Offering Details

Back

Under Review / Emerald Lake Energy Ltd.

Emerald Lake Energy Ltd.

Corporate Divestiture

Corporate DivestitureBid Deadline: May 30, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

EMERALD LAKE HAS SOLD ITS INTERESTS IN THE PROGRESS AREA OF ALBERTA.

*Loss due to one-time expenses during the fourth quarter of 2023. Net operating income for calendar year 2023 was $49,000.

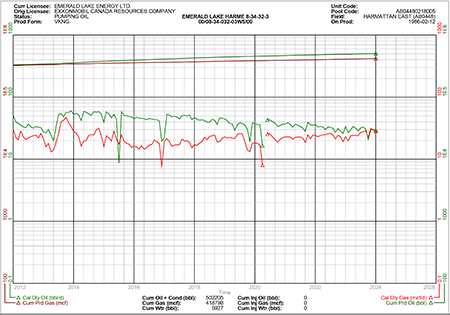

Gross Production Group Plot of Emerald Lake's Oil & Natural Gas Wells

Emerald Lake Energy Ltd. (“Emerald Lake” or the “Company”) has engaged Sayer Energy Advisors to assist it with a corporate sale process.

Emerald Lake is a private junior oil and natural gas company with long life working interests in located in the Cyn-Pem, Carson Creek North, Harmattan East, Homeglen Rimbey, Medicine River and Progress areas of Alberta (the “Properties”). The Properties consist primarily of non-operated working interests in several units. In addition, the Company holds certain interests in Fee Title lands and GORR interests ("GORR/Fee Title Royalties").

Emerald Lake’s preference is a sale of the shares of the Company but it will also entertain separate offers for the GORR/Fee Title Royalties.

Average daily sales production net to Emerald Lake from the Properties for the fourth quarter of 2023 was approximately 233 boe/d, consisting of approximately 178 bbl/d of oil and natural gas liquids and 330 Mcf/d of natural gas.

Operating income net to Emerald Lake for the fourth quarter of 2023 was approximately $402,000 or approximately $1.6 million annualized. These numbers do not reflect the recent reduction in annual operating expenses estimated to be approximately $500,000 because of lower electrical costs and capital reductions.

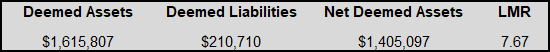

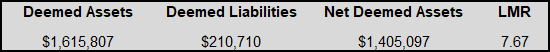

The Properties consist largely of non-operated unit interests. The Company’s only operated working interests are two wells located at Harmattan. As of February 3, 2024, the Harmattan property had a deemed net asset value of $1.4 million (deemed assets of $1.6 million and deemed liabilities of $210,710), with an LMR ratio of 7.67.

As at December 31, 2023, Emerald Lake had total unused Canadian income tax pools of approximately $3.2 million.

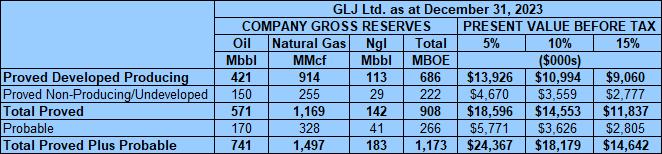

Emerald Lake’s reserve volumes have continuously realized positive annual revisions from GLJ Ltd. (“GLJ”), the Company’s third-party reserve evaluator. The RLI for the Properties on a proved developed producing basis is 9.3 years.

Additional corporate information relating to Emerald Lake will be provided to parties upon execution of a confidentiality agreement.

Emerald Lake is a private junior oil and natural gas company with long life working interests in located in the Cyn-Pem, Carson Creek North, Harmattan East, Homeglen Rimbey, Medicine River and Progress areas of Alberta (the “Properties”). The Properties consist primarily of non-operated working interests in several units. In addition, the Company holds certain interests in Fee Title lands and GORR interests ("GORR/Fee Title Royalties").

Emerald Lake’s preference is a sale of the shares of the Company but it will also entertain separate offers for the GORR/Fee Title Royalties.

Average daily sales production net to Emerald Lake from the Properties for the fourth quarter of 2023 was approximately 233 boe/d, consisting of approximately 178 bbl/d of oil and natural gas liquids and 330 Mcf/d of natural gas.

Operating income net to Emerald Lake for the fourth quarter of 2023 was approximately $402,000 or approximately $1.6 million annualized. These numbers do not reflect the recent reduction in annual operating expenses estimated to be approximately $500,000 because of lower electrical costs and capital reductions.

The Properties consist largely of non-operated unit interests. The Company’s only operated working interests are two wells located at Harmattan. As of February 3, 2024, the Harmattan property had a deemed net asset value of $1.4 million (deemed assets of $1.6 million and deemed liabilities of $210,710), with an LMR ratio of 7.67.

