Offering Details

Back

Undeveloped Land / Bounty Developments Ltd.

Bounty Developments Ltd.

Property Divestiture

Property DivestitureBid Deadline: December 19, 2024

12:00 PM

Download Full PDF - Printable

OVERVIEW

BOUNTY HAS SOLD ITS INTERESTS IN THE WEMBLEY AREA OF ALBERTA AND A PORTION OF ITS INTERESTS IN THE VALHALLA AND WAPITI AREAS OF ALBERTA.

Bounty Developments Ltd. (“Bounty” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the farmout or sale of its oil and natural gas interests located in the Elmworth, Valhalla, Wapiti and Wembley areas of Alberta (the “Properties”).

The Properties consist of predominantly 100% working interests in Crown mineral rights with prospective drilling locations for oil and natural gas primarily in the Montney, Charlie Lake, and Halfway formations.

At Elmworth, Bounty has a 100% working interest in 5.75 sections of land: three sections with P&NG rights from surface to basement, two sections with rights from surface to the base of the Charlie Lake Formation and three-quarters of a section with rights from surface to the base of the Halfway Formation. These sections are highly prospective for multiple pay sequences in the Montney and Charlie Lake formations.

At Valhalla, Bounty has a 100% working interest in an aggregate of 3.75 sections of land, and a 50% working interest in one section, with P&NG rights to the Charlie Lake and Halfway formations. These lands are highly prospective for multiple pay sequences in the Charlie Lake and Halfway formations.

At Wapiti, Bounty has a 100% working interest in five sections of land with P&NG rights to the Charlie Lake and Halfway formations. These lands are highly prospective for multiple pay sequences in the Charlie Lake and Halfway formations.

At Wembley, Bounty has a 100% working interest in 1.25 sections of land with P&NG rights to the Charlie Lake and other formations. These lands are highly prospective for the multiple pay sequences in the Charlie Lake Formation.

Further geological details of the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

The Properties consist of predominantly 100% working interests in Crown mineral rights with prospective drilling locations for oil and natural gas primarily in the Montney, Charlie Lake, and Halfway formations.

At Elmworth, Bounty has a 100% working interest in 5.75 sections of land: three sections with P&NG rights from surface to basement, two sections with rights from surface to the base of the Charlie Lake Formation and three-quarters of a section with rights from surface to the base of the Halfway Formation. These sections are highly prospective for multiple pay sequences in the Montney and Charlie Lake formations.

At Valhalla, Bounty has a 100% working interest in an aggregate of 3.75 sections of land, and a 50% working interest in one section, with P&NG rights to the Charlie Lake and Halfway formations. These lands are highly prospective for multiple pay sequences in the Charlie Lake and Halfway formations.

At Wapiti, Bounty has a 100% working interest in five sections of land with P&NG rights to the Charlie Lake and Halfway formations. These lands are highly prospective for multiple pay sequences in the Charlie Lake and Halfway formations.

At Wembley, Bounty has a 100% working interest in 1.25 sections of land with P&NG rights to the Charlie Lake and other formations. These lands are highly prospective for the multiple pay sequences in the Charlie Lake Formation.

Further geological details of the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

LMR Summary

Bounty does not own an interest in any wells or facilities.

Seismic Overview

The Company does not have ownership in any seismic data relating to the Properties.

Reserves Overview

Bounty does not have a third-party reserve report.

Bounty does not own an interest in any wells or facilities.

Seismic Overview

The Company does not have ownership in any seismic data relating to the Properties.

Reserves Overview

Bounty does not have a third-party reserve report.

ELMWORTH

Township 69-71, Range 5 W6

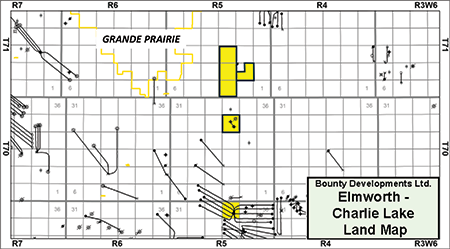

At Elmworth, Bounty has a 100% working interest in 5.75 sections of land: three sections with P&NG rights from surface to basement, two sections with rights from surface to the base of the Charlie Lake Formation and three-quarters of a section with rights from surface to the base of the Halfway Formation. The Company believes these sections are highly prospective for multiple pay sequences in the Montney and Charlie Lake formations.

At Elmworth, Bounty has a 100% working interest in 5.75 sections of land: three sections with P&NG rights from surface to basement, two sections with rights from surface to the base of the Charlie Lake Formation and three-quarters of a section with rights from surface to the base of the Halfway Formation. The Company believes these sections are highly prospective for multiple pay sequences in the Montney and Charlie Lake formations.

The three sections of Montney rights and the 5.75 sections of Charlie Lake and other rights comprise two separate sale packages.

