Offering Details

Back

Under Review / Cavvy Energy Ltd.

Cavvy Energy Ltd.

Property Divestiture

Property DivestitureBid Deadline: May 16, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

CAVVY ENERGY LTD., FORMERLY PIERIDAE ENERGY LIMITED, HAS CHANGED ITS NAME EFFECTIVE MAY 9, 2025.

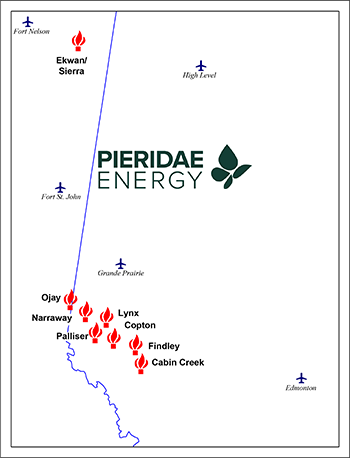

Pieridae Energy Limited (“Pieridae” or the “Company”) has engaged Sayer Energy Advisors to assist it with the sale of certain of its oil and natural gas interests located in northern Alberta and northeastern British Columbia.

The properties are located in the Cabin Creek, Copton, Findley, Lynx, Narraway and Palliser areas of Alberta and the Ekwan, Ojay and Sierra areas of northeastern British Columbia (the “Properties”).

Average daily production net to Pieridae from the Properties for the year-ended December 31, 2023 was approximately 3,562 boe/d, consisting of approximately 21.2 MMcf/d of natural gas and 33 bbl/d of oil and natural gas liquids.

Operating income net to Pieridae from the Properties for the year-ended December 31, 2023 was approximately $9.0 million.

The properties are located in the Cabin Creek, Copton, Findley, Lynx, Narraway and Palliser areas of Alberta and the Ekwan, Ojay and Sierra areas of northeastern British Columbia (the “Properties”).

Average daily production net to Pieridae from the Properties for the year-ended December 31, 2023 was approximately 3,562 boe/d, consisting of approximately 21.2 MMcf/d of natural gas and 33 bbl/d of oil and natural gas liquids.

Operating income net to Pieridae from the Properties for the year-ended December 31, 2023 was approximately $9.0 million.

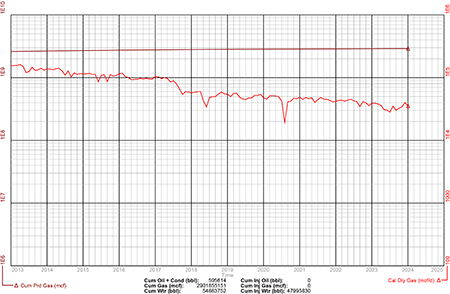

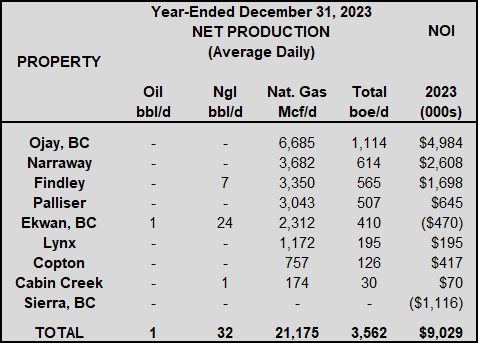

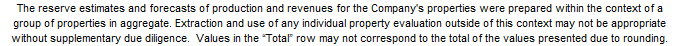

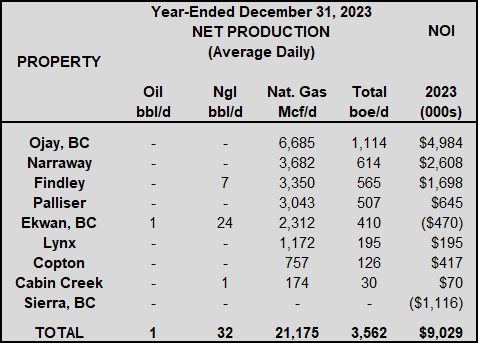

Production & NOI Overview

Average daily production net to Pieridae from the Properties for the year-ended December 31, 2023 was approximately 3,562 boe/d, consisting of approximately 21.2 MMcf/d of natural gas and 33 bbl/d of oil and natural gas liquids as outlined below.

Average daily production net to Pieridae from the Properties for the year-ended December 31, 2023 was approximately 3,562 boe/d, consisting of approximately 21.2 MMcf/d of natural gas and 33 bbl/d of oil and natural gas liquids as outlined below.

Operating income net to Pieridae from the Properties for the year-ended December 31, 2023 was approximately $9.0 million. Note that the operating income numbers outlined above include physical hedges.

LMR Summary

Alberta LMR

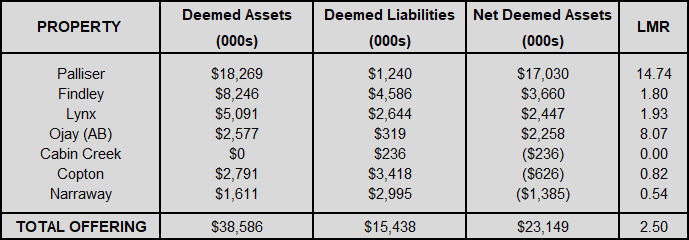

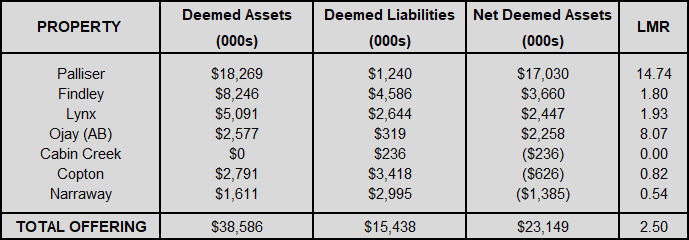

The LMR for each of the Alberta Properties as of March 2, 2024 is summarized below.

Alberta LMR

The LMR for each of the Alberta Properties as of March 2, 2024 is summarized below.

Summary of LMR by Property

As of March 2, 2024, the properties in Alberta had a deemed net asset value of $23.1 million (deemed assets of $38.6 million and deemed liabilities of $15.4 million), with an LMR ratio of 2.50.

British Columbia

Pieridae’s PCA score in British Columbia is 71.6. The Company has a $1.8 million security deposit with the BCER.

Reserves Overview

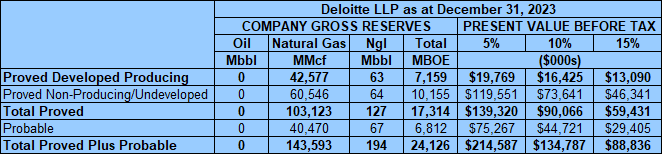

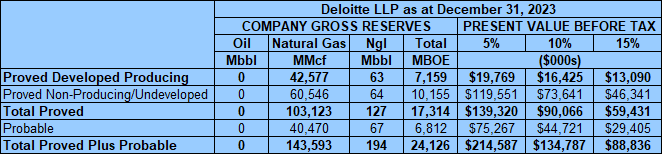

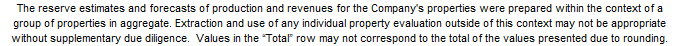

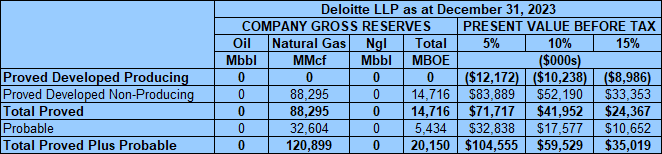

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Properties contained remaining proved plus probable reserves of 143.6 Bcf of natural gas and 194,000 barrels of natural gas liquids (24.1 million boe), with an estimated net present value of $134.8 million using forecast pricing at a 10% discount.

British Columbia

Pieridae’s PCA score in British Columbia is 71.6. The Company has a $1.8 million security deposit with the BCER.

Reserves Overview

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Properties contained remaining proved plus probable reserves of 143.6 Bcf of natural gas and 194,000 barrels of natural gas liquids (24.1 million boe), with an estimated net present value of $134.8 million using forecast pricing at a 10% discount.

Marketing Overview

Pieridae has a fuel natural gas supply agreement with Milner Power II Limited Partnership. A portion of the Findley property is sour and Pieridae generates revenue from sulphur sales. Sweet natural gas from the Findley property is sold as fuel gas to Milner Power for power generation which has resulted in an increase in operating income net to Pieridae through reduced gathering and processing charges.

