Offering Details

Back

Under Review / SCCC Petroleum Corporation

SCCC Petroleum Corporation

Corporate Divestiture

Corporate DivestitureBid Deadline: May 23, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

SCCC Petroleum Corporation (“SCCC” or the “Company”) has engaged Sayer Energy Advisors to assist it with a corporate sale process.SCCC is a private junior oil and natural gas company with oil sands interests located in the Red Earth area of Alberta (the “Property”). There is currently no production from the Property.

The Company has no bank debt or severance obligations.

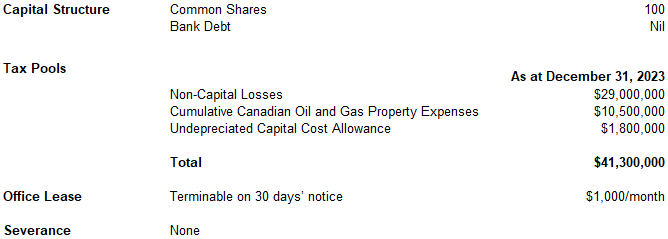

As at December 31, 2023, SCCC had total unused Canadian income tax pools of approximately $41.3 million including $29.0 million of non-capital losses.

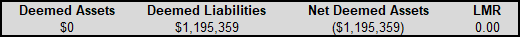

As of March 2, 2024, SCCC had a deemed net asset value of ($1.2 million) (deemed assets of $0 and deemed liabilities of $1.2 million), with an LMR ratio of 0.00. These numbers do not include SCCC’s current security deposit with the Alberta Energy Regulator ("AER") of approximately $1.5 million.

Additional corporate and technical information relating to SCCC will be provided to parties upon execution of a confidentiality agreement.

Overview Map Showing the Location of SCCC’s Property

Corporate Overview

SCCC is a tightly-held private junior oil and natural gas company with no bank debt or severance obligations.

As at December 31, 2023, SCCC had total unused Canadian income tax pools of approximately $41.3 million as outlined below.

Additional corporate information relating to SCCC will be provided to parties upon execution of a confidentiality agreement.

RED EARTH

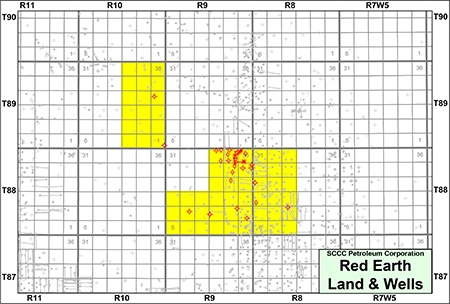

Township 88-89, Range 8-10 W5At Red Earth, SCCC holds a 100% working interest in several oil sands leases from the top of the Peace River to base of the Pekisko Formation. The oil sands leases comprise 63 sections of land with indefinite lease expiry.

The Property is currently shut-in. The Red Earth property was designed as a cyclic steam pilot project targeting the Lower Cretaceous Bluesky Formation. The Company acquired the Property to pursue this enhanced recovery. In 2015, the Company received approval for the commercial scheme which was amended in 2017 to simplify the steam injection process.

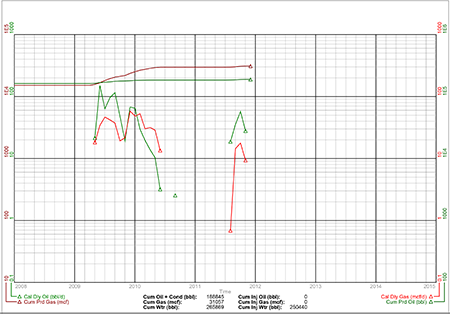

Red Earth, Alberta – Gross Production Group Plot of SCCC’s Natural Gas Wells

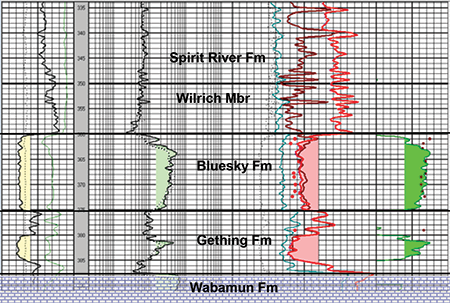

The Lower Cretaceous Bluesky Formation regionally is a broad, predictable sand deposited in a near-shore environment with minimal base structure variations. The Bluesky is found at a depth of approximately 400 metres and overlain by capstone shales of the Wilrich and Spirit River formations. The target reservoir is shown in the following well logs.

SCCC Petroleum RedEarth 100/01-35-088-09W5/0 – Bluesky Formation Type Log

The Bluesky target reservoir contains substantial oil in place. Initial production from the Property from a prior operator showed heavy oil (10°API) with approximately 90,000-200,000 cps at 16°C. The reservoir is 10-16 metres thick with 31% porosity and 1,000-3,000 mD of permeability.

Further details on the geology and development history of the Property are available in the virtual data room for parties that execute a confidentiality agreement.

Red Earth Facilities

At Red Earth, SCCC has a working interest in the following facility.

The Company has Class II disposal approval at Red Earth in the Wabamun Formation for the well 00/13-36-088-09W5/2. SCCC also had a license to divert water for up to 164,250 m3/year from the water supply well at 07-26-088-09W5 for in situ recovery, which has been suspended due to non-operation.

Red Earth Reserves

The Company does not have a current third-party reserve report.

Red Earth LMR as of March 2, 2024

As of March 2, 2024, SCCC had a deemed net asset value of ($1.2 million) (deemed assets of $0 and deemed liabilities of $1.2 million), with an LMR ratio of 0.00. These numbers do not include SCCC’s current security deposit with the AER which is approximately $1.5 million.

Red Earth Well List

Click here to download the complete well list in Excel.

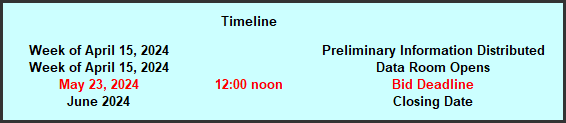

PROCESS & TIMELINE

Sayer Energy Advisors is accepting offers relating to this process until 12:00 pm on Thursday May 23, 2024.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

Sayer Energy Advisors is accepting proposals from interested parties until

noon on Thursday May 23, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Company with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: most recent financial information, summary land information, LMR information and other relevant corporate and technical information.

Download Confidentiality Agreement

To receive further information on the Company please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.