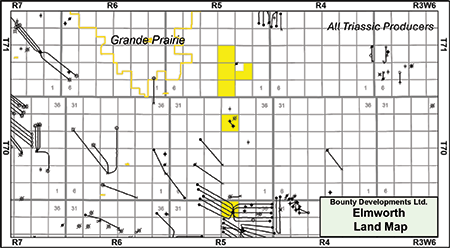

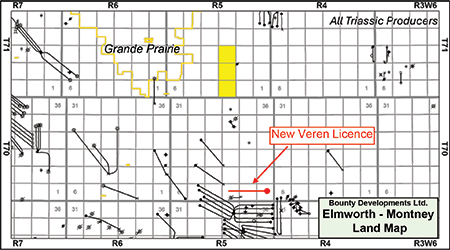

Elmworth Montney

Bounty has a 100% working interest in three contiguous sections of Montney rights in the Elmworth area. These lands are situated in an area with prolific land activity and offsetting development in the West Gold Creek Montney by Veren Inc.

Elmworth Montney

Bounty has a 100% working interest in three contiguous sections of Montney rights in the Elmworth area. These lands are situated in an area with prolific land activity and offsetting development in the West Gold Creek Montney by Veren Inc.

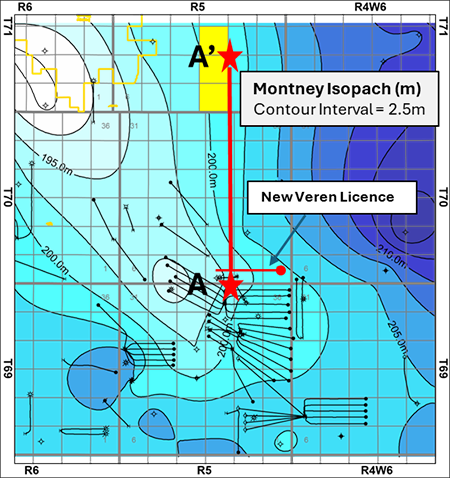

The following map shows all offsetting Elmworth Montney horizontal wells.

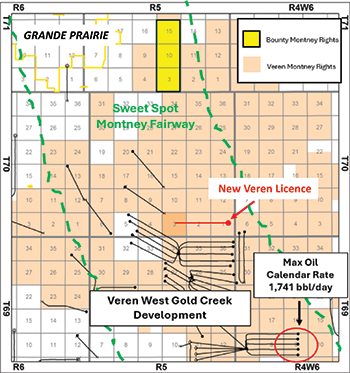

The success of recent Gold Creek wells is pushing non-stacked development NW along the Montney fairway. This fairway falls in the high sand content portion of turbidite deposits closer to the NE shoreline with rock and pressures that are favorable for two bench frac growth to upper reserves without significant frac barriers or wet upper sands.

Veren’s five-well pad along this fairway (circled above) demonstrates how wells using this new fracing technique allows for tight horizontal spacing.

The middle and upper Montney have a sweet spot that enables the exploitation of reserves in both benches with one long vertical frac. This sweet spot fairway has Montney rock that is within the volatile oil window. The hydrocarbon bearing upper sand is normally pressured, contains large middle and upper oil reserves with permeability. This area is high in silica and closer to the Montney NE shore.

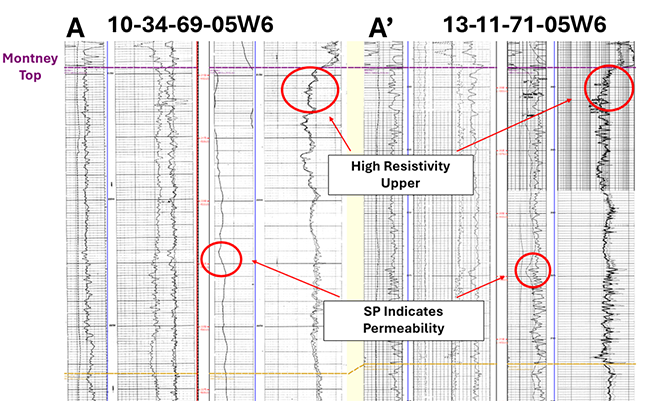

The following map is an isopach of the Montney Formation at Elmworth. Logs from control wells near Bounty’s lands demonstrate the high silica content, and volatile oil reserves amenable to economic development. With high permeability turbidite deposits, and high upper Montney resistivity, the wells are very similar to offsetting development.

Veren’s five-well pad along this fairway (circled above) demonstrates how wells using this new fracing technique allows for tight horizontal spacing.

The middle and upper Montney have a sweet spot that enables the exploitation of reserves in both benches with one long vertical frac. This sweet spot fairway has Montney rock that is within the volatile oil window. The hydrocarbon bearing upper sand is normally pressured, contains large middle and upper oil reserves with permeability. This area is high in silica and closer to the Montney NE shore.