The Company has a sulphur sale agreement at Edson with Petrosul International Ltd.

Pieridae also has natural gas purchase agreements with NOVA Gas Transmission Ltd. relating to the Properties.

Development Plan Overview

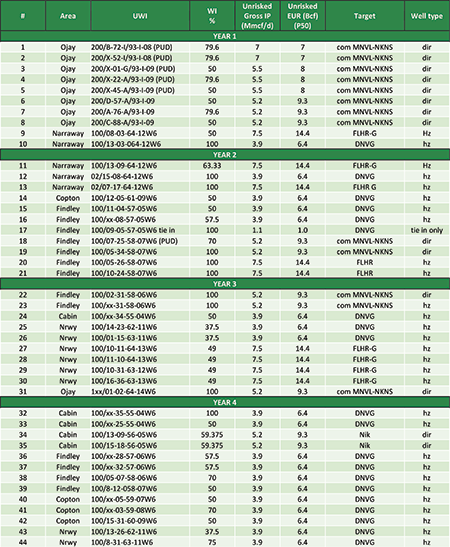

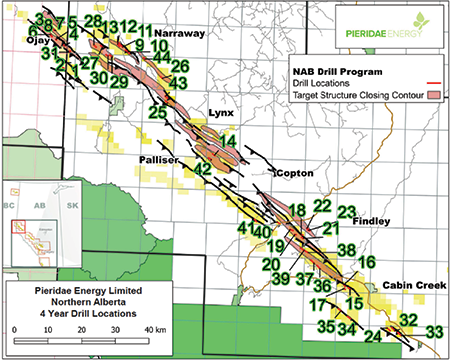

Pieridae has developed a multi-year program focused on sweet natural gas development locations throughout the Northern Alberta Foothills as listed in the following chart.

The main play types include traditional multi-zone completions and specific horizontal targeting of high-quality reservoirs in the Dunvegan, Cadotte, and Falher formations. The Company believes additional step-out locations can be generated as each play is appraised.

Pieridae has a fuel natural gas supply agreement with Milner Power II Limited Partnership. A portion of the Findley property is sour and Pieridae generates revenue from sulphur sales. Sweet natural gas from the Findley property is sold as fuel gas to Milner Power for power generation which has resulted in an increase in operating income net to Pieridae through reduced gathering and processing charges.

The Company has a sulphur sale agreement at Edson with Petrosul International Ltd.

Pieridae also has natural gas purchase agreements with NOVA Gas Transmission Ltd. relating to the Properties.

Development Plan Overview

Pieridae has developed a multi-year program focused on sweet natural gas development locations throughout the Northern Alberta Foothills as listed in the following chart.

The main play types include traditional multi-zone completions and specific horizontal targeting of high-quality reservoirs in the Dunvegan, Cadotte, and Falher formations. The Company believes additional step-out locations can be generated as each play is appraised.

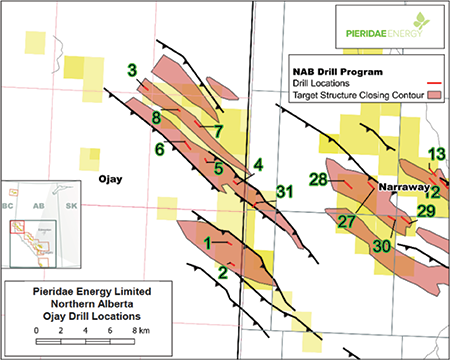

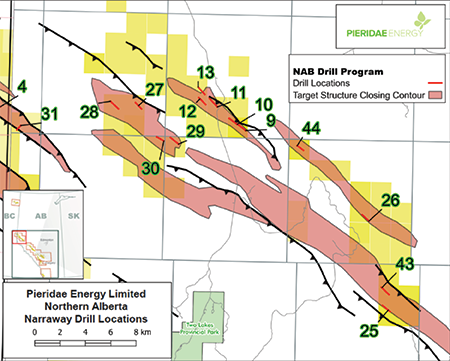

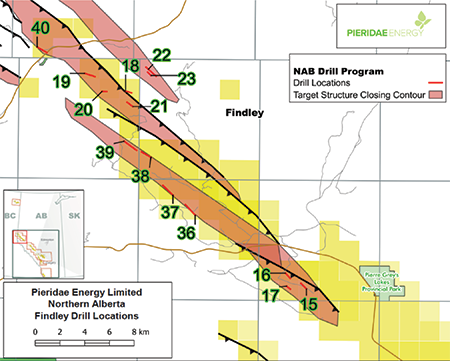

The location numbers on the following map correspond with the preceding development plan summary chart.

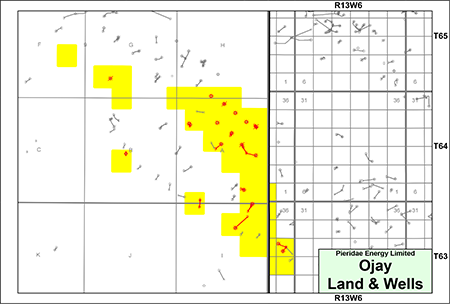

OJAY, B.C.

Township 63-64, Range 14 W6 - NTS 093-I-08 - 093-I-09

At Ojay, Pieridae holds various operated and non-operated working interests ranging from 50-100% in approximately 110 spacing units of land and 4.5 sections of land in Alberta. The Ojay property also contains two operated wells on the Alberta side of the provincial border. The Ojay property is producing commingled natural gas from the Nikanassin, Cadotte, Cadomin and Gething formations.

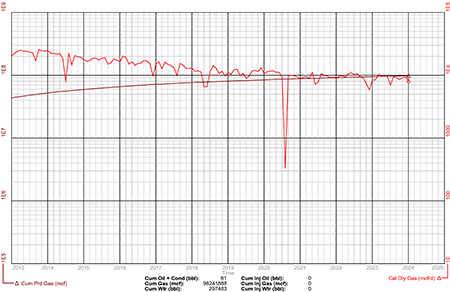

Average daily production net to Pieridae from Ojay for the year-ended December 31, 2023 was approximately 1,114 boe/d, consisting of 6.7 MMcf/d of natural gas.

Operating income net to Pieridae from Ojay for the year-ended December 31, 2023 was approximately $5.0 million.

At Ojay, Pieridae holds various operated and non-operated working interests ranging from 50-100% in approximately 110 spacing units of land and 4.5 sections of land in Alberta. The Ojay property also contains two operated wells on the Alberta side of the provincial border. The Ojay property is producing commingled natural gas from the Nikanassin, Cadotte, Cadomin and Gething formations.

Average daily production net to Pieridae from Ojay for the year-ended December 31, 2023 was approximately 1,114 boe/d, consisting of 6.7 MMcf/d of natural gas.

Operating income net to Pieridae from Ojay for the year-ended December 31, 2023 was approximately $5.0 million.

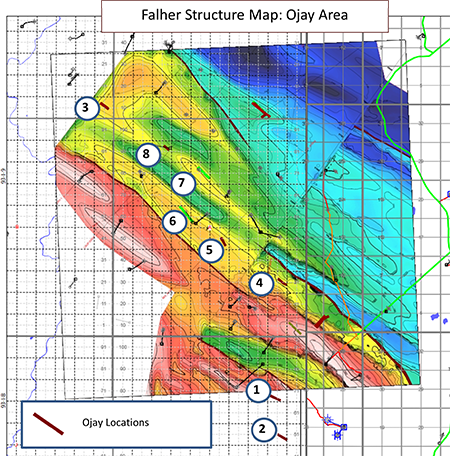

Ojay Upside

The Ojay property contains abundant Mannville and Nikanassin reservoirs with up to 100 metres of cumulative net sand that have historically produced commingled in directional completions. These reservoirs have not been exploited by existing wells.

The Ojay property contains abundant Mannville and Nikanassin reservoirs with up to 100 metres of cumulative net sand that have historically produced commingled in directional completions. These reservoirs have not been exploited by existing wells.

Producing wells at Ojay take advantage of abundant net sand thickness in the Mannville Group and Nikanassin Formation. Existing wells can be prolific, and reservoirs tend to be fracture enhanced and exhibit at least partial communication across individual structures. Pressure mapping and depletion profiles support the drilling of additional wells into identified structures.

Existing wells in the area, and the proved undeveloped locations booked in the Deloitte Report are planned as deviated wellbores with multi-sand comingled completions. Horizontal development of individual reservoirs has not been exploited to date. Foothills analogues indicate that horizontal drilling will be beneficial in terms of initial production rates and enhanced ultimate recovery.

