Offering Details

Back

Under Review / Coastal Resources Limited

Coastal Resources Limited

Property Divestiture

Property DivestitureBid Deadline: December 12, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

COASTAL HAS SOLD ITS INTERESTS IN THE GILBY WEST AREA OF ALBERTA AND A PORTION OF ITS INTERESTS IN THE CARBON/TWINING/SWALWELL AND WILLESDEN GREEN AREAS OF ALBERTA.

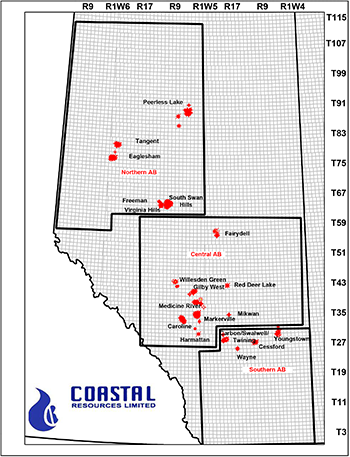

Coastal Resources Limited (“Coastal” or the “Company”) has engaged Sayer Energy Advisors to assist it with the sale of certain of its oil and natural gas interests located in Alberta (the “Properties”).

The Properties consist of operated and non-operated working interests in the Central AB, Northern AB and Southern AB packages.

Preference will be given to offers to acquire all of the Properties in each package in one transaction; however, offers may be considered for individual properties.

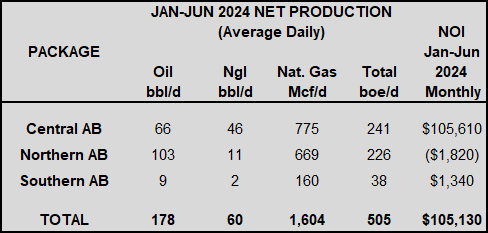

Average daily sales production net to Coastal from the Properties for the six months ended June 30, 2024 was approximately 505 boe/d, consisting of 1.6 MMcf/d of natural gas and 238 barrels of oil and natural gas liquids per day.

Operating income net to Coastal from the Properties for the six months ended June 30, 2024 was approximately $105,000 per month, or $1.3 million on an annualized basis.

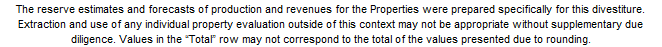

As of October 5, 2024, the Properties had a deemed net asset value of ($1.5 million) (deemed assets of $9.6 million less liabilities of $11.1 million), with an LMR ratio of 0.86.

Coastal Resources Limited (“Coastal” or the “Company”) has engaged Sayer Energy Advisors to assist it with the sale of certain of its oil and natural gas interests located in Alberta (the “Properties”).

The Properties consist of operated and non-operated working interests in the Central AB, Northern AB and Southern AB packages.

Preference will be given to offers to acquire all of the Properties in each package in one transaction; however, offers may be considered for individual properties.

Average daily sales production net to Coastal from the Properties for the six months ended June 30, 2024 was approximately 505 boe/d, consisting of 1.6 MMcf/d of natural gas and 238 barrels of oil and natural gas liquids per day.

Operating income net to Coastal from the Properties for the six months ended June 30, 2024 was approximately $105,000 per month, or $1.3 million on an annualized basis.

As of October 5, 2024, the Properties had a deemed net asset value of ($1.5 million) (deemed assets of $9.6 million less liabilities of $11.1 million), with an LMR ratio of 0.86.

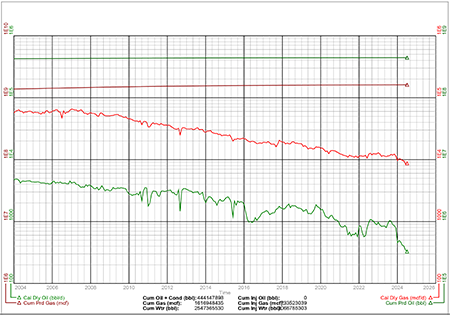

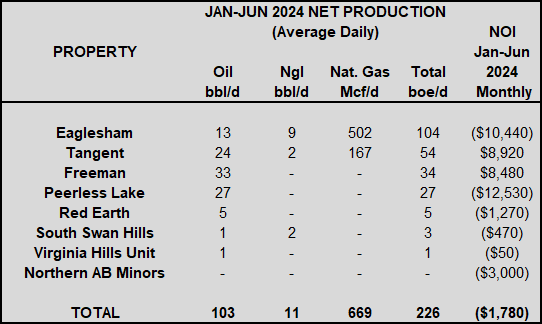

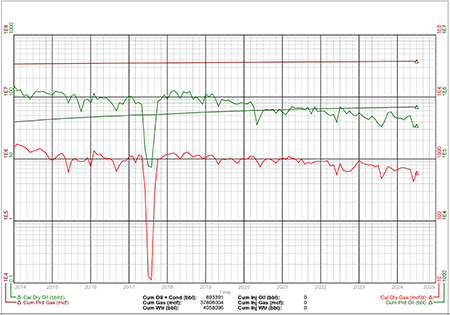

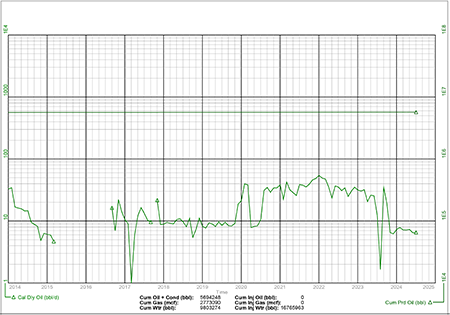

Production Overview

Average daily sales production net to Coastal from the Properties for the six months ended June 30, 2024 was approximately 505 boe/d, consisting of 1.6 MMcf/d of natural gas and 238 barrels of oil and natural gas liquids per day.

Operating income net to Coastal from the Properties for the six months ended June 30, 2024 was approximately $105,000 per month, or $1.3 million on an annualized basis.

Average daily sales production net to Coastal from the Properties for the six months ended June 30, 2024 was approximately 505 boe/d, consisting of 1.6 MMcf/d of natural gas and 238 barrels of oil and natural gas liquids per day.

Operating income net to Coastal from the Properties for the six months ended June 30, 2024 was approximately $105,000 per month, or $1.3 million on an annualized basis.

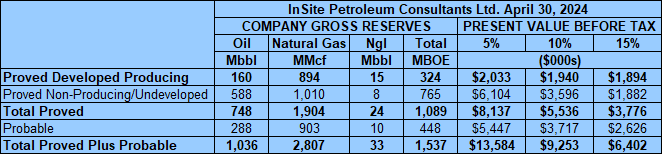

Reserves Overview

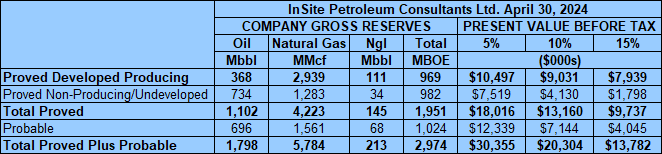

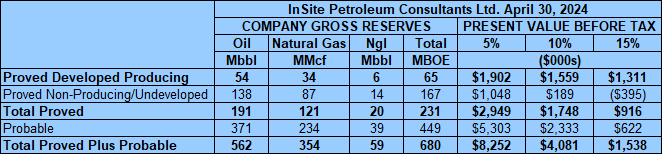

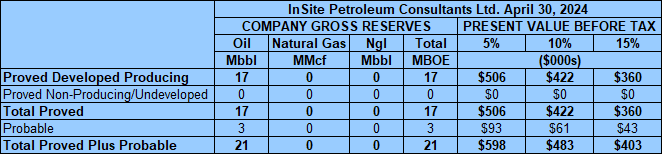

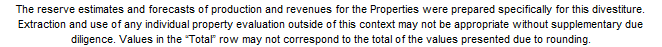

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Properties contained remaining proved plus probable reserves of 2.0 million barrels of oil and natural gas liquids and 5.8 Bcf of natural gas (3.0 million boe), with an estimated net present value of $20.3 million using forecast pricing at a 10% discount.

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Properties contained remaining proved plus probable reserves of 2.0 million barrels of oil and natural gas liquids and 5.8 Bcf of natural gas (3.0 million boe), with an estimated net present value of $20.3 million using forecast pricing at a 10% discount.

Development Drilling & Upside Overview

The Company has identified 26 drilling opportunities, 15 well reactivations, two optimization projects and one recompletion on the Properties.

The majority of the drilling locations and reactivation opportunities are identified in the InSite Report as proven and probable reserves. In addition to the InSite Report, other projects have also been identified.

On a risked-basis, the Company believes there is potential to add over 1,000 boe/d net production, 85% of which is medium to light oil production.

LMR Summary as of October 5, 2024

As of October 5, 2024, the Properties had a deemed net asset value of ($1.5 million) (deemed assets of $9.6 million less liabilities of $11.1 million), with an LMR ratio of 0.86.

The Company has identified 26 drilling opportunities, 15 well reactivations, two optimization projects and one recompletion on the Properties.

The majority of the drilling locations and reactivation opportunities are identified in the InSite Report as proven and probable reserves. In addition to the InSite Report, other projects have also been identified.

On a risked-basis, the Company believes there is potential to add over 1,000 boe/d net production, 85% of which is medium to light oil production.

LMR Summary as of October 5, 2024

As of October 5, 2024, the Properties had a deemed net asset value of ($1.5 million) (deemed assets of $9.6 million less liabilities of $11.1 million), with an LMR ratio of 0.86.

Marketing Summary

Coastal has marketing contracts in place with Trafigura for oil and Suncor Energy Marketing Inc. for natural gas liquids.

Further details of the marketing arrangements will be made available in the virtual data room for parties that execute a confidentiality agreement.

Well List

Click here to download the complete well list in Excel.

Coastal has marketing contracts in place with Trafigura for oil and Suncor Energy Marketing Inc. for natural gas liquids.

Further details of the marketing arrangements will be made available in the virtual data room for parties that execute a confidentiality agreement.

Well List

Click here to download the complete well list in Excel.

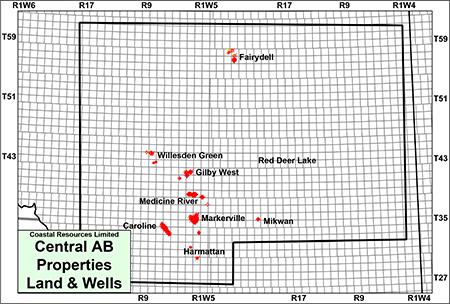

CENTRAL AB PROPERTIES

COASTAL HAS SOLD ITS INTERESTS IN THE GILBY WEST AREA OF ALBERTA.

In the Central AB package, Coastal has various operated and non-operated working interests in the Caroline, Fairydell, Gilby West, Harmattan, Markerville/Garrington, Medicine River, Mikwan, Ricinus, Red Deer Lake and Willesden Green areas as well as interests in certain minor properties.

In the Central AB package, Coastal has various operated and non-operated working interests in the Caroline, Fairydell, Gilby West, Harmattan, Markerville/Garrington, Medicine River, Mikwan, Ricinus, Red Deer Lake and Willesden Green areas as well as interests in certain minor properties.

