Offering Details

Back

Under Review / Outpost Energy Ltd.

Outpost Energy Ltd.

Corporate Divestiture

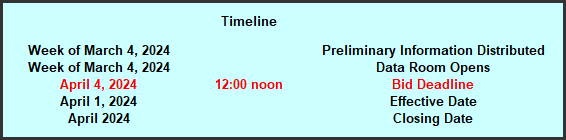

Corporate DivestitureBid Deadline: April 4, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

OUTPOST HAS SOLD ITS INTERESTS IN THE RAINBOW LAKE AREA OF ALBERTA.

Outpost Energy Ltd. (“Outpost” or the “Company”) has engaged Sayer Energy Advisors to assist it with a corporate sale process.

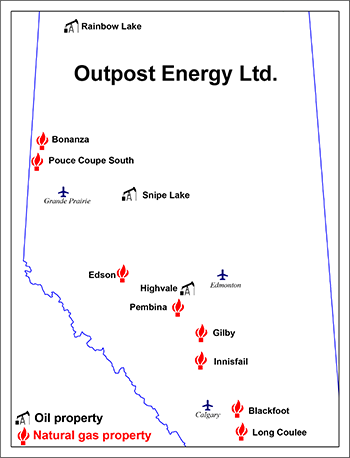

Outpost is a private junior oil and natural gas company with operated working interests located in the Blackfoot, Bonanza, Edson, Gilby, Highvale, Innisfail, Long Coulee, Pembina, Pouce Coupe South, Rainbow Lake and Snipe Lake areas of Alberta as well as non-producing properties located throughout Alberta (the “Properties”).

Forecasted average daily sales production net to Outpost from the Properties on a proved developed producing basis for the year ended December 31, 2024 is approximately 395 boe/d, consisting of approximately 2.0 MMcf/d of natural gas and 57 bbl/d of oil and natural gas liquids.

Forecasted operating income net to Outpost on a proved developed producing basis for the year ended December 31, 2024 is approximately $1.4 million.

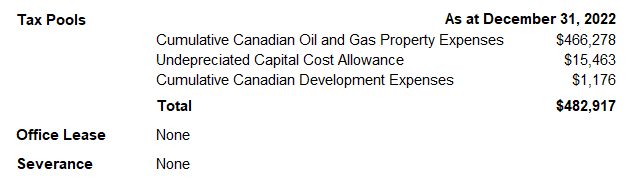

The Company has minimal bank debt and positive working capital. As at December 31, 2022, Outpost had total unused Canadian income tax pools of approximately $483,000.

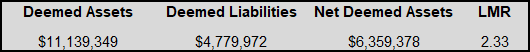

As of February 3, 2024, Outpost had a deemed net asset value of $6.4 million (deemed assets of $11.1 million and deemed liabilities of $4.8 million), with an LMR ratio of 2.33.

Additional corporate information relating to Outpost will be provided to parties upon execution of a confidentiality agreement.

Outpost’s preference is a sale of the shares of the Company but it will also entertain offers for the individual Properties.

Outpost Energy Ltd. (“Outpost” or the “Company”) has engaged Sayer Energy Advisors to assist it with a corporate sale process.

Outpost is a private junior oil and natural gas company with operated working interests located in the Blackfoot, Bonanza, Edson, Gilby, Highvale, Innisfail, Long Coulee, Pembina, Pouce Coupe South, Rainbow Lake and Snipe Lake areas of Alberta as well as non-producing properties located throughout Alberta (the “Properties”).

Forecasted average daily sales production net to Outpost from the Properties on a proved developed producing basis for the year ended December 31, 2024 is approximately 395 boe/d, consisting of approximately 2.0 MMcf/d of natural gas and 57 bbl/d of oil and natural gas liquids.

Forecasted operating income net to Outpost on a proved developed producing basis for the year ended December 31, 2024 is approximately $1.4 million.

The Company has minimal bank debt and positive working capital. As at December 31, 2022, Outpost had total unused Canadian income tax pools of approximately $483,000.

As of February 3, 2024, Outpost had a deemed net asset value of $6.4 million (deemed assets of $11.1 million and deemed liabilities of $4.8 million), with an LMR ratio of 2.33.

Additional corporate information relating to Outpost will be provided to parties upon execution of a confidentiality agreement.

Outpost’s preference is a sale of the shares of the Company but it will also entertain offers for the individual Properties.

Corporate Overview

Outpost is a tightly-held private junior oil and natural gas company with one shareholder, and no debt or severance obligations.

The Company has minimal bank debt and positive working capital.

As at December 31, 2022, Outpost had total unused Canadian income tax pools of approximately $483,000 as outlined below.

Additional corporate information relating to Outpost will be provided to parties upon execution of a confidentiality agreement.

Outpost is a tightly-held private junior oil and natural gas company with one shareholder, and no debt or severance obligations.

The Company has minimal bank debt and positive working capital.

As at December 31, 2022, Outpost had total unused Canadian income tax pools of approximately $483,000 as outlined below.

Additional corporate information relating to Outpost will be provided to parties upon execution of a confidentiality agreement.

Production Overview

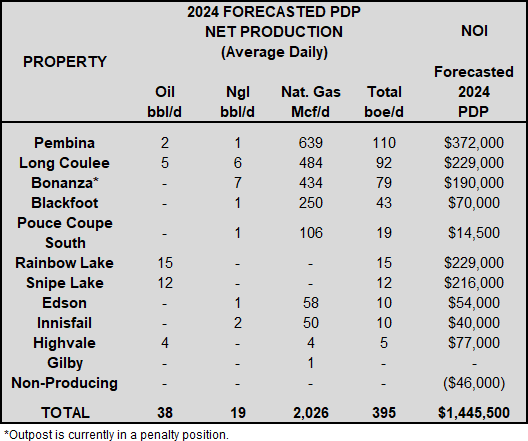

Forecasted average daily sales production net to Outpost from the Properties on a proved developed producing basis for the year ended December 31, 2024 is approximately 395 boe/d, consisting of approximately 2.0 MMcf/d of natural gas and 57 bbl/d of oil and natural gas liquids as outlined below.

Forecasted operating income net to Outpost on a proved developed producing basis for the year ended December 31, 2024 is approximately $1.4 million as outlined below.

Forecasted average daily sales production net to Outpost from the Properties on a proved developed producing basis for the year ended December 31, 2024 is approximately 395 boe/d, consisting of approximately 2.0 MMcf/d of natural gas and 57 bbl/d of oil and natural gas liquids as outlined below.

Forecasted operating income net to Outpost on a proved developed producing basis for the year ended December 31, 2024 is approximately $1.4 million as outlined below.

LMR Summary

As of February 3, 2024, Outpost had a deemed net asset value of $6.4 million (deemed assets of $11.1 million and deemed liabilities of $4.8 million), with an LMR ratio of 2.33.

As of February 3, 2024, Outpost had a deemed net asset value of $6.4 million (deemed assets of $11.1 million and deemed liabilities of $4.8 million), with an LMR ratio of 2.33.

Seismic Overview

The Company does not have an interest in any seismic data relating to the Properties.