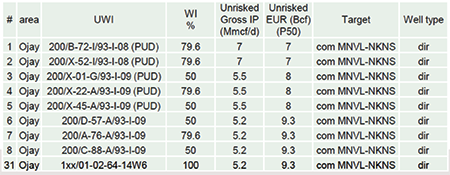

Pieridae has included the following drilling locations at Ojay in the proposed four-year development plan:

Existing wells in the area, and the proved undeveloped locations booked in the Deloitte Report are planned as deviated wellbores with multi-sand comingled completions. Horizontal development of individual reservoirs has not been exploited to date. Foothills analogues indicate that horizontal drilling will be beneficial in terms of initial production rates and enhanced ultimate recovery.

Pieridae has included the following drilling locations at Ojay in the proposed four-year development plan:

Further details on the drilling opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

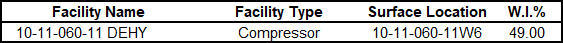

Ojay Facilities

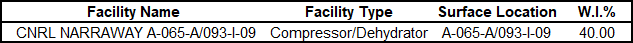

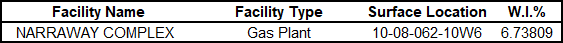

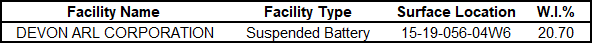

At Ojay, Pieridae has a working interest in the following facility. The Company also has working interests in several batteries at Ojay. Further details on the facilities are available in the virtual data room for parties which execute a confidentiality agreement.

Ojay Facilities

At Ojay, Pieridae has a working interest in the following facility. The Company also has working interests in several batteries at Ojay. Further details on the facilities are available in the virtual data room for parties which execute a confidentiality agreement.

Ojay Marketing

Natural gas from Ojay is processed at Canadian Natural Resources Limited’s Narraway plant at 10-08-062-10W6 and sold to Nova Gas Transmission Ltd. at the Narraway River meter station.

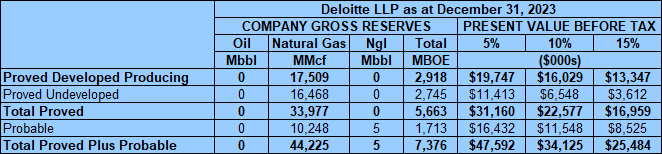

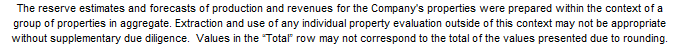

Ojay Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Ojay property contained remaining proved plus probable reserves of 44.2 Bcf of natural gas and 5,000 barrels of natural gas liquids (7.4 million boe), with an estimated net present value of $34.1 million using forecast pricing at a 10% discount.

Natural gas from Ojay is processed at Canadian Natural Resources Limited’s Narraway plant at 10-08-062-10W6 and sold to Nova Gas Transmission Ltd. at the Narraway River meter station.

Ojay Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Ojay property contained remaining proved plus probable reserves of 44.2 Bcf of natural gas and 5,000 barrels of natural gas liquids (7.4 million boe), with an estimated net present value of $34.1 million using forecast pricing at a 10% discount.

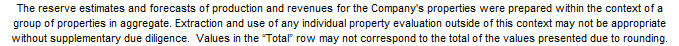

Ojay, AB LMR as of March 2, 2024

The Ojay property contains two operated wells on the Alberta side of the provincial border.

As of March 2, 2024, the Ojay property had a deemed net asset value of $2.3 million (deemed assets of $2.6 million and deemed liabilities of $319,490), with an LMR ratio of 8.07.

The Ojay property contains two operated wells on the Alberta side of the provincial border.

As of March 2, 2024, the Ojay property had a deemed net asset value of $2.3 million (deemed assets of $2.6 million and deemed liabilities of $319,490), with an LMR ratio of 8.07.

Ojay Well List

Click here to download the complete well list in Excel.

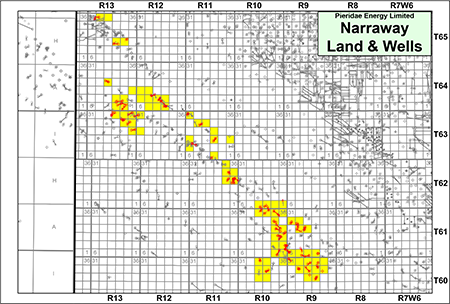

NARRAWAY, AB

Township 60-65, Range 9-13 W6

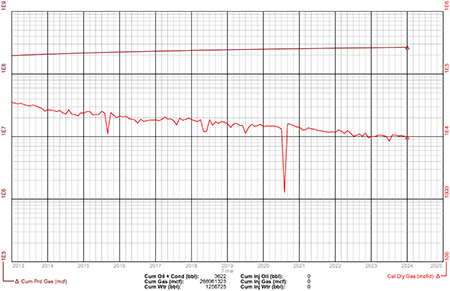

At Narraway, Pieridae holds various working interests ranging from 25-100% in approximately 84 sections of land. The Narraway property is producing commingled natural gas from the Cadotte, Dunvegan, Nikanassin and Falher formations.

Average daily production net to Pieridae from Narraway for the year-ended December 31, 2023 was 614 boe/d, consisting of approximately 3.7 MMcf/d of natural gas.

Operating income net to Pieridae from Narraway for the year-ended December 31, 2023 was approximately $2.6 million.

At Narraway, Pieridae holds various working interests ranging from 25-100% in approximately 84 sections of land. The Narraway property is producing commingled natural gas from the Cadotte, Dunvegan, Nikanassin and Falher formations.

Average daily production net to Pieridae from Narraway for the year-ended December 31, 2023 was 614 boe/d, consisting of approximately 3.7 MMcf/d of natural gas.

Operating income net to Pieridae from Narraway for the year-ended December 31, 2023 was approximately $2.6 million.

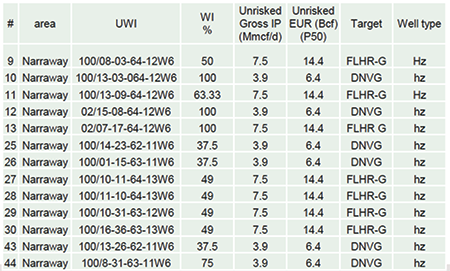

Narraway Upside

The Mannville targets at Narraway are demonstrated in existing wells to be sensitive to natural fractures; however, horizontal technology has not been deployed to date. The Narraway drilling program is intended to test this concept in the 100/08-03-64-12W6 well, targeting the Falher “G” sandstone. This reservoir is the basal sand unit of the Falher in this area and can be very prolific, as demonstrated in the approximately 45 Bcf of natural gas produced from the 100/08-04-63-11W6/00 well.

Dunvegan horizontal wells have been successful in nearby plains analogues. The horizontal well 100/13-03-64-12W6 will be used to evaluate deliverability of the Dunvegan in the foothills and this data can be used to support Dunvegan drill locations in other strike areas within this package.

Additional reservoirs are available for future exploration/development including the Cadotte, Upper Falher members, Cadomin, Gething, and Nikanassin.

Pieridae has included the following drilling locations at Narraway in the proposed four-year development plan:

The Mannville targets at Narraway are demonstrated in existing wells to be sensitive to natural fractures; however, horizontal technology has not been deployed to date. The Narraway drilling program is intended to test this concept in the 100/08-03-64-12W6 well, targeting the Falher “G” sandstone. This reservoir is the basal sand unit of the Falher in this area and can be very prolific, as demonstrated in the approximately 45 Bcf of natural gas produced from the 100/08-04-63-11W6/00 well.

Dunvegan horizontal wells have been successful in nearby plains analogues. The horizontal well 100/13-03-64-12W6 will be used to evaluate deliverability of the Dunvegan in the foothills and this data can be used to support Dunvegan drill locations in other strike areas within this package.

Additional reservoirs are available for future exploration/development including the Cadotte, Upper Falher members, Cadomin, Gething, and Nikanassin.

Pieridae has included the following drilling locations at Narraway in the proposed four-year development plan:

Further details on the drilling opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

Narraway Facilities

Narraway Facilities

At Narraway, Pieridae has a working interest in the following facility. The Company also has working interests in several batteries at Narraway. Further details on the facilities are available in the virtual data room for parties which execute a confidentiality agreement.

Narraway Marketing

Natural gas from Narraway is processed at Canadian Natural Resources Limited’s Narraway plant at 10-08-062-10W6 and sold to Nova Gas Transmission Ltd. at the Narraway River meter station.