Central AB Properties

Central AB Properties Reserves

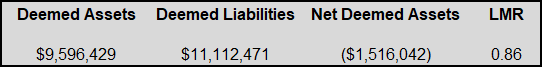

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Central AB Properties contained remaining proved plus probable reserves of 916,000 barrels of oil and natural gas liquids and 2.4 Bcf of natural gas (1.3 million boe), with an estimated net present value of $10.1 million using forecast pricing at a 10% discount.

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Central AB Properties contained remaining proved plus probable reserves of 916,000 barrels of oil and natural gas liquids and 2.4 Bcf of natural gas (1.3 million boe), with an estimated net present value of $10.1 million using forecast pricing at a 10% discount.

Central AB Development Drilling & Upside

The Company has identified six drilling opportunities, three well reactivations and two optimization projects on the Central AB Properties.

The majority of the drilling locations and reactivation opportunities are identified in the InSite Report as proven and probable reserves. In addition to the InSite Report, other projects have also been identified.

On a risked-basis, the Company believes there is potential to add over 340 boe/d net production, 88% of which is medium to light oil production.

The Company has identified six drilling opportunities, three well reactivations and two optimization projects on the Central AB Properties.

The majority of the drilling locations and reactivation opportunities are identified in the InSite Report as proven and probable reserves. In addition to the InSite Report, other projects have also been identified.

On a risked-basis, the Company believes there is potential to add over 340 boe/d net production, 88% of which is medium to light oil production.

MARKERVILLE / GARRINGTON

Township 35-36, Range 2-3 W5

At Markerville/Garrington, Coastal holds predominantly non-operated working interests in 18.75 sections of land as well as a 10.3567515% working interest in the Markerville Gas Unit No. 1 operated by Harvest Operations Corp.

Average daily sales production net to Coastal from Markerville/Garrington for the six months ended June 30, 2024 was approximately 376 Mcf/d of natural gas and 23 barrels of natural gas liquids per day (86 boe/d).

Operating income net to Coastal from Markerville/Garrington for the six months ended June 30, 2024 was approximately $17,800 per month, or $213,600 on an annualized basis.

The Company has also identified potential to reactivate its natural gas wells in Section 21-036-02W5.

At Markerville/Garrington, Coastal holds predominantly non-operated working interests in 18.75 sections of land as well as a 10.3567515% working interest in the Markerville Gas Unit No. 1 operated by Harvest Operations Corp.

Average daily sales production net to Coastal from Markerville/Garrington for the six months ended June 30, 2024 was approximately 376 Mcf/d of natural gas and 23 barrels of natural gas liquids per day (86 boe/d).

Operating income net to Coastal from Markerville/Garrington for the six months ended June 30, 2024 was approximately $17,800 per month, or $213,600 on an annualized basis.

The Company has also identified potential to reactivate its natural gas wells in Section 21-036-02W5.

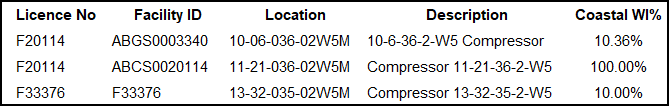

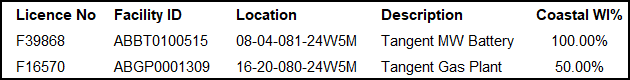

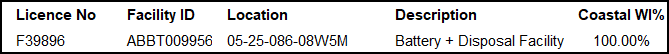

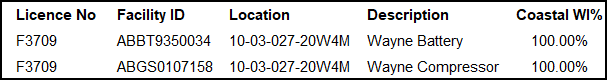

Markerville/Garrington Facilities

The Company holds working interests in the following facilities at Markerville/Garrington.

The Company holds working interests in the following facilities at Markerville/Garrington.

Markerville/Garrington Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Markerville/Garrington property contained remaining proved plus probable reserves of 1.3 Bcf of natural gas and 82,000 barrels natural gas liquids (304,000 boe), with an estimated net present value of $2.2 million using forecast pricing at a 10% discount.

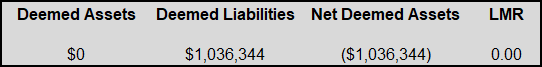

Markerville/Garrington LMR

As of October 5, 2024, the Markerville/Garrington property had a deemed net asset value of ($1.0 million) (deemed assets of $0 less liabilities of $1.0 million), with an LMR ratio of 0.00.

As of October 5, 2024, the Markerville/Garrington property had a deemed net asset value of ($1.0 million) (deemed assets of $0 less liabilities of $1.0 million), with an LMR ratio of 0.00.

Markerville/Garrington Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

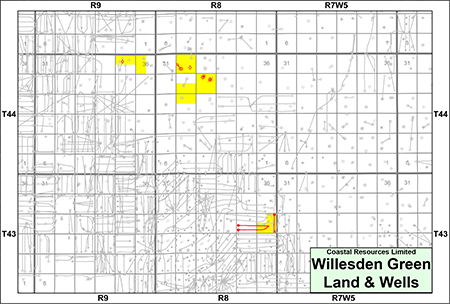

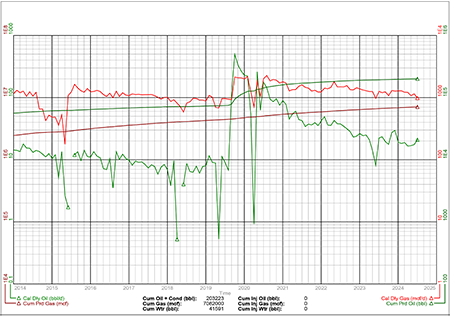

WILLESDEN GREEN

COASTAL HAS SOLD A PORTION OF ITS INTERESTS IN THE WILLESDEN GREEN AREA OF ALBERTA.

Township 43-44, Range 8-9 W5

At Willesden Green, Coastal holds various working interests in 4.75 sections of land. Coastal’s production at Willesden Green is operated primarily by Baccalieu Energy Inc., Obsidian Energy Ltd. and Coastal.

Average daily sales production net to Coastal from Willesden Green for the six months ended June 30, 2024 was approximately 63 boe/d, consisting of 268 Mcf/d of natural gas and 19 barrels of oil and natural gas liquids per day.

Operating income net to Coastal from Willesden Green for the six months ended June 30, 2024 was approximately $23,000 per month, or $276,000 on an annualized basis.

Township 43-44, Range 8-9 W5

At Willesden Green, Coastal holds various working interests in 4.75 sections of land. Coastal’s production at Willesden Green is operated primarily by Baccalieu Energy Inc., Obsidian Energy Ltd. and Coastal.

Average daily sales production net to Coastal from Willesden Green for the six months ended June 30, 2024 was approximately 63 boe/d, consisting of 268 Mcf/d of natural gas and 19 barrels of oil and natural gas liquids per day.

Operating income net to Coastal from Willesden Green for the six months ended June 30, 2024 was approximately $23,000 per month, or $276,000 on an annualized basis.

Willesden Green Facilities

The Company does not hold interests in any facilities at Willesden Green.

The Company does not hold interests in any facilities at Willesden Green.

Willesden Green Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Willesden Green property contained remaining proved plus probable reserves of 527 MMcf of natural gas and 26,000 barrels of oil and natural gas liquids (114,000 boe), with an estimated net present value of $844,000 using forecast pricing at a 10% discount.

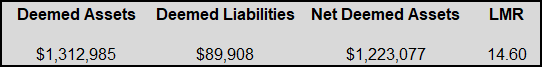

Willesden Green LMR

As of October 5, 2024, the Willesden Green property had a deemed net asset value of $1.2 million (deemed assets of $1.3 million less liabilities of $89,908), with an LMR ratio of 14.60.

As of October 5, 2024, the Willesden Green property had a deemed net asset value of $1.2 million (deemed assets of $1.3 million less liabilities of $89,908), with an LMR ratio of 14.60.

Willesden Green Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

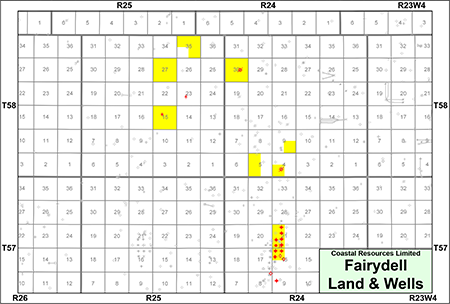

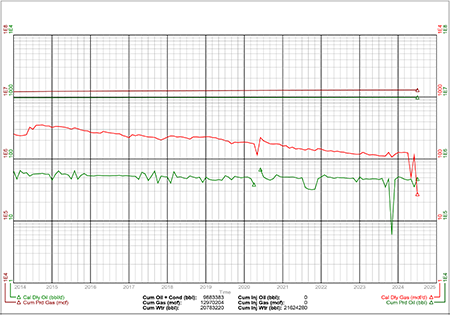

FAIRYDELL

Township 57-58, Range 24-25 W4

At Fairydell, Coastal holds working interests ranging from 35%-100% in 5.5 sections of land.

Average daily sales production net to Coastal from Fairydell for the six months ended June 30, 2024 was approximately 43 boe/d, consisting of 39 barrels of oil and natural gas liquids per day and 28 Mcf/d of natural gas.

Operating income net to Coastal from Fairydell for the six months ended June 30, 2024 was approximately $41,200 per month, or $494,400 on an annualized basis.

At Fairydell, Coastal holds working interests ranging from 35%-100% in 5.5 sections of land.

Average daily sales production net to Coastal from Fairydell for the six months ended June 30, 2024 was approximately 43 boe/d, consisting of 39 barrels of oil and natural gas liquids per day and 28 Mcf/d of natural gas.

Operating income net to Coastal from Fairydell for the six months ended June 30, 2024 was approximately $41,200 per month, or $494,400 on an annualized basis.

Fairydell Facilities

The Company holds working interests in the following facilities at Fairydell.

The Company holds working interests in the following facilities at Fairydell.

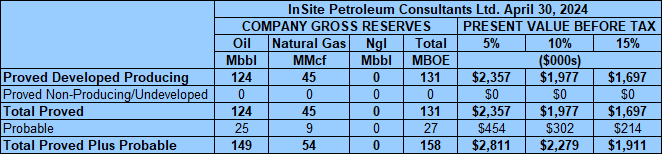

Fairydell Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Fairydell property contained remaining proved plus probable reserves of 149,000 barrels of oil and 54 MMcf of natural gas (158,000 boe), with an estimated net present value of $2.3 million using forecast pricing at a 10% discount.

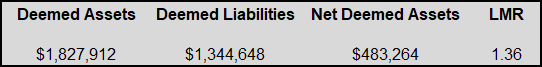

Fairydell LMR

As of October 5, 2024, the Fairydell property had a deemed net asset value of $483,264 (deemed assets of $1.8 million less liabilities of $1.3 million), with an LMR ratio of 1.36.

As of October 5, 2024, the Fairydell property had a deemed net asset value of $483,264 (deemed assets of $1.8 million less liabilities of $1.3 million), with an LMR ratio of 1.36.