As at December 31, 2023, Emerald Lake had total unused Canadian income tax pools of approximately $3.2 million.

Emerald Lake’s reserve volumes have continuously realized positive annual revisions from GLJ Ltd. (“GLJ”), the Company’s third-party reserve evaluator. The RLI for the Properties on a proved developed producing basis is 9.3 years.

Additional corporate information relating to Emerald Lake will be provided to parties upon execution of a confidentiality agreement.

Corporate Upside

Substantial sums of capital have been spent by Emerald Lake in 2022-2023 for catch up on regulatory and environmental items not addressed due to the COVID pandemic. This is reflected in the reduced operating budgets Emerald Lake has received from the various operators. In addition, Emerald Lake is realizing substantial savings on electricity costs as outlined below. Further details on this spending and future cost savings will be available in the virtual data room for parties that execute a confidentiality agreement.

Substantial sums of capital have been spent by Emerald Lake in 2022-2023 for catch up on regulatory and environmental items not addressed due to the COVID pandemic. This is reflected in the reduced operating budgets Emerald Lake has received from the various operators. In addition, Emerald Lake is realizing substantial savings on electricity costs as outlined below. Further details on this spending and future cost savings will be available in the virtual data room for parties that execute a confidentiality agreement.

- Power costs:

- Emerald Lake power prices averaged $133.55 per MWh in 2023, or approximately $900,000

- One of the unit operators has entered into electricity hedges that will reduce the annual field electricity costs by over $300,000 net to Emerald Lake

- Emerald Lake expects to see further reductions in its electricity costs and has the ability to hedge at $85 per MWh

- Reducing power costs from $900,000 to +/-$600,000

- Accordingly, Emerald Lake’s operating income is expected to increase by over $300,000 on an annual basis

- Capital Costs/Operating Costs:

- Emerald Lake expenses all capital expenditures as operating costs with the exception of drilling and completion costs

- 2022 and 2023 were “catchup years” from COVID for capital items which were $700,000 and $500,000 respectively

- The Company expects this to trend downward to $300,000 resulting in $200,000 in additional operating cash flow

In addition, Emerald Lake has Fee Simple land under lease which the Company expects to be developed in the near future which could generate between $70,000 to $100,000 in additional royalty revenue per year. Further information on this lease will be provided to parties which execute a confidentiality agreement.

Corporate Overview

Emerald Lake is a tightly-held private junior oil and natural gas company with a small number of shareholders, and no debt or severance obligations.

The Company has no bank debt.

As at December 31, 2023, Emerald Lake had total unused Canadian income tax pools of approximately $3.2 million as outlined below.

Additional corporate information relating to Emerald Lake will be provided to parties upon execution of a confidentiality agreement.

Corporate Overview

Emerald Lake is a tightly-held private junior oil and natural gas company with a small number of shareholders, and no debt or severance obligations.

The Company has no bank debt.

As at December 31, 2023, Emerald Lake had total unused Canadian income tax pools of approximately $3.2 million as outlined below.

Additional corporate information relating to Emerald Lake will be provided to parties upon execution of a confidentiality agreement.

Production Overview

Average daily sales production net to Emerald Lake from the Properties for the fourth quarter of 2023 was approximately 233 boe/d, consisting of approximately 178 bbl/d of oil and natural gas liquids and 330 Mcf/d of natural gas as outlined below.

Operating income net to Emerald Lake for the fourth quarter of 2023 was approximately $402,000 or approximately $1.6 million annualized as outlined below. These numbers do not reflect the recent reduction in annual operating expenses estimated to be approximately $500,000 because of lower electrical costs and capital reductions.

Average daily sales production net to Emerald Lake from the Properties for the fourth quarter of 2023 was approximately 233 boe/d, consisting of approximately 178 bbl/d of oil and natural gas liquids and 330 Mcf/d of natural gas as outlined below.

Operating income net to Emerald Lake for the fourth quarter of 2023 was approximately $402,000 or approximately $1.6 million annualized as outlined below. These numbers do not reflect the recent reduction in annual operating expenses estimated to be approximately $500,000 because of lower electrical costs and capital reductions.

*Loss due to one-time expenses during the fourth quarter of 2023. Net operating income for calendar year 2023 was $49,000.

Gross Production Group Plot of Emerald Lake's Oil & Natural Gas Wells

LMR Summary

The Properties consist largely of non-operated unit interests. The Company’s only operated interests are two wells located at Harmattan.

As of February 3, 2024, the Harmattan property had a deemed net asset value of $1.4 million (deemed assets of $1.6 million and deemed liabilities of $210,710), with an LMR ratio of 7.67.

The Properties consist largely of non-operated unit interests. The Company’s only operated interests are two wells located at Harmattan.