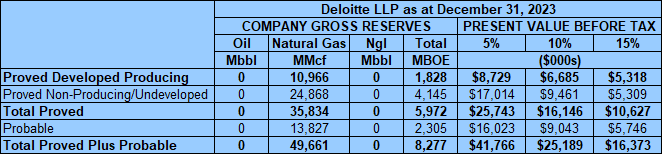

Narraway Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Narraway property contained remaining proved plus probable reserves of 49.7 Bcf of natural gas (8.3 million boe), with an estimated net present value of $25.2 million using forecast pricing at a 10% discount.

Natural gas from Narraway is processed at Canadian Natural Resources Limited’s Narraway plant at 10-08-062-10W6 and sold to Nova Gas Transmission Ltd. at the Narraway River meter station.

Narraway Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Narraway property contained remaining proved plus probable reserves of 49.7 Bcf of natural gas (8.3 million boe), with an estimated net present value of $25.2 million using forecast pricing at a 10% discount.

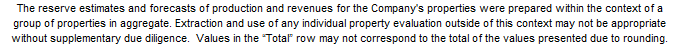

Narraway LMR as of March 2, 2024

As of March 2, 2024, the Narraway property had a deemed net asset value of ($1.4 million) (deemed assets of $1.6 million and deemed liabilities of $3.0 million), with an LMR ratio of 0.54.

As of March 2, 2024, the Narraway property had a deemed net asset value of ($1.4 million) (deemed assets of $1.6 million and deemed liabilities of $3.0 million), with an LMR ratio of 0.54.

Narraway Well List

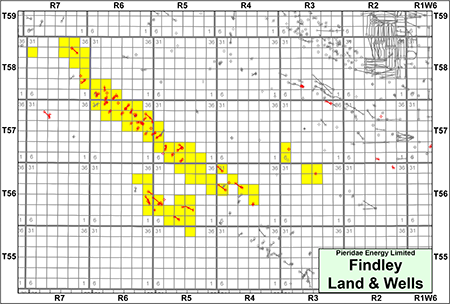

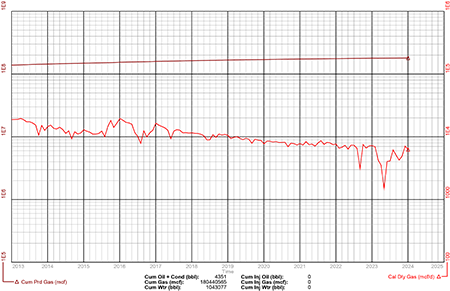

FINDLEY, AB

Township 55-58, Range 1-7 W6

At Findley, Pieridae holds working interests ranging from 57.5-100% in approximately 68 sections of land. The Findley property is producing natural gas from the Dunvegan, Gething, Charlie Lake, Cadotte, Paddy and Fahler formations. A portion of the Findley property is sour and Pieridae generates revenue from sulphur sales. Sweet natural gas from the Findley property is sold as fuel gas to Milner Power II Limited Partnership for power generation.

Average daily production net to Pieridae from Findley for the year-ended December 31, 2023 was approximately 565 boe/d, consisting of 3.4 MMcf/d of natural gas per day and seven bbl/d of natural gas liquids.

Operating income net to Pieridae from Findley for the year-ended December 31, 2023 was approximately $1.7 million.

At Findley, Pieridae holds working interests ranging from 57.5-100% in approximately 68 sections of land. The Findley property is producing natural gas from the Dunvegan, Gething, Charlie Lake, Cadotte, Paddy and Fahler formations. A portion of the Findley property is sour and Pieridae generates revenue from sulphur sales. Sweet natural gas from the Findley property is sold as fuel gas to Milner Power II Limited Partnership for power generation.

Average daily production net to Pieridae from Findley for the year-ended December 31, 2023 was approximately 565 boe/d, consisting of 3.4 MMcf/d of natural gas per day and seven bbl/d of natural gas liquids.

Operating income net to Pieridae from Findley for the year-ended December 31, 2023 was approximately $1.7 million.

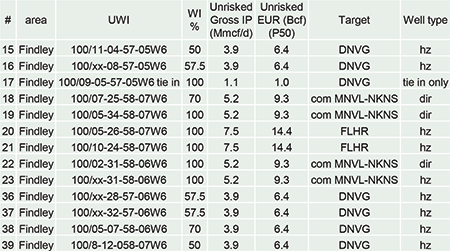

Findley Upside

The main structure at Findley is a Devonian cored thrust sheet carrying Wabamun, Turner Valley, Charlie Lake, Nikanassin, Spirit River, Cadotte, Paddy, and Dunvegan reservoirs. The Company has identified potential drilling locations targeting reservoirs in the Mannville Group and the Dunvegan Formation. Horizontal drilling has not been utilized in the area but has great potential to enhance initial production rates and estimated ultimate recovery compared to the current directional penetrations.

Falher potential was proven in frontal structures in 2014 with the 100/13-26-58-07/02 unstimulated recompletion, which has produced 6.2 Bcf of natural gas. Follow-up locations are available to be drilled on this discovery, as identified in the location list (below) as drill numbers 18, 19, 20 and 21. Additional follow-ups are also available on a deeper untested sheet (wells 22-23).

The Dunvegan Formation is a development target at Findley with many locations available. Water has not been identified in the main structure, so downdip infill locations are available to drill. Virgin pressures have been identified in a sub-structure, wells 15-17 will exploit this undrained reservoir.

Pieridae has included the following drilling locations at Findley in the proposed four-year development plan:

The main structure at Findley is a Devonian cored thrust sheet carrying Wabamun, Turner Valley, Charlie Lake, Nikanassin, Spirit River, Cadotte, Paddy, and Dunvegan reservoirs. The Company has identified potential drilling locations targeting reservoirs in the Mannville Group and the Dunvegan Formation. Horizontal drilling has not been utilized in the area but has great potential to enhance initial production rates and estimated ultimate recovery compared to the current directional penetrations.

Falher potential was proven in frontal structures in 2014 with the 100/13-26-58-07/02 unstimulated recompletion, which has produced 6.2 Bcf of natural gas. Follow-up locations are available to be drilled on this discovery, as identified in the location list (below) as drill numbers 18, 19, 20 and 21. Additional follow-ups are also available on a deeper untested sheet (wells 22-23).

The Dunvegan Formation is a development target at Findley with many locations available. Water has not been identified in the main structure, so downdip infill locations are available to drill. Virgin pressures have been identified in a sub-structure, wells 15-17 will exploit this undrained reservoir.

Pieridae has included the following drilling locations at Findley in the proposed four-year development plan:

Further details on the drilling opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

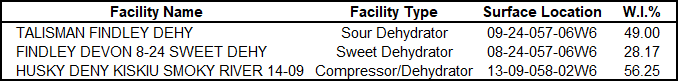

Findley Facilities

Findley Facilities

At Findley, Pieridae has working interests in the following facilities. The Company also has working interests in several batteries at Findley. Further details on the facilities are available in the virtual data room for parties which execute a confidentiality agreement.

Findley Marketing

Pieridae has a fuel natural gas supply agreement with Milner Power II Limited Partnership. Sweet natural gas from Findley is processed at the Maxim Milner M2 facility at 02-15-058-08W5. Custody transfer to Maxim is at the pipeline tie-in location at 10-04-059-07W6.

The fuel gas supply agreement with Milner provides for a reliable alternative sales point to the previous sales point at Canadian Natural’s Horse processing facility, which had limited capacity for volumes from Findley. Sweet natural gas can still be delivered to Canadian Natural’s Horse facility at 14-23-058-26W5 as well as Peyto Exploration & Development Corp.’s Edson facility as alternative processing/sales points.

Sour natural gas from Findley is processed at Peyto’s Edson gas plant and sold to Nova Gas Transmission Ltd. at the Edson meter station.

Natural gas from Kiskiu is sold to Nova Gas at the Marsh Head Creek West #2 meter station.

Findley Reserves

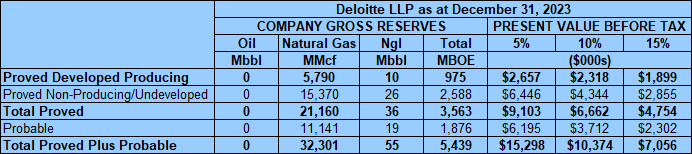

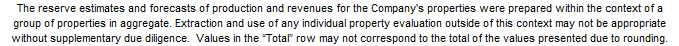

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Findley property contained remaining proved plus probable reserves of 32.3 Bcf of natural gas and 55,000 barrels of natural gas liquids (5.4 million boe), with an estimated net present value of $10.4 million using forecast pricing at a 10% discount.