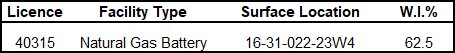

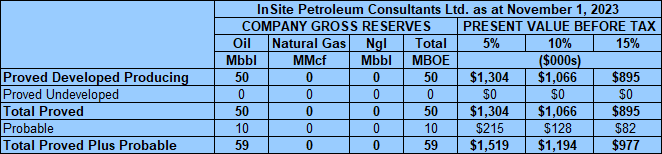

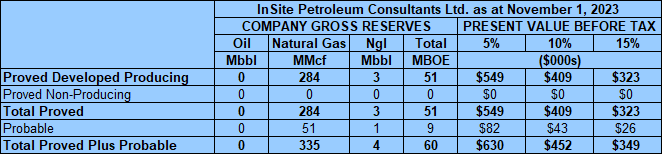

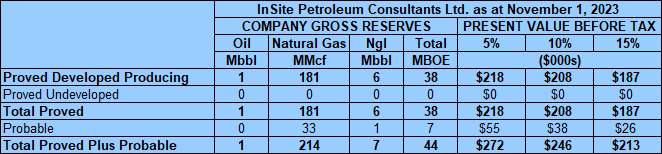

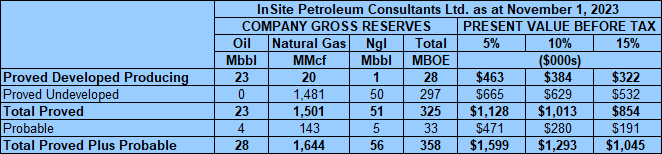

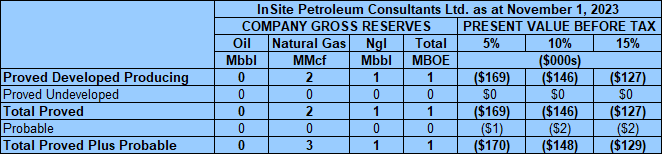

Reserves Overview

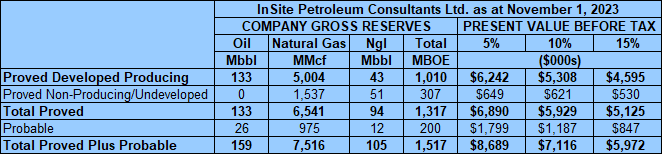

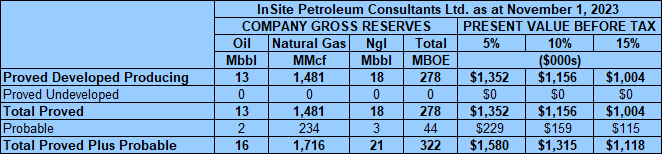

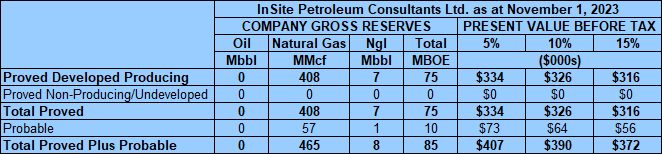

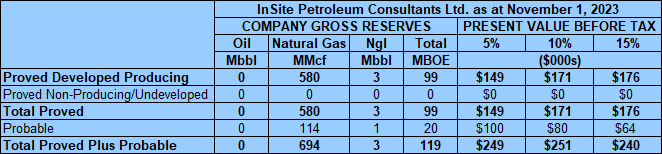

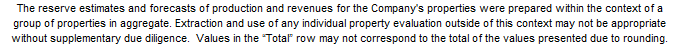

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Properties contained remaining proved plus probable reserves of 7.5 Bcf of natural gas and 264,000 barrels of oil and natural gas liquids (1.5 million boe), with an estimated net present value of $7.1 million using forecast pricing at a 10% discount.

The Company does not have an interest in any seismic data relating to the Properties.

Reserves Overview

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Properties contained remaining proved plus probable reserves of 7.5 Bcf of natural gas and 264,000 barrels of oil and natural gas liquids (1.5 million boe), with an estimated net present value of $7.1 million using forecast pricing at a 10% discount.

Marketing Overview

Outpost’s natural gas and natural gas liquids are marketed through Acme Energy Marketing Ltd. on a 30-day evergreen contract.

Well List

Click here to download the complete well list in Excel.

Outpost’s natural gas and natural gas liquids are marketed through Acme Energy Marketing Ltd. on a 30-day evergreen contract.

Well List

Click here to download the complete well list in Excel.

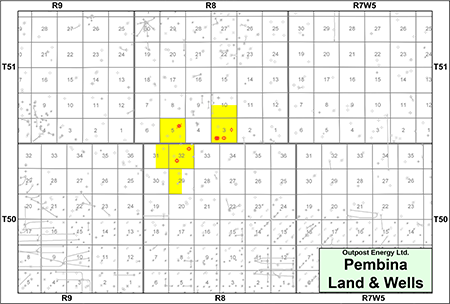

PEMBINA

Township 50-51, Range 8 W5

In the Pembina area, Outpost holds operated working interests ranging from 60-100% in approximately 4.5 sections of land. The Pembina property is producing natural gas from the Lower Mannville, Ellerslie and Glauconitic Sandstone formations.

The Pembina property consist of two separate land parcels which are divided by a river; however, Outpost has a pipeline which connects the two parcels.

Forecasted average daily sales production net to Outpost from Pembina on a proved developed producing basis for the year ended December 31, 2024 is approximately 110 boe/d, consisting of 639 Mcf/d of natural gas and three bbl/d of oil and natural gas liquids.

Forecasted operating income net to Outpost from Pembina on a proved developed producing basis for the year ended December 31, 2024 is approximately $372,000.

In the Pembina area, Outpost holds operated working interests ranging from 60-100% in approximately 4.5 sections of land. The Pembina property is producing natural gas from the Lower Mannville, Ellerslie and Glauconitic Sandstone formations.

The Pembina property consist of two separate land parcels which are divided by a river; however, Outpost has a pipeline which connects the two parcels.

Forecasted average daily sales production net to Outpost from Pembina on a proved developed producing basis for the year ended December 31, 2024 is approximately 110 boe/d, consisting of 639 Mcf/d of natural gas and three bbl/d of oil and natural gas liquids.

Forecasted operating income net to Outpost from Pembina on a proved developed producing basis for the year ended December 31, 2024 is approximately $372,000.

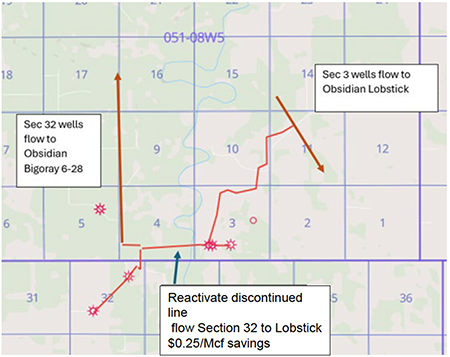

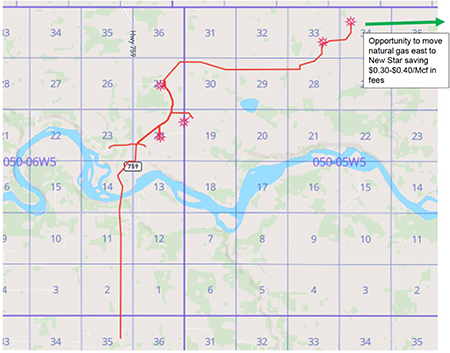

The following map shows the pipelines owned by Outpost at Pembina.

Pembina Facilities

At Pembina, Outpost has working interests in the following facilities.

At Pembina, Outpost has working interests in the following facilities.

Pembina Marketing

Outpost has a 30-day evergreen purchase contract in place with Acme Energy Marketing Ltd. for natural gas and natural gas liquids.

Natural gas from Pembina is delivered to Obsidian Energy Ltd.’s Lobstick facility at 17-050-07W5.

The Pembina property consist of two separate land parcels which are divided by a river; however, Outpost has a pipeline which connects the two parcels. The Company also believes there is potential for natural gas to be sold to Obsidian’s Lobstick facility on the east side of the property for lower fees.

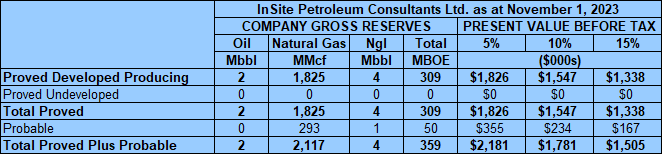

Pembina Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Pembina property contained remaining proved plus probable reserves of 2.1 Bcf of natural gas and 6,000 barrels of oil and natural gas liquids (359,000 boe), with an estimated net present value of $1.8 million using forecast pricing at a 10% discount.

Outpost has a 30-day evergreen purchase contract in place with Acme Energy Marketing Ltd. for natural gas and natural gas liquids.

Natural gas from Pembina is delivered to Obsidian Energy Ltd.’s Lobstick facility at 17-050-07W5.

The Pembina property consist of two separate land parcels which are divided by a river; however, Outpost has a pipeline which connects the two parcels. The Company also believes there is potential for natural gas to be sold to Obsidian’s Lobstick facility on the east side of the property for lower fees.

Pembina Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Pembina property contained remaining proved plus probable reserves of 2.1 Bcf of natural gas and 6,000 barrels of oil and natural gas liquids (359,000 boe), with an estimated net present value of $1.8 million using forecast pricing at a 10% discount.

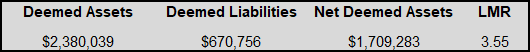

Pembina LMR as of February 3, 2024

As of February 3, 2024, the Pembina property had a deemed net asset value of $1.7 million (deemed assets of $2.4 million and deemed liabilities of $670,756), with an LMR ratio of 3.55.

As of February 3, 2024, the Pembina property had a deemed net asset value of $1.7 million (deemed assets of $2.4 million and deemed liabilities of $670,756), with an LMR ratio of 3.55.

