Offering Details

Back

Under Review / MNP Ltd. - Eco-Industrial Business Park Inc.

MNP Ltd. - Eco-Industrial Business Park Inc.

Receivership Sale

Receivership SaleBid Deadline: August 22, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

On November 4, 2021, MNP Ltd. was appointed as the receiver (“MNP” or the “Receiver”) of Eco-Industrial Business Park Inc. (“Eco-Industrial” or the “Company”) pursuant to an Order of the Court of Queen’s Bench of Alberta (as at then was). The Receiver has engaged Sayer Energy Advisors to assist it with a joint venture or sale of Eco-Industrial’s disposal wells and facility located in the Edmonton area of Alberta (the “Property”).

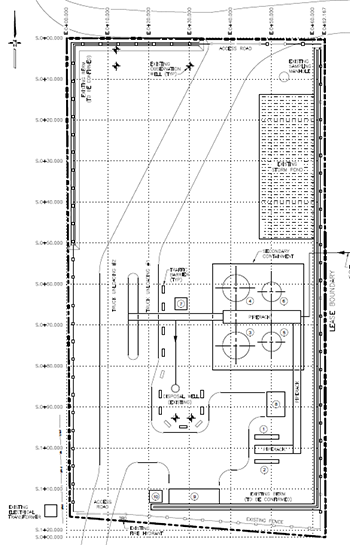

The Property consists of two Class 1A disposal wells and an injection facility located within the Eco-Industrial Business Park in northeast Edmonton, Alberta.

The Property consists of two Class 1A disposal wells and an injection facility located within the Eco-Industrial Business Park in northeast Edmonton, Alberta.

EDMONTON

Township 53, Range 23 W4

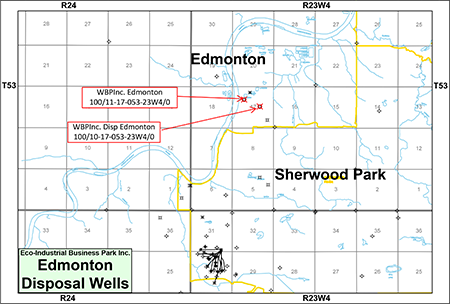

Eco-Industrial holds a 100% working interest in two Class 1A disposal wells, WBPInc. Edmonton Disp 100/10-17-053-23W4/0 and WBPInc. Edmonton 100/11-17-053-23W4/0 and an injection facility at 11-17-053-23W4. The wells were originally used to dispose wastewater fluid from a methanol production facility. After the closure of the methanol facility, in 2014 the new owners of Eco-Industrial obtained approval for a commercial Oilfield Waste Management Facility which included the 11-17-053-23W4 Class 1A disposal well, two 750-barrel tanks and truck unloading facilities.

The 10-17-53-23W4 Class 1A well continued injecting as a service well, primarily receiving fluid from nearby groundwater monitoring wells. Both disposal wells inject into the Nisku Formation of which the Company holds the mineral rights.

The 11-17 well was drilled vertically in 1970 but unlike the 10-17 well drilled in 1965 it was completed open hole. Prior to 1990 the well regularly injected daily volumes over 3,000 m3 before being shut-in for facility operational reasons.

Eco-Industrial holds a 100% working interest in two Class 1A disposal wells, WBPInc. Edmonton Disp 100/10-17-053-23W4/0 and WBPInc. Edmonton 100/11-17-053-23W4/0 and an injection facility at 11-17-053-23W4. The wells were originally used to dispose wastewater fluid from a methanol production facility. After the closure of the methanol facility, in 2014 the new owners of Eco-Industrial obtained approval for a commercial Oilfield Waste Management Facility which included the 11-17-053-23W4 Class 1A disposal well, two 750-barrel tanks and truck unloading facilities.

The 10-17-53-23W4 Class 1A well continued injecting as a service well, primarily receiving fluid from nearby groundwater monitoring wells. Both disposal wells inject into the Nisku Formation of which the Company holds the mineral rights.

The 11-17 well was drilled vertically in 1970 but unlike the 10-17 well drilled in 1965 it was completed open hole. Prior to 1990 the well regularly injected daily volumes over 3,000 m3 before being shut-in for facility operational reasons.

The Property is strategically located within the city of Edmonton, having ideal access to major transportation infrastructure including Anthony Henday Drive and the Yellowhead Highway. The facility is licensed to accept most oilfield exploration and production waste streams as well as several industrial wastewater streams to serve local area businesses.

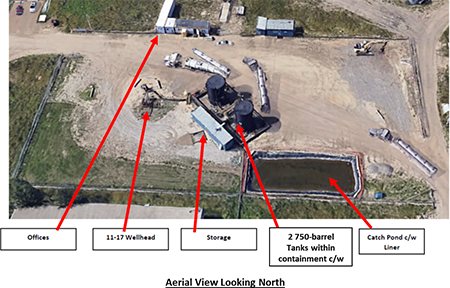

The facility at 11-17-053-23W4 is currently equipped with two 750-barrel tanks, containment, and gravity feeds to the well. Recent injectivity testing has shown that the well can accept economic volumes of clean fluid on a vacuum and over 800 m3/d if pumped at the maximum allowable wellhead injectivity pressure (MWHIP) of 4,160 kPa.