Fairydell Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

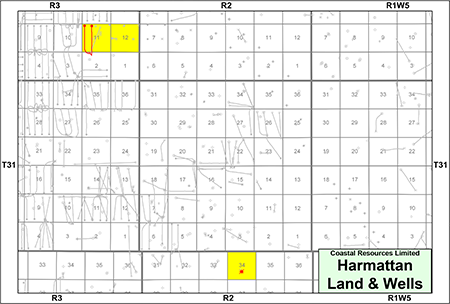

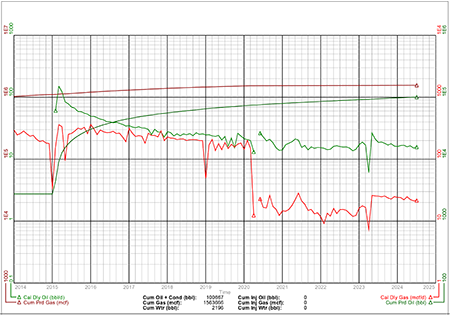

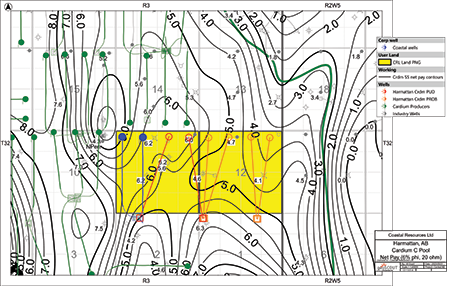

HARMATTAN

Township 30-32, Range 2-3 W5

At Harmattan, Coastal holds working interests ranging from 30%-100% in three sections of land. The Company’s oil production at Harmattan is operated. Coastal’s non-operated natural gas interests are operated by HWN Energy Ltd.

Average daily sales production net to Coastal from Harmattan for the six months ended June 30, 2024 was approximately 22 boe/d, consisting of 19 barrels of oil and natural gas liquids per day and 14 Mcf/d of natural gas.

Operating income net to Coastal from Harmattan for the six months ended June 30, 2024 was approximately $31,800 per month, or $381,600 on an annualized basis.

The Company has identified potential restart at 06-34-030-02W5.

At Harmattan, Coastal holds working interests ranging from 30%-100% in three sections of land. The Company’s oil production at Harmattan is operated. Coastal’s non-operated natural gas interests are operated by HWN Energy Ltd.

Average daily sales production net to Coastal from Harmattan for the six months ended June 30, 2024 was approximately 22 boe/d, consisting of 19 barrels of oil and natural gas liquids per day and 14 Mcf/d of natural gas.

Operating income net to Coastal from Harmattan for the six months ended June 30, 2024 was approximately $31,800 per month, or $381,600 on an annualized basis.

The Company has identified potential restart at 06-34-030-02W5.

The following map shows the Cardium C net pay on Coastal’s lands at Harmattan, using a 6% porosity and 20 ohms resistivity cutoff.

The Company has two probable undeveloped drilling locations and four probable locations on its lands at Harmattan.

The Company has two probable undeveloped drilling locations and four probable locations on its lands at Harmattan.

Harmattan Facilities

The Company holds working interests in the following facilities at Harmattan.

Harmattan Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Harmattan property contained remaining proved plus probable reserves of 621,000 barrels of oil and natural gas liquids and 354 MMcf of natural gas (680,000 boe), with an estimated net present value of $4.1 million using forecast pricing at a 10% discount.

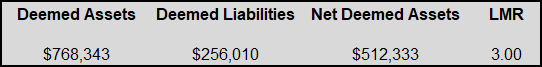

Harmattan LMR

As of October 5, 2024, the Harmattan property had a deemed net asset value of $512,333 (deemed assets of $768,343 less liabilities of $256,010), with an LMR ratio of 3.33.

As of October 5, 2024, the Harmattan property had a deemed net asset value of $512,333 (deemed assets of $768,343 less liabilities of $256,010), with an LMR ratio of 3.33.

Harmattan Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

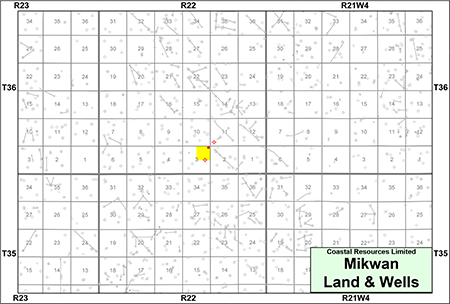

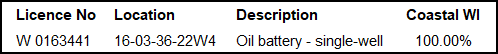

MIKWAN

Township 36, Range 22 W4

At Mikwan, Coastal holds a 100% working interest in one quarter section of land. Coastal’s production at Mikwan is from one operated Nisku oil well.

Average daily sales production net to Coastal from Mikwan for the six months ended June 30, 2024 was approximately six barrels of oil per day (six boe/d).

Operating income net to Coastal from Mikwan for the six months ended June 30, 2024 was approximately $5,200 per month, or $62,400 on an annualized basis.

At Mikwan, Coastal holds a 100% working interest in one quarter section of land. Coastal’s production at Mikwan is from one operated Nisku oil well.

Average daily sales production net to Coastal from Mikwan for the six months ended June 30, 2024 was approximately six barrels of oil per day (six boe/d).

Operating income net to Coastal from Mikwan for the six months ended June 30, 2024 was approximately $5,200 per month, or $62,400 on an annualized basis.

Mikwan Facilities

The Company holds working interests in the following facility at Mikwan.

The Company holds working interests in the following facility at Mikwan.

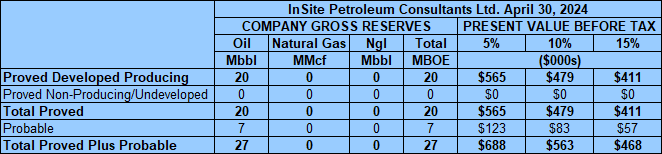

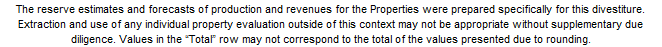

Mikwan Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Mikwan property contained remaining proved plus probable reserves of 27,000 barrels of oil (27,000 boe), with an estimated net present value of $563,000 using forecast pricing at a 10% discount.

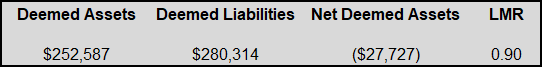

Mikwan LMR

As of October 5, 2024, the Mikwan property had a deemed net asset value of ($27,727) (deemed assets of $252,587 less liabilities of $280,314), with an LMR ratio of 0.90.

As of October 5, 2024, the Mikwan property had a deemed net asset value of ($27,727) (deemed assets of $252,587 less liabilities of $280,314), with an LMR ratio of 0.90.

Mikwan Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

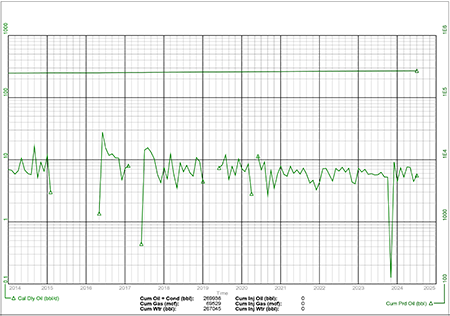

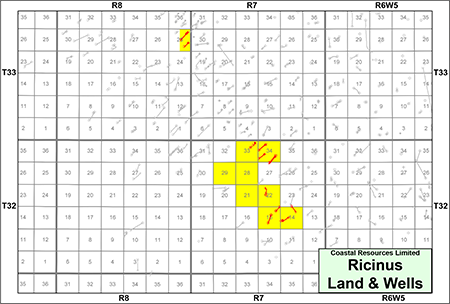

RICINUS

Township 32-33, Range 7-8 W5

At Ricinus, Coastal holds various non-operated working interests ranging from 8.33%-20% and GORR interests in 8.5 sections of land. Coastal’s production at Ricinus is operated primarily by TAQA North Ltd. and Tourmaline Oil Corp.

Average daily sales production net to Coastal from Ricinus for the six months ended June 30, 2024 was approximately five boe/d, consisting of 25 Mcf/d of natural gas and one barrel of natural gas liquids per day.

Operating income net to Coastal from Ricinus for the six months ended June 30, 2024 was approximately $10 per month, or $120 on an annualized basis.

At Ricinus, Coastal holds various non-operated working interests ranging from 8.33%-20% and GORR interests in 8.5 sections of land. Coastal’s production at Ricinus is operated primarily by TAQA North Ltd. and Tourmaline Oil Corp.

Average daily sales production net to Coastal from Ricinus for the six months ended June 30, 2024 was approximately five boe/d, consisting of 25 Mcf/d of natural gas and one barrel of natural gas liquids per day.

Operating income net to Coastal from Ricinus for the six months ended June 30, 2024 was approximately $10 per month, or $120 on an annualized basis.

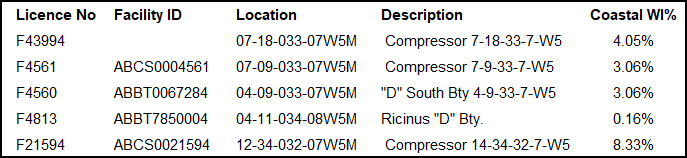

Ricinus Facilities

The Company holds working interests in the following facilities at Ricinus.

The Company holds working interests in the following facilities at Ricinus.

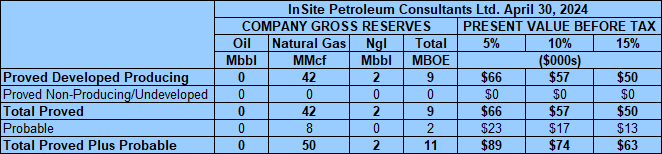

Ricinus Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Ricinus property contained remaining proved plus probable reserves of 50 MMcf of natural gas and 2,000 barrels of natural gas liquids (11,000 boe), with an estimated net present value of $74,000 using forecast pricing at a 10% discount.

Ricinus LMR

Coastal does not operate any wells or facilities at Ricinus.

Coastal does not operate any wells or facilities at Ricinus.

Ricinus Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

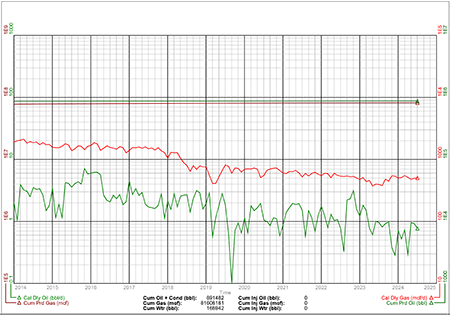

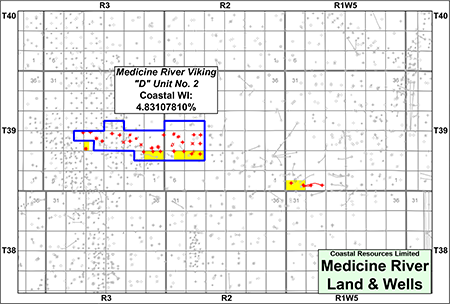

MEDICINE RIVER

Township 39, Range 1-3 W5

At Medicine River, Coastal holds various working interests in three quarter sections of land as well as a 4.83107810% working interest in the Medicine River Viking “D” Unit No. 2. Operated by BTG Energy Corp.