Pembina Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

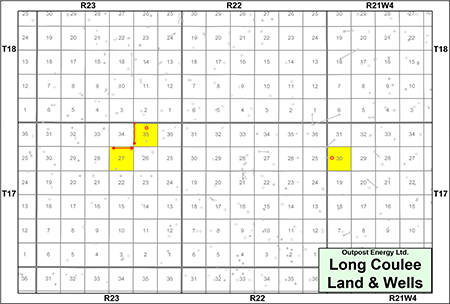

LONG COULEE

Township 17, Range 21-23 W4

At Long Coulee, Outpost holds 50-100% operated working interests in three sections of land. The property produces oil and natural gas from the Ellerslie and Glauconitic Sandstone formations.

Forecasted average daily sales production net to Outpost from Long Coulee on a proved developed producing basis for the year ended December 31, 2024 is approximately 92 boe/d, consisting of 484 Mcf/d of natural gas and 11 bbl/d of oil and natural gas liquids.

Forecasted operating income net to Outpost from Long Coulee on a proved developed producing basis for the year ended December 31, 2024 is approximately $229,000.

At Long Coulee, Outpost holds 50-100% operated working interests in three sections of land. The property produces oil and natural gas from the Ellerslie and Glauconitic Sandstone formations.

Forecasted average daily sales production net to Outpost from Long Coulee on a proved developed producing basis for the year ended December 31, 2024 is approximately 92 boe/d, consisting of 484 Mcf/d of natural gas and 11 bbl/d of oil and natural gas liquids.

Forecasted operating income net to Outpost from Long Coulee on a proved developed producing basis for the year ended December 31, 2024 is approximately $229,000.

The following map shows the pipelines owned by Outpost at Long Coulee.

Long Coulee Facilities

Outpost does not have an interest in any facilities at Long Coulee.

Long Coulee Marketing

Outpost does not have an interest in any facilities at Long Coulee.

Long Coulee Marketing

Outpost has a 30-day evergreen purchase contract in place with Acme Energy Marketing Ltd. for natural gas and natural gas liquids.

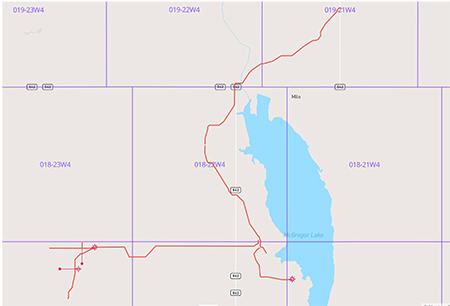

Natural gas from Long Coulee is delivered to Canadian Natural Resources Limited’s Indian Lake #2 meter station at 04-22-018-21W4.

Long Coulee Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as of November 1, 2023, the Long Coulee property contained remaining proved plus probable reserves of 1.7 Bcf of natural gas and 37,000 barrels of oil and natural gas liquids (322,000 boe), with an estimated net present value of $1.3 million using forecast pricing at a 10% discount.

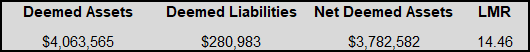

Long Coulee LMR as of February 3, 2024

As of February 3, 2024, the Long Coulee property had a deemed net asset value of $3.8 million (deemed assets of $4.1 million and deemed liabilities of $280,983), with an LMR ratio of 14.46.

As of February 3, 2024, the Long Coulee property had a deemed net asset value of $3.8 million (deemed assets of $4.1 million and deemed liabilities of $280,983), with an LMR ratio of 14.46.

Long Coulee Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

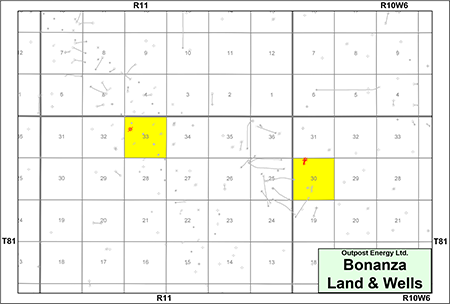

BONANZA

Township 81, Range 10-11 W6

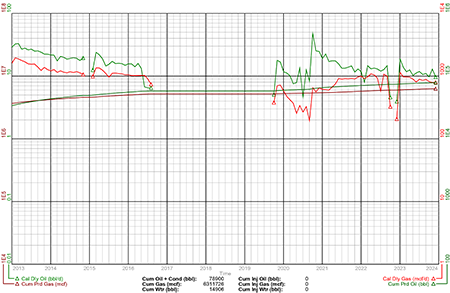

At Bonanza, Outpost holds a 100% operated and a 66.66% non-operated working interest in two sections of land. The well 100/14-30-081-10W6/2 is operated by Canadian Natural. Production from Bonanza is from the Kiskatinaw Formation. The 100/14-30-081-10W6/2 well was shut-in from August to November 2023 for a required clean out. Prior to being shut in, the well produced natural gas at a rate of approximately 1.5 MMcf/d (250 boe/d) gross. Outpost is currently in a penalty position on the 100/14-30-081-10W6/2 well.

Forecasted average daily sales production net to Outpost from Bonanza on a proved developed producing basis for the year ended December 31, 2024 is approximately 79 boe/d, consisting of 434 Mcf/d of natural gas and seven bbl/d of natural gas liquids.

Forecasted operating income net to Outpost from Bonanza on a proved developed producing basis for the year ended December 31, 2024 is approximately $190,000.

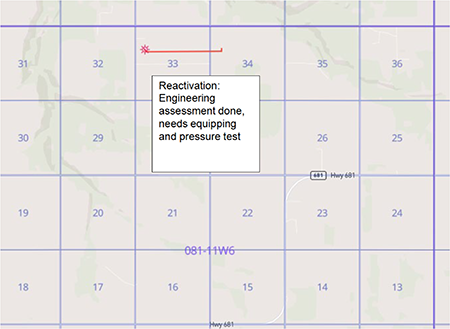

The Company has identified a tie-in for the well 100/12-33-081-11W6/0 to a pipeline owned by Canadian Natural. Outpost has an engineering assessment complete for the pipeline, no reserves have been assigned in the InSite Report. The well is capable of 250-260 Mcf/d of natural gas production.

At Bonanza, Outpost holds a 100% operated and a 66.66% non-operated working interest in two sections of land. The well 100/14-30-081-10W6/2 is operated by Canadian Natural. Production from Bonanza is from the Kiskatinaw Formation. The 100/14-30-081-10W6/2 well was shut-in from August to November 2023 for a required clean out. Prior to being shut in, the well produced natural gas at a rate of approximately 1.5 MMcf/d (250 boe/d) gross. Outpost is currently in a penalty position on the 100/14-30-081-10W6/2 well.

Forecasted average daily sales production net to Outpost from Bonanza on a proved developed producing basis for the year ended December 31, 2024 is approximately 79 boe/d, consisting of 434 Mcf/d of natural gas and seven bbl/d of natural gas liquids.

Forecasted operating income net to Outpost from Bonanza on a proved developed producing basis for the year ended December 31, 2024 is approximately $190,000.

The Company has identified a tie-in for the well 100/12-33-081-11W6/0 to a pipeline owned by Canadian Natural. Outpost has an engineering assessment complete for the pipeline, no reserves have been assigned in the InSite Report. The well is capable of 250-260 Mcf/d of natural gas production.

The following map shows the pipelines owned by Outpost at Bonanza.

The 100/14-30-081-10W6/2 well was shut-in from August to November 2023 for a required clean out. Prior to being shut in, the well produced natural gas at a rate of approximately 1.5 MMcf/d (250 boe/d) gross.