The Devonian aged Nisku Formation in the Edmonton area is ideal for commercial disposal activity. The reservoir is a large aquifer that sits on the edge of a carbonate shelf which consists predominately of dolomite. The aquifer covers a large areal extent and ranges in thickness from 40 to 80 metres. It is overlain by a shale cap rock of the Calmar Formation which contains injection fluids.

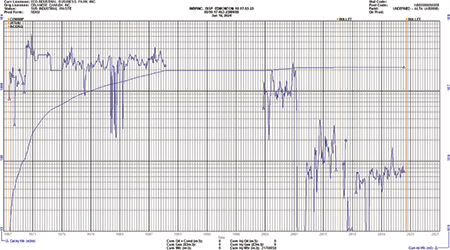

Both the 10-17 and 11-17 wells have demonstrated the high injectivity of the Nisku Formation. The gaps in injection history shown on the following injection plots are a result of business interruptions rather than a loss of injectivity.

The Devonian aged Nisku Formation in the Edmonton area is ideal for commercial disposal activity. The reservoir is a large aquifer that sits on the edge of a carbonate shelf which consists predominately of dolomite. The aquifer covers a large areal extent and ranges in thickness from 40 to 80 metres. It is overlain by a shale cap rock of the Calmar Formation which contains injection fluids.

Both the 10-17 and 11-17 wells have demonstrated the high injectivity of the Nisku Formation. The gaps in injection history shown on the following injection plots are a result of business interruptions rather than a loss of injectivity.

Project Development

Recently the facility license was amended to accommodate future expansion to provide additional on-site storage and pumping capacity along with filtration equipment. It is anticipated that this additional storage, with an effective engineered design, will enable the facility to handle more solids with longer fluid retention time and allow for increased settling, coupled with filtration. The proposed modifications will allow the facility operator to enhance the revenue stream by handling higher value waste streams (solids).

Under care of the Receiver, the two disposal wells and the facility are in compliance with the current regulations along with Directives 051 and 058, and the associated Site-Specific Liability Assessment has recently been updated. The Alberta Energy Regulator (“AER”) has accepted an operations plan such that operations may resume, and has granted approval to construct and operate an oilfield waste management facility as described in Amendment C to Approval WM154, granted on November 29, 2023.

With adequate provisions for solids processing, cash flow models based on various sensitivities suggest that annual net revenue could range from $1.8 million at 300 m3/d of fluids disposal to over $8.0 million per year at 600 m3/d depending on the volume and quality of the waste received.

Injection Facility

In November 2023, the AER approved the Company’s application to amend the waste management facility to increase the maximum storage capacity from 240 m3 to 876 m3. The application was made after a strategic operating plan and detailed FEED study facilities engineering review was performed to provide a design that will improve the overall performance and operability of the facility.

Recently the facility license was amended to accommodate future expansion to provide additional on-site storage and pumping capacity along with filtration equipment. It is anticipated that this additional storage, with an effective engineered design, will enable the facility to handle more solids with longer fluid retention time and allow for increased settling, coupled with filtration. The proposed modifications will allow the facility operator to enhance the revenue stream by handling higher value waste streams (solids).

Under care of the Receiver, the two disposal wells and the facility are in compliance with the current regulations along with Directives 051 and 058, and the associated Site-Specific Liability Assessment has recently been updated. The Alberta Energy Regulator (“AER”) has accepted an operations plan such that operations may resume, and has granted approval to construct and operate an oilfield waste management facility as described in Amendment C to Approval WM154, granted on November 29, 2023.

With adequate provisions for solids processing, cash flow models based on various sensitivities suggest that annual net revenue could range from $1.8 million at 300 m3/d of fluids disposal to over $8.0 million per year at 600 m3/d depending on the volume and quality of the waste received.

Injection Facility

In November 2023, the AER approved the Company’s application to amend the waste management facility to increase the maximum storage capacity from 240 m3 to 876 m3. The application was made after a strategic operating plan and detailed FEED study facilities engineering review was performed to provide a design that will improve the overall performance and operability of the facility.

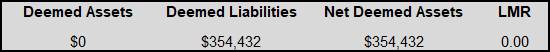

Edmonton LMR as of June 1, 2024

As of June 1, 2024, the Property had a deemed net asset value of ($354,432) (deemed assets of $0 and deemed liabilities of $354,432), with an LMR ratio of 0.00.

As of June 1, 2024, the Property had a deemed net asset value of ($354,432) (deemed assets of $0 and deemed liabilities of $354,432), with an LMR ratio of 0.00.

Edmonton Property Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

PROCESS & TIMELINE

Sayer Energy Advisors is accepting proposals relating to this process until 12:00 pm on Thursday August 22, 2024.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting proposals from interested parties until

noon on Thursday August 22, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Property with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, mail (brye@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: financial information, LMR information and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Property please contact Ben Rye, Tom Pavic or Sydney Birkett at 403.266.6133.