As of February 3, 2024, the Harmattan property had a deemed net asset value of $1.4 million (deemed assets of $1.6 million and deemed liabilities of $210,710), with an LMR ratio of 7.67.

Seismic Overview

The Company does not have an interest in any seismic data relating to the Properties.

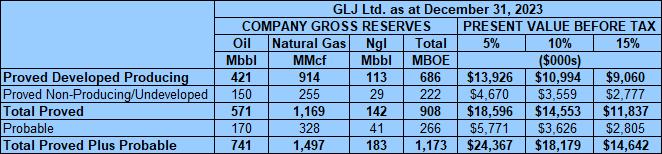

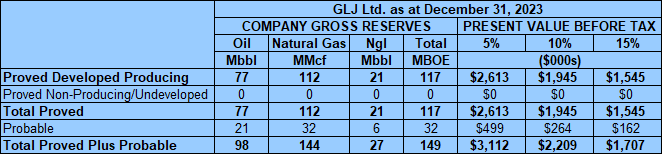

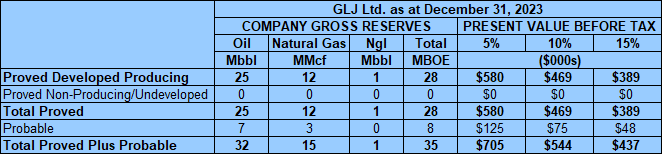

Reserves Overview

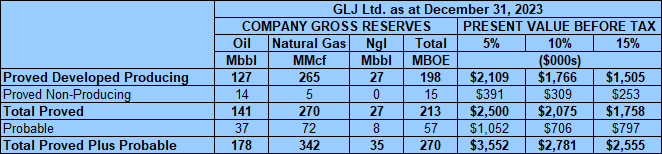

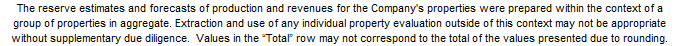

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s January 1, 2024 forecast pricing.

GLJ estimated that, as at December 31, 2023, the Properties contained remaining proved plus probable reserves of 924,000 barrels of oil and natural gas liquids and 1.5 Bcf of natural gas (1.2 million boe), with an estimated net present value of $18.2 million using forecast pricing at a 10% discount.

The Company does not have an interest in any seismic data relating to the Properties.

Reserves Overview

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s January 1, 2024 forecast pricing.

GLJ estimated that, as at December 31, 2023, the Properties contained remaining proved plus probable reserves of 924,000 barrels of oil and natural gas liquids and 1.5 Bcf of natural gas (1.2 million boe), with an estimated net present value of $18.2 million using forecast pricing at a 10% discount.

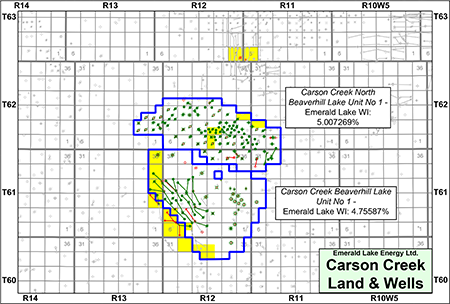

CARSON CREEK

Township 60-63, Range 11-13 W5

At Carson Creek, Emerald Lake holds a 5.007269% working interest in the Carson Creek North Beaverhill Lake Unit No 1 and a 4.75587% working interest in the Carson Creek Beaverhill Lake Unit No 1 both operated by Conifer Energy Inc. as well as certain non-unit wells shown in red on the following plat.

The Carson Creek North Beaverhill Lake Unit No 1 is well suited for tertiary CO2 recovery and the natural gas unit has carbon sequestration potential.

Average daily sales production net to Emerald Lake from Carson Creek for the fourth quarter of 2023 was approximately 93 boe/d, consisting of 69 bbl/d of oil and natural gas liquids and 146 Mcf/d of natural gas.

Net operating income to Emerald Lake from Carson Creek was materially impacted during 2023 due to elevated power costs. For the fourth quarter of 2023 this was approximately $20,000, or $80,000 on an annualized basis. The operator has since hedged the majority of the electricity costs for 2024 and beyond. In addition, it has budgeted additional cost savings that together will increase the operating cash flow by $450,000.

As Emerald Lake’s capital costs and activity levels decrease in the area, the Company expects additional reductions in operating expenses than those accounted for above. Emerald Lake expenses all capital expenditures as operating costs, with the exception of drilling and completions.

At Carson Creek, Emerald Lake holds a 5.007269% working interest in the Carson Creek North Beaverhill Lake Unit No 1 and a 4.75587% working interest in the Carson Creek Beaverhill Lake Unit No 1 both operated by Conifer Energy Inc. as well as certain non-unit wells shown in red on the following plat.