Pieridae has a fuel natural gas supply agreement with Milner Power II Limited Partnership. Sweet natural gas from Findley is processed at the Maxim Milner M2 facility at 02-15-058-08W5. Custody transfer to Maxim is at the pipeline tie-in location at 10-04-059-07W6.

The fuel gas supply agreement with Milner provides for a reliable alternative sales point to the previous sales point at Canadian Natural’s Horse processing facility, which had limited capacity for volumes from Findley. Sweet natural gas can still be delivered to Canadian Natural’s Horse facility at 14-23-058-26W5 as well as Peyto Exploration & Development Corp.’s Edson facility as alternative processing/sales points.

Sour natural gas from Findley is processed at Peyto’s Edson gas plant and sold to Nova Gas Transmission Ltd. at the Edson meter station.

Natural gas from Kiskiu is sold to Nova Gas at the Marsh Head Creek West #2 meter station.

Findley Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Findley property contained remaining proved plus probable reserves of 32.3 Bcf of natural gas and 55,000 barrels of natural gas liquids (5.4 million boe), with an estimated net present value of $10.4 million using forecast pricing at a 10% discount.

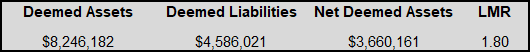

Findley LMR as of March 2, 2024

As of March 2, 2024, the Findley property had a deemed net asset value of $3.7 million (deemed assets of $8.2 million and deemed liabilities of $4.6 million), with an LMR ratio of 1.80.

As of March 2, 2024, the Findley property had a deemed net asset value of $3.7 million (deemed assets of $8.2 million and deemed liabilities of $4.6 million), with an LMR ratio of 1.80.

Findley Well List

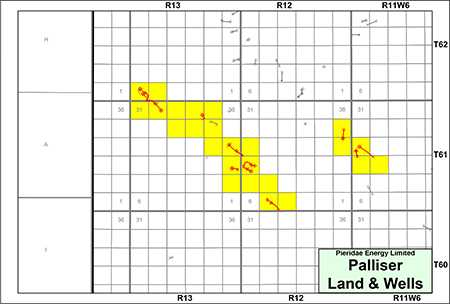

PALLISER, AB

Township 61-62, Range 11-13 W6

At Palliser, Pieridae holds a 100% working interest in 25 sections of land. The Palliser property is producing natural gas from the Charlie Lake Formation. The Company also generates revenue from sulphur sales at Palliser.

Average daily production net to Pieridae from Palliser for the year-ended December 31, 2023 was approximately 507 boe/d, consisting of approximately 3.0 MMcf/d of natural gas.

Operating income net to Pieridae from Palliser for the year-ended December 31, 2023 was approximately $645,000.

At Palliser, Pieridae holds a 100% working interest in 25 sections of land. The Palliser property is producing natural gas from the Charlie Lake Formation. The Company also generates revenue from sulphur sales at Palliser.

Average daily production net to Pieridae from Palliser for the year-ended December 31, 2023 was approximately 507 boe/d, consisting of approximately 3.0 MMcf/d of natural gas.

Operating income net to Pieridae from Palliser for the year-ended December 31, 2023 was approximately $645,000.

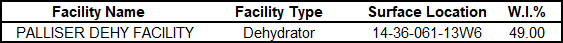

Palliser Facilities

At Palliser, Pieridae has a working interest in the following facility. Further details on the facilities are available in the virtual data room for parties which execute a confidentiality agreement.

Palliser Marketing

Natural gas from Palliser is processed at Peyto Exploration & Development Corp.’s Edson facility and sold to Nova Gas Transmission Ltd. at the Edson meter station.

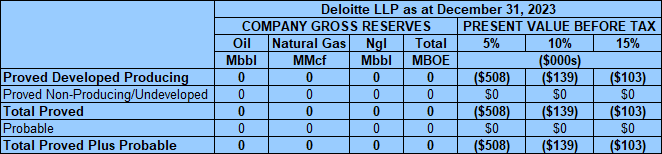

Palliser Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

The Palliser property was evaluated as part of the Deloitte Report and no reserves were assigned. The property had an estimated net present value of ($139,000) using forecast pricing at a 10% discount.

Natural gas from Palliser is processed at Peyto Exploration & Development Corp.’s Edson facility and sold to Nova Gas Transmission Ltd. at the Edson meter station.

Palliser Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

The Palliser property was evaluated as part of the Deloitte Report and no reserves were assigned. The property had an estimated net present value of ($139,000) using forecast pricing at a 10% discount.

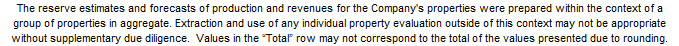

Palliser LMR as of March 2, 2024

As of March 2, 2024, the Palliser property had a deemed net asset value of $17.0 million (deemed assets of $18.3 million and deemed liabilities of $1.2 million), with an LMR ratio of 14.74.

As of March 2, 2024, the Palliser property had a deemed net asset value of $17.0 million (deemed assets of $18.3 million and deemed liabilities of $1.2 million), with an LMR ratio of 14.74.

Palliser Well List

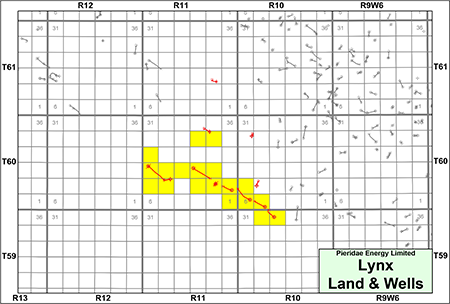

LYNX, AB

Township 59-61, Range 10-11 W6

At Lynx, Pieridae holds various working interests in approximately 19 sections of land. The Lynx property is producing natural gas from two 100% owned Charlie Lake wells in Section 15-060-11W6.

Average daily production net to Pieridae from Lynx for the year-ended December 31, 2023 was approximately 195 boe/d, consisting of approximately 1.2 MMcf/d of natural gas.

Operating income net to Pieridae from Lynx for the year-ended December 31, 2023 was approximately $195,000.

At Lynx, Pieridae holds various working interests in approximately 19 sections of land. The Lynx property is producing natural gas from two 100% owned Charlie Lake wells in Section 15-060-11W6.

Average daily production net to Pieridae from Lynx for the year-ended December 31, 2023 was approximately 195 boe/d, consisting of approximately 1.2 MMcf/d of natural gas.

Operating income net to Pieridae from Lynx for the year-ended December 31, 2023 was approximately $195,000.

Lynx Facilities

At Lynx, Pieridae has a working interest in the following facility. Further details on the facilities are available in the virtual data room for parties which execute a confidentiality agreement.

Lynx Marketing

Natural gas from Lynx is processed at Peyto Exploration & Development Corp.’s Edson facility and sold to Nova Gas Transmission Ltd. at the Edson meter station.

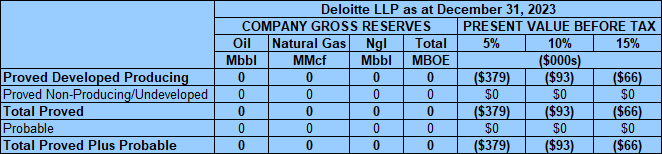

Lynx Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

The Lynx property was evaluated as part of the Deloitte Report and no reserves were assigned. The property had an estimated net present value of ($93,000) using forecast pricing at a 10% discount.

Natural gas from Lynx is processed at Peyto Exploration & Development Corp.’s Edson facility and sold to Nova Gas Transmission Ltd. at the Edson meter station.

Lynx Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

The Lynx property was evaluated as part of the Deloitte Report and no reserves were assigned. The property had an estimated net present value of ($93,000) using forecast pricing at a 10% discount.

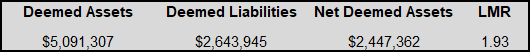

Lynx LMR as of March 2, 2024

As of March 2, 2024, the Lynx property had a deemed net asset value of $2.4 million (deemed assets of $5.1 million and deemed liabilities of $2.6 million), with an LMR ratio of 1.93.

As of March 2, 2024, the Lynx property had a deemed net asset value of $2.4 million (deemed assets of $5.1 million and deemed liabilities of $2.6 million), with an LMR ratio of 1.93.