Average daily sales production net to Coastal from Medicine River for the six months ended June 30, 2024 was approximately four boe/d, consisting of 13 Mcf/d of natural gas and two barrels of natural gas liquids per day.

Operating income net to Coastal from Medicine River for the six months ended June 30, 2024 was approximately ($720) per month, or ($8,640) on an annualized basis.

At Medicine River, Coastal holds various working interests in three quarter sections of land as well as a 4.83107810% working interest in the Medicine River Viking “D” Unit No. 2. Operated by BTG Energy Corp.

Average daily sales production net to Coastal from Medicine River for the six months ended June 30, 2024 was approximately four boe/d, consisting of 13 Mcf/d of natural gas and two barrels of natural gas liquids per day.

Operating income net to Coastal from Medicine River for the six months ended June 30, 2024 was approximately ($720) per month, or ($8,640) on an annualized basis.

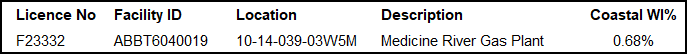

Medicine River Facilities

The Company holds working interests in the following facility at Medicine River.

The Company holds working interests in the following facility at Medicine River.

Medicine River Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Medicine River property contained remaining proved plus probable reserves of 17 MMcf of natural gas and 2,000 barrels of natural gas liquids (5,000 boe), with an estimated net present value of $11,000 using forecast pricing at a 10% discount.

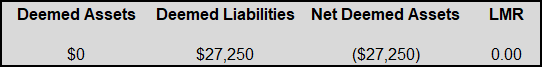

Medicine River LMR

As of October 5, 2024, the Medicine River property had a deemed net asset value of ($27,250) (deemed assets of $0 less liabilities of $27,250), with an LMR ratio of 0.00.

As of October 5, 2024, the Medicine River property had a deemed net asset value of ($27,250) (deemed assets of $0 less liabilities of $27,250), with an LMR ratio of 0.00.

Medicine River Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

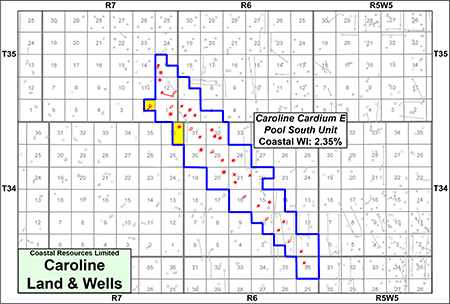

CAROLINE

Township 33-35, Range 6-7 W5

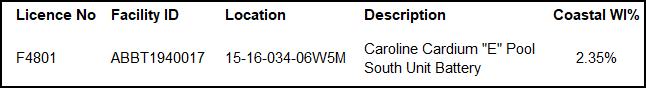

At Caroline, Coastal holds a 2.35% working interest in the Caroline Cardium E Pool South Unit operated by Tourmaline Oil Corp.

Average daily sales production net to Coastal from Caroline for the six months ended June 30, 2024 was approximately seven Mcf/d of natural gas and minor volumes of oil and natural gas liquids per day.

Operating income net to Coastal from Caroline for the six months ended June 30, 2024 was approximately ($310) per month, or ($3,720) on an annualized basis.

At Caroline, Coastal holds a 2.35% working interest in the Caroline Cardium E Pool South Unit operated by Tourmaline Oil Corp.

Average daily sales production net to Coastal from Caroline for the six months ended June 30, 2024 was approximately seven Mcf/d of natural gas and minor volumes of oil and natural gas liquids per day.

Operating income net to Coastal from Caroline for the six months ended June 30, 2024 was approximately ($310) per month, or ($3,720) on an annualized basis.

Caroline Facilities

The Company holds working interests in the following facility at Caroline.

The Company holds working interests in the following facility at Caroline.

Caroline Reserves

The Company does not have any reserves assigned to Caroline.

Caroline LMR

Coastal does not operate any wells or facilities at Caroline.

Caroline Well List

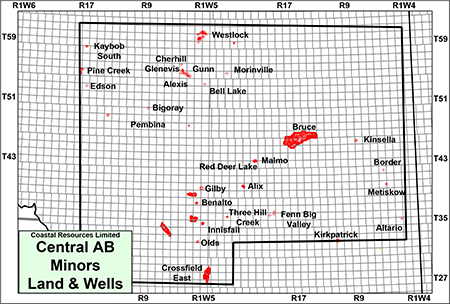

CENTRAL AB MINORS

Township 26-60, Range 3 W4 -17 W5

In the Central AB package, Coastal holds various working interests in land and wells in the Alexis, Alix, Altario, Bell Lake, Benalto, Bigoray, Border, Bruce, Cherhill, Crossfield East, Edson, Fenn Big Valley, Gilby, Glenevis, Gunn, Harmattan, Innisfail, Kaybob South, Kinsella, Kirkpatrick, Malmo, Metiskow, Morinville, Olds, Pembina, Pine Creek, Red Deer Lake, Three Hills Creek and Westlock areas of Alberta (collectively, the “Central AB Minors”).

Average daily sales production net to Coastal from Central AB Minors for the six months ended June 30, 2024 was approximately 7 boe/d, consisting of 39 Mcf/d of natural gas and two barrels of natural gas liquids per day.

Operating income net to Coastal from Central AB Minors for the six months ended June 30, 2024 was approximately ($11,800) per month, or ($141,600) on an annualized basis.

In the Central AB package, Coastal holds various working interests in land and wells in the Alexis, Alix, Altario, Bell Lake, Benalto, Bigoray, Border, Bruce, Cherhill, Crossfield East, Edson, Fenn Big Valley, Gilby, Glenevis, Gunn, Harmattan, Innisfail, Kaybob South, Kinsella, Kirkpatrick, Malmo, Metiskow, Morinville, Olds, Pembina, Pine Creek, Red Deer Lake, Three Hills Creek and Westlock areas of Alberta (collectively, the “Central AB Minors”).

Average daily sales production net to Coastal from Central AB Minors for the six months ended June 30, 2024 was approximately 7 boe/d, consisting of 39 Mcf/d of natural gas and two barrels of natural gas liquids per day.

Operating income net to Coastal from Central AB Minors for the six months ended June 30, 2024 was approximately ($11,800) per month, or ($141,600) on an annualized basis.

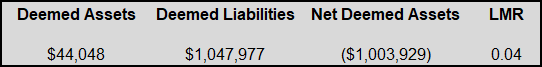

Central AB Minors LMR

As of October 5, 2024, the Properties had a deemed net asset value of ($1.0 million) (deemed assets of $44,048 less liabilities of $1.0 million), with an LMR ratio of 0.04.

As of October 5, 2024, the Properties had a deemed net asset value of ($1.0 million) (deemed assets of $44,048 less liabilities of $1.0 million), with an LMR ratio of 0.04.

Central AB Minors Well List

Click here to download the complete well list in Excel.

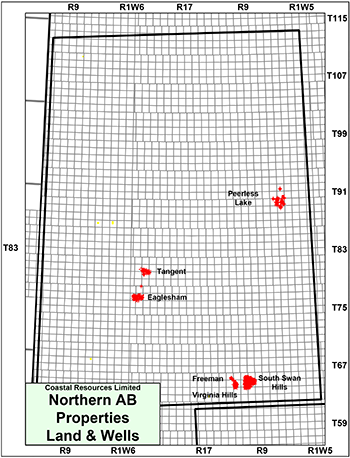

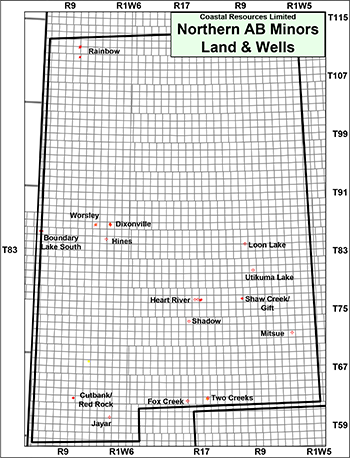

NORTHERN AB PROPERTIES

In the Northern AB package, Coastal has various operated and non-operated working interests in the Eaglesham, Freeman, Peerless Lake, Red Earth, South Swan Hills, Tangent and Virginia Hills areas as well as interests in certain minor properties.

The Company also holds a 100% interest in a 45.6-kilometre sales pipeline from the Kidney battery at 08-24-090-06W5M to the Plains Midstream Sales header at Red Earth. The Company has identified that an increase in volumes transported along this pipeline will result in a significant increase in operating income from the Peerless Lake property.

The Company also holds a 100% interest in a 45.6-kilometre sales pipeline from the Kidney battery at 08-24-090-06W5M to the Plains Midstream Sales header at Red Earth. The Company has identified that an increase in volumes transported along this pipeline will result in a significant increase in operating income from the Peerless Lake property.

Northern Alberta Properties

Northern AB Properties Reserves

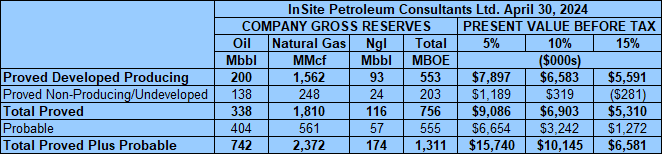

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Northern AB Properties contained remaining proved plus probable reserves of 1.1 million barrels of oil and natural gas liquids and 2.8 Bcf of natural gas (1.5 million boe), with an estimated net present value of $9.3 million using forecast pricing at a 10% discount.

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Northern AB Properties contained remaining proved plus probable reserves of 1.1 million barrels of oil and natural gas liquids and 2.8 Bcf of natural gas (1.5 million boe), with an estimated net present value of $9.3 million using forecast pricing at a 10% discount.

Northern AB Development Drilling & Upside

The Company has identified 19 drilling opportunities, 11 well reactivations and one recompletion on the Northern AB Properties.

The majority of the drilling locations and reactivation opportunities are identified in the InSite Report as proven and probable reserves. In addition to the InSite Report, other projects have also been identified.

On a risked-basis, the Company believes there is potential to add over 650 boe/d net production, 88% of which is medium to light oil production.

The Company has identified 19 drilling opportunities, 11 well reactivations and one recompletion on the Northern AB Properties.

The majority of the drilling locations and reactivation opportunities are identified in the InSite Report as proven and probable reserves. In addition to the InSite Report, other projects have also been identified.

On a risked-basis, the Company believes there is potential to add over 650 boe/d net production, 88% of which is medium to light oil production.

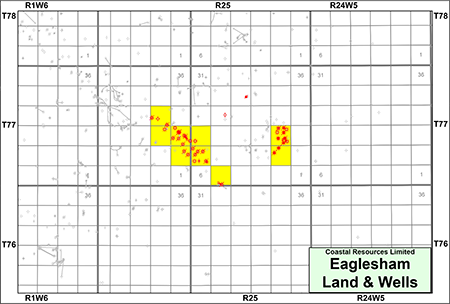

EAGLESHAM

Township 77, Range 25-26 W5

Coastal holds various non-operated working interests ranging from 12.792%-50% in 9 sections of land at Eaglesham operated by Canadian Natural Resources Limited.

