Offering Details

Back

Under Review / Conifer Energy Inc.

Conifer Energy Inc.

Property Divestiture

Property DivestitureBid Deadline: December 19, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

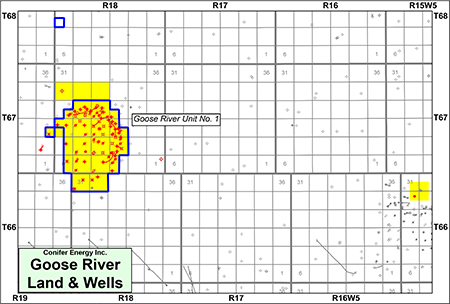

Conifer Energy Inc. (“Conifer” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of its oil and natural gas interests located in the Goose River area of Alberta (the “Property”). The Property consists of various working interests including Conifer’s interest in the Goose River Unit No. 1 (the “Unit”) and Conifer’s interest in the Snipe-Goose Gas Gathering System which flows to the Paramount Resources Ltd. Kaybob Gas Plant located at 08-09-064-19W5. Conifer is selling the Property in order to focus on its core operations.

Production from the Goose River Unit No. 1 was shut-in in September 2019 due to low commodity prices. The well Cfr GooseR 00/02-08-067-18W5/0 was restarted in the fourth quarter of 2020.

Conifer has identified at least 14 reactivation opportunities to reinstate production from the Unit, with total production capability of approximately 150 to 175 bbl/d of oil.

Conifer has identified the potential for Duvernay development on its lands at Goose River. Duvernay production and development in the Kaybob area has been gradually moving to the northeast and is encroaching into the Goose River area.

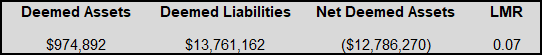

As of September 7, 2024, the Property had a deemed net asset value of ($12.8 million) (deemed assets of $974,892 and deemed liabilities of $13.8 million), with an LMR ratio of 0.07.

Production from the Goose River Unit No. 1 was shut-in in September 2019 due to low commodity prices. The well Cfr GooseR 00/02-08-067-18W5/0 was restarted in the fourth quarter of 2020.

Conifer has identified at least 14 reactivation opportunities to reinstate production from the Unit, with total production capability of approximately 150 to 175 bbl/d of oil.

Conifer has identified the potential for Duvernay development on its lands at Goose River. Duvernay production and development in the Kaybob area has been gradually moving to the northeast and is encroaching into the Goose River area.

As of September 7, 2024, the Property had a deemed net asset value of ($12.8 million) (deemed assets of $974,892 and deemed liabilities of $13.8 million), with an LMR ratio of 0.07.

GOOSE RIVER

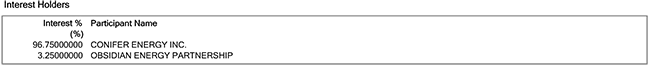

Township 66-68, Range 15-19 W5At Goose River, Conifer holds various working interests, including a 96.75% working interest in the Goose River Unit No. 1 and a 66.86% working interest in the Snipe-Goose Gas Gathering System.

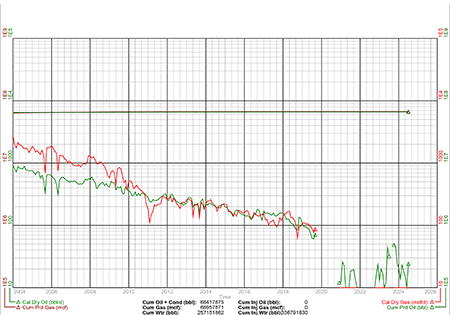

Average daily production net to Conifer from the Property for eight months ended August 31, 2024 was approximately 18 boe/d, consisting of 16 barrels of oil and natural gas liquids per day and 10 Mcf/d of natural gas.

Operating income net to Conifer from the Property for the eight months ended August 31, 2024 was approximately ($532,000) or ($66,500) on a monthly basis.

Production from the Goose River Unit No. 1 was shut-in in September 2019 due to low commodity prices. The well Cfr GooseR 00/02-08-067-18W5/0 was restarted in the fourth quarter of 2020.

Average daily production net to Conifer from the Property for eight months ended August 31, 2024 was approximately 18 boe/d, consisting of 16 barrels of oil and natural gas liquids per day and 10 Mcf/d of natural gas.

Operating income net to Conifer from the Property for the eight months ended August 31, 2024 was approximately ($532,000) or ($66,500) on a monthly basis.