The Carson Creek North Beaverhill Lake Unit No 1 is well suited for tertiary CO2 recovery and the natural gas unit has carbon sequestration potential.

Average daily sales production net to Emerald Lake from Carson Creek for the fourth quarter of 2023 was approximately 93 boe/d, consisting of 69 bbl/d of oil and natural gas liquids and 146 Mcf/d of natural gas.

Net operating income to Emerald Lake from Carson Creek was materially impacted during 2023 due to elevated power costs. For the fourth quarter of 2023 this was approximately $20,000, or $80,000 on an annualized basis. The operator has since hedged the majority of the electricity costs for 2024 and beyond. In addition, it has budgeted additional cost savings that together will increase the operating cash flow by $450,000.

As Emerald Lake’s capital costs and activity levels decrease in the area, the Company expects additional reductions in operating expenses than those accounted for above. Emerald Lake expenses all capital expenditures as operating costs, with the exception of drilling and completions.

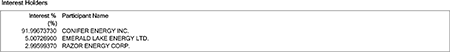

Carson Creek North Beaverhill Lake Unit No 1

Carson Creek North Beaverhill Lake Unit No 1

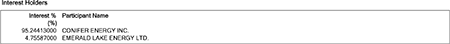

Gross Production Group Plot

Carson Creek Beaverhill Lake Unit No 1

Carson Creek Beaverhill Lake Unit No 1

Gross Production Group Plot

Carson Creek Facilities

At Carson Creek, Emerald Lake has working interests in the unit facilities including the following:

At Carson Creek, Emerald Lake has working interests in the unit facilities including the following:

Carson Creek Marketing

Oil from Carson Creek is sold to Tidal Energy Marketing Inc.

Natural gas from Carson Creek is delivered to Conifer’s Carson Creek Gas Processing Plant at 04-23-061-12W5. Conifer markets Emerald Lake’s natural gas from Carson Creek.

Natural gas liquids from Carson Creek are taken in kind and sold to Cenovus Energy Inc.

Carson Creek Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s January 1, 2024 forecast pricing.

GLJ estimated that, as at December 31, 2023, the Carson Creek property contained remaining proved plus probable reserves of 213,000 barrels of oil and natural gas liquids and 342 MMcf of natural gas (270,000 boe), with an estimated net present value of $2.8 million using forecast pricing at a 10% discount.

Oil from Carson Creek is sold to Tidal Energy Marketing Inc.

Natural gas from Carson Creek is delivered to Conifer’s Carson Creek Gas Processing Plant at 04-23-061-12W5. Conifer markets Emerald Lake’s natural gas from Carson Creek.

Natural gas liquids from Carson Creek are taken in kind and sold to Cenovus Energy Inc.

Carson Creek Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s January 1, 2024 forecast pricing.

GLJ estimated that, as at December 31, 2023, the Carson Creek property contained remaining proved plus probable reserves of 213,000 barrels of oil and natural gas liquids and 342 MMcf of natural gas (270,000 boe), with an estimated net present value of $2.8 million using forecast pricing at a 10% discount.

Carson Creek LMR

Emerald Lake does not operate any wells or facilities at Carson Creek.

Carson Creek Well List

Click here to download the complete well list in Excel.

Emerald Lake does not operate any wells or facilities at Carson Creek.

Carson Creek Well List

Click here to download the complete well list in Excel.

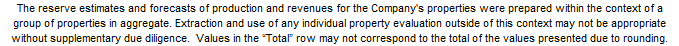

HARMATTAN

Township 32, Range 3 W5

At Harmattan, Emerald Lake holds various working interests in 5.5 sections of land with 10%-25.4% working interests in certain wells operated by Whitecap Resources Inc., and an 84.091% operated working interest in two producing oil wells in Section 034-032-03W5. The property produces oil and natural gas from the Cardium and Viking formations.

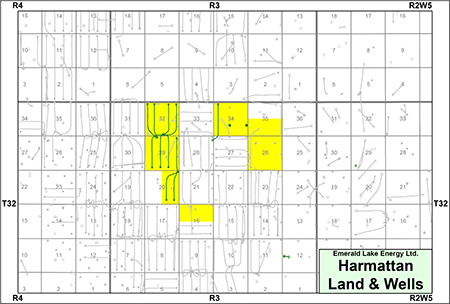

The Emerald Lake HarmE 100/08-34-032-03W5/0 well has historically responded very well to casing compression. The current casing compressor was installed in June 2013, and is undersized and unable to draw the casing down any further. With an upgraded compressor, additional drawdown on the casing is expected to yield an uptick in production.

Average daily sales production net to Emerald Lake from Harmattan for the fourth quarter of 2023 was approximately 58 boe/d, consisting of 46 bbl/d of oil and natural gas liquids and 72 Mcf/d of natural gas.