Lynx Well List

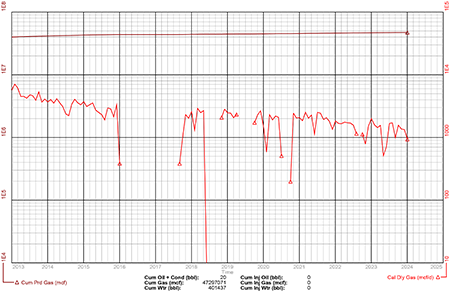

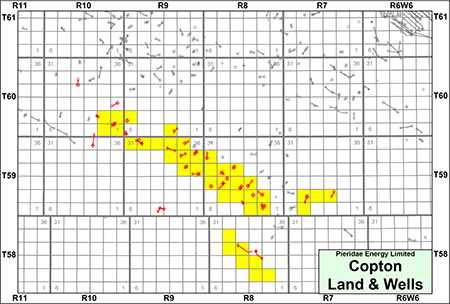

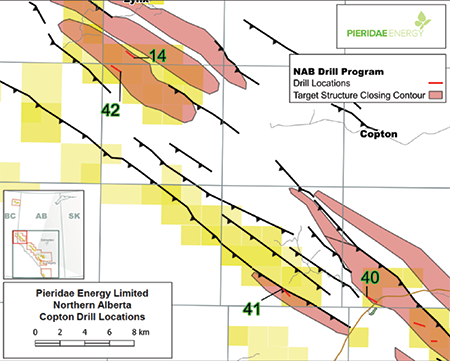

COPTON, AB

Township 58-60, Range 7-10 W6

At Copton, Pieridae holds various working interests ranging from 50-100% in approximately 41 sections of land. The Copton property is producing natural gas from the Dunvegan, Nikanassin, Cadomin, Cadotte and Notikewin formations.

Average daily production net to Pieridae from Copton for the year-ended December 31, 2023 was approximately 126 boe/d, consisting of 757 Mcf/d of natural gas.

Operating income net to Pieridae from Copton for the year-ended December 31, 2023 was approximately $417,000.

At Copton, Pieridae holds various working interests ranging from 50-100% in approximately 41 sections of land. The Copton property is producing natural gas from the Dunvegan, Nikanassin, Cadomin, Cadotte and Notikewin formations.

Average daily production net to Pieridae from Copton for the year-ended December 31, 2023 was approximately 126 boe/d, consisting of 757 Mcf/d of natural gas.

Operating income net to Pieridae from Copton for the year-ended December 31, 2023 was approximately $417,000.

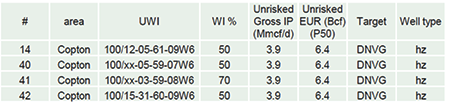

Copton Upside

At Copton, the Dunvegan, Cadotte and Spirit River reservoirs are all productive with well-defined pools and structures. It is anticipated that drilling horizontal development wells will be effective in achieving additional drainage from these pools.

In addition to the wells in the development plan targeting the Dunvegan Formation, the Company believes there are viable Cadotte and Spirit River locations.

Pieridae has included the following horizontal drilling locations at Copton in the proposed four-year development plan:

At Copton, the Dunvegan, Cadotte and Spirit River reservoirs are all productive with well-defined pools and structures. It is anticipated that drilling horizontal development wells will be effective in achieving additional drainage from these pools.

In addition to the wells in the development plan targeting the Dunvegan Formation, the Company believes there are viable Cadotte and Spirit River locations.

Pieridae has included the following horizontal drilling locations at Copton in the proposed four-year development plan:

Further details on the drilling opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

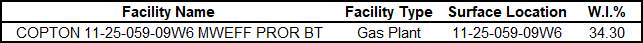

Copton Facilities

Copton Facilities

At Copton, Pieridae has a working interest in the following facility. The Company also has working interests in several batteries at Copton. Further details on the facilities are available in the virtual data room for parties which execute a confidentiality agreement.

Copton Marketing

Natural gas from Copton is processed at Kelt Exploration Ltd.’s Copton facility at 11-25-059-09W6 and sold to Nova Gas Transmission Ltd. at the Copton Creek meter station.

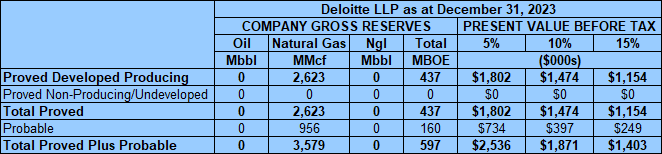

Copton Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Copton property contained remaining proved plus probable reserves of 3.6 Bcf of natural gas (597,000 boe), with an estimated net present value of $1.9 million using forecast pricing at a 10% discount.

Natural gas from Copton is processed at Kelt Exploration Ltd.’s Copton facility at 11-25-059-09W6 and sold to Nova Gas Transmission Ltd. at the Copton Creek meter station.

Copton Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Copton property contained remaining proved plus probable reserves of 3.6 Bcf of natural gas (597,000 boe), with an estimated net present value of $1.9 million using forecast pricing at a 10% discount.

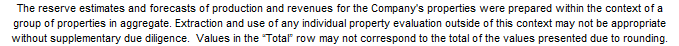

Copton LMR as of March 2, 2024

As of March 2, 2024, the Copton property had a deemed net asset value of ($626,418) (deemed assets of $2.8 million and deemed liabilities of $3.4 million), with an LMR ratio of 0.82.

As of March 2, 2024, the Copton property had a deemed net asset value of ($626,418) (deemed assets of $2.8 million and deemed liabilities of $3.4 million), with an LMR ratio of 0.82.

Copton Well List

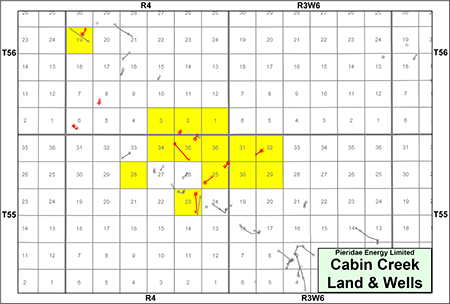

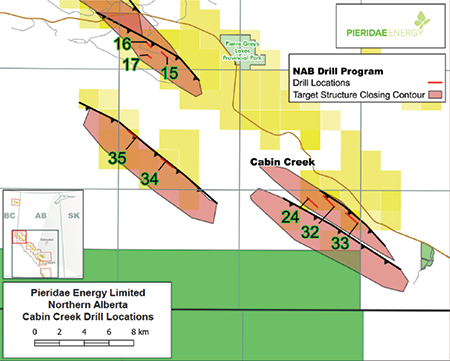

CABIN CREEK, AB

Township 55-56, Range 3-4 W6

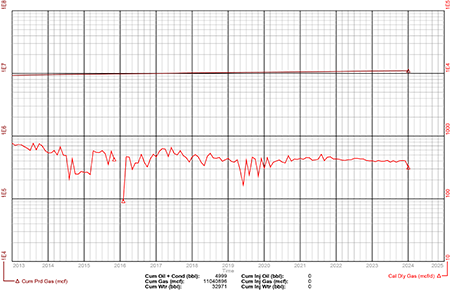

In the Cabin Creek area, Pieridae holds working interests ranging from 50-100% in 14 sections of land. The property includes both operated and non-operated interests. The Cabin Creek property is producing natural gas from the Dunvegan Formation.

Average daily production net to Pieridae from Cabin Creek for the year-ended December 31, 2023 was approximately 30 boe/d, consisting of 174 Mcf/d of natural gas and one bbl/d of natural gas liquids.

Operating income net to Pieridae from Cabin Creek for the year-ended December 31, 2023 was approximately $70,000.

In the Cabin Creek area, Pieridae holds working interests ranging from 50-100% in 14 sections of land. The property includes both operated and non-operated interests. The Cabin Creek property is producing natural gas from the Dunvegan Formation.

Average daily production net to Pieridae from Cabin Creek for the year-ended December 31, 2023 was approximately 30 boe/d, consisting of 174 Mcf/d of natural gas and one bbl/d of natural gas liquids.

Operating income net to Pieridae from Cabin Creek for the year-ended December 31, 2023 was approximately $70,000.

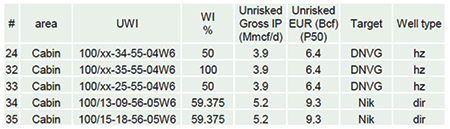

Cabin Creek Upside

At Cabin Creek, the Dunvegan reservoir is of high quality and has only been exploited with vertical wells. The Company believes horizontal development will increase the initial production and estimated ultimate recovery of wells into these proven pools.