The following map is an isopach of the Montney Formation at Elmworth. Logs from control wells near Bounty’s lands demonstrate the high silica content, and volatile oil reserves amenable to economic development. With high permeability turbidite deposits, and high upper Montney resistivity, the wells are very similar to offsetting development.

The following well logs on Bounty’s lands show similar log response to wells in the heart of production to an analogue to the south. A key well 13-11-71-05W6 shows the Montney with strong permeability responses in the middle Montney with high resistivity porosity in the upper and a high silica content between the zones.

Elmworth Charlie Lake

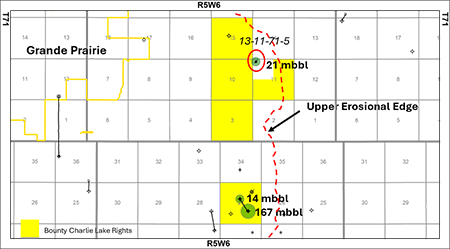

At Elmworth, Bounty has a 100% working interest in 5.75 sections of Charlie Lake rights. Offsetting vertical production indicates the presence of light oil reserves in several formations on Bounty’s lands.

At Elmworth, Bounty has a 100% working interest in 5.75 sections of Charlie Lake rights. Offsetting vertical production indicates the presence of light oil reserves in several formations on Bounty’s lands.

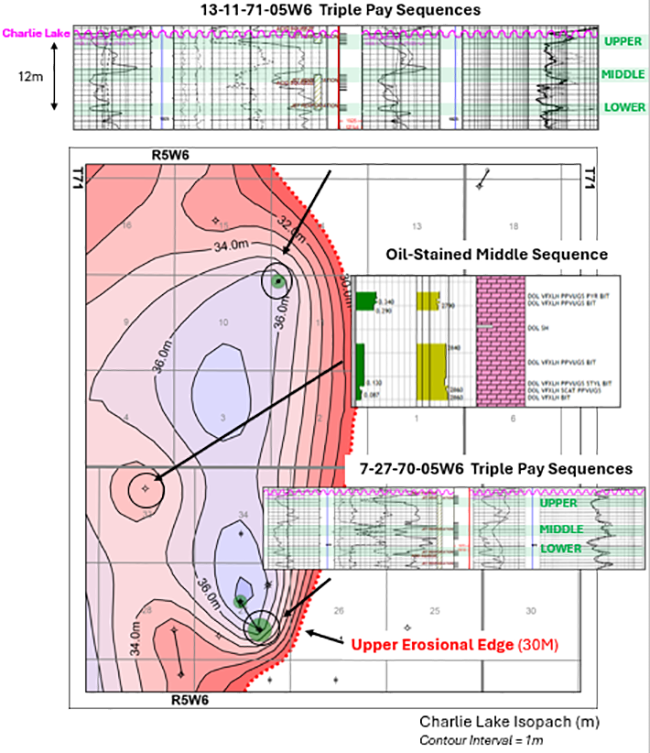

Bounty’s lands are situated in a thick Charlie Lake layer having three dolomite and sandstone reservoirs with proven reserves. Production from both upper and lower zones from vertical perforations indicates high permeability zones which are amenable to improved recoveries through horizontal drilling.

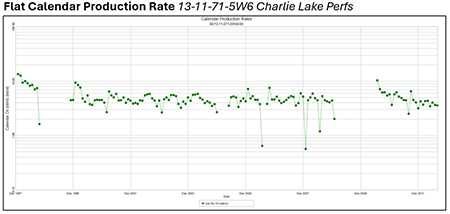

The flat production profile demonstrates a larger, undrained pool in the upper and lower zones perforated in the 13-11-071-05W6 well. These sequences are stratigraphically equivalent to the pay sequences that produced 166,000 barrels of light oil from the 07-27-070-05W6 well.

The thick Charlie Lake reservoir on Bounty’s lands contains three productive members with less than 15 metres of separation. Core from wells to the west shows oil saturation continues north-south. Vertical production in the area follows the erosional edge from the south. This demonstrates large amounts of reserves in these target sequences, which have produced over 166,000 barrels of light oil from three perforated zones in the southern pool from the well 07-27-070-05W6.

