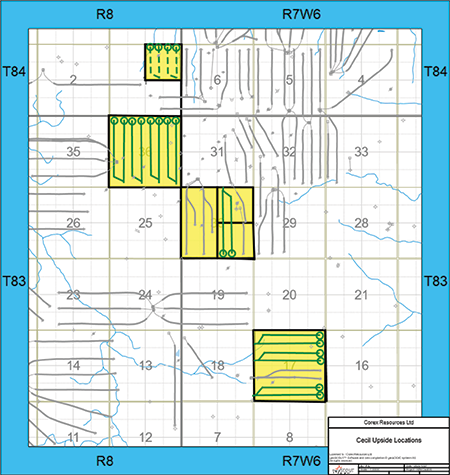

Cecil Upside

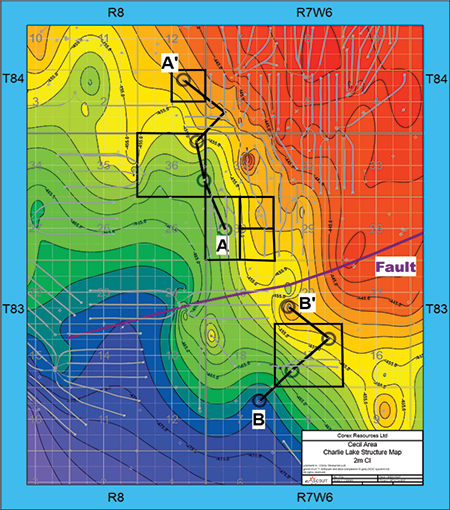

Based on geological evaluation and mapping, the Company has recognized two separate pools over the north and south of its lands at Cecil. The Cecil north Charlie Lake pool over the Company’s lands to the north and the Cecil South Charlie Lake pool over Section 17-083-07W6. Further details on the geology and upside will be available in the virtual data room for parties that sign a confidentiality agreement.

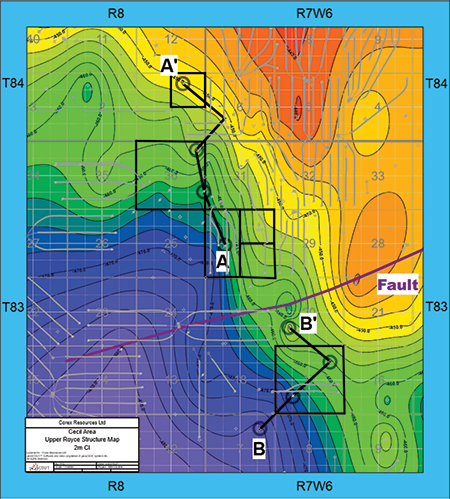

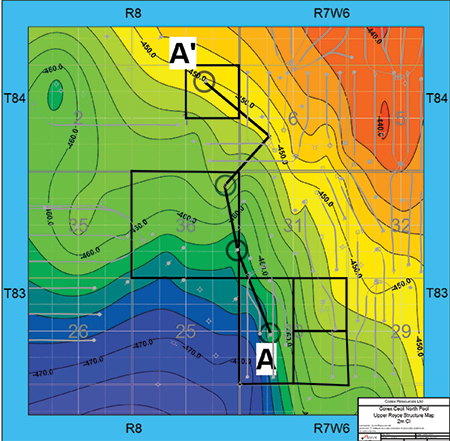

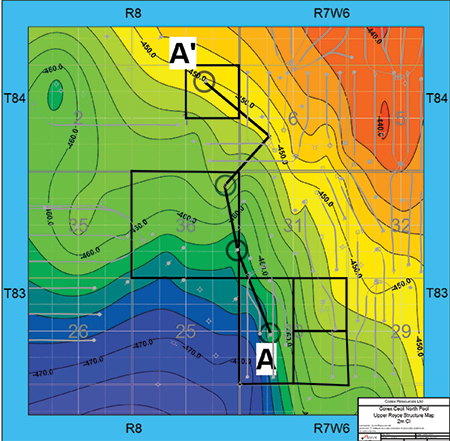

The following maps show the structure of the Charlie Lake and Upper Royce formations at Cecil.

Based on geological evaluation and mapping, the Company has recognized two separate pools over the north and south of its lands at Cecil. The Cecil north Charlie Lake pool over the Company’s lands to the north and the Cecil South Charlie Lake pool over Section 17-083-07W6. Further details on the geology and upside will be available in the virtual data room for parties that sign a confidentiality agreement.

The following maps show the structure of the Charlie Lake and Upper Royce formations at Cecil.