Operating income net to Emerald Lake from Harmattan for the fourth quarter of 2023 was approximately $181,000, or $724,000 on an annualized basis.

At Harmattan, Emerald Lake holds various working interests in 5.5 sections of land with 10%-25.4% working interests in certain wells operated by Whitecap Resources Inc., and an 84.091% operated working interest in two producing oil wells in Section 034-032-03W5. The property produces oil and natural gas from the Cardium and Viking formations.

The Emerald Lake HarmE 100/08-34-032-03W5/0 well has historically responded very well to casing compression. The current casing compressor was installed in June 2013, and is undersized and unable to draw the casing down any further. With an upgraded compressor, additional drawdown on the casing is expected to yield an uptick in production.

Average daily sales production net to Emerald Lake from Harmattan for the fourth quarter of 2023 was approximately 58 boe/d, consisting of 46 bbl/d of oil and natural gas liquids and 72 Mcf/d of natural gas.

Operating income net to Emerald Lake from Harmattan for the fourth quarter of 2023 was approximately $181,000, or $724,000 on an annualized basis.

Harmattan, Alberta

Gross Production Group Plot of Emerald Lake's Oil & Natural Gas Wells

Emerald Lake HarmE 100/08-34-032-03W5/0

Gross Production Plot

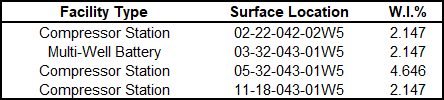

Harmattan Facilities

Emerald Lake has a 19.24% working interest in a multi-well battery at 16-20-032-03W5 at Harmattan.

Harmattan Marketing

The majority of the Company’s non-operated oil from Harmattan is taken in kind. Oil is sold to Plains Midstream Canada at 08-15-034-04W5 and Gibson Energy Marketing, LLC at 05-24-032-03W5.

Harmattan Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s January 1, 2024 forecast pricing.

GLJ estimated that, as at December 31, 2023, the Harmattan property contained remaining proved plus probable reserves of 359,000 barrels of oil and natural gas liquids and 508 MMcf of natural gas (444,000 boe), with an estimated net present value of $8.6 million using forecast pricing at a 10% discount.

Emerald Lake has a 19.24% working interest in a multi-well battery at 16-20-032-03W5 at Harmattan.

Harmattan Marketing

The majority of the Company’s non-operated oil from Harmattan is taken in kind. Oil is sold to Plains Midstream Canada at 08-15-034-04W5 and Gibson Energy Marketing, LLC at 05-24-032-03W5.

Harmattan Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s January 1, 2024 forecast pricing.

GLJ estimated that, as at December 31, 2023, the Harmattan property contained remaining proved plus probable reserves of 359,000 barrels of oil and natural gas liquids and 508 MMcf of natural gas (444,000 boe), with an estimated net present value of $8.6 million using forecast pricing at a 10% discount.

Harmattan LMR as of February 3, 2024

As of February 3, 2024, the Harmattan property had a deemed net asset value of $1.4 million (deemed assets of $1.6 million and deemed liabilities of $210,710), with an LMR ratio of 7.67.

As of February 3, 2024, the Harmattan property had a deemed net asset value of $1.4 million (deemed assets of $1.6 million and deemed liabilities of $210,710), with an LMR ratio of 7.67.

Harmattan Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

HOMEGLEN RIMBEY

Township 42-44, Range 1-2 W5

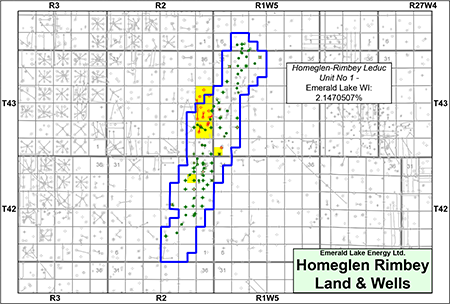

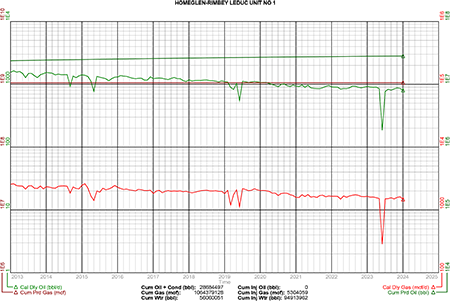

In the Homeglen Rimbey area, Emerald Lake holds a 2.1470507% working interest in the Homeglen-Rimbey Leduc Unit No 1 operated by i3 Canada Ltd. as well as interests in certain non-unit wells which are shown in red on the following plat.

Average daily sales production net to Emerald Lake from Homeglen Rimbey for the fourth quarter of 2023 was 30 boe/d, consisting of 24 bbl/d of oil and natural gas liquids and 36 Mcf/d of natural gas.

Operating income net to Emerald Lake from Homeglen Rimbey for the fourth quarter of 2023 was approximately $108,000, or $433,000 on an annualized basis.

In the Homeglen Rimbey area, Emerald Lake holds a 2.1470507% working interest in the Homeglen-Rimbey Leduc Unit No 1 operated by i3 Canada Ltd. as well as interests in certain non-unit wells which are shown in red on the following plat.

Average daily sales production net to Emerald Lake from Homeglen Rimbey for the fourth quarter of 2023 was 30 boe/d, consisting of 24 bbl/d of oil and natural gas liquids and 36 Mcf/d of natural gas.

Operating income net to Emerald Lake from Homeglen Rimbey for the fourth quarter of 2023 was approximately $108,000, or $433,000 on an annualized basis.

Homeglen Rimbey Facilities

At Homeglen Rimbey, Emerald Lake has working interests in the following unit facilities:

At Homeglen Rimbey, Emerald Lake has working interests in the following unit facilities:

Homeglen Rimbey Marketing

Emerald Lake’s oil at Homeglen Rimbey is sold to Plains Midstream Canada.

Natural gas from Homeglen Rimbey is sold to i3.

Homeglen Rimbey Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s January 1, 2024 forecast pricing.

GLJ estimated that, as at December 31, 2023, the Homeglen Rimbey property contained remaining proved plus probable reserves of 125,000 barrels of oil and natural gas liquids and 144 MMcf of natural gas (149,000 boe), with an estimated net present value of $2.2 million using forecast pricing at a 10% discount.

Emerald Lake’s oil at Homeglen Rimbey is sold to Plains Midstream Canada.

Natural gas from Homeglen Rimbey is sold to i3.

Homeglen Rimbey Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s January 1, 2024 forecast pricing.

GLJ estimated that, as at December 31, 2023, the Homeglen Rimbey property contained remaining proved plus probable reserves of 125,000 barrels of oil and natural gas liquids and 144 MMcf of natural gas (149,000 boe), with an estimated net present value of $2.2 million using forecast pricing at a 10% discount.

Homeglen Rimbey LMR

Emerald Lake does not operate any wells or facilities at Homeglen Rimbey.

Homeglen Rimbey Well List

Click here to download the complete well list in Excel.

Emerald Lake does not operate any wells or facilities at Homeglen Rimbey.

Homeglen Rimbey Well List

Click here to download the complete well list in Excel.

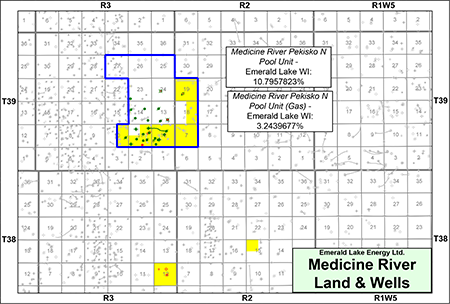

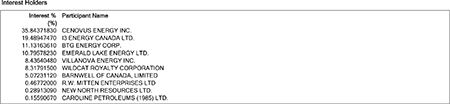

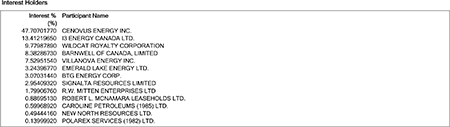

MEDICINE RIVER

Township 39, Range 2-3 W5

At Medicine River, Emerald Lake holds a 10.7957823% working interest in the Medicine River Pekisko N Pool Unit and a 3.2439677% working interest in the Medicine River Pekisko N Pool Unit (Gas), both operated by Cenovus Energy Inc. as well as certain non-unit wells shown in red on the following plat.

Cenovus is currently in the process of selling its interests at Medicine River to BTG Energy Corp. BTG owns a natural gas plant in the area which has capacity to facilitate the natural gas cap blow down. Natural gas from the gas cap is currently being reinjected at Medicine River and GLJ has currently booked 480 MMcf of total proved plus probable reserves net to Emerald Lake in the GLJ Report.

Average daily sales production net to Emerald Lake from Medicine River for the fourth quarter of 2023 was 23 boe/d, consisting of 17 bbl/d of oil and natural gas liquids and 31 Mcf/d of natural gas.

Operating income net to Emerald Lake from Medicine River for the fourth quarter of 2023 was approximately $51,000, or $204,000 on an annualized basis.

At Medicine River, Emerald Lake holds a 10.7957823% working interest in the Medicine River Pekisko N Pool Unit and a 3.2439677% working interest in the Medicine River Pekisko N Pool Unit (Gas), both operated by Cenovus Energy Inc. as well as certain non-unit wells shown in red on the following plat.