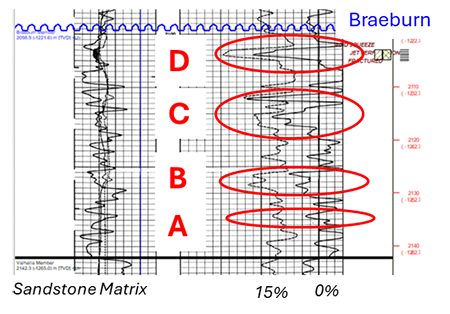

Braeburn Member

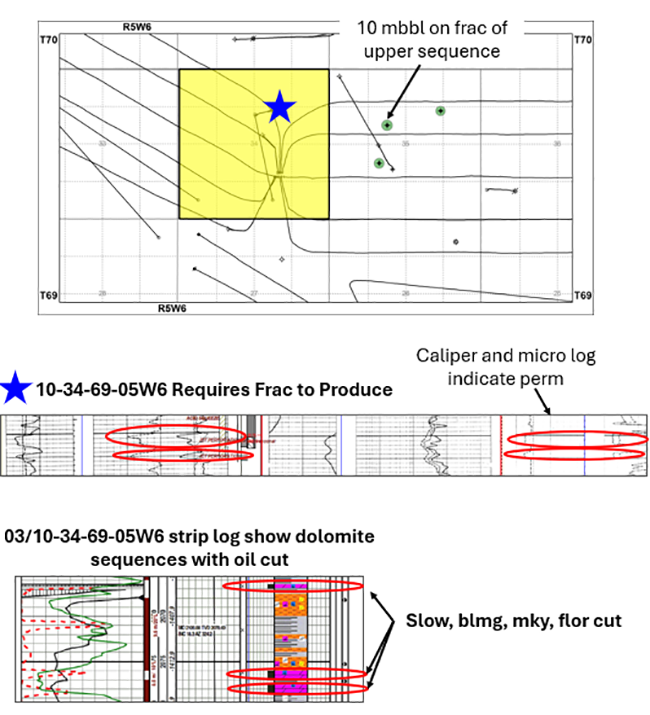

At Elmworth, Bounty’s lands offer un-exploited Charlie Lake indicated by the vertical logs of new Montney horizontal wells drilled nearby. These two pay sequences are further supported by production to the east and drilling samples of porosity and dolomites, offering an excellent horizontal opportunity.

At Elmworth, Bounty’s lands offer un-exploited Charlie Lake indicated by the vertical logs of new Montney horizontal wells drilled nearby. These two pay sequences are further supported by production to the east and drilling samples of porosity and dolomites, offering an excellent horizontal opportunity.

VALHALLA

BOUNTY HAS SOLD A PORTION OF ITS INTERESTS IN THE VALHALLA AREA OF ALBERTA.

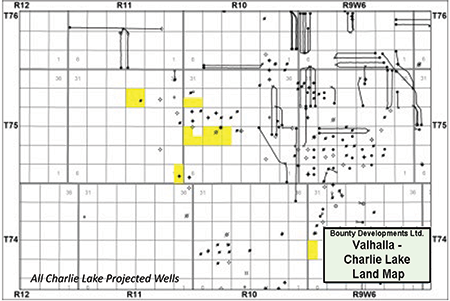

Township 74-75, Range 9-11 W6

At Valhalla, Bounty has a 100% working interest in an aggregate of 3.75 sections of land, and a 50% working interest in one section, with P&NG rights to the Charlie Lake and Halfway formations. The Company believes these lands are highly prospective for multiple pay sequences in the Charlie Lake and Halfway formations.

Township 74-75, Range 9-11 W6

At Valhalla, Bounty has a 100% working interest in an aggregate of 3.75 sections of land, and a 50% working interest in one section, with P&NG rights to the Charlie Lake and Halfway formations. The Company believes these lands are highly prospective for multiple pay sequences in the Charlie Lake and Halfway formations.

Valhalla Charlie Lake

Bounty’s lands contain light oil reserves in six distinct stratigraphic vugular dolomite beds, which can be exploited both vertically and horizontally. Log analysis and seismic analysis indicate large areal extent with high porosity in multiple Charlie Lake zones.

At Valhalla, the Valhalla, Boundary, and multiple Braeburn members have all produced light oil from proximal wells. These zones allow for more than a dozen drilling locations on Bounty’s lands.

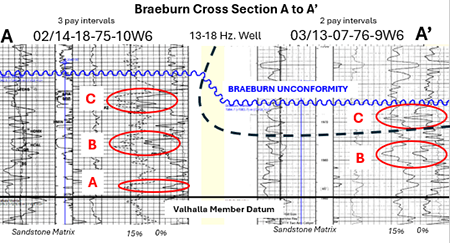

Braeburn Member

In the Braeburn Member, Bounty’s lands have greater net pay and, in some cases, double the pay sequences than a successful two-mile Braeburn horizontal offset. The vertical well 08-25-75-11W6 produced 46,000 barrels of oil. The upper pay sequence Braeburn D logs demonstrate the Braeburn member with four oil bearing dolomite layers that are present on Bounty’s Lands.

Bounty’s lands contain light oil reserves in six distinct stratigraphic vugular dolomite beds, which can be exploited both vertically and horizontally. Log analysis and seismic analysis indicate large areal extent with high porosity in multiple Charlie Lake zones.