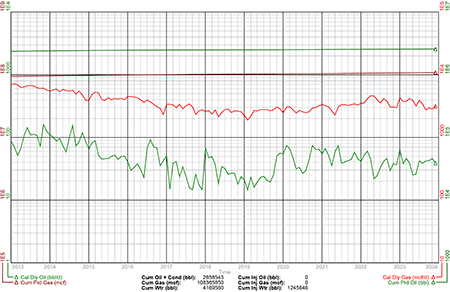

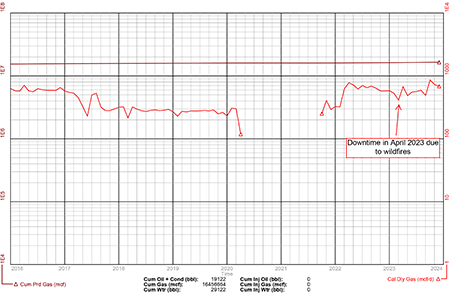

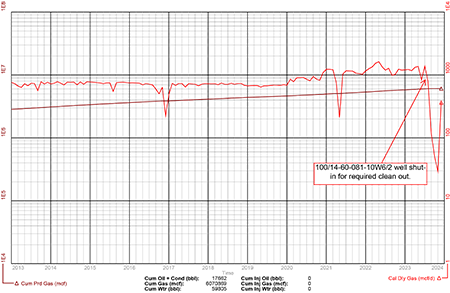

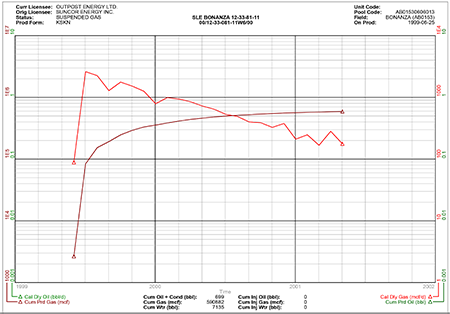

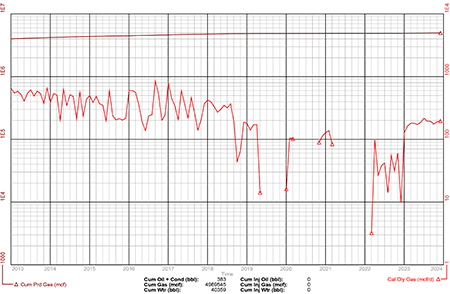

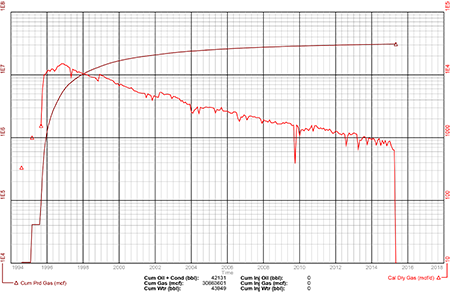

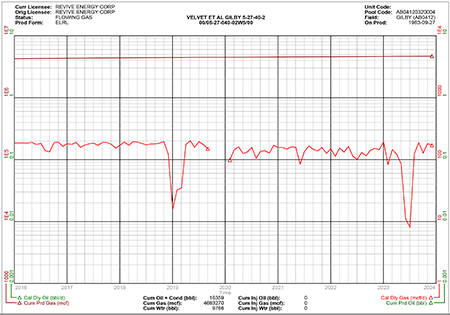

The following chart shows the production history of the 100/12-33-081-11W6/0 well. Outpost has identified the potential for reactivation of this well but no reserves have been assigned to the well in the InSite Report.

The following chart shows the production history of the 100/12-33-081-11W6/0 well. Outpost has identified the potential for reactivation of this well but no reserves have been assigned to the well in the InSite Report.

Bonanza Facilities

Outpost does not have an interest in any facilities at Bonanza.

Bonanza Marketing

Outpost does not have an interest in any facilities at Bonanza.

Bonanza Marketing

Canadian Natural markets Outpost’s natural gas and natural gas liquids from Bonanza.

Natural gas from Bonanza is delivered to Canadian Natural’s Cecil South meter station at 08-15-084-08W6.

Bonanza Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Bonanza property contained remaining proved plus probable reserves of 465 MMcf of natural gas and 8,000 barrels of natural gas liquids (85,000 boe), with an estimated net present value of $390,000 using forecast pricing at a 10% discount.

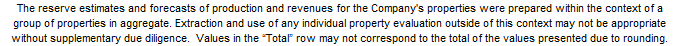

Bonanza LMR as of February 3, 2024

As of February 3, 2024, the Bonanza property had a deemed net asset value of ($101,020) (deemed assets of $0 and deemed liabilities of $101,020), with an LMR ratio of 0.00.

As of February 3, 2024, the Bonanza property had a deemed net asset value of ($101,020) (deemed assets of $0 and deemed liabilities of $101,020), with an LMR ratio of 0.00.

Bonanza Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

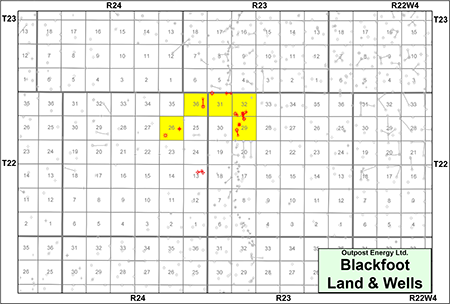

BLACKFOOT

Township 22, Range 23-24 W4

In the Blackfoot area, Outpost holds a 62.5% working interest in approximately five sections of land. The property is producing oil and natural gas primarily from the Glauconitic Sandstone Formation.

Forecasted average daily sales production net to Outpost from Blackfoot on a proved developed producing basis for the year ended December 31, 2024 is 43 boe/d, consisting of 250 Mcf/d of natural gas and one bbl/d of natural gas liquids.

Forecasted operating income net to Outpost from Blackfoot on a proved developed producing basis for the year ended December 31, 2024 is approximately $70,000.

Outpost has identified potential to re-activate the well Outpost Blackft 100/05-29-022-23W4/2. The 05-29 well has been tested and the production test indicated that there is 500 Mcf/d of natural gas under a bridge plug in the Glauconitic Sandstone Formation that has not been booked in the InSite Report.

In the Blackfoot area, Outpost holds a 62.5% working interest in approximately five sections of land. The property is producing oil and natural gas primarily from the Glauconitic Sandstone Formation.

Forecasted average daily sales production net to Outpost from Blackfoot on a proved developed producing basis for the year ended December 31, 2024 is 43 boe/d, consisting of 250 Mcf/d of natural gas and one bbl/d of natural gas liquids.

Forecasted operating income net to Outpost from Blackfoot on a proved developed producing basis for the year ended December 31, 2024 is approximately $70,000.

Outpost has identified potential to re-activate the well Outpost Blackft 100/05-29-022-23W4/2. The 05-29 well has been tested and the production test indicated that there is 500 Mcf/d of natural gas under a bridge plug in the Glauconitic Sandstone Formation that has not been booked in the InSite Report.

The following map shows the pipelines owned by Outpost at Blackfoot.

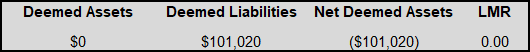

Blackfoot Facilities

At Blackfoot, Outpost has working interests in the following facilities.

At Blackfoot, Outpost has working interests in the following facilities.

Blackfoot Marketing

Lynx Energy ULC. markets Outpost’s natural gas and natural gas liquids at Blackfoot.

Natural gas from Blackfoot is delivered to Lynx Cavalier plant at 15-32-023-23W4.

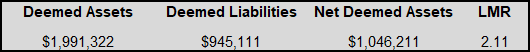

Blackfoot Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as of November 1, 2023, the Blackfoot property contained remaining proved plus probable reserves of 694 MMcf of natural gas and 3,000 barrels of natural gas liquids (119,000 boe), with an estimated net present value of $251,000 using forecast pricing at a 10% discount.

Lynx Energy ULC. markets Outpost’s natural gas and natural gas liquids at Blackfoot.

Natural gas from Blackfoot is delivered to Lynx Cavalier plant at 15-32-023-23W4.

Blackfoot Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as of November 1, 2023, the Blackfoot property contained remaining proved plus probable reserves of 694 MMcf of natural gas and 3,000 barrels of natural gas liquids (119,000 boe), with an estimated net present value of $251,000 using forecast pricing at a 10% discount.

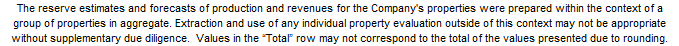

Blackfoot LMR as of February 3, 2024

As of February 3, 2024, the Blackfoot property had a deemed net asset value of $1.0 million (deemed assets of $2.0 million and deemed liabilities of $945,111), with an LMR ratio of 2.11.

As of February 3, 2024, the Blackfoot property had a deemed net asset value of $1.0 million (deemed assets of $2.0 million and deemed liabilities of $945,111), with an LMR ratio of 2.11.

Blackfoot Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

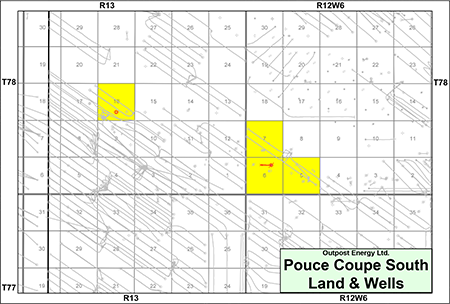

POUCE COUPE SOUTH

Township 78, Range 12-13 W6

At Pouce Coupe South, Outpost holds operated working interests ranging from 55-67% in four sections of land. The Pouce Coupe South property is producing natural gas from the Baldonnel Formation from the well 100/03-16-078-13W6/0.

Forecasted average daily sales production net to Outpost from Pouce Coupe South on a proved developed producing basis for the year ended December 31, 2024 is approximately 19 boe/d, consisting of 106 Mcf/d of natural gas and one bbl/d of natural gas liquids.