In addition to the Dunvegan Formation, the Company believes Cadomin/Nikanassin locations are also available. Several promising reservoirs are available as recompletion zones near the locations in Sections 34 & 35-055-04W6. Horizontal wells targeting these sweet natural gas units could be very prolific considering the abundance of fracturing noted in the vertical uphole penetrations.

Pieridae has included the following horizontal drilling locations at Cabin Creek in the proposed four-year development plan:

At Cabin Creek, the Dunvegan reservoir is of high quality and has only been exploited with vertical wells. The Company believes horizontal development will increase the initial production and estimated ultimate recovery of wells into these proven pools.

In addition to the Dunvegan Formation, the Company believes Cadomin/Nikanassin locations are also available. Several promising reservoirs are available as recompletion zones near the locations in Sections 34 & 35-055-04W6. Horizontal wells targeting these sweet natural gas units could be very prolific considering the abundance of fracturing noted in the vertical uphole penetrations.

Pieridae has included the following horizontal drilling locations at Cabin Creek in the proposed four-year development plan:

Further details on the drilling opportunities will be available in the virtual data room for parties that execute a confidentiality agreement.

Cabin Creek Facilities

Cabin Creek Facilities

At Cabin Creek, Pieridae has a working interest in the following facility. Further details on the facilities are available in the virtual data room for parties which execute a confidentiality agreement.

Cabin Creek Marketing

The Company’s natural gas from Cabin Creek is processed at Canadian Natural Resources Limited’s processing facility at Horse Lake and sold to Nova Gas Transmission Ltd. at the Marsh Head Creek West meter station.

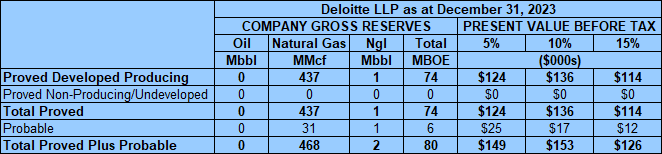

Cabin Creek Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Cabin Creek property contained remaining proved plus probable reserves of 468 MMcf of natural gas and 2,000 barrels of natural gas liquids (80,000 boe), with an estimated net present value of $153,000 using forecast pricing at a 10% discount.

The Company’s natural gas from Cabin Creek is processed at Canadian Natural Resources Limited’s processing facility at Horse Lake and sold to Nova Gas Transmission Ltd. at the Marsh Head Creek West meter station.

Cabin Creek Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Cabin Creek property contained remaining proved plus probable reserves of 468 MMcf of natural gas and 2,000 barrels of natural gas liquids (80,000 boe), with an estimated net present value of $153,000 using forecast pricing at a 10% discount.

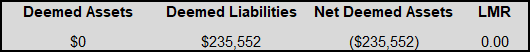

Cabin Creek LMR as of March 2, 2024

As of March 2, 2024, the Cabin Creek property had a deemed net asset value of ($235,552) (deemed assets of $0 and deemed liabilities of $235,552), with an LMR ratio of 0.00.

As of March 2, 2024, the Cabin Creek property had a deemed net asset value of ($235,552) (deemed assets of $0 and deemed liabilities of $235,552), with an LMR ratio of 0.00.

Cabin Creek Well List

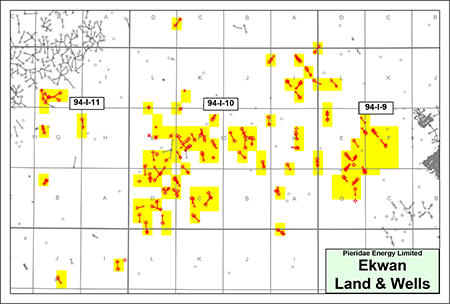

EKWAN, B.C.

NTS 094-I-09 - 094-I-15

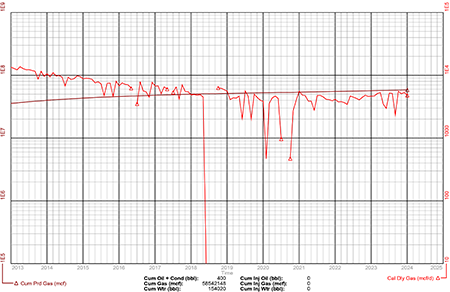

At Ekwan, Pieridae holds mainly 100% working interests in 496 spacing units of land. The Ekwan property is producing natural gas from the Jean Marie and Kakisa formations.

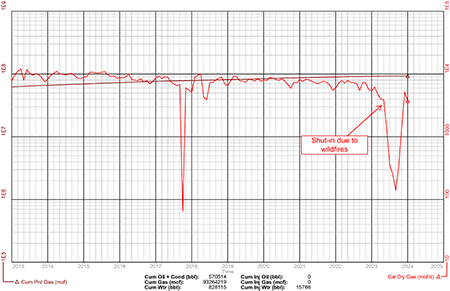

The Ekwan property suffered production loss due to shut-ins as a result of the wildfires in April 2023 but production is now largely back on stream.

Average daily production net to Pieridae from Ekwan for the year-ended December 31, 2023 was approximately 410 boe/d, consisting of 2.3 MMcf/d of natural gas and 25 bbl/d of oil and natural gas liquids. By March 2024, production from 35 wells restored production to 977 boe/d. There are additional fire damaged wells that remain shut-in due to time constraints associated with winter access.

Operating income net to Pieridae from Ekwan for the year-ended December 31, 2023 was approximately ($470,000).

At Ekwan, Pieridae holds mainly 100% working interests in 496 spacing units of land. The Ekwan property is producing natural gas from the Jean Marie and Kakisa formations.

The Ekwan property suffered production loss due to shut-ins as a result of the wildfires in April 2023 but production is now largely back on stream.

Average daily production net to Pieridae from Ekwan for the year-ended December 31, 2023 was approximately 410 boe/d, consisting of 2.3 MMcf/d of natural gas and 25 bbl/d of oil and natural gas liquids. By March 2024, production from 35 wells restored production to 977 boe/d. There are additional fire damaged wells that remain shut-in due to time constraints associated with winter access.

Operating income net to Pieridae from Ekwan for the year-ended December 31, 2023 was approximately ($470,000).

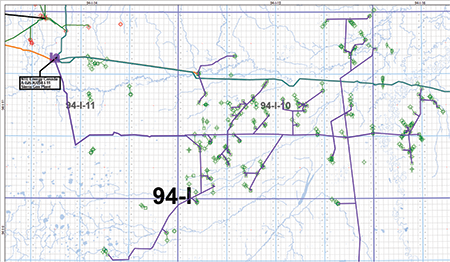

Pieridae has identified the importance of lowering operational costs at Ekwan by making the SCADA system operational. This would eliminate the cost of ice road construction going forward, which historically has been substantial.

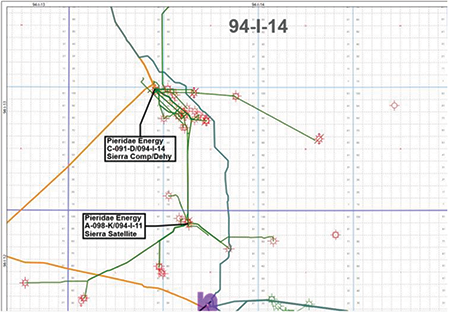

The following map shows that the sweet natural gas production from Ekwan is connected to the NTE Energy Canda A-026-K/094-I-11 Sierra Gas Plant.

The following map shows that the sweet natural gas production from Ekwan is connected to the NTE Energy Canda A-026-K/094-I-11 Sierra Gas Plant.

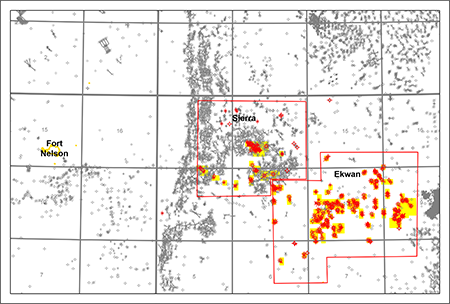

The following map shows the location of Sierra and Ekwan relative to the town of Fort Nelson.

The Ekwan property was impacted by wildfires in 2023 but production has now been re-established. By March 2024, production from 35 wells restored production to 977 boe/d. There are additional fire damaged wells that remain shut-in due to time constraints associated with winter access.

Ekwan Facilities

Ekwan Facilities

At Ekwan, Pieridae has a working interest in the following facility. The Company also has working interests in several batteries at Ekwan. Further details on the facilities are available in the virtual data room for parties which execute a confidentiality agreement.