At Valhalla, the Valhalla, Boundary, and multiple Braeburn members have all produced light oil from proximal wells. These zones allow for more than a dozen drilling locations on Bounty’s lands.

Braeburn Member

In the Braeburn Member, Bounty’s lands have greater net pay and, in some cases, double the pay sequences than a successful two-mile Braeburn horizontal offset. The vertical well 08-25-75-11W6 produced 46,000 barrels of oil. The upper pay sequence Braeburn D logs demonstrate the Braeburn member with four oil bearing dolomite layers that are present on Bounty’s Lands.

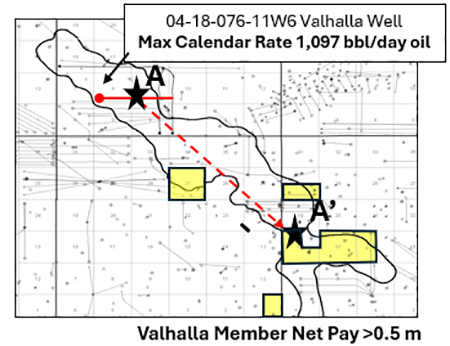

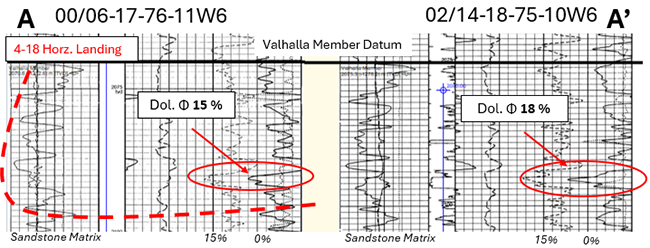

Valhalla Member

On Bounty’s lands, the Valhalla Member has a large areal extent, oil staining/cuts, high porosity and permeability indicators. Bounty believes its lands have reserves with comparable or greater thicknesses and porosity than top tier production.

The successful Longshore Resources Ltd. well 04-18-076-11W6, targeting the Valhalla Member pay sequence, demonstrates how prolific this fairway and its members can be. Continuation of this Valhalla potential to the SE towards Bounty’s lands is supported by oil shows, porosity and strip logs which demonstrate reserves analogous to high-rate producers.

On Bounty’s lands, the Valhalla Member has a large areal extent, oil staining/cuts, high porosity and permeability indicators. Bounty believes its lands have reserves with comparable or greater thicknesses and porosity than top tier production.

The successful Longshore Resources Ltd. well 04-18-076-11W6, targeting the Valhalla Member pay sequence, demonstrates how prolific this fairway and its members can be. Continuation of this Valhalla potential to the SE towards Bounty’s lands is supported by oil shows, porosity and strip logs which demonstrate reserves analogous to high-rate producers.

Boundary Lake Member

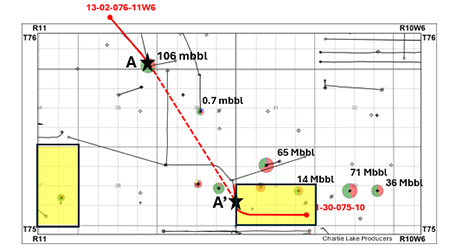

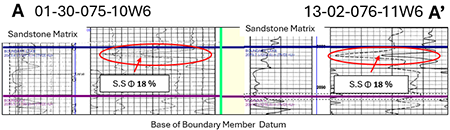

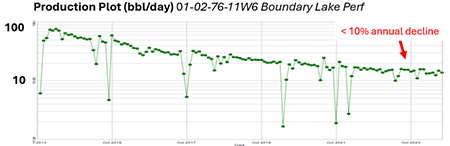

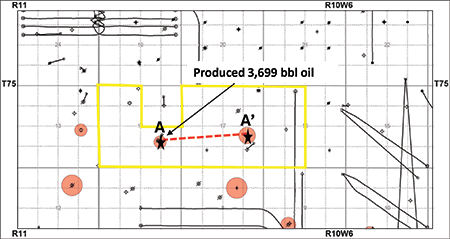

At Valhalla, Bounty’s lands contain light oil reserves in the high porosity Boundary Lake Member. The vertical logs of the 01-30-075-10W6 well show a reservoir very similar to the logs of the horizontal well offsetting the vertical producer 01-02-076-11W6 which has produced 106,000 barrels of oil to-date and is still producing at a rate of approximately 15 bbl/d of oil.

At Valhalla, Bounty’s lands contain light oil reserves in the high porosity Boundary Lake Member. The vertical logs of the 01-30-075-10W6 well show a reservoir very similar to the logs of the horizontal well offsetting the vertical producer 01-02-076-11W6 which has produced 106,000 barrels of oil to-date and is still producing at a rate of approximately 15 bbl/d of oil.