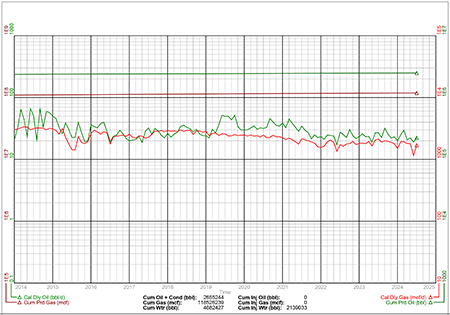

Average daily sales production net to Coastal from Eaglesham for the six months ended June 30, 2024 was approximately 104 boe/d, consisting of 502 Mcf/d of natural gas and 20 barrels of oil and natural gas liquids per day.

Operating income net to Coastal from Eaglesham for the six months ended June 30, 2024 was approximately ($10,400) per month, or ($124,800) on an annualized basis.

Coastal holds various non-operated working interests ranging from 12.792%-50% in 9 sections of land at Eaglesham operated by Canadian Natural Resources Limited.

Average daily sales production net to Coastal from Eaglesham for the six months ended June 30, 2024 was approximately 104 boe/d, consisting of 502 Mcf/d of natural gas and 20 barrels of oil and natural gas liquids per day.

Operating income net to Coastal from Eaglesham for the six months ended June 30, 2024 was approximately ($10,400) per month, or ($124,800) on an annualized basis.

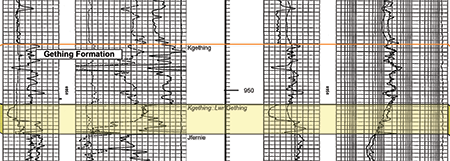

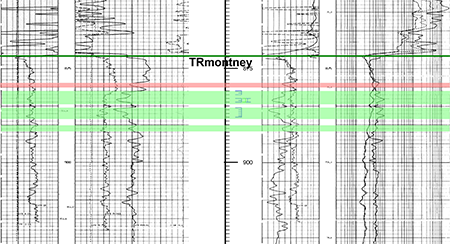

The primary producing reservoir at Eaglesham is the Debolt Formation. Coastal has also identified upside potential in the Gething Formation as shown in the following well logs for the well CNRL Eagle 100/01-13-077-26W5/0. There is offsetting production history at in the Gething in the 102/07-13/02 well.

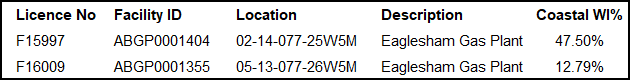

Eaglesham Facilities

The Company holds working interests in the following facilities at Eaglesham.

Eaglesham Reserves

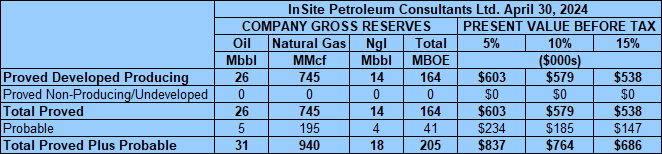

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Eaglesham property contained remaining proved plus probable reserves of 940 MMcf of natural gas and 49,000 barrels of oil and natural gas liquids (205,000 boe), with an estimated net present value of $764,000 using forecast pricing at a 10% discount.

Eaglesham LMR

Coastal does not operate any wells or facilities at Eaglesham.

Eaglesham Well List

Coastal does not operate any wells or facilities at Eaglesham.

Eaglesham Well List

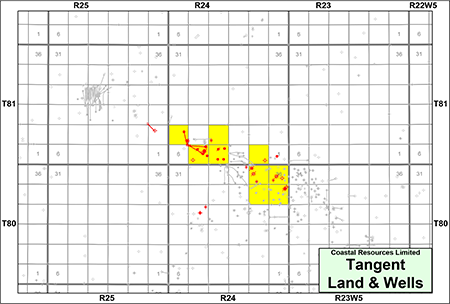

TANGENT

Township 80-81, Range 24-25 W4

At Tangent, Coastal various operated and non-operated interests ranging from 40%-100% in nine sections of land. Oil production from Tangent is from the Montney Formation.

Average daily sales production net to Coastal from Tangent for the six months ended June 30, 2024 was approximately 54 boe/d, consisting of 167 Mcf/d of natural gas and 26 barrels of oil and natural gas liquids per day.

Operating income net to Coastal from Tangent for the six months ended June 30, 2024 was approximately $8,900 per month, or $106,800 on an annualized basis.

At Tangent, Coastal various operated and non-operated interests ranging from 40%-100% in nine sections of land. Oil production from Tangent is from the Montney Formation.

Average daily sales production net to Coastal from Tangent for the six months ended June 30, 2024 was approximately 54 boe/d, consisting of 167 Mcf/d of natural gas and 26 barrels of oil and natural gas liquids per day.

Operating income net to Coastal from Tangent for the six months ended June 30, 2024 was approximately $8,900 per month, or $106,800 on an annualized basis.

The following well logs for the well CRL Tangent 100//06-04-081-24W5/0 show the Montney Formation at Tangent.

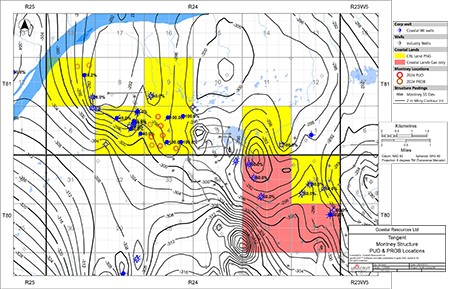

The following structure map shows Coastal’s proved undeveloped and probable Montney drilling locations at Tangent.

Tangent Facilities

The Company holds working interests in the following facilities at Tangent.

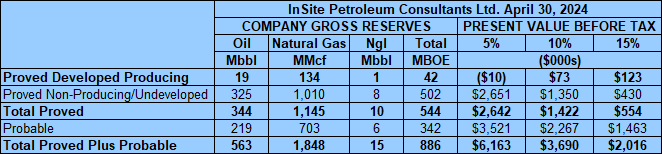

Tangent Reserves

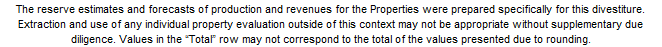

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Tangent property contained remaining proved plus probable reserves of 578,000 barrels of oil and natural gas liquids and 1.8 Bcf of natural gas (886,000 boe), with an estimated net present value of $3.7 million using forecast pricing at a 10% discount.

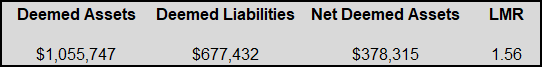

Tangent LMR

As of October 5, 2024, the Tangent property had a deemed net asset value of $378,315 (deemed assets of $1.1 million less liabilities of $677,432), with an LMR ratio of 1.56.

As of October 5, 2024, the Tangent property had a deemed net asset value of $378,315 (deemed assets of $1.1 million less liabilities of $677,432), with an LMR ratio of 1.56.

Tangent Well List

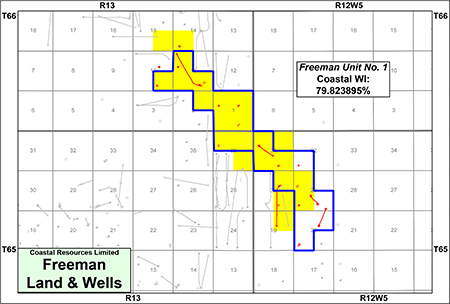

FREEMAN

Township 65-66, Range 12-13 W5

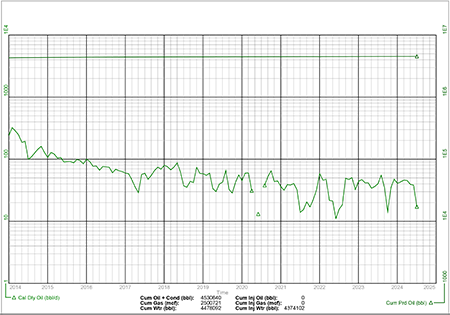

At Freeman, Coastal holds various working interests in five sections of land including a 79.823895% operated working interest in the Freeman Unit No. 1.

Average daily sales production net to Coastal from Freeman for the six months ended June 30, 2024 was approximately 33 barrels of oil per day (33 boe/d).

Operating income net to Coastal from Freeman for the six months ended June 30, 2024 was approximately $16,900 per month, or $202,800 on an annualized basis.

At Freeman, Coastal holds various working interests in five sections of land including a 79.823895% operated working interest in the Freeman Unit No. 1.

Average daily sales production net to Coastal from Freeman for the six months ended June 30, 2024 was approximately 33 barrels of oil per day (33 boe/d).

Operating income net to Coastal from Freeman for the six months ended June 30, 2024 was approximately $16,900 per month, or $202,800 on an annualized basis.

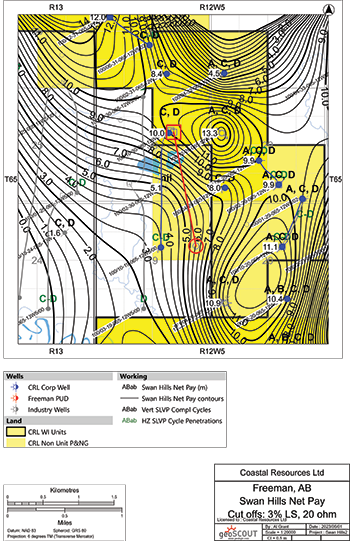

The following well logs for the well CRL Virg 100/10-20-065-12W5/0 show the Slave Point Formation at Freeman. The Slave Point reef build up in the Freeman Unit consists of four stages labelled A, B, C, D from oldest to youngest. Most of the productive, porous limestone reservoir is found in the top C and D pulses of the reef build up.

The following map shows the Swan Hills net pay on Coastal’s lands at Freeman, using a 3% limestone and 20 ohms resistivity cutoff.

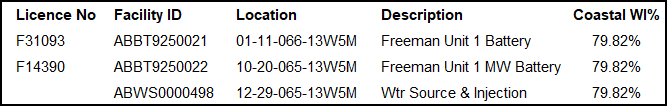

Freeman Facilities

The Company holds working interests in the following facility at Freeman.

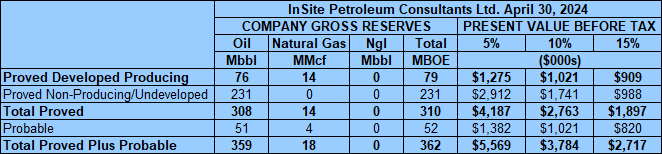

Freeman Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Freeman property contained remaining proved plus probable reserves of 359,000 barrels of oil and 18 MMcf of natural gas (362,000 boe), with an estimated net present value of $3.8 million using forecast pricing at a 10% discount.

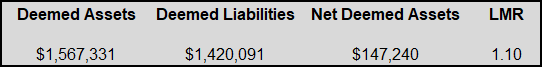

Freeman LMR

As of October 5, 2024, the Freeman property had a deemed net asset value of $147,240 (deemed assets of $1.6 million less liabilities of $1.4 million), with an LMR ratio of 1.10.