Cecil North Pool

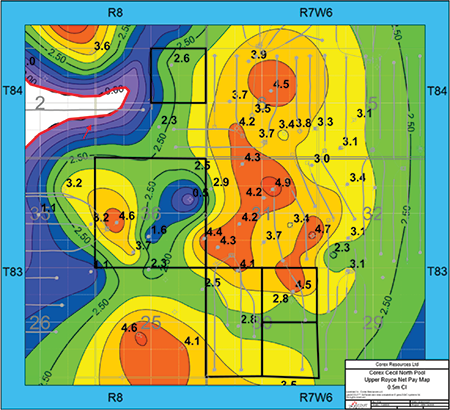

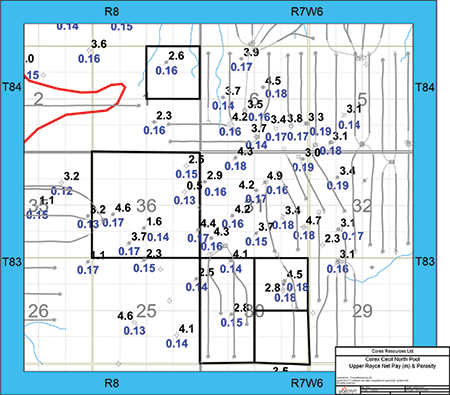

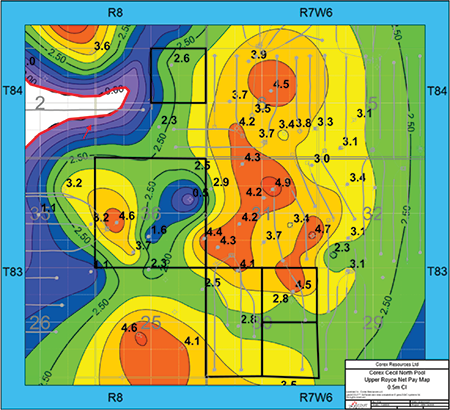

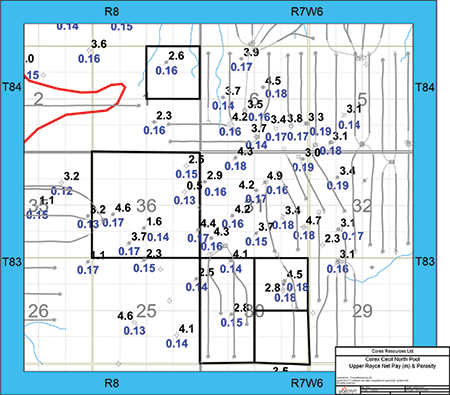

The Charlie Lake Formation in the Cecil north pool has an average net pay of 3.3 metres with average porosity of 16% and water saturation of 37%.

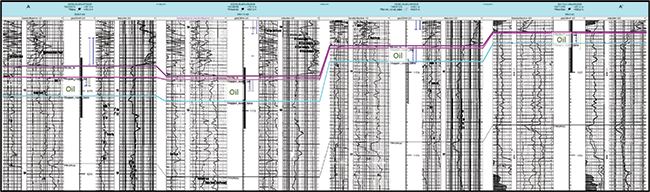

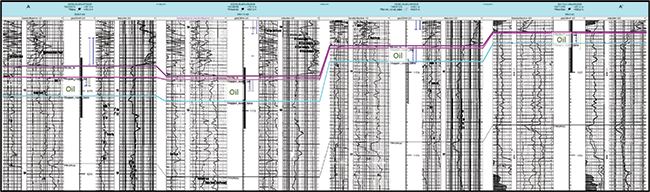

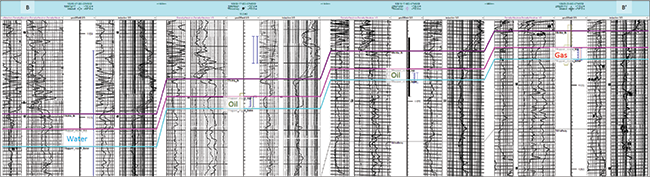

The following cross section shows the Charlie Lake and Upper Royce formations in the north portion of the Property.

The Charlie Lake Formation in the Cecil north pool has an average net pay of 3.3 metres with average porosity of 16% and water saturation of 37%.

The following cross section shows the Charlie Lake and Upper Royce formations in the north portion of the Property.