Forecasted operating income net to Outpost from Pouce Coupe South on a proved developed producing basis for the year ended December 31, 2024 is approximately $14,500.

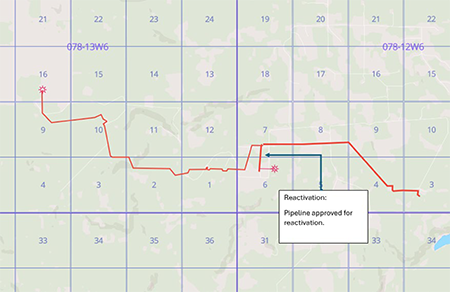

The Company has identified that the well SLE PCoupeS 100/15-06-078-12W6/0 could be capable of producing between 175-215 Mcf/d of natural gas by moving the compressor to the header at 03-07-078-12W6.

At Pouce Coupe South, Outpost holds operated working interests ranging from 55-67% in four sections of land. The Pouce Coupe South property is producing natural gas from the Baldonnel Formation from the well 100/03-16-078-13W6/0.

Forecasted average daily sales production net to Outpost from Pouce Coupe South on a proved developed producing basis for the year ended December 31, 2024 is approximately 19 boe/d, consisting of 106 Mcf/d of natural gas and one bbl/d of natural gas liquids.

Forecasted operating income net to Outpost from Pouce Coupe South on a proved developed producing basis for the year ended December 31, 2024 is approximately $14,500.

The Company has identified that the well SLE PCoupeS 100/15-06-078-12W6/0 could be capable of producing between 175-215 Mcf/d of natural gas by moving the compressor to the header at 03-07-078-12W6.

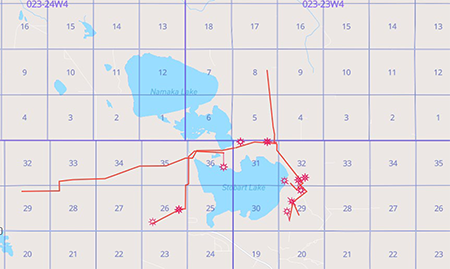

The following map shows the pipelines owned by Outpost at Pouce Coupe South.

The following chart shows the production history of the 100/15-06-078-12W6/0 well. The Company believes there is potential for reactivation of this well. Proved developed non-producing reserves have been assigned to the well in the InSite Report.

Pouce Coupe South Facilities

Outpost does not have an interest in any facilities at Pouce Coupe South.

Pouce Coupe South Marketing

Outpost has a 30-day evergreen purchase contract in place with Acme Energy Marketing Ltd. for natural gas and natural gas liquids.

Natural gas from Pouce Coupe South is delivered to North River Midstream Inc.’s Gordondale East plant.

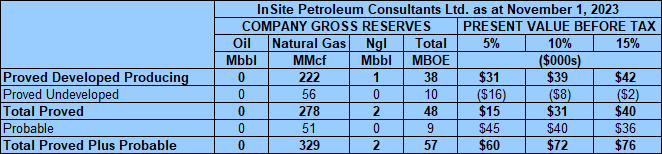

Pouce Coupe South Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Pouce Coupe South property contained remaining proved plus probable reserves of 329 MMcf of natural gas and 2,000 barrels of natural gas liquids (57,000 boe), with an estimated net present value of $72,000 using forecast pricing at a 10% discount.

Outpost has a 30-day evergreen purchase contract in place with Acme Energy Marketing Ltd. for natural gas and natural gas liquids.

Natural gas from Pouce Coupe South is delivered to North River Midstream Inc.’s Gordondale East plant.

Pouce Coupe South Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Pouce Coupe South property contained remaining proved plus probable reserves of 329 MMcf of natural gas and 2,000 barrels of natural gas liquids (57,000 boe), with an estimated net present value of $72,000 using forecast pricing at a 10% discount.

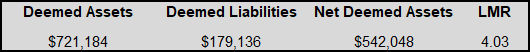

Pouce Coupe South LMR as of February 3, 2024

As of February 3, 2024, the Pouce Coupe South property had a deemed net asset value of $542,048 (deemed assets of $721,184 and deemed liabilities of $179,136), with an LMR ratio of 4.03.

As of February 3, 2024, the Pouce Coupe South property had a deemed net asset value of $542,048 (deemed assets of $721,184 and deemed liabilities of $179,136), with an LMR ratio of 4.03.

Pouce Coupe South Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

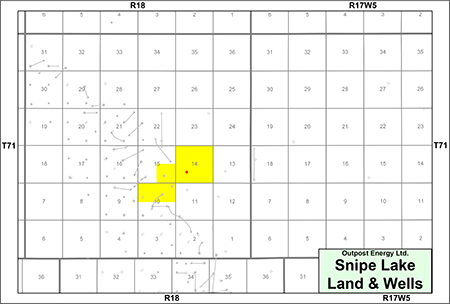

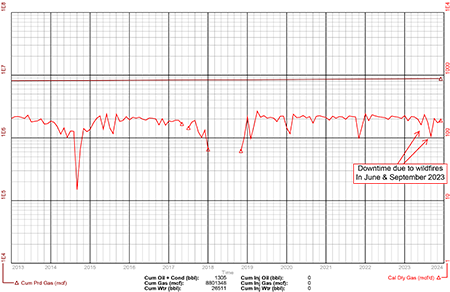

SNIPE LAKE

Township 71, Range 18 W5

At Snipe Lake, Outpost holds a 100% working interest in 1.75 sections of land. The Snipe Lake property is producing oil from the Swan Hills Formation from the well Outpost SnipeLk 00/06-14-071-18W5/0.

Forecasted average daily sales production net to Outpost from Snipe Lake on a proved developed producing basis for the year ended December 31, 2024 is approximately 12 bbl/d of oil.

Forecasted operating income net to Outpost from Snipe Lake on a proved developed producing basis for the year ended December 31, 2024 is approximately $216,000.

At Snipe Lake, Outpost holds a 100% working interest in 1.75 sections of land. The Snipe Lake property is producing oil from the Swan Hills Formation from the well Outpost SnipeLk 00/06-14-071-18W5/0.

Forecasted average daily sales production net to Outpost from Snipe Lake on a proved developed producing basis for the year ended December 31, 2024 is approximately 12 bbl/d of oil.

Forecasted operating income net to Outpost from Snipe Lake on a proved developed producing basis for the year ended December 31, 2024 is approximately $216,000.

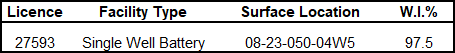

Snipe Lake Facilities

Outpost owns a single well battery with six 400-barrel tanks at Snipe Lake. The tanks are used to continue production during breakup and through wet conditions.

Snipe Lake Marketing

Outpost has a 30-day evergreen purchase contract in place with Acme Energy Marketing Ltd. for natural gas and natural gas liquids.

Oil from Snipe Lake is delivered to Long Run Exploration Ltd.’s facility at 07-04-071-18W5.

Snipe Lake Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Snipe Lake property contained remaining proved plus probable reserves of 59,000 barrels of oil, with an estimated net present value of $1.2 million using forecast pricing at a 10% discount.

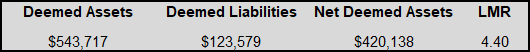

Snipe Lake LMR as of February 3, 2024

As of February 3, 2024, the Snipe Lake property had a deemed net asset value of $420,138 (deemed assets of $543,717 and deemed liabilities of $123,579), with an LMR ratio of 4.40.

As of February 3, 2024, the Snipe Lake property had a deemed net asset value of $420,138 (deemed assets of $543,717 and deemed liabilities of $123,579), with an LMR ratio of 4.40.

Snipe Lake Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

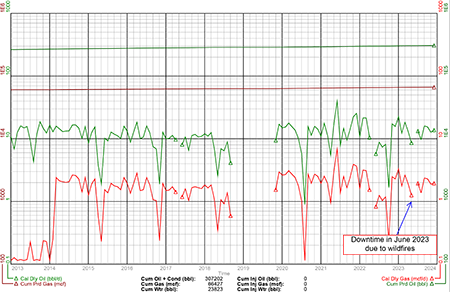

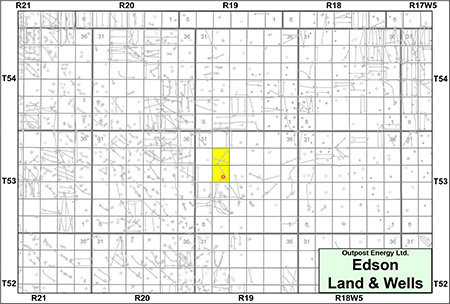

EDSON

Township 53, Range 19 W5

At Edson, Outpost holds a 32.32% non-operated working interest in two sections of land. The Edson property is producing natural gas from the Viking Formation from the well Alberta856 Edson 00/07-20-053-19W5/0 operated by Peyto Exploration & Development Corp.