Production from the Goose River Unit No. 1 was shut-in in September 2019 due to low commodity prices. The well Cfr GooseR 00/02-08-067-18W5/0 was restarted in the fourth quarter of 2020.

Goose River Geology

There are at least 14 reactivation opportunities to reinstate production from the Unit, with production capability of between approximately 150-175 bbl/d of oil. Production from the Unit is from the Swan Hills Formation. The Company estimates these well and associated facility reactivations can be achieved for total capital expenditures of approximately $8.2 million. Further details of the reactivation candidates and capex estimates are available in the virtual data room for parties that execute a confidentiality agreement.

The Company has identified four initial Swan Hills drilling locations, with seven follow-up drilling locations as shown on the following map.

The Company has identified four initial Swan Hills drilling locations, with seven follow-up drilling locations as shown on the following map.

The Unit was previously under waterflood and miscible solvent flood. The following logs show the transition from the Upper Devonian Swan Hills Reef Margin Facies on the northeast edge of the Unit to the toe of the reef (off-reef Waterways Formation) outside of the Unit. The Reef Margin Facies has high porosity and permeability and is the main producing area of the reef. The centre of the reef (southwest of the reef margin) is occupied by the Lagoonal Facies, which, overall has lower porosity and permeability. This area has not been as well swept by the waterflood or miscible solvent, and is where the Company has identified a number of drilling locations.

Conifer has identified the potential for Duvernay development on its lands at Goose River. Duvernay production and development in the Kaybob area has been gradually moving to the northeast and is encroaching into the Goose River area.

The following cross-section from Kaybob to Goose River shows the productive Duvernay interval (shown in red) which is being exploited with horizontal drilling.

Goose River Seismic

The Company has ownership in various trade and proprietary 2D and 3D seismic data relating to the Property. Further details of the seismic ownership will be available in the virtual data room for parties that execute a confidentiality agreement.

Goose River Facilities

The Company has a 66.86% working interest in the Snipe-Goose Gas Gathering System.

Conifer also has working interests in three satellites at 02-16-067-18W5, 10-17-067-18W5 and 10-05-067-18W5 along with the main unit battery at 10-04-09-08W5 associated with Goose River, as shown on the following map.

Conifer also has working interests in three satellites at 02-16-067-18W5, 10-17-067-18W5 and 10-05-067-18W5 along with the main unit battery at 10-04-09-08W5 associated with Goose River, as shown on the following map.

Goose River Marketing

Currently all natural gas from Goose River is consumed onsite as fuel gas. Natural gas production is connected through the Snipe-Goose Gathering System to the Paramount Resources Ltd. Kaybob Gas Plant located at 08-09-064-19W5. The Company has a natural gas handling agreement in place with Paramount.

Oil production from Goose River is trucked to the Conifer Judy Creek facility located at 11-06-064-11W5.

Oil production from Goose River is trucked to the Conifer Judy Creek facility located at 11-06-064-11W5.

Goose River Reserves

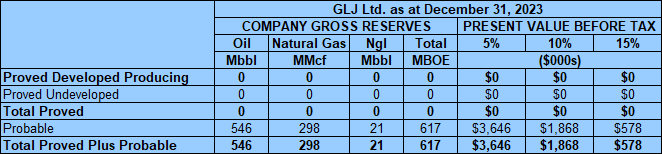

GLJ Ltd. (“GLJ”) prepared an independent reserves evaluation of the Property (the “GLJ Report”). The GLJ Report is effective December 31, 2023 using GLJ’s forecast pricing as at January 1, 2024.

GLJ estimates that, as at December 31, 2023, the Property contained remaining proved plus probable reserves of 567,000 barrels of oil and natural gas liquids and 298 MMcf of natural gas (617,000 boe), with an estimated net present value of $1.9 million using forecast pricing at a 10% discount.

GLJ estimates that, as at December 31, 2023, the Property contained remaining proved plus probable reserves of 567,000 barrels of oil and natural gas liquids and 298 MMcf of natural gas (617,000 boe), with an estimated net present value of $1.9 million using forecast pricing at a 10% discount.

Goose River LMR as of September 7, 2024

As of September 7, 2024, the Property had a deemed net asset value of ($12.8 million) (deemed assets of $974,892 and deemed liabilities of $13.8 million), with an LMR ratio of 0.07.

Goose River Well List

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Property until 12:00 pm on Thursday December 19, 2024.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday, December 19, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Property with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, mail (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, the GLJ Report, LMR information, most recent net operations summary and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Property please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.