Cecil North Pool

Structural Cross Section A-A'

Cecil North

Upper Royce Member Structure Map

Cecil North

Upper Royce Member Net Pay Map

Cecil North

Upper Royce Member Net Pay & Porosity Map

Structural Cross Section A-A'

Cecil North

Upper Royce Member Structure Map

Cecil North

Upper Royce Member Net Pay Map

Cecil North

Upper Royce Member Net Pay & Porosity Map

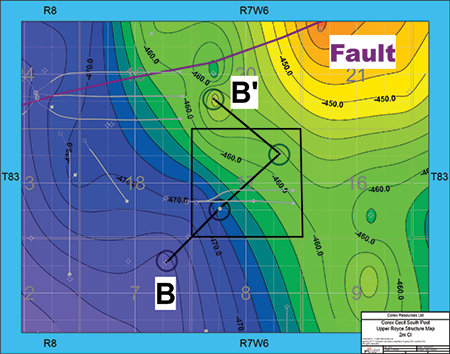

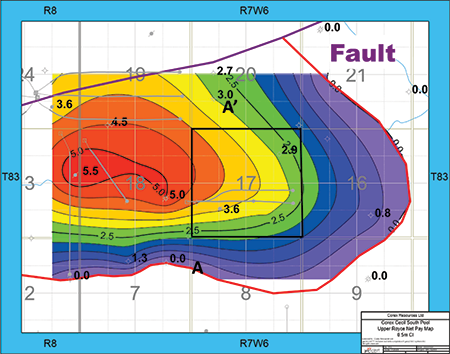

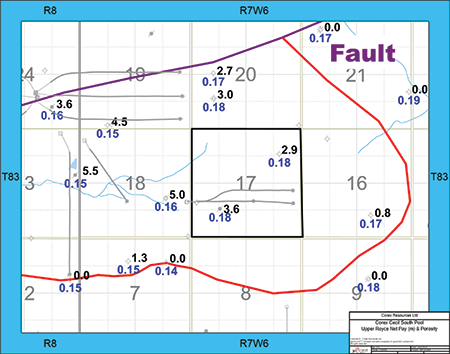

Cecil South Pool

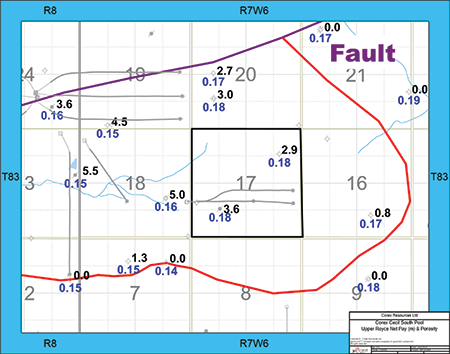

The Charlie Lake Formation in the Cecil south pool has an average net pay of 3.3 metres with average porosity of 18% and water saturation of 37%.

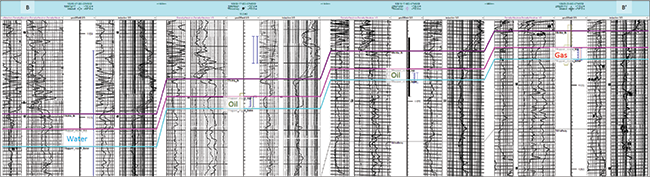

The following cross section shows the Charlie Lake and Upper Royce formations in the south portion of the Property.

The Charlie Lake Formation in the Cecil south pool has an average net pay of 3.3 metres with average porosity of 18% and water saturation of 37%.

The following cross section shows the Charlie Lake and Upper Royce formations in the south portion of the Property.

Cecil South Pool

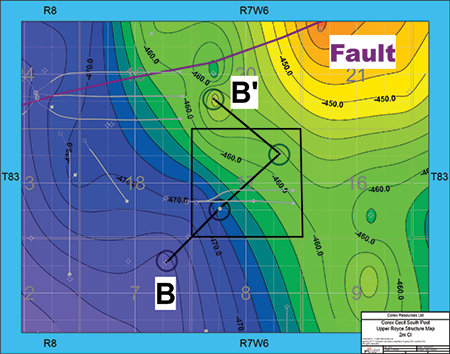

Structural Cross Section B-B'

Cecil South

Upper Royce Member Structure Map

Cecil South

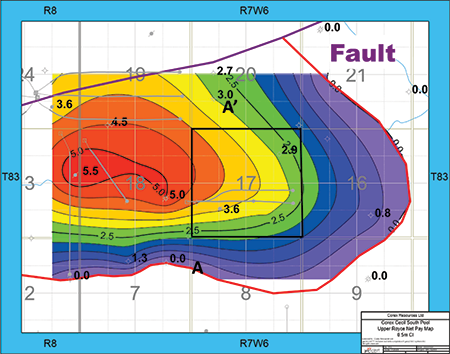

Upper Royce Member Net Pay Map

Cecil South

Upper Royce Member Net Pay & Porosity Map

Structural Cross Section B-B'

Cecil South

Upper Royce Member Structure Map

Cecil South

Upper Royce Member Net Pay Map

Cecil South

Upper Royce Member Net Pay & Porosity Map

The Company has 16 horizontal drilling locations with probable undeveloped reserves assigned and four additional unbooked locations in the northeast quarter of Section 01-084-08W6 as shown on the following map.