Forecasted average daily sales production net to Outpost from Edson on a proved developed producing basis for the year ended December 31, 2024 is approximately 10 boe/d, consisting of 58 Mcf/d of natural gas and one barrel per day of natural gas liquids.

Forecasted operating income net to Outpost from Edson on a proved developed producing basis for the year ended December 31, 2024 is approximately $54,000.

At Edson, Outpost holds a 32.32% non-operated working interest in two sections of land. The Edson property is producing natural gas from the Viking Formation from the well Alberta856 Edson 00/07-20-053-19W5/0 operated by Peyto Exploration & Development Corp.

Forecasted average daily sales production net to Outpost from Edson on a proved developed producing basis for the year ended December 31, 2024 is approximately 10 boe/d, consisting of 58 Mcf/d of natural gas and one barrel per day of natural gas liquids.

Forecasted operating income net to Outpost from Edson on a proved developed producing basis for the year ended December 31, 2024 is approximately $54,000.

Edson Facilities

Outpost does not have an interest in any facilities at Edson.

Edson Marketing

Peyto markets Outpost’s natural gas production from Edson. Natural gas is delivered to Edson gas plant at 01-24-052-20W5.

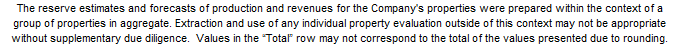

Edson Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Edson property contained remaining proved plus probable reserves of 335 MMcf of natural gas and 4,000 barrels of natural gas liquids (60,000 boe), with an estimated net present value of $452,000 using forecast pricing at a 10% discount.

Edson LMR as of February 3, 2024

Outpost does not operate any wells or facilities at Edson.

Edson Well List

Outpost does not operate any wells or facilities at Edson.

Edson Well List

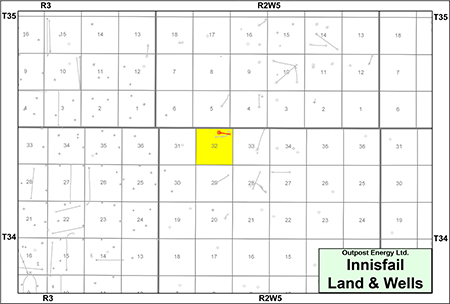

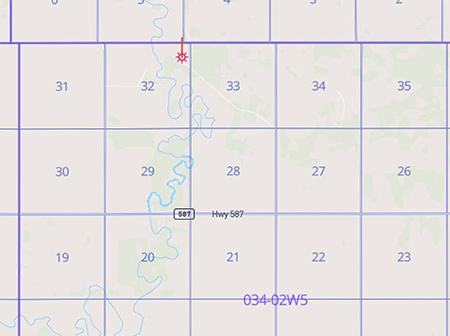

INNISFAIL

Township 34, Range 2 W5

At Innisfail, Outpost holds a 100% working interest in one section of land with one low-decline natural gas well Outpost Innis 00/15-32-034-02W5/04 producing from the Pekisko Formation.

Forecasted average daily sales production net to Outpost from Innisfail on a proved developed producing basis for the year ended December 31, 2024 is approximately 10 boe/d, consisting of 50 Mcf/d of natural gas and two bbl/d of oil and natural gas liquids.

Forecasted operating income net to Outpost from Innisfail on a proved developed producing basis for the year ended December 31, 2024 is approximately $40,000.

At Innisfail, Outpost holds a 100% working interest in one section of land with one low-decline natural gas well Outpost Innis 00/15-32-034-02W5/04 producing from the Pekisko Formation.

Forecasted average daily sales production net to Outpost from Innisfail on a proved developed producing basis for the year ended December 31, 2024 is approximately 10 boe/d, consisting of 50 Mcf/d of natural gas and two bbl/d of oil and natural gas liquids.

Forecasted operating income net to Outpost from Innisfail on a proved developed producing basis for the year ended December 31, 2024 is approximately $40,000.

The following map shows the pipelines owned by Outpost at Innisfail.

Innisfail Facilities

Outpost does not have an interest in any facilities at Innisfail.

Innisfail Marketing

Outpost does not have an interest in any facilities at Innisfail.

Innisfail Marketing

Tourmaline Oil Corp. markets Outpost’s natural gas production from Innisfail. Natural gas is delivered to Tourmaline’s facility at 13-05-034-03W5.

Innisfail Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Innisfail property contained remaining proved plus probable reserves of 214 MMcf of natural gas and 8,000 barrels of natural gas liquids (44,000 boe), with an estimated net present value of $246,000 using forecast pricing at a 10% discount.

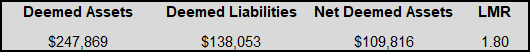

Innisfail LMR as of February 3, 2024

As of February 3, 2024, the Innisfail property had a deemed net asset value of $109,816 (deemed assets of $247,869 and deemed liabilities of $138,053), with an LMR ratio of 1.80.

As of February 3, 2024, the Innisfail property had a deemed net asset value of $109,816 (deemed assets of $247,869 and deemed liabilities of $138,053), with an LMR ratio of 1.80.

Innisfail Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

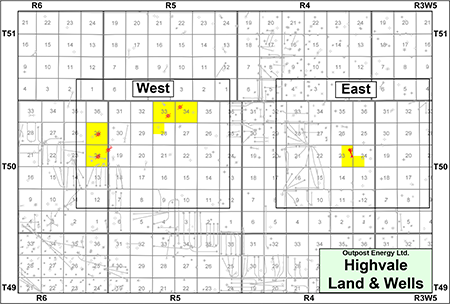

HIGHVALE

Township 50, Range 4-6 W5

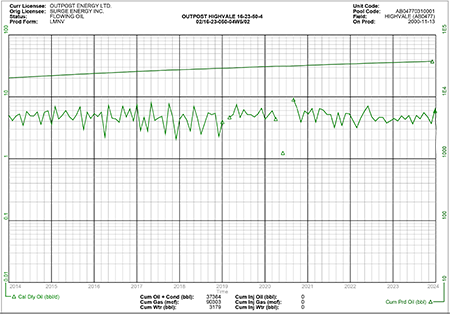

At Highvale, Outpost holds operated working interests ranging from 82-100% in five sections of land. Production from Highvale is from the Mannville Group. The Highvale property is characterized by two distinct plays in the east and the west. At East Highvale, in Township 50-04W5, Outpost produces oil from the well Outpost Highvale 02/16-23-050-04W5/0. West Highvale is characterized by suspended natural gas wells which are forecasted to be reactivated.

Forecasted average daily sales production net to Outpost from Highvale on a proved developed producing basis for the year ended December 31, 2024 is approximately five boe/d, consisting of four bbl/d of oil and four Mcf/d of natural gas.

Forecasted operating income net to Outpost from Highvale on a proved developed producing basis for the year ended December 31, 2024 is approximately $77,000.

At Highvale, Outpost holds operated working interests ranging from 82-100% in five sections of land. Production from Highvale is from the Mannville Group. The Highvale property is characterized by two distinct plays in the east and the west. At East Highvale, in Township 50-04W5, Outpost produces oil from the well Outpost Highvale 02/16-23-050-04W5/0. West Highvale is characterized by suspended natural gas wells which are forecasted to be reactivated.

Forecasted average daily sales production net to Outpost from Highvale on a proved developed producing basis for the year ended December 31, 2024 is approximately five boe/d, consisting of four bbl/d of oil and four Mcf/d of natural gas.

Forecasted operating income net to Outpost from Highvale on a proved developed producing basis for the year ended December 31, 2024 is approximately $77,000.

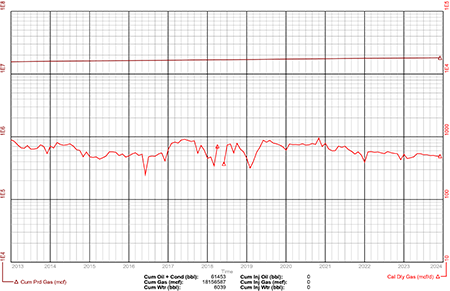

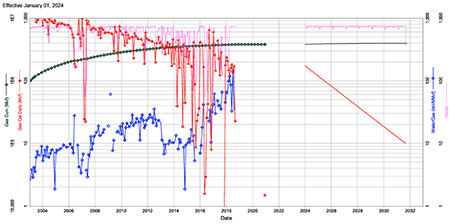

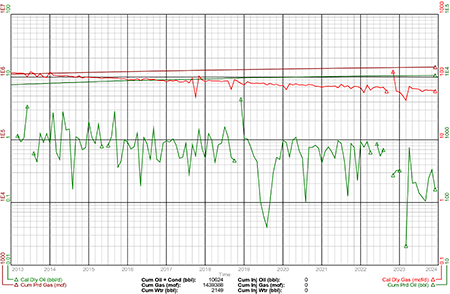

West Highvale is characterized by suspended natural gas wells which are forecasted to be reactivated. The following production plot shows the historical production profile of the natural gas wells.