As of October 5, 2024, the Freeman property had a deemed net asset value of $147,240 (deemed assets of $1.6 million less liabilities of $1.4 million), with an LMR ratio of 1.10.

Freeman Well List

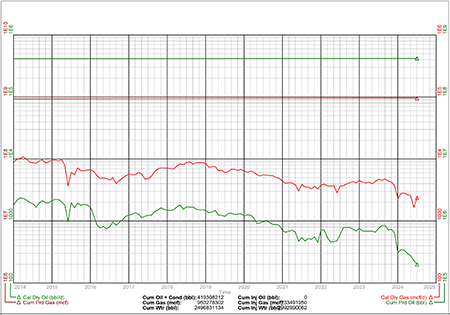

PEERLESS LAKE

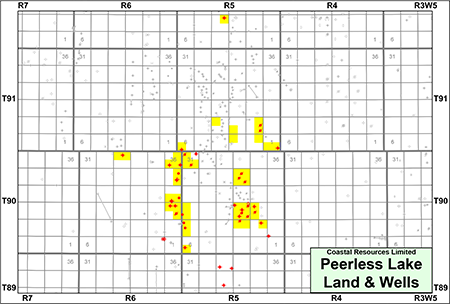

Township 89-92, Range 5-6 W5

At Peerless Lake, Coastal holds various operated and non-operated working interests ranging from 25%-100% in 9.5 sections of land. Coastal’s production at Peerless Lake is from the Keg River Formation.

Average daily sales production net to Coastal from Peerless Lake for the six months ended June 30, 2024 was approximately 27 barrels of oil per day (27 boe/d).

Operating income net to Coastal from Peerless Lake for the six months ended June 30, 2024 was approximately ($12,500) per month, or ($150,000) on an annualized basis.

At Peerless Lake, Coastal holds various operated and non-operated working interests ranging from 25%-100% in 9.5 sections of land. Coastal’s production at Peerless Lake is from the Keg River Formation.

Average daily sales production net to Coastal from Peerless Lake for the six months ended June 30, 2024 was approximately 27 barrels of oil per day (27 boe/d).

Operating income net to Coastal from Peerless Lake for the six months ended June 30, 2024 was approximately ($12,500) per month, or ($150,000) on an annualized basis.

Peerless Lake Facilities

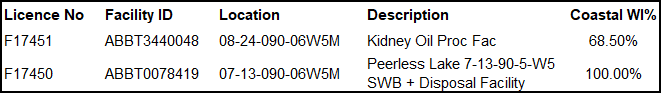

The Company holds working interests in the following facilities at Peerless Lake.

The Company holds working interests in the following facilities at Peerless Lake.

The Company also holds a 100% interest in a 45.6-kilometre sales pipeline from the Kidney battery at 08-24-090-06W5M to the Plains Midstream Sales header at Red Earth. The Company has identified that an increase in volumes transported along this pipeline will result in a significant increase in operating income from the Peerless Lake property. Further details will be made available in the virtual data room for parties that execute a confidentiality agreement.

Peerless Lake Reserves

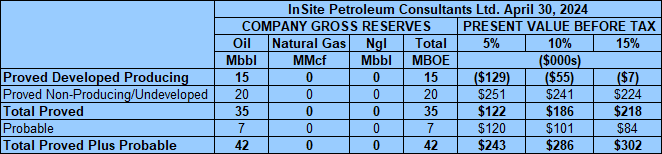

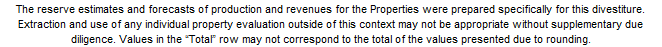

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Peerless Lake property contained remaining proved plus probable reserves of 42,000 barrels of oil (42,000 boe), with an estimated net present value of $286,000 using forecast pricing at a 10% discount.

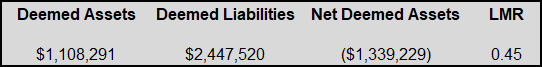

Peerless Lake LMR

As of October 5, 2024, the Peerless Lake property had a deemed net asset value of ($1.3 million) (deemed assets of $1.1 million less liabilities of $2.4 million), with an LMR ratio of 0.45.

As of October 5, 2024, the Peerless Lake property had a deemed net asset value of ($1.3 million) (deemed assets of $1.1 million less liabilities of $2.4 million), with an LMR ratio of 0.45.

Peerless Lake Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

RED EARTH

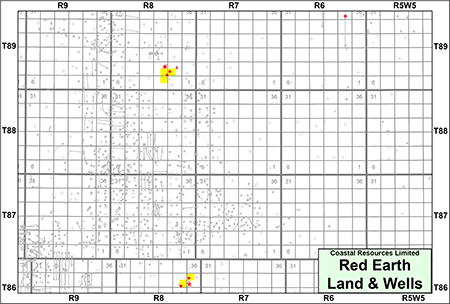

Township 86-89, Range 6-8 W5

At Red Earth, Coastal holds various operated and non-operated working interests ranging from 9.09%-100% in 1.25 sections of land. Coastal’s production at Red Earth is primarily from the Granite Wash and Slave Point formations.

Average daily sales production net to Coastal from Red Earth for the six months ended June 30, 2024 was approximately five barrels of oil per day (five boe/d).

Operating income net to Coastal from Red Earth for the six months ended June 30, 2024 was approximately ($1,300) per month, or ($15,600) on an annualized basis.

At Red Earth, Coastal holds various operated and non-operated working interests ranging from 9.09%-100% in 1.25 sections of land. Coastal’s production at Red Earth is primarily from the Granite Wash and Slave Point formations.

Average daily sales production net to Coastal from Red Earth for the six months ended June 30, 2024 was approximately five barrels of oil per day (five boe/d).

Operating income net to Coastal from Red Earth for the six months ended June 30, 2024 was approximately ($1,300) per month, or ($15,600) on an annualized basis.

Red Earth Facilities

The Company holds working interests in the following facilities at Red Earth.

The Company holds working interests in the following facilities at Red Earth.

Red Earth Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Red Earth property contained remaining proved plus probable reserves of 21,000 barrels of oil (21,000 boe), with an estimated net present value of $483,000 using forecast pricing at a 10% discount.

Red Earth LMR

As of October 5, 2024, the Red Earth property had a deemed net asset value of ($222,828) (deemed assets of $14,010 less liabilities of $236,838), with an LMR ratio of 0.06.

As of October 5, 2024, the Red Earth property had a deemed net asset value of ($222,828) (deemed assets of $14,010 less liabilities of $236,838), with an LMR ratio of 0.06.

Red Earth Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

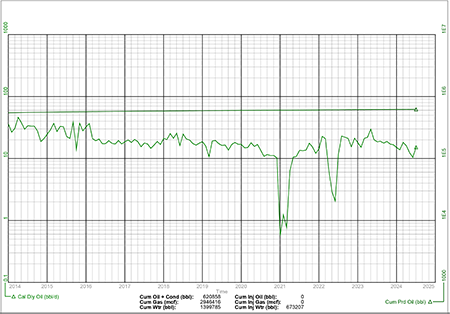

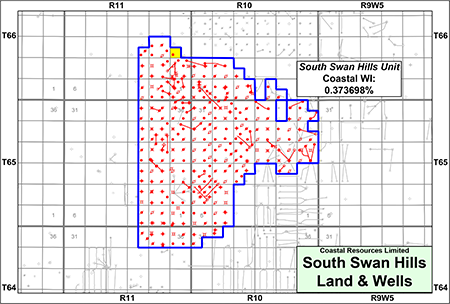

SOUTH SWAN HILLS

Township 64-66, Range 10-11 W5

At South Swan Hills, Coastal holds a 0.373698% working interests in the South Swan Hills Unit operated by Razor Energy Corp.

Average daily sales production net to Coastal from South Swan Hills for the six months ended June 30, 2024 was approximately one barrel of oil and minor natural gas volumes per day (one boe/d).

Operating income net to Coastal from South Swan Hills for the six months ended June 30, 2024 was approximately ($470) per month, or ($5,640) on an annualized basis.

At South Swan Hills, production has partially been curtailed due to Razor entering into Bankruptcy proceedings under the Companies’ Creditors Arrangement act in early 2024.

At South Swan Hills, Coastal holds a 0.373698% working interests in the South Swan Hills Unit operated by Razor Energy Corp.

Average daily sales production net to Coastal from South Swan Hills for the six months ended June 30, 2024 was approximately one barrel of oil and minor natural gas volumes per day (one boe/d).

Operating income net to Coastal from South Swan Hills for the six months ended June 30, 2024 was approximately ($470) per month, or ($5,640) on an annualized basis.

At South Swan Hills, production has partially been curtailed due to Razor entering into Bankruptcy proceedings under the Companies’ Creditors Arrangement act in early 2024.

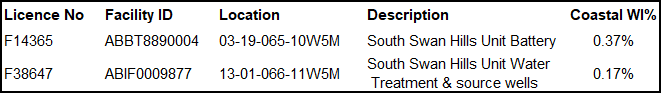

South Swan Hills Facilities

The Company holds working interests in the following facilities at South Swan Hills.

The Company holds working interests in the following facilities at South Swan Hills.

South Swan Hills Reserves

The Company does not have any reserves at South Swan Hills.

South Swan Hills LMR

Coastal does not operate any wells or facilities at South Swan Hills.

South Swan Hills Well List

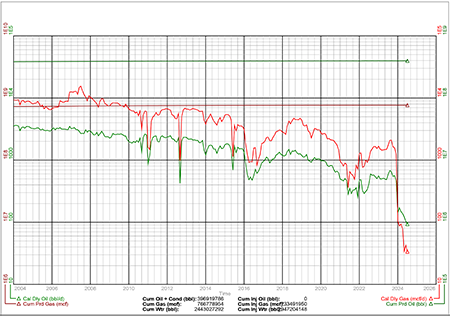

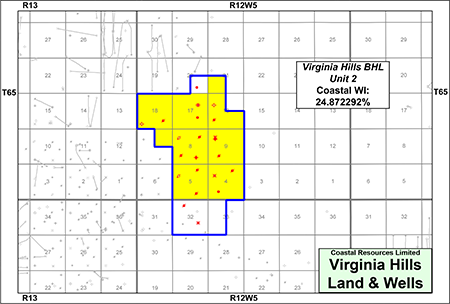

VIRGINIA HILLS

Township 64-65, Range 12 W5

At Virginia Hills, Coastal holds a 24.872292% working interest in the Virginia Hills BHL Unit 2 operated by Razor Energy Corp.

Average daily sales production net to Coastal from the Virginia Hills BHL Unit 2 for the six months ended June 30, 2024 was approximately one barrel of oil per day (one boe/d).

Operating income net to Coastal from the Virginia Hills BHL Unit 2 for the six months ended June 30, 2024 was approximately $50 per month, or $600 on an annualized basis.

At Virginia Hills, Coastal holds a 24.872292% working interest in the Virginia Hills BHL Unit 2 operated by Razor Energy Corp.