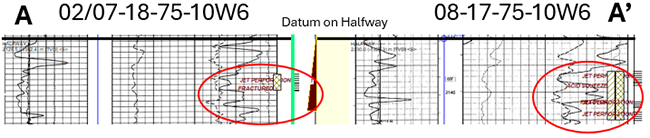

Halfway Member

At Valhalla, Bounty believes its lands contain undrained high liquids Halfway natural gas reserves. The vertical well 02/07-18-75-10W6 produced from the Halfway and was still producing at a rate of approximately 210 Mcf/d of natural gas prior to it being shut-in. This well has produced the most liquids from the Halfway in the area. Production from the 08-17-75-10W6 well also has a similar liquid content. The Company believes this is a potential horizontal target.

At Valhalla, Bounty believes its lands contain undrained high liquids Halfway natural gas reserves. The vertical well 02/07-18-75-10W6 produced from the Halfway and was still producing at a rate of approximately 210 Mcf/d of natural gas prior to it being shut-in. This well has produced the most liquids from the Halfway in the area. Production from the 08-17-75-10W6 well also has a similar liquid content. The Company believes this is a potential horizontal target.

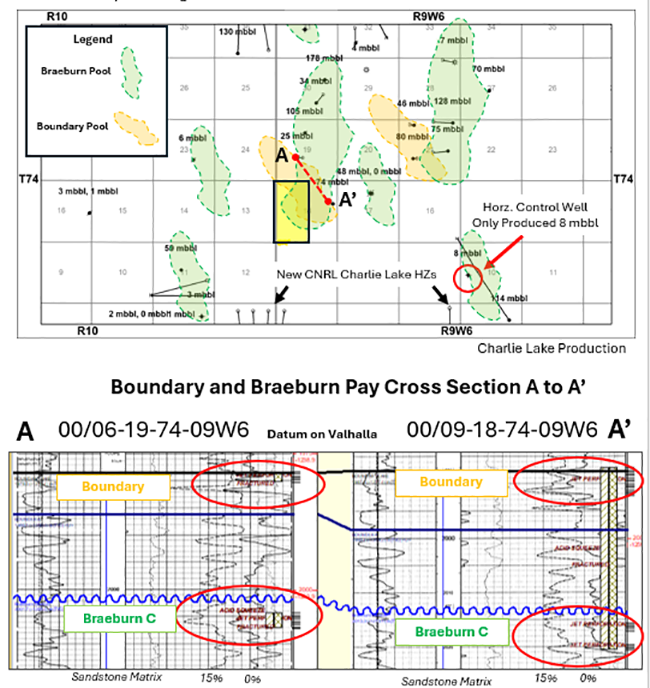

Braeburn Boundary Lake Member

At Valhalla, proximal production and logs indicate Bounty rights in the west half of Section 18-074-09W6 contain two oil bearing dolomite pay sequences. Production in analogous vertical pools to the north demonstrate highly heterogenous permeability and porosity that vertically can produce up to 380,000 barrels of oil. Recent horizontal development allows for exploitation of multiple high-quality pockets, with a control well producing as little as 8,000 barrels of oil.

At Valhalla, proximal production and logs indicate Bounty rights in the west half of Section 18-074-09W6 contain two oil bearing dolomite pay sequences. Production in analogous vertical pools to the north demonstrate highly heterogenous permeability and porosity that vertically can produce up to 380,000 barrels of oil. Recent horizontal development allows for exploitation of multiple high-quality pockets, with a control well producing as little as 8,000 barrels of oil.

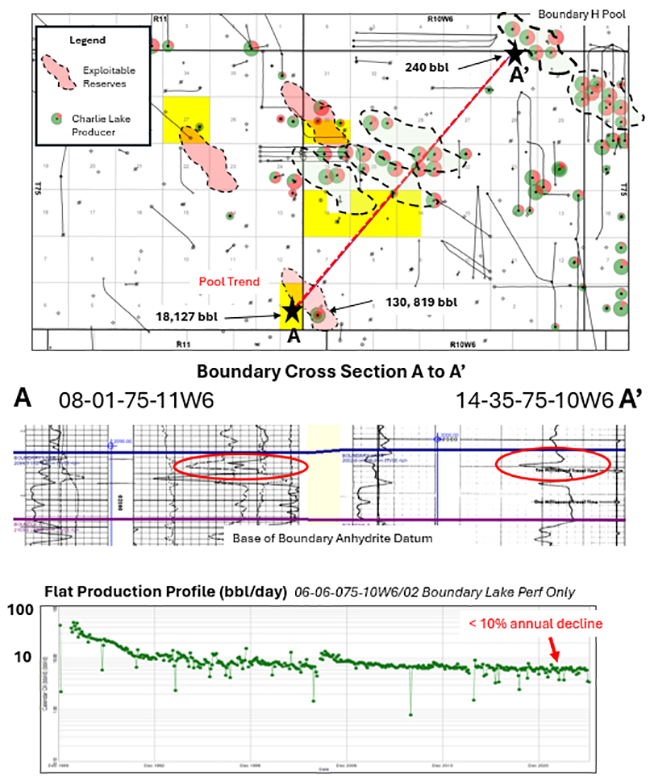

Boundary Lake Member

At Valhalla, the vertical logs of the 08-01-75-11W6 well show a reservoir analogous to a well SW of the Boundary H pool in Township 76 Range 10 W6. The vertical well 06-06-075-10W6/02 (no frac) has produced 130,000 barrels of oil to-date with a low decline indicating a larger undrained reservoir.