There is a sales line tied in to the 09-25-049-06W5 pipeline owned by Axiom Oil & Gas Inc. The Company has identified the possibility to build a header at 08-02-049-06W5 going to the Obsidian facility at 03-02-050-06W5. Outpost has allocated capital of $500,000 which is included in the InSite Report for this project.

Outpost has also identified other possibilities for natural gas delivery including the option to construct an approximately two-mile pipeline to transport natural gas to the east to the New Star Energy Ltd. facility at 04-10-051-04W5 in order to take advantage of lower fees.

The following map shows the pipelines owned by Outpost at West Highvale.

Outpost has also identified other possibilities for natural gas delivery including the option to construct an approximately two-mile pipeline to transport natural gas to the east to the New Star Energy Ltd. facility at 04-10-051-04W5 in order to take advantage of lower fees.

The following map shows the pipelines owned by Outpost at West Highvale.

Highvale Facilities

At Highvale, Outpost has working interests in the following facilities.

At Highvale, Outpost has working interests in the following facilities.

Highvale Marketing

Oil from Highvale East is trucked to Secure Energy Services Inc.’s facility at 03-05-049-06W5.

Highvale Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Highvale property contained remaining proved plus probable reserves of 1.6 Bcf of natural gas and 84,000 barrels of oil and natural gas liquids (358,000 boe), with an estimated net present value of $1.3 million using forecast pricing at a 10% discount.

Oil from Highvale East is trucked to Secure Energy Services Inc.’s facility at 03-05-049-06W5.

Highvale Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Highvale property contained remaining proved plus probable reserves of 1.6 Bcf of natural gas and 84,000 barrels of oil and natural gas liquids (358,000 boe), with an estimated net present value of $1.3 million using forecast pricing at a 10% discount.

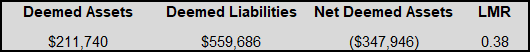

Highvale LMR as of February 3, 2024

As of February 3, 2024, the Highvale property had a deemed net asset value of ($347,946) (deemed assets of $211,740 and deemed liabilities of $559,686), with an LMR ratio of 0.38.

As of February 3, 2024, the Highvale property had a deemed net asset value of ($347,946) (deemed assets of $211,740 and deemed liabilities of $559,686), with an LMR ratio of 0.38.

Highvale Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

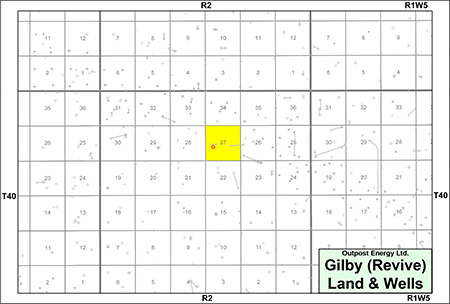

GILBY

Township 40, Range 2 W5

In the Gilby area, Outpost holds an operated 6.13% working interest in one section of land and the producing Ellerslie natural gas well Velvet et al Gilby 100/05-27-040-02W5/0.

Forecasted average daily sales production net to Outpost from Gilby on a proved developed producing basis for the year ended December 31, 2024 is approximately one Mcf/d of natural gas.

Forecasted operating income net to Outpost from Gilby on a proved developed producing basis for the year ended December 31, 2024 is nominal.

In the Gilby area, Outpost holds an operated 6.13% working interest in one section of land and the producing Ellerslie natural gas well Velvet et al Gilby 100/05-27-040-02W5/0.

Forecasted average daily sales production net to Outpost from Gilby on a proved developed producing basis for the year ended December 31, 2024 is approximately one Mcf/d of natural gas.

Forecasted operating income net to Outpost from Gilby on a proved developed producing basis for the year ended December 31, 2024 is nominal.

Gilby Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

InSite estimated that, as at November 1, 2023, the Gilby property contained remaining proved plus probable reserves of 3.0 MMcf of natural gas and 1,000 barrels of natural gas liquids (1,000 boe). The property had an estimated net present value of ($148,000) using forecast pricing at a 10% discount.

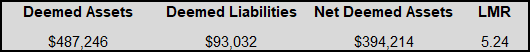

Gilby LMR as of February 3, 2024

As of February 3, 2024, the Gilby property had a deemed net asset value of $394,214 (deemed assets of $487,246 and deemed liabilities of $93,032), with an LMR ratio of 5.24.

As of February 3, 2024, the Gilby property had a deemed net asset value of $394,214 (deemed assets of $487,246 and deemed liabilities of $93,032), with an LMR ratio of 5.24.

Gilby Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

NON-PRODUCING PROPERTIES

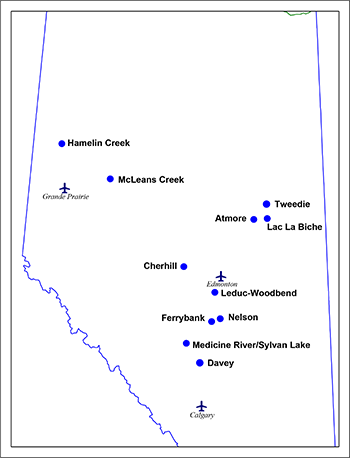

Outpost holds working interests in certain non-producing properties located in the Atmore, Cherhill, Davey, Ferrybank, Hamelin Creek, Lac La Biche, Leduc-Woodbend, McLeans Creek, Medicine River/Sylvan Lake, Nelson and Tweedie areas of Alberta.

Forecasted operating income net to Outpost from the non-producing properties on a proved developed producing basis for the year ended December 31, 2024 is approximately ($46,000).

Forecasted operating income net to Outpost from the non-producing properties on a proved developed producing basis for the year ended December 31, 2024 is approximately ($46,000).

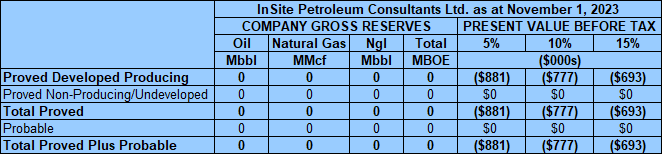

Non-Producing Properties Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

The Non-Producing Properties were evaluated as part of the InSite report and no reserves were assigned. The Non-Producing Properties had an estimated net present value of ($777,000) using forecast pricing at a 10% discount.

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties (the “InSite Report”). The InSite Report is effective November 1, 2023 using InSite’s September 30, 2023 forecast pricing.

The Non-Producing Properties were evaluated as part of the InSite report and no reserves were assigned. The Non-Producing Properties had an estimated net present value of ($777,000) using forecast pricing at a 10% discount.

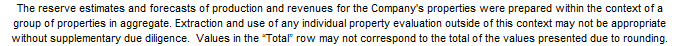

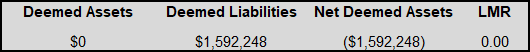

Non-Producing Properties LMR as of February 3, 2024

As of February 3, 2024, the Non-Producing Properties had a deemed net asset value of ($1,592,248) (deemed assets of $0 and deemed liabilities of $1,592,248), with an LMR ratio of 0.00.

As of February 3, 2024, the Non-Producing Properties had a deemed net asset value of ($1,592,248) (deemed assets of $0 and deemed liabilities of $1,592,248), with an LMR ratio of 0.00.

Non-Producing Properties Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

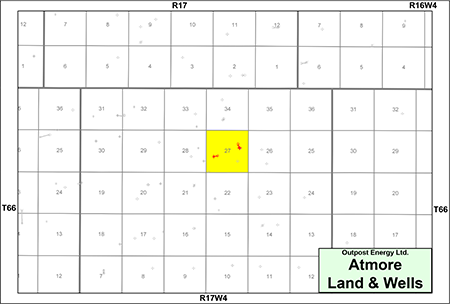

ATMORE

Township 66, Range 17 W4

In the Atmore area, Outpost holds a 100% working interest in one abandoned well and one reclaimed well.

In the Atmore area, Outpost holds a 100% working interest in one abandoned well and one reclaimed well.

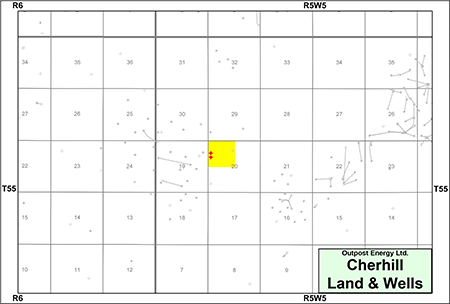

CHERHILL

Township 55, Range 5 W5

At Cherhill, Outpost holds a 100% working interest in one quarter section of land with two abandoned Mannville natural gas wells.

