Offering Details

Back

Under Review / Acquisition Oil Corp.

Acquisition Oil Corp.

Property Divestiture

Property DivestitureBid Deadline: January 16, 2025

12:00 PM

Download Full PDF - Printable

OVERVIEW

Acquisition Oil Corp. (“AOC” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of its oil and natural gas interests located in the Prestville area of Alberta (the “Property”).

At Prestville, AOC holds primarily a 100% working interest in 23 sections of land. The Property comprises long-life oil production from the Slave Point Formation. The Slave Point reservoir contains an estimated 18.5 million barrels of original oil in place. The Slave Point D Pool has been under waterflood since 2021. The Company has infrastructure and facility capacity at Prestville capable of handling full development of the Property. Production from the Property is currently limited by wellhead injection capacity.

Average daily production net to AOC from Prestville for the six months ended June 30, 2024 was approximately 294 boe/d, consisting of 259 bbl/d of oil and natural gas liquids and 211 Mcf/d of natural gas.

Operating income net to AOC from Prestville for the six months ended June 30, 2024 averaged approximately $282,000 per month, or $3.4 million on an annualized basis.

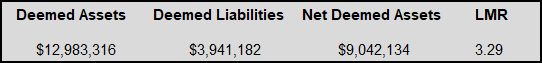

As of October 5, 2024, the Property had a deemed net asset value of $9.0 million (deemed assets of $13.0 million and deemed liabilities of $3.9 million), with an LMR ratio of 3.29.

At Prestville, AOC holds primarily a 100% working interest in 23 sections of land. The Property comprises long-life oil production from the Slave Point Formation. The Slave Point reservoir contains an estimated 18.5 million barrels of original oil in place. The Slave Point D Pool has been under waterflood since 2021. The Company has infrastructure and facility capacity at Prestville capable of handling full development of the Property. Production from the Property is currently limited by wellhead injection capacity.

Average daily production net to AOC from Prestville for the six months ended June 30, 2024 was approximately 294 boe/d, consisting of 259 bbl/d of oil and natural gas liquids and 211 Mcf/d of natural gas.

Operating income net to AOC from Prestville for the six months ended June 30, 2024 averaged approximately $282,000 per month, or $3.4 million on an annualized basis.

As of October 5, 2024, the Property had a deemed net asset value of $9.0 million (deemed assets of $13.0 million and deemed liabilities of $3.9 million), with an LMR ratio of 3.29.

PRESTVILLE

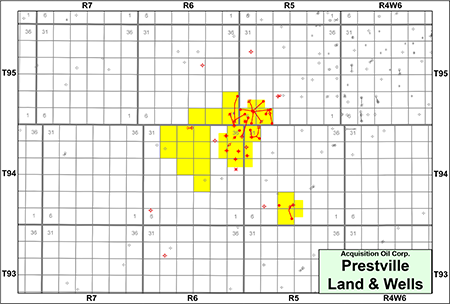

Township 93-95, Range 5-7 W6

At Prestville, AOC holds primarily a 100% working interest in 23 sections of land. The Property comprises long-life oil production from the Devonian Slave Point Formation of the Beaverhill Lake Group. The Slave Point reservoir contains an estimated 18.5 million barrels of original oil in place. The Slave Point D Pool has been under waterflood since 2021.

The Property currently has two water injection wells, Acquisition Oil Cran 100/03-05-095-05W6/00 and Acquisition Oil 16-6 Hz Cran 100/07-07-095-05W6/00. The Company has infrastructure and facility capacity at Prestville capable of handling full development of the Property. Production from the Property is currently limited by injection capacity of these two wells.

