Offering Details

Back

Under Review / Sequoia Resources Corporation

Sequoia Resources Corporation

Bankruptcy Sale

Bankruptcy SaleBid Deadline: July 4, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

On March 23, 2018, pursuant to the Bankruptcy and Insolvency Act (“BIA”), Sequoia Resources Corporation (“Sequoia” or the “Company”), filed an assignment in Bankruptcy and PricewaterhouseCoopers Inc. LIT was appointed as Licensed Insolvency Trustee (the “Trustee”).

Sayer Energy Advisors has been engaged to assist the Trustee with the sale of Sequoia’s remaining oil and natural gas properties (the “Properties”).

Further to a closure order from the Alberta Energy Regulator, Sequoia’s licensed properties have been shut-in since March 2018. As a result, all production numbers stated herein reflect the production capability of the various wells or properties prior to the shut-in.

Prior to the closure order, average production net to Sequoia from the Properties was approximately 5,150 boe/d consisting of 29.9 MMcf/d of natural gas and 165 barrels of oil and natural gas liquids per day.

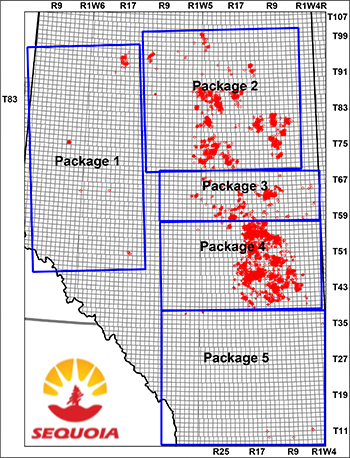

The Properties consist of both operated and non-operated interests located throughout Alberta. For this offering, the Properties are separated into the following geographical packages: Package 1, Package 2, Package 3, Package 4 and Package 5.

Since the shut-in of its licensed properties, the Company has continued to collect significant revenue from third-party road use. Sequoia has received approximately $7.2 million in gross third-party road use revenue since March 2018.

Additional revenue potential exists in go-forward maintenance fees pertaining to the roads which have not been charged since the shut-in order. Over 95% of all the revenue has been generated though 14 road use dispositions. The majority of these roads are located in the Marten Hills area of Alberta which has seen significant activity in the Clearwater horizontal oil play.

The companies which have been paying the majority of the road use fees are Headwater Exploration Inc., Spur Petroleum Ltd. and Tamarack Valley Energy Ltd. Additional revenues have been received from Canadian Natural Resources Limited, NOVA Gas Transmission Ltd., Rangeland Midstream Canada Ltd. and Rubellite Energy Inc.

Further details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

All offers received at the bid deadline will be reviewed by the Trustee and the most acceptable offer or offers may be accepted by the Trustee, subject to Court approval.

Sayer Energy Advisors has been engaged to assist the Trustee with the sale of Sequoia’s remaining oil and natural gas properties (the “Properties”).

Further to a closure order from the Alberta Energy Regulator, Sequoia’s licensed properties have been shut-in since March 2018. As a result, all production numbers stated herein reflect the production capability of the various wells or properties prior to the shut-in.

Prior to the closure order, average production net to Sequoia from the Properties was approximately 5,150 boe/d consisting of 29.9 MMcf/d of natural gas and 165 barrels of oil and natural gas liquids per day.

The Properties consist of both operated and non-operated interests located throughout Alberta. For this offering, the Properties are separated into the following geographical packages: Package 1, Package 2, Package 3, Package 4 and Package 5.

Since the shut-in of its licensed properties, the Company has continued to collect significant revenue from third-party road use. Sequoia has received approximately $7.2 million in gross third-party road use revenue since March 2018.

Additional revenue potential exists in go-forward maintenance fees pertaining to the roads which have not been charged since the shut-in order. Over 95% of all the revenue has been generated though 14 road use dispositions. The majority of these roads are located in the Marten Hills area of Alberta which has seen significant activity in the Clearwater horizontal oil play.

The companies which have been paying the majority of the road use fees are Headwater Exploration Inc., Spur Petroleum Ltd. and Tamarack Valley Energy Ltd. Additional revenues have been received from Canadian Natural Resources Limited, NOVA Gas Transmission Ltd., Rangeland Midstream Canada Ltd. and Rubellite Energy Inc.

Further details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

All offers received at the bid deadline will be reviewed by the Trustee and the most acceptable offer or offers may be accepted by the Trustee, subject to Court approval.

Production Overview

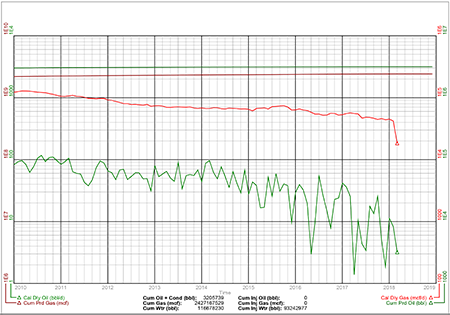

Prior to the closure order, average production net to Sequoia from the Properties was approximately 5,150 boe/d consisting of 29.9 MMcf/d of natural gas and 165 barrels of oil and natural gas liquids per day.

Prior to the closure order, average production net to Sequoia from the Properties was approximately 5,150 boe/d consisting of 29.9 MMcf/d of natural gas and 165 barrels of oil and natural gas liquids per day.

PACKAGE 1

Township 51-96, Range 17 W5 - 5 W6

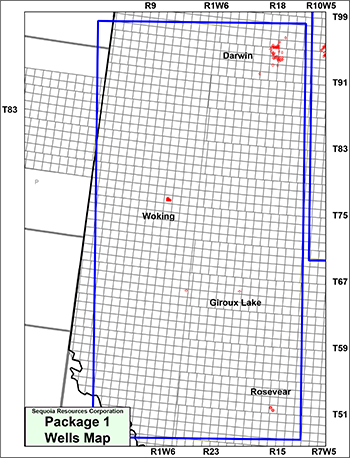

In Package 1, Sequoia’s main properties are in the Darwin, Giroux Lake, Rosevear and Woking areas of Alberta, as shown on the following map.

Details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

In Package 1, Sequoia’s main properties are in the Darwin, Giroux Lake, Rosevear and Woking areas of Alberta, as shown on the following map.

Details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

Package 1 Well List

Click here to download the complete well list in Excel.

PACKAGE 2

Township 71-100, Range 6 W4 - 12 W5

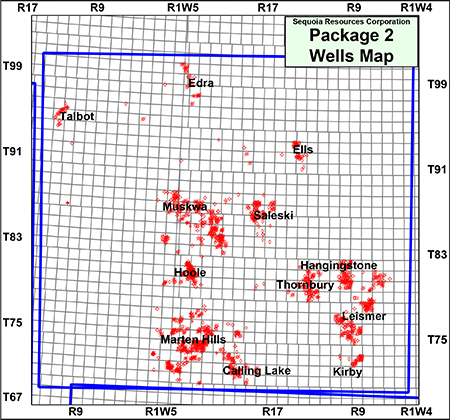

In Package 2, Sequoia’s main properties are in the Calling Lake, Edra, Ells, Hangingstone, Hoole, Kirby, Leismer, Marten Hills, Muskwa, Saleski, Talbot, and Thornbury areas of Alberta, as shown on the following map.

Details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

In Package 2, Sequoia’s main properties are in the Calling Lake, Edra, Ells, Hangingstone, Hoole, Kirby, Leismer, Marten Hills, Muskwa, Saleski, Talbot, and Thornbury areas of Alberta, as shown on the following map.

Details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

Package 2 Well List

Click here to download the complete well list in Excel.

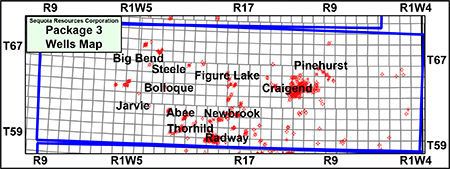

PACKAGE 3

Township 59-69, Range 2 W4 - 2 W5

In Package 3, Sequoia’s main properties are in the Abee, Big Bend, Bolloque, Craigend, Figure Lake, Jarvie, Newbrook, Pinehurst, Radway, Steele and Thorhild areas of Alberta, as shown on the following map.

Details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

In Package 3, Sequoia’s main properties are in the Abee, Big Bend, Bolloque, Craigend, Figure Lake, Jarvie, Newbrook, Pinehurst, Radway, Steele and Thorhild areas of Alberta, as shown on the following map.

Details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

Package 3 Well List

Click here to download the complete well list in Excel.

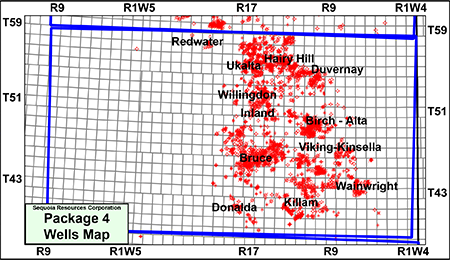

PACKAGE 4

Township 40-59, Range 4-20 W4

In Package 4, Sequoia’s main properties are in the Birch-Alta, Bruce, Donalda, Duvernay, Hairy Hill, Inland, Killam, Redwater, Ukalta, Viking-Kinsella, Willingdon and Wainwright areas of Alberta, as shown on the following map.

Details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

In Package 4, Sequoia’s main properties are in the Birch-Alta, Bruce, Donalda, Duvernay, Hairy Hill, Inland, Killam, Redwater, Ukalta, Viking-Kinsella, Willingdon and Wainwright areas of Alberta, as shown on the following map.

Details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

Package 4 Well List

Click here to download the complete well list in Excel.

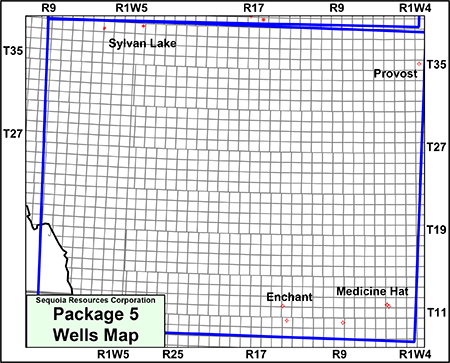

PACKAGE 5

Township 10-38, Range 3 W4 - 4 W5

In Package 5, Sequoia’s main properties are in the Enchant, Medicine Hat, Provost and Sylvan Lake areas of Alberta, as shown on the following map.

Details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

In Package 5, Sequoia’s main properties are in the Enchant, Medicine Hat, Provost and Sylvan Lake areas of Alberta, as shown on the following map.

Details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

Package 5 Well List

Click here to download the complete well list in Excel.

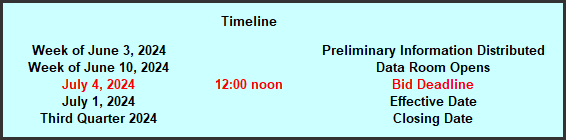

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Properties until 12:00 pm on Thursday July 4, 2024. All offers received at the bid deadline will be reviewed by the Trustee and the most acceptable offer or offers may be accepted by the Trustee, subject to Court approval

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday July 4, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, mail (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, historical lease operating statements, LMR information and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.