Average daily sales production net to Coastal from the Virginia Hills BHL Unit 2 for the six months ended June 30, 2024 was approximately one barrel of oil per day (one boe/d).

Operating income net to Coastal from the Virginia Hills BHL Unit 2 for the six months ended June 30, 2024 was approximately $50 per month, or $600 on an annualized basis.

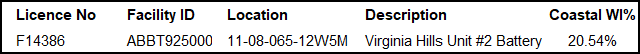

Virginia Hills Facilities

The Company holds working interests in the following facility at Virginia Hills.

The Company holds working interests in the following facility at Virginia Hills.

Virginia Hills Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Virginia Hills property contained remaining proved plus probable reserves of 21,000 barrels of oil (21,000 boe), with an estimated net present value of $247,000 using forecast pricing at a 10% discount.

Virginia Hills LMR

Coastal does not operate any wells or facilities at Virginia Hills.

Virginia Hills Well List

Coastal does not operate any wells or facilities at Virginia Hills.

Virginia Hills Well List

NORTHERN AB MINORS

Township 60-112, Range 1 W5 - 11W6

In the Northern AB package, Coastal holds various working interests in land and wells in the Boundary Lake South, Cutbank/Red Rock, Dixonville, Fox Creek, Heart River, Hines, Jayar, Loon Lake, Mitsue, Rainbow, Shadow, Shaw Creek/Gift, Two Creeks, Utikuma Lake and Worsley areas of Alberta, (collectively, the “Northern AB Minors”).

There is currently no production from the Northern AB Minors.

In the Northern AB package, Coastal holds various working interests in land and wells in the Boundary Lake South, Cutbank/Red Rock, Dixonville, Fox Creek, Heart River, Hines, Jayar, Loon Lake, Mitsue, Rainbow, Shadow, Shaw Creek/Gift, Two Creeks, Utikuma Lake and Worsley areas of Alberta, (collectively, the “Northern AB Minors”).

There is currently no production from the Northern AB Minors.

Northern AB Minors LMR

As of October 5, 2024, the Properties had a deemed net asset value of ($562,210) (deemed assets of $0 less liabilities of $562,210), with an LMR ratio of 0.00.

As of October 5, 2024, the Properties had a deemed net asset value of ($562,210) (deemed assets of $0 less liabilities of $562,210), with an LMR ratio of 0.00.

Northern AB Minors Well List

Click here to download the complete well list in Excel.

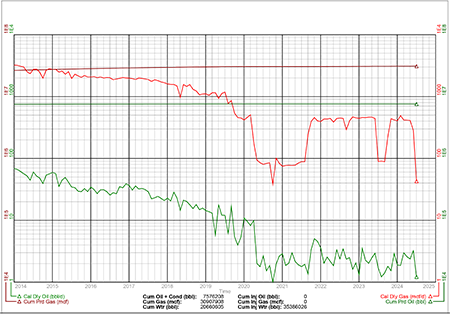

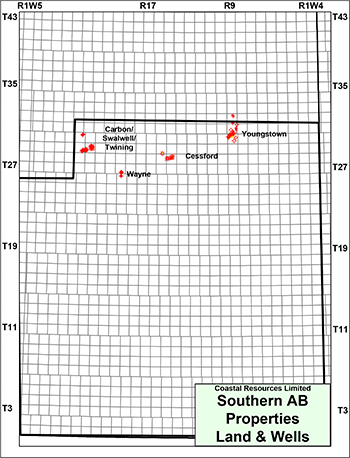

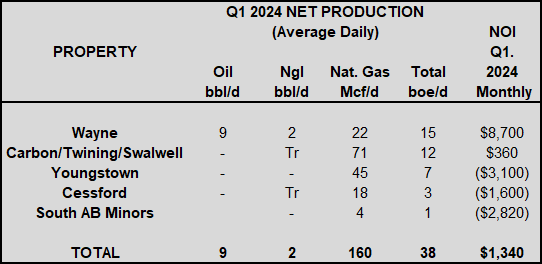

SOUTHERN AB PROPERTIES

In the Southern AB package, Coastal holds various operated and non-operated working interests in the Carbon/Swalwell/Twining, Cessford, Wayne and Youngstown areas as well as interests in certain minor properties.

Southern Alberta Properties

Southern AB Properties Reserves

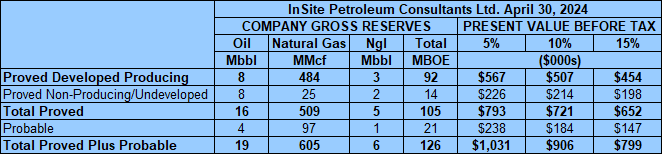

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Southern AB Properties contained remaining proved plus probable reserves of 605 MMcf of natural gas and 25,000 barrels of oil and natural gas liquids (126,000 boe), with an estimated net present value of $906,000 using forecast pricing at a 10% discount.

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Southern AB Properties contained remaining proved plus probable reserves of 605 MMcf of natural gas and 25,000 barrels of oil and natural gas liquids (126,000 boe), with an estimated net present value of $906,000 using forecast pricing at a 10% discount.

Southern AB Development Drilling & Upside

The Company has identified one drilling opportunity and one recompletion on the Southern AB Properties.

On a risked-basis, the Company believes there is potential to add over 40 boe/d net production, 52% of which is medium to light oil production.

The Company has identified one drilling opportunity and one recompletion on the Southern AB Properties.

On a risked-basis, the Company believes there is potential to add over 40 boe/d net production, 52% of which is medium to light oil production.

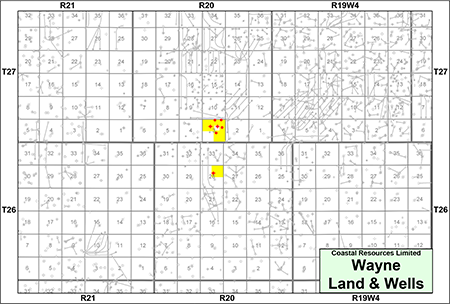

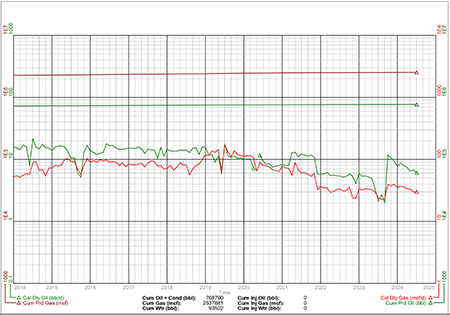

WAYNE

Township 26-27, Range 20 W4

At Wayne, Coastal holds 100% operated working interests in one section of land. Coastal’s oil production at Wayne is from the Ellerslie Formation.

Average daily sales production net to Coastal from Wayne for the six months ended June 30, 2024 was approximately 15 boe/d, consisting of 11 barrels of oil and natural gas liquids per day and 22 Mcf/d of natural gas.

Operating income net to Coastal from Wayne for the six months ended June 30, 2024 was approximately $8,700 per month, or $104,400 on an annualized basis.

At Wayne, Coastal holds 100% operated working interests in one section of land. Coastal’s oil production at Wayne is from the Ellerslie Formation.

Average daily sales production net to Coastal from Wayne for the six months ended June 30, 2024 was approximately 15 boe/d, consisting of 11 barrels of oil and natural gas liquids per day and 22 Mcf/d of natural gas.

Operating income net to Coastal from Wayne for the six months ended June 30, 2024 was approximately $8,700 per month, or $104,400 on an annualized basis.

Wayne Facilities

The Company holds working interests in the following facilities at Wayne.

The Company holds working interests in the following facilities at Wayne.

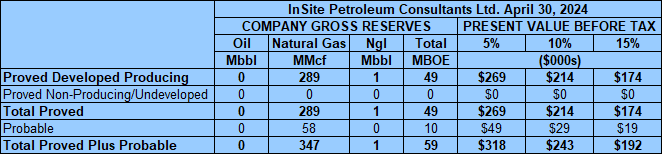

Wayne Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Wayne property contained remaining proved plus probable reserves of 23,000 barrels of oil and natural gas liquids and 52 MMcf of natural gas (32,000 boe), with an estimated net present value of $395,000 using forecast pricing at a 10% discount.

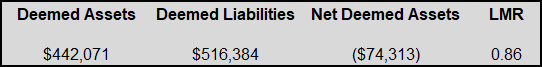

Wayne LMR

As of October 5, 2024, the Wayne property had a deemed net asset value of ($74,313) (deemed assets of $442,071 less liabilities of $516,384), with an LMR ratio of 0.86.

As of October 5, 2024, the Wayne property had a deemed net asset value of ($74,313) (deemed assets of $442,071 less liabilities of $516,384), with an LMR ratio of 0.86.

Wayne Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

CARBON / TWINING / SWALWELL

COASTAL HAS SOLD A PORTION OF ITS INTERESTS IN THE CARBON/TWINING/SWALWELL AREAS OF ALBERTA.

Township 29-30, Range 23-24 W4

At Carbon/Twining/Swalwell, Coastal holds various working interests ranging from 6.25%-50% in four sections of land. Production at Carbon/Twining/Swalwell is CBM production operated by Lynx Energy ULC.

Average daily sales production net to Coastal from Carbon/Twining/Swalwell for the six months ended June 30, 2024 was approximately 12 boe/d, consisting of 71 Mcf/d of natural gas and trace amounts of natural gas liquids per day.

Operating income net to Coastal Carbon/Twining/Swalwell for the six months ended June 30, 2024 was approximately ($360) per month, or ($4,320) on an annualized basis.

Township 29-30, Range 23-24 W4

At Carbon/Twining/Swalwell, Coastal holds various working interests ranging from 6.25%-50% in four sections of land. Production at Carbon/Twining/Swalwell is CBM production operated by Lynx Energy ULC.

Average daily sales production net to Coastal from Carbon/Twining/Swalwell for the six months ended June 30, 2024 was approximately 12 boe/d, consisting of 71 Mcf/d of natural gas and trace amounts of natural gas liquids per day.

Operating income net to Coastal Carbon/Twining/Swalwell for the six months ended June 30, 2024 was approximately ($360) per month, or ($4,320) on an annualized basis.

Carbon/Twining/Swalwell Facilities

The Company does not hold interests in any facilities at Carbon/Twining/Swalwell.

Carbon/Twining/Swalwell Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Carbon/Twining/Swalwell property contained remaining proved plus probable reserves of 347 MMcf of natural gas and 1,000 barrels of natural gas liquids (59,000 boe), with an estimated net present value of $243,000 using forecast pricing at a 10% discount.

The Company does not hold interests in any facilities at Carbon/Twining/Swalwell.

Carbon/Twining/Swalwell Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Carbon/Twining/Swalwell property contained remaining proved plus probable reserves of 347 MMcf of natural gas and 1,000 barrels of natural gas liquids (59,000 boe), with an estimated net present value of $243,000 using forecast pricing at a 10% discount.

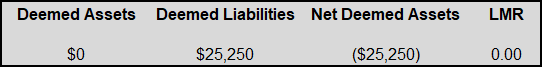

Carbon/Twining/Swalwell LMR

As of October 5, 2024, the Carbon/Twining/Swalwell property had a deemed net asset value of ($25,250) (deemed assets of $0 less liabilities of $25,250), with an LMR ratio of 0.00.