At Valhalla, the vertical logs of the 08-01-75-11W6 well show a reservoir analogous to a well SW of the Boundary H pool in Township 76 Range 10 W6. The vertical well 06-06-075-10W6/02 (no frac) has produced 130,000 barrels of oil to-date with a low decline indicating a larger undrained reservoir.

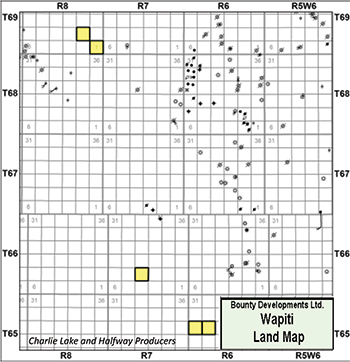

WAPITI

BOUNTY HAS SOLD A PORTION OF ITS INTERESTS IN THE WAPITI AREA OF ALBERTA.

Township 65-69, Range 8-9 W6

At Wapiti, Bounty has a 100% working interest in five sections of land with P&NG rights to the Charlie Lake and Halfway formations. The Company believes these lands are highly prospective for multiple pay sequences in the Charlie Lake and Halfway formations.

Township 65-69, Range 8-9 W6

At Wapiti, Bounty has a 100% working interest in five sections of land with P&NG rights to the Charlie Lake and Halfway formations. The Company believes these lands are highly prospective for multiple pay sequences in the Charlie Lake and Halfway formations.

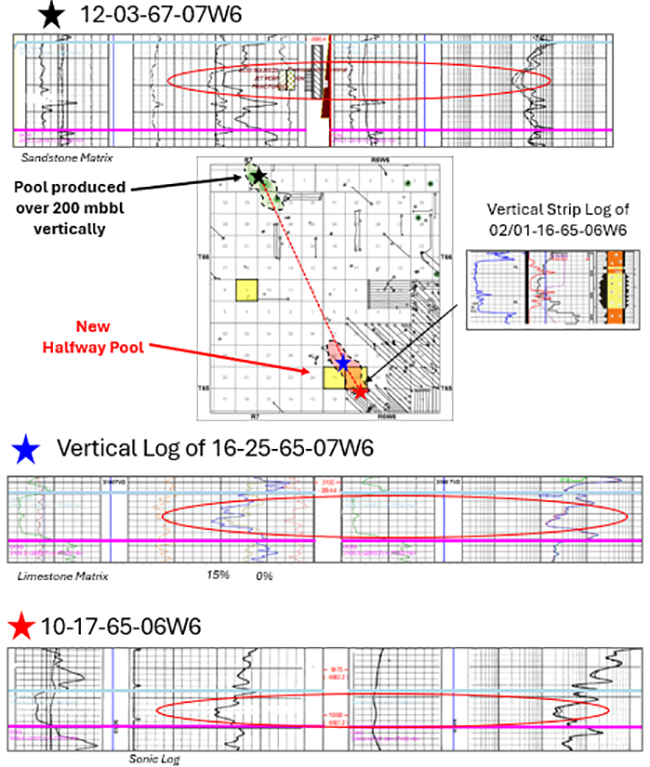

Halfway Member

At Wapiti, Bounty has identified un-exploited Halfway and Charlie Lake oil reserves indicated by the vertical logs of new Montney horizontal wells drilled near its lands. Halfway logs demonstrate pay trending through the Company’s lands with comparable or better resistivity and porosity responses than an analog producer of 155,000 barrels of oil (12-03-067-07W6).

At Wapiti, Bounty has identified un-exploited Halfway and Charlie Lake oil reserves indicated by the vertical logs of new Montney horizontal wells drilled near its lands. Halfway logs demonstrate pay trending through the Company’s lands with comparable or better resistivity and porosity responses than an analog producer of 155,000 barrels of oil (12-03-067-07W6).