At Cherhill, Outpost holds a 100% working interest in one quarter section of land with two abandoned Mannville natural gas wells.

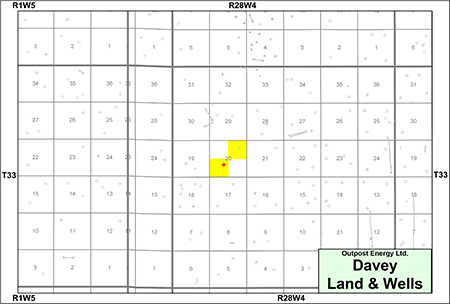

DAVEY

Township 33, Range 28 W4

The Company holds a 100% working interest in one half section of land with one abandoned well.

The Company holds a 100% working interest in one half section of land with one abandoned well.

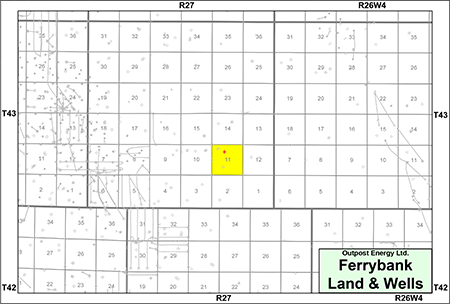

FERRYBANK

Township 43, Range 27 W4

At Ferrybank, Outpost holds a 97.5% working interest in P&NG rights from the base of the Belly River Formation to the base of the Viking Formation in one section of land, on which there is one abandoned Viking natural gas well.

At Ferrybank, Outpost holds a 97.5% working interest in P&NG rights from the base of the Belly River Formation to the base of the Viking Formation in one section of land, on which there is one abandoned Viking natural gas well.

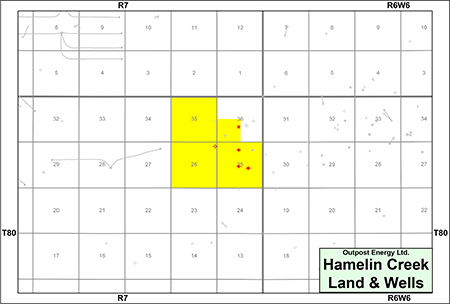

HAMELIN CREEK

Township 80, Range 7 W6

At Hamelin Creek, Outpost holds a 52.5% working interest in 3.25 sections of land with five abandoned Nordegg and Charlie Lake oil wells.

At Hamelin Creek, Outpost holds a 52.5% working interest in 3.25 sections of land with five abandoned Nordegg and Charlie Lake oil wells.

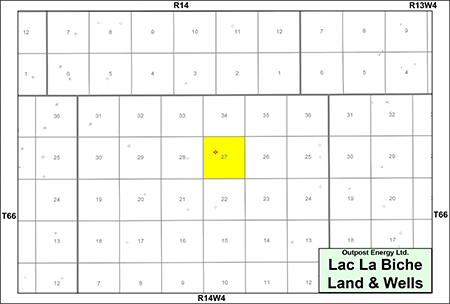

LAC LA BICHE

Township 66, Range 14 W4

At Lac La Biche, Outpost holds a 100% working interest in P&NG rights from surface to the base of the Mannville Group in one section of land, on which there is one abandoned well.

At Lac La Biche, Outpost holds a 100% working interest in P&NG rights from surface to the base of the Mannville Group in one section of land, on which there is one abandoned well.

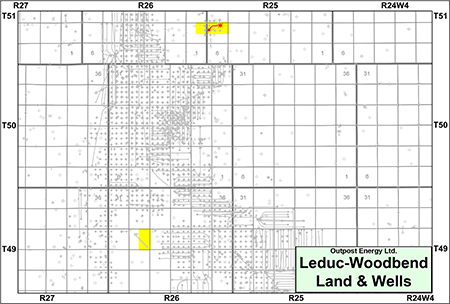

LEDUC-WOODBEND

Township 49-51, Range 25-26 W4

At Leduc-Woodbend, Outpost holds a 100% working interest in 1.25 sections of land on which there are two non-producing which were drilled in the Ellerslie and Blairmore formations.

At Leduc-Woodbend, Outpost holds a 100% working interest in 1.25 sections of land on which there are two non-producing which were drilled in the Ellerslie and Blairmore formations.

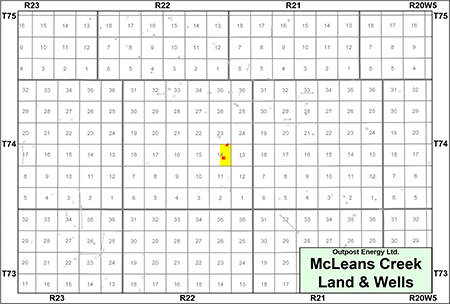

MCLEANS CREEK

Township 74, Range 22 W5

At McLeans Creek, Outpost holds a 100% working interest in one half section of land on which there are two non-producing wells, consisting of one suspended injection well and one suspended Gilwood well.

At McLeans Creek, Outpost holds a 100% working interest in one half section of land on which there are two non-producing wells, consisting of one suspended injection well and one suspended Gilwood well.

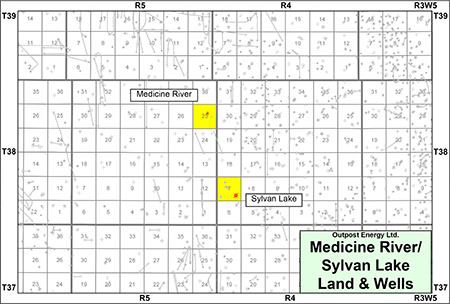

MEDICINE RIVER / SYLVAN LAKE

Township 38, Range 4-5 W5

At Medicine River Outpost holds a 50% working interest in one section of land with one abandoned Ostracod natural gas well, Outpost MedRiv 00/10-25-038-05W5/0. At Sylvan Lake, Outpost holds an 87.5% working interest in one section of land with one suspended Ostracod natural gas well, Outpost SyLake 00/01-07-038-04W5/2.

At Medicine River Outpost holds a 50% working interest in one section of land with one abandoned Ostracod natural gas well, Outpost MedRiv 00/10-25-038-05W5/0. At Sylvan Lake, Outpost holds an 87.5% working interest in one section of land with one suspended Ostracod natural gas well, Outpost SyLake 00/01-07-038-04W5/2.

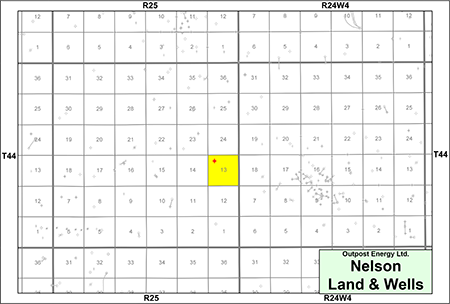

NELSON

Township 44, Range 25 W4

At Nelson, Outpost holds a 50% working interest in one section of land, on which there is one abandoned Cardium natural gas well.

At Nelson, Outpost holds a 50% working interest in one section of land, on which there is one abandoned Cardium natural gas well.

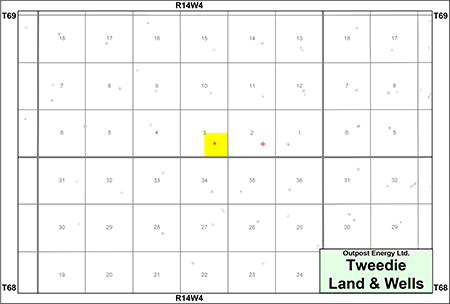

TWEEDIE

Township 69, Range 14 W4

At Tweedie, Outpost holds a 100% working interest in one quarter section of land with two abandoned wells.

At Tweedie, Outpost holds a 100% working interest in one quarter section of land with two abandoned wells.

PROCESS & TIMELINE

Sayer Energy Advisors is accepting offers relating to this process until 12:00 pm on Thursday April 4, 2024. Outpost's preference is a sale of the shares of the Company but it will also entertain offers for the individual Properties.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting offers from interested parties until

noon on Thursday April 4, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Company with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (brye@sayeradvisors.com) or fax (403.266.4467).Included in the confidential information is the following: most recent net lease operating statements, the InSite Report, summary land information, LMR information and other relevant corporate and technical information.

Download Confidentiality Agreement

To receive further information on the Company please contact Ben Rye, Tom Pavic or Sydney Birkett at 403.266.6133.