Ekwan Marketing

Natural gas from Ekwan is sold to Nova Gas Transmission Ltd. at the Sierra meter station.

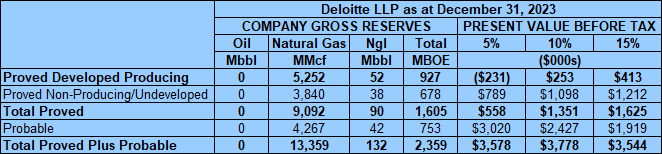

Ekwan Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Ekwan property contained remaining proved plus probable reserves of 13.4 Bcf of natural gas and 132,000 barrels of natural gas liquids (2.4 million boe), with an estimated net present value of $3.8 million using forecast pricing at a 10% discount.

Natural gas from Ekwan is sold to Nova Gas Transmission Ltd. at the Sierra meter station.

Ekwan Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Ekwan property contained remaining proved plus probable reserves of 13.4 Bcf of natural gas and 132,000 barrels of natural gas liquids (2.4 million boe), with an estimated net present value of $3.8 million using forecast pricing at a 10% discount.

Ekwan Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

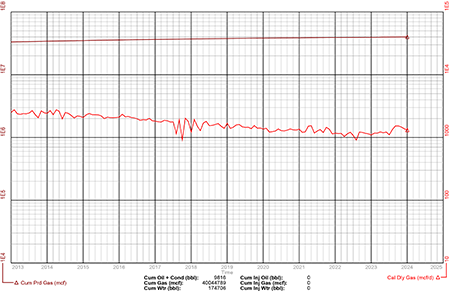

SIERRA, B.C.

NTS 094-I-11- 094-I-14

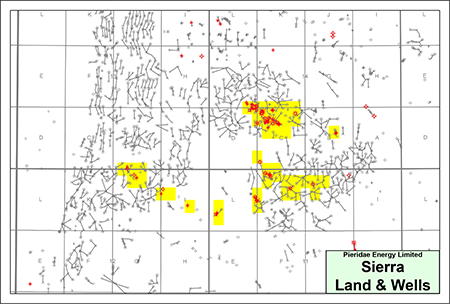

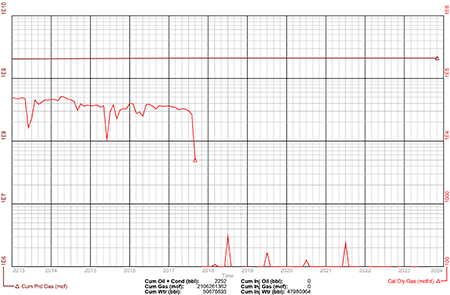

In the Sierra area, Pieridae holds a 100% working interest in 168 spacing units of land. The target formation at Sierra is the Pine Point Formation.

The Sierra property is not currently producing. Natural gas from Sierra became stranded when Enbridge Inc. shut down its sulphur train in September 2017 rather than perform a turnaround. Production from Sierra was dehydrated at C-091-D and delivered to the Enbridge Fort Nelson natural gas plant for sweetening and sales into T-North.

The Sierra property has had several minor reactivations since 2017 in order to maintain active status. Production capacity from Sierra is approximately 35-40 MMcf/d of natural gas net to Pieridae.

Operating income net to Pieridae from Sierra for the year-ended December 31, 2023 was approximately ($1.1 million).

In the Sierra area, Pieridae holds a 100% working interest in 168 spacing units of land. The target formation at Sierra is the Pine Point Formation.

The Sierra property is not currently producing. Natural gas from Sierra became stranded when Enbridge Inc. shut down its sulphur train in September 2017 rather than perform a turnaround. Production from Sierra was dehydrated at C-091-D and delivered to the Enbridge Fort Nelson natural gas plant for sweetening and sales into T-North.

The Sierra property has had several minor reactivations since 2017 in order to maintain active status. Production capacity from Sierra is approximately 35-40 MMcf/d of natural gas net to Pieridae.

Operating income net to Pieridae from Sierra for the year-ended December 31, 2023 was approximately ($1.1 million).

Pieridae has 16 wells capable of production at Sierra. In order to resume production, an amine plant with acid gas compression and disposal would be required at C-091-D along with a new connection to the TC Energy NGTL system.

Pieridae estimated the capital cost to restart Sierra to be approximately $31.0 million. This amount assumes scaled-down facility capital based on prior engineering estimates plus disposal well conversion costs. Minimal capital has been utilized to firm-up capital requirements.

Three high-level restart estimates were provided by Rheaume Engineering, SIGIT Group Inc. and Equinox Engineering Ltd. with costs ranging from approximately $28.9 million to $34.0 million. The estimates did not include any costs associated with the acid gas disposal well, sales pipeline, meter station or overdue turnaround work at the C-091-D main compressor/dehydrator or A-098-K satellite.

The estimates expect the critical path on this project would be the construction and commissioning of the TCPL meter station and expect a 30-month delay from project sanctioning.

Economics show that a 600 e3m3/d raw inlet case yields the highest net present value and rate of return with production resuming September 2024 and wells phased in over time to offset decline. All wells are on production by 2029 and decline takes over with field end of life in 2039.

The following map outlines the infrastructure associated with the Sierra property.

Pieridae estimated the capital cost to restart Sierra to be approximately $31.0 million. This amount assumes scaled-down facility capital based on prior engineering estimates plus disposal well conversion costs. Minimal capital has been utilized to firm-up capital requirements.

Three high-level restart estimates were provided by Rheaume Engineering, SIGIT Group Inc. and Equinox Engineering Ltd. with costs ranging from approximately $28.9 million to $34.0 million. The estimates did not include any costs associated with the acid gas disposal well, sales pipeline, meter station or overdue turnaround work at the C-091-D main compressor/dehydrator or A-098-K satellite.

The estimates expect the critical path on this project would be the construction and commissioning of the TCPL meter station and expect a 30-month delay from project sanctioning.

Economics show that a 600 e3m3/d raw inlet case yields the highest net present value and rate of return with production resuming September 2024 and wells phased in over time to offset decline. All wells are on production by 2029 and decline takes over with field end of life in 2039.

The following map outlines the infrastructure associated with the Sierra property.

The Sierra property has had several minor reactivations since 2017 in order to maintain active status.

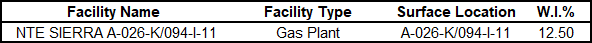

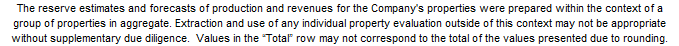

Sierra Facilities

Sierra Facilities

At Sierra, Pieridae has a working interest in the following facilities. The Company also has working interests in several batteries at Sierra. Further details on the facilities are available in the virtual data room for parties which execute a confidentiality agreement.

Sierra Marketing

Natural gas from Sierra went into the North River Midstream natural gas gathering system, processed at the Enbridge Inc. Fort Nelson plant and then sold into T-North.

Sierra Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Sierra property contained remaining proved plus probable reserves of 120.9 Bcf of natural gas (20.2 million boe), with an estimated net present value of $59.5 million using forecast pricing at a 10% discount.

Natural gas from Sierra went into the North River Midstream natural gas gathering system, processed at the Enbridge Inc. Fort Nelson plant and then sold into T-North.

Sierra Reserves

Deloitte LLP (“Deloitte”) prepared an independent reserves evaluation of the Properties (the “Deloitte Report”). The Deloitte Report is effective December 31, 2023 using an average of Deloitte, GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule Associates Limited forecast pricing as at January 1, 2024 (“IC4 forecast pricing January 1, 2024”).

Deloitte estimated that, as at December 31, 2023, the Sierra property contained remaining proved plus probable reserves of 120.9 Bcf of natural gas (20.2 million boe), with an estimated net present value of $59.5 million using forecast pricing at a 10% discount.

Sierra Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

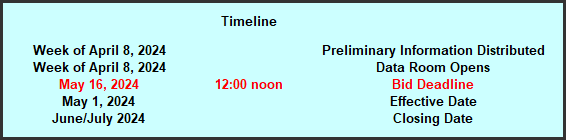

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Properties until 12:00 pm on Thursday May 16, 2024.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transactions with the parties submitting the most acceptable proposals at the conclusion of the process.

transactions with the parties submitting the most acceptable proposals at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday May 16, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, mail (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, the Deloitte Report, LMR and PCA information, most recent net operations summary, detailed facilities information and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.