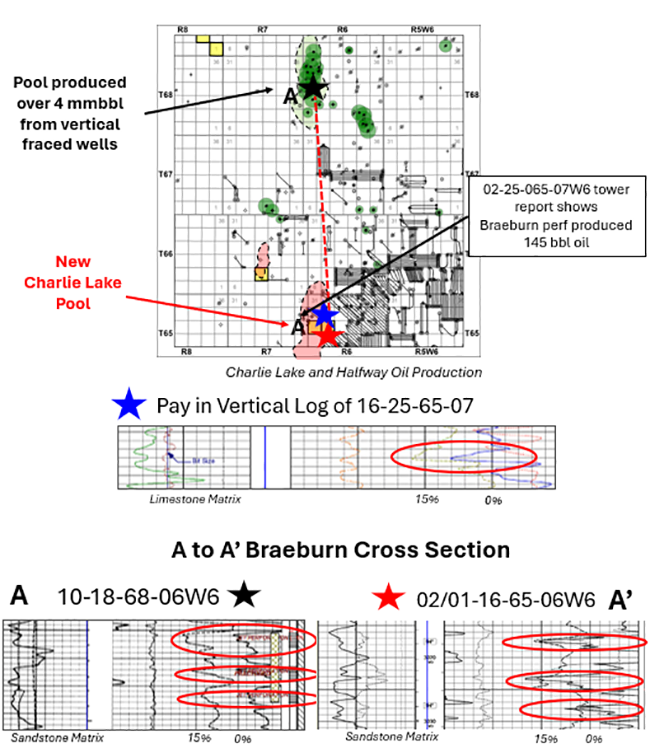

Braeburn Member

At Wapiti, Bounty has identified un-exploited Charlie Lake oil reserves. Vertical logs from new offsetting Montney horizontal wells indicate the presence of oil in the Charlie Lake Formation on Bounty’s lands. These Braeburn logs further demonstrate the potential for an untapped oil pool comparable to vertical wells that yield up to 900,000 barrels in a pool to the north.

At Wapiti, Bounty has identified un-exploited Charlie Lake oil reserves. Vertical logs from new offsetting Montney horizontal wells indicate the presence of oil in the Charlie Lake Formation on Bounty’s lands. These Braeburn logs further demonstrate the potential for an untapped oil pool comparable to vertical wells that yield up to 900,000 barrels in a pool to the north.

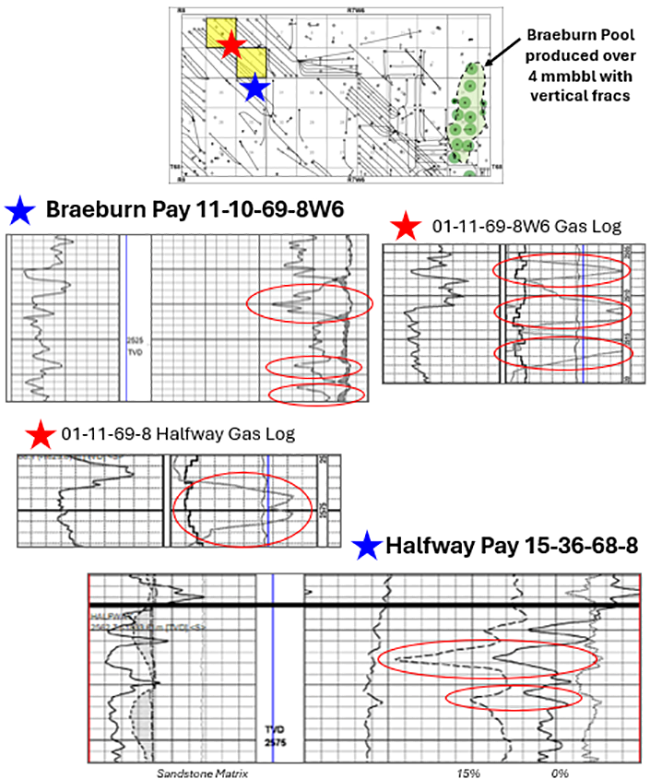

Braeburn Member

At Wapiti, Bounty’s lands offer un-exploited Charlie Lake and Halfway oil reserves indicated by the vertical logs of new Montney horizontal wells drilled nearby. These reserves are further supported by gas responses and drilling samples of porosity and dolomites.

At Wapiti, Bounty’s lands offer un-exploited Charlie Lake and Halfway oil reserves indicated by the vertical logs of new Montney horizontal wells drilled nearby. These reserves are further supported by gas responses and drilling samples of porosity and dolomites.

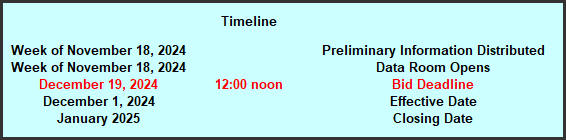

PROCESS & TIMELINE

Sayer Energy Advisors is accepting proposals relating to this process until 12:00 pm on Thursday December 19, 2024.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting proposals from interested parties until

noon on Thursday December 19, 2024.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, mail (brye@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: mineral property reports, geological presentations and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Ben Rye, Tom Pavic or Sydney Birkett at 403.266.6133.