Cenovus is currently in the process of selling its interests at Medicine River to BTG Energy Corp. BTG owns a natural gas plant in the area which has capacity to facilitate the natural gas cap blow down. Natural gas from the gas cap is currently being reinjected at Medicine River and GLJ has currently booked 480 MMcf of total proved plus probable reserves net to Emerald Lake in the GLJ Report.

Average daily sales production net to Emerald Lake from Medicine River for the fourth quarter of 2023 was 23 boe/d, consisting of 17 bbl/d of oil and natural gas liquids and 31 Mcf/d of natural gas.

Operating income net to Emerald Lake from Medicine River for the fourth quarter of 2023 was approximately $51,000, or $204,000 on an annualized basis.

Medicine River Pekisko N Pool Unit

Medicine River Pekisko N Pool Unit (Gas)

Medicine River Pekisko N Pool Unit & Medicine River Pekisko N Pool Unit (Gas)

Gross Production Group Plot

Medicine River Facilities

At Medicine River, Emerald Lake has working interests in the following unit facilities:

At Medicine River, Emerald Lake has working interests in the following unit facilities:

Medicine River Marketing

Plains Midstream Canada markets Emerald Lake’s oil at Medicine River.

Natural gas from Medicine River is processed at the 10-14-039-03W5 natural gas plant.

Medicine River Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s January 1, 2024 forecast pricing.

GLJ estimated that, as at December 31, 2023, the Medicine River property contained remaining proved plus probable reserves of 158,000 barrels of oil and natural gas liquids and 480 MMcf of natural gas (238,000 boe), with an estimated net present value of $3.4 million using forecast pricing at a 10% discount.

Plains Midstream Canada markets Emerald Lake’s oil at Medicine River.

Natural gas from Medicine River is processed at the 10-14-039-03W5 natural gas plant.

Medicine River Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s January 1, 2024 forecast pricing.

GLJ estimated that, as at December 31, 2023, the Medicine River property contained remaining proved plus probable reserves of 158,000 barrels of oil and natural gas liquids and 480 MMcf of natural gas (238,000 boe), with an estimated net present value of $3.4 million using forecast pricing at a 10% discount.

Medicine River LMR

Emerald Lake does not operate any wells or facilities at Medicine River.

Medicine River Well List

Click here to download the complete well list in Excel.

Emerald Lake does not operate any wells or facilities at Medicine River.

Medicine River Well List

Click here to download the complete well list in Excel.

CYN-PEM

Township 51, Range 10-11 W5

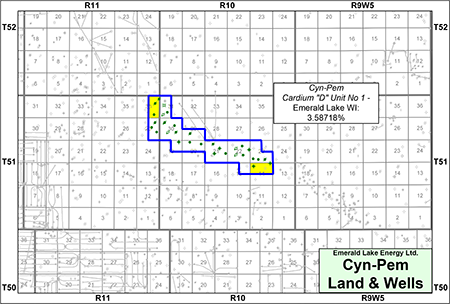

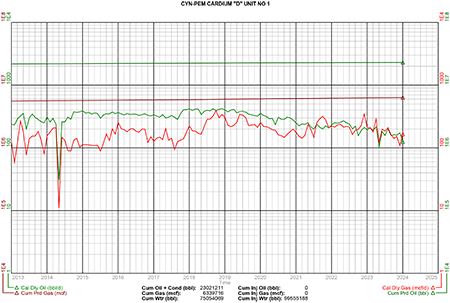

In the Cyn-Pem area, Emerald Lake holds a 3.58718% working interest in the Cyn-Pem Cardium “D” Unit No 1 operated by Whitecap Resources Inc.

Average daily sales production net to Emerald Lake from Cyn-Pem for the fourth quarter of 2023 was six boe/d, consisting of six bbl/d of oil and one Mcf/d of natural gas.

Operating income net to Emerald Lake from Cyn-Pem for the fourth quarter of 2023 was approximately ($5,000). Operating income in the fourth quarter was impacted by one-time expenditures. Net operating income for calendar year 2023 was $49,000.

In the Cyn-Pem area, Emerald Lake holds a 3.58718% working interest in the Cyn-Pem Cardium “D” Unit No 1 operated by Whitecap Resources Inc.

Average daily sales production net to Emerald Lake from Cyn-Pem for the fourth quarter of 2023 was six boe/d, consisting of six bbl/d of oil and one Mcf/d of natural gas.

Operating income net to Emerald Lake from Cyn-Pem for the fourth quarter of 2023 was approximately ($5,000). Operating income in the fourth quarter was impacted by one-time expenditures. Net operating income for calendar year 2023 was $49,000.