As of October 5, 2024, the Carbon/Twining/Swalwell property had a deemed net asset value of ($25,250) (deemed assets of $0 less liabilities of $25,250), with an LMR ratio of 0.00.

Carbon/Twining/Swalwell Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

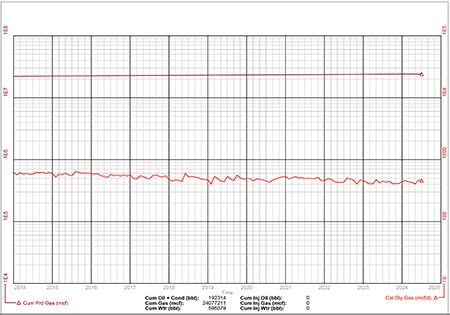

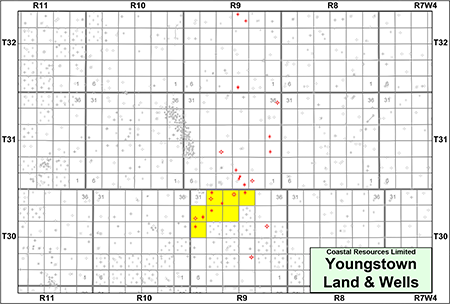

YOUNGSTOWN

Township 30-32, Range 9 W4

At Youngstown, Coastal holds primarily operated working interests ranging from 62.5%-100% in seven sections of land. Coastal’s natural gas production at Youngstown is from the Glauconitic Sandstone Formation.

The one producing well, 100/10-33-030-09W4, is on contract with a Bitcoin operator to fuel a power generator.

Average daily sales production net to Coastal from Youngstown for the six months ended June 30, 2024 was approximately seven boe/d consisting of 45 Mcf/d of natural gas.

Operating income net to Coastal from Youngstown for the six months ended June 30, 2024 was approximately ($3,100) per month, or ($37,200) on an annualized basis.

At Youngstown, Coastal holds primarily operated working interests ranging from 62.5%-100% in seven sections of land. Coastal’s natural gas production at Youngstown is from the Glauconitic Sandstone Formation.

The one producing well, 100/10-33-030-09W4, is on contract with a Bitcoin operator to fuel a power generator.

Average daily sales production net to Coastal from Youngstown for the six months ended June 30, 2024 was approximately seven boe/d consisting of 45 Mcf/d of natural gas.

Operating income net to Coastal from Youngstown for the six months ended June 30, 2024 was approximately ($3,100) per month, or ($37,200) on an annualized basis.

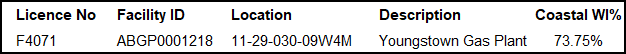

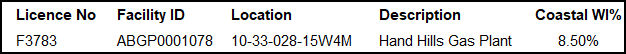

Youngstown Facilities

The Company holds working interests in the following facility at Youngstown.

The Company holds working interests in the following facility at Youngstown.

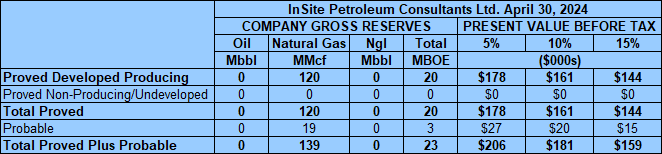

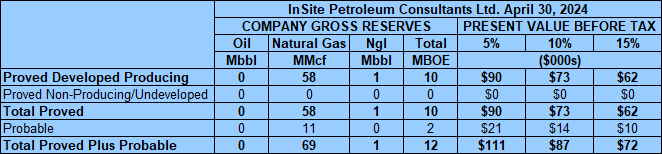

Youngstown Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Youngstown property contained remaining proved plus probable reserves of 139 MMcf of natural gas (23,000 boe), with an estimated net present value of $181,000 using forecast pricing at a 10% discount.

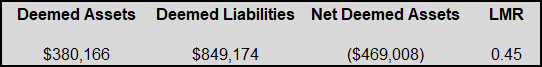

Youngstown LMR

As of October 5, 2024, the Youngstown property had a deemed net asset value of ($469,008) (deemed assets of $380,166 less liabilities of $849,174), with an LMR ratio of 0.45.

As of October 5, 2024, the Youngstown property had a deemed net asset value of ($469,008) (deemed assets of $380,166 less liabilities of $849,174), with an LMR ratio of 0.45.

Youngstown Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

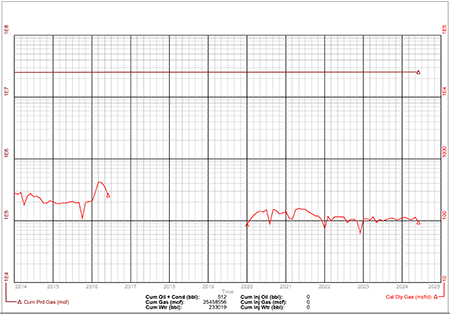

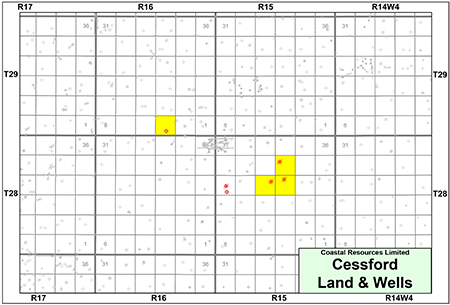

CESSFORD

Township 28-29, Range 15-16 W4

At Cessford, Coastal holds various working interests ranging from 50%-100% and GORR interests in four sections of land. Coastal’s production at Cessford is from the Mannville Group.

Average daily sales production net to Coastal from Cessford for the six months ended June 30, 2024 was approximately three boe/d, consisting of 17 Mcf/d of natural gas and trace amounts of natural gas liquids per day.

Operating income net to Coastal from Cessford for the six months ended June 30, 2024 was approximately ($1,600) per month, or ($19,200) on an annualized basis.

At Cessford, Coastal holds various working interests ranging from 50%-100% and GORR interests in four sections of land. Coastal’s production at Cessford is from the Mannville Group.

Average daily sales production net to Coastal from Cessford for the six months ended June 30, 2024 was approximately three boe/d, consisting of 17 Mcf/d of natural gas and trace amounts of natural gas liquids per day.

Operating income net to Coastal from Cessford for the six months ended June 30, 2024 was approximately ($1,600) per month, or ($19,200) on an annualized basis.

Cessford Facilities

The Company holds working interests in the following facility at Cessford.

The Company holds working interests in the following facility at Cessford.

Cessford Reserves

InSite Petroleum Consultants Ltd. (“InSite”) prepared an independent reserves evaluation of the Properties specifically for this divestiture (the “InSite Report”). The InSite Report is a sensitivity evaluation of a report dated April 30, 2023 which was mechanically updated to April 30, 2024 using Sproule Associates Limited’s April 30, 2024 forecast pricing.

InSite estimated that, as of April 30, 2024, the Cessford property contained remaining proved plus probable reserves of 69 MMcf of natural gas and 1,000 barrels of natural gas liquids (12,000 boe), with an estimated net present value of $87,000 using forecast pricing at a 10% discount.

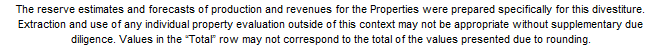

Cessford LMR

As of October 5, 2024, the Cessford property had a deemed net asset value of ($58,290) (deemed assets of $0 less liabilities of $58,290), with an LMR ratio of 0.00.

As of October 5, 2024, the Cessford property had a deemed net asset value of ($58,290) (deemed assets of $0 less liabilities of $58,290), with an LMR ratio of 0.00.

Cessford Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

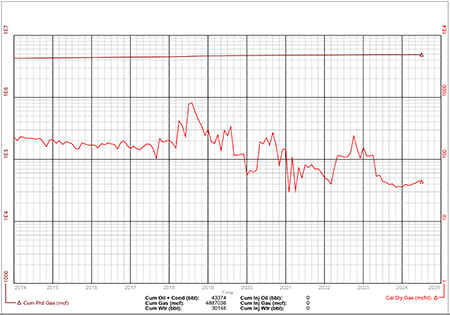

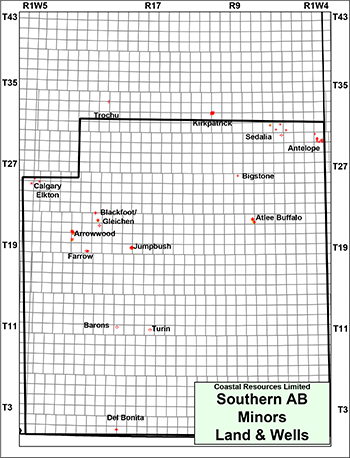

SOUTH AB MINORS

Township 3-33, Range 1 W4 - 1 W5

In the Southern AB package, Coastal holds various working interests in land and wells in the Antelope, Arrowwood, Atlee Buffalo, Barons, Bigstone, Blackfoot/Gleichen, Calgary Elkton, Del Bonita, Farrow, Jumpbush, Kirkpatrick, Sedalia, Trochu and Turin areas of Alberta (collectively, the “South AB Minors”).

Average daily sales production net to Coastal from South AB Minors for the six months ended June 30, 2024 was approximately one boe/d, consisting of four Mcf/d of natural gas.

Operating income net to Coastal from South AB Minors for the six months ended June 30, 2024 was approximately ($2,300) per month, or ($27,600) on an annualized basis.

In the Southern AB package, Coastal holds various working interests in land and wells in the Antelope, Arrowwood, Atlee Buffalo, Barons, Bigstone, Blackfoot/Gleichen, Calgary Elkton, Del Bonita, Farrow, Jumpbush, Kirkpatrick, Sedalia, Trochu and Turin areas of Alberta (collectively, the “South AB Minors”).

Average daily sales production net to Coastal from South AB Minors for the six months ended June 30, 2024 was approximately one boe/d, consisting of four Mcf/d of natural gas.

Operating income net to Coastal from South AB Minors for the six months ended June 30, 2024 was approximately ($2,300) per month, or ($27,600) on an annualized basis.

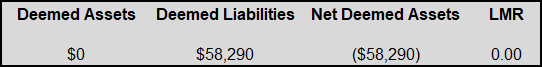

South AB Minors LMR

As of October 5, 2024, the Properties had a deemed net asset value of ($41,750) (deemed assets of $0 less liabilities of $41,750), with an LMR ratio of 0.00.

As of October 5, 2024, the Properties had a deemed net asset value of ($41,750) (deemed assets of $0 less liabilities of $41,750), with an LMR ratio of 0.00.

South AB Minors Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

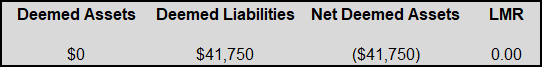

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Properties until 12:00 pm on Thursday December 12, 2024. Preference will be given to offers to acquire all of the Properties in one transaction.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday December 12 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, mail (brye@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, the InSite Report, LMR information, most recent net operations summary, detailed facilities information and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Ben Rye, Tom Pavic or Sydney Birkett at 403.266.6133.