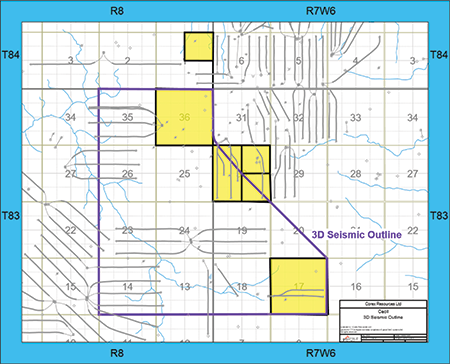

Cecil Seismic

In the Cecil area, Corex has an interest in certain trade 3D seismic data. More details relating to the seismic will be available in the virtual data room for parties that execute a confidentiality agreement.

Corex has a seismic license that allows them to utilize and analyze the 3D seismic data. The license is not transferable upon a transaction. The acquiring company will need to obtain their own seismic license from the owner of the seismic data.

In the Cecil area, Corex has an interest in certain trade 3D seismic data. More details relating to the seismic will be available in the virtual data room for parties that execute a confidentiality agreement.

Corex has a seismic license that allows them to utilize and analyze the 3D seismic data. The license is not transferable upon a transaction. The acquiring company will need to obtain their own seismic license from the owner of the seismic data.

Cecil Marketing

Corex’s wells are pipeline connected to the Spoke Resources Ltd. 14-31-083-07W6 multi-well battery. Marketing of Corex’s crude oil and associated solution gas is handled by Contango Commodity Marketing Inc.

Cecil Facilities

At Cecil, Corex owns a multi-well battery located at 00/03-36-083-08W6.

Further details on the Company’s facilities are available in the virtual data room for parties that execute a confidentiality agreement.

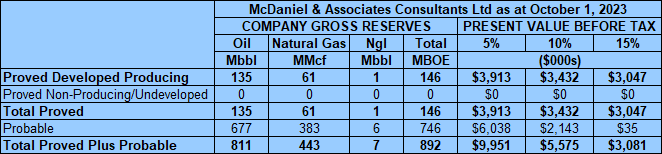

Cecil Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Property as a mechanical update of the evaluation which was completed as part of the Company’s 2022 year-end reporting (the “McDaniel Report”). The McDaniel Report is effective October 1, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s October 1, 2023 forecast pricing (“3C Average”).

McDaniel estimated that, as of October 1, 2023, the Cecil property contained remaining proved plus probable reserves of 818,000 barrels of oil and natural gas liquids and 443 MMcf of natural gas (892,000 boe), with an estimated net present value of $5.6 million using forecast pricing at a 10% discount.

Corex’s wells are pipeline connected to the Spoke Resources Ltd. 14-31-083-07W6 multi-well battery. Marketing of Corex’s crude oil and associated solution gas is handled by Contango Commodity Marketing Inc.

Cecil Facilities

At Cecil, Corex owns a multi-well battery located at 00/03-36-083-08W6.

Further details on the Company’s facilities are available in the virtual data room for parties that execute a confidentiality agreement.

Cecil Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Property as a mechanical update of the evaluation which was completed as part of the Company’s 2022 year-end reporting (the “McDaniel Report”). The McDaniel Report is effective October 1, 2023 using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s October 1, 2023 forecast pricing (“3C Average”).

McDaniel estimated that, as of October 1, 2023, the Cecil property contained remaining proved plus probable reserves of 818,000 barrels of oil and natural gas liquids and 443 MMcf of natural gas (892,000 boe), with an estimated net present value of $5.6 million using forecast pricing at a 10% discount.

Cecil LMR as of October 7, 2023

As of October 7, 2023, the Cecil property had a deemed net asset value of $1.2 million (deemed assets of $2.4 million and deemed liabilities of $1.2 million), with an LMR ratio of 1.99.

As of October 7, 2023, the Cecil property had a deemed net asset value of $1.2 million (deemed assets of $2.4 million and deemed liabilities of $1.2 million), with an LMR ratio of 1.99.

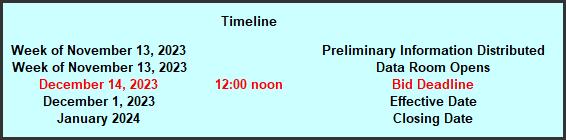

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Property until 12:00 pm on Thursday December 14, 2023.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday December 14, 2023.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Property with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, the McDaniel Report, LMR information, most recent net operations summary, and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Property please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.