Cyn-Pem Facilities

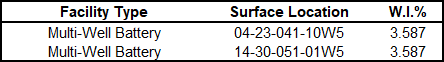

At Cyn-Pem, Emerald Lake has working interests in the following unit facilities:

At Cyn-Pem, Emerald Lake has working interests in the following unit facilities:

Cyn-Pem Marketing

Emerald Lake’s oil production from Cyn-Pem is sold to Tidal Energy Marketing Inc.

Cyn-Pem Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s January 1, 2024 forecast pricing.

GLJ estimated that, as at December 31, 2023, the Cyn-Pem property contained remaining proved plus probable reserves of 33,000 barrels of oil and natural gas liquids and 15 MMcf of natural gas (35,000 boe), with an estimated net present value of $544,000 using forecast pricing at a 10% discount.

Emerald Lake’s oil production from Cyn-Pem is sold to Tidal Energy Marketing Inc.

Cyn-Pem Reserves

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s January 1, 2024 forecast pricing.

GLJ estimated that, as at December 31, 2023, the Cyn-Pem property contained remaining proved plus probable reserves of 33,000 barrels of oil and natural gas liquids and 15 MMcf of natural gas (35,000 boe), with an estimated net present value of $544,000 using forecast pricing at a 10% discount.

Cyn-Pem LMR

Emerald Lake does not operate any wells or facilities at Cyn-Pem.

Cyn-Pem Well List

Click here to download the complete well list in Excel.

Emerald Lake does not operate any wells or facilities at Cyn-Pem.

Cyn-Pem Well List

Click here to download the complete well list in Excel.

GORR/FEE TITLE ROYALTIES

Township 08-53, Range 8W4 - 6W5

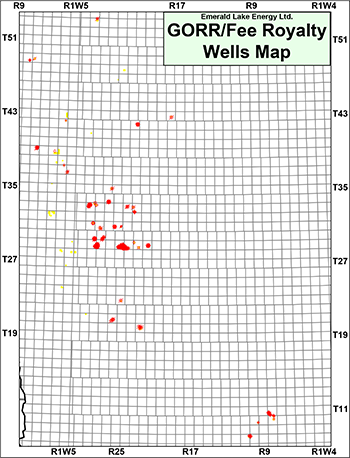

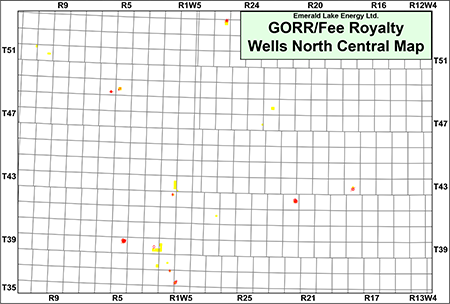

The Company holds interests in a total of 36,520 gross acres of Fee Title lands and GORR interests throughout Alberta, as shown on the following plat.

Average daily sales production net to Emerald Lake from the GORR/Fee Title Royalties for the fourth quarter of 2023 was eight boe/d, consisting of 43 Mcf/d of natural gas and one bbl/d of natural gas liquids.

Royalty revenue net to Emerald Lake for 2023 was approximately $55,000. Emerald Lake’s royalty revenue is highly dependent on the price of natural gas. In 2022, in a higher price environment, Emerald Lake’s royalty revenue was approximately $168,000.

In addition, Emerald Lake has Fee Simple land under lease which the Company expects to be developed in the near future which could generate between $70,000 to $100,000 in additional royalty revenue per year. Further information on this lease will be provided to parties which execute a confidentiality agreement.

The Company holds interests in a total of 36,520 gross acres of Fee Title lands and GORR interests throughout Alberta, as shown on the following plat.

Average daily sales production net to Emerald Lake from the GORR/Fee Title Royalties for the fourth quarter of 2023 was eight boe/d, consisting of 43 Mcf/d of natural gas and one bbl/d of natural gas liquids.

Royalty revenue net to Emerald Lake for 2023 was approximately $55,000. Emerald Lake’s royalty revenue is highly dependent on the price of natural gas. In 2022, in a higher price environment, Emerald Lake’s royalty revenue was approximately $168,000.

In addition, Emerald Lake has Fee Simple land under lease which the Company expects to be developed in the near future which could generate between $70,000 to $100,000 in additional royalty revenue per year. Further information on this lease will be provided to parties which execute a confidentiality agreement.

PROCESS & TIMELINE

Sayer Energy Advisors is accepting offers relating to this process until 12:00 pm on Thursday May 30, 2024. Emerald Lake's preference is a sale of the shares of the Company but it will also entertain separate offers for the GORR/Fee Title Royalties.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

Sayer Energy Advisors is accepting offers from interested parties until

noon on Thursday May 30, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Company with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, mail (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: most recent net lease operating statements, the GLJ Report, summary land information, LMR and other relevant corporate and technical information.

Download Confidentiality Agreement

To receive further information on the Company please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.