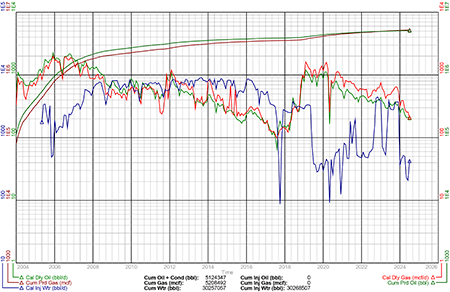

Average daily production net to AOC from Prestville for the six months ended June 30, 2024 was approximately 294 boe/d, consisting of 259 bbl/d of oil and natural gas liquids and 211 Mcf/d of natural gas.

Operating income net to AOC from Prestville for the six months ended June 30, 2024 averaged approximately $282,000 per month, or $3.4 million on an annualized basis.

At Prestville, AOC holds primarily a 100% working interest in 23 sections of land. The Property comprises long-life oil production from the Devonian Slave Point Formation of the Beaverhill Lake Group. The Slave Point reservoir contains an estimated 18.5 million barrels of original oil in place. The Slave Point D Pool has been under waterflood since 2021.

The Property currently has two water injection wells, Acquisition Oil Cran 100/03-05-095-05W6/00 and Acquisition Oil 16-6 Hz Cran 100/07-07-095-05W6/00. The Company has infrastructure and facility capacity at Prestville capable of handling full development of the Property. Production from the Property is currently limited by injection capacity of these two wells.

Average daily production net to AOC from Prestville for the six months ended June 30, 2024 was approximately 294 boe/d, consisting of 259 bbl/d of oil and natural gas liquids and 211 Mcf/d of natural gas.

Operating income net to AOC from Prestville for the six months ended June 30, 2024 averaged approximately $282,000 per month, or $3.4 million on an annualized basis.

The Slave Point D Pool has been under waterflood since 2021. Peak production, upon full re-pressurization, is estimated at 400 bbl/d to 425 bbl/d of oil based on current injection rates.

Prestville Upside

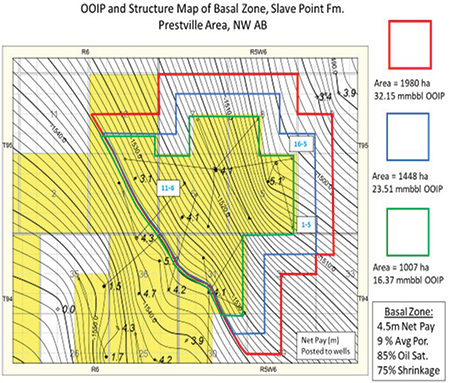

At Prestville, the Company has initiated a waterflood in the Slave Point D Pool. The Property was originally established with several vertical producing wells on the Company’s lands targeting the Slave Point Reef. The play has since transitioned to horizontal development of the Basal Slave Point Formation. Detailed mapping techniques have allowed AOC to determine ideal horizontal well placement, areas of increased porosity and permeability, ideal frac placements and waterflood strategies. The Basal reservoir is mapped to both the east and west of the Prestville pool using vertical well control.

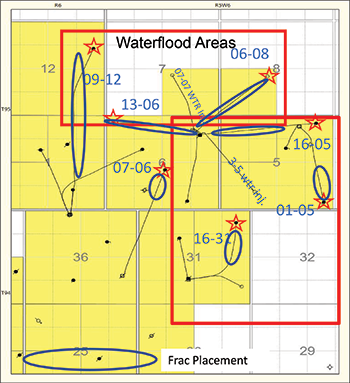

The following map shows the breakdown of original oil in place within the Slave Point Basal zone within certain areas northeast of the oil/water contact which focused development of the Property to the northeast portion. The Company has water injection wells at Acquisition Oil Cran 100/03-05-095-05W6/00 and Acquisition Oil 16-6 Hz Cran 100/07-07-095-05W6/00.

In addition, the Company’s lands to the southeast of the oil water contact are prospective for natural gas development in the Bluesky Formation as seen in the well Acquisition Oil Cranberry 00/16-33-094-06W6/00.

Production from the Property is currently limited by injection capacity. The Company has identified potential to convert the well Acquisition Oil Cran 00/10-05-095-05W6/00 to an injection well in order to increase the production.

Prestville Upside

At Prestville, the Company has initiated a waterflood in the Slave Point D Pool. The Property was originally established with several vertical producing wells on the Company’s lands targeting the Slave Point Reef. The play has since transitioned to horizontal development of the Basal Slave Point Formation. Detailed mapping techniques have allowed AOC to determine ideal horizontal well placement, areas of increased porosity and permeability, ideal frac placements and waterflood strategies. The Basal reservoir is mapped to both the east and west of the Prestville pool using vertical well control.

The following map shows the breakdown of original oil in place within the Slave Point Basal zone within certain areas northeast of the oil/water contact which focused development of the Property to the northeast portion. The Company has water injection wells at Acquisition Oil Cran 100/03-05-095-05W6/00 and Acquisition Oil 16-6 Hz Cran 100/07-07-095-05W6/00.

In addition, the Company’s lands to the southeast of the oil water contact are prospective for natural gas development in the Bluesky Formation as seen in the well Acquisition Oil Cranberry 00/16-33-094-06W6/00.

Production from the Property is currently limited by injection capacity. The Company has identified potential to convert the well Acquisition Oil Cran 00/10-05-095-05W6/00 to an injection well in order to increase the production.

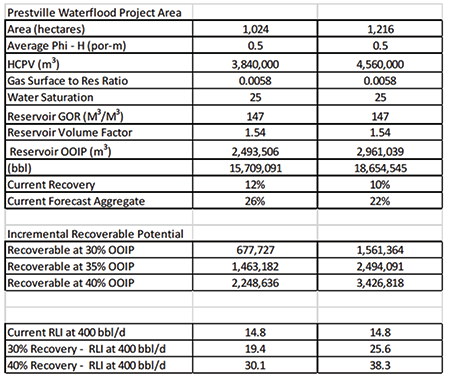

AOC’s Prestville waterflood project area is estimated to have original oil in place of 18.5 million barrels with production ranging from current levels with potential to increase up to 600 bbl/d of oil through water flood expansion and acid fracture stimulations.

The Company believes the frac performance strategy is to manage the pace of stimulations in the pool to ensure that the waterflood areas are not materially de-pressured. It is critical for the stimulation pace to match water injection rates.

The Company believes the frac performance strategy is to manage the pace of stimulations in the pool to ensure that the waterflood areas are not materially de-pressured. It is critical for the stimulation pace to match water injection rates.

AOC believes it is ideal to prioritize stimulating the Acquisition Oil 16-6 Hz Cran 00/06-08-095-05W6/00 as this well drains the updip portion of the pool. Stimulating all of the wells will have better economic results as the localized areas re-pressurize so optimal timing of fracture stimulations on the 00/06-08-095-05W6/00, Acquisition Oil Hz Cran 00/09-12-095-06W6/02, Acquisition Oil 16-6Hz Cran 00/16-05-095-05W6/02 and Acquisition Oil 16-6Hz Cran 00/13-06-095-05W6/00 wells will be dependent on this process.

Stimulation at Acquisition Oil Hz Cran 00/07-06-095-05W6/02 should occur after the water shut off. This well has down dip pressure support and is independent of the other flood areas so production performance will dictate the stimulation timing.

The Basal Slave Point play at Prestville continues further to the northeast of the Property and falls within the Caribou Protection Plan area.

Analog data implies that production within each waterflood area will start trending upwards when certain voidage thresholds are achieved. The upward trend in production in Phase 1 is occurring at Prestville.

The waterflood project area conservatively represents 15.7 million barrels of OOIP with a reserve life index exceeding 15 years.

Stimulation at Acquisition Oil Hz Cran 00/07-06-095-05W6/02 should occur after the water shut off. This well has down dip pressure support and is independent of the other flood areas so production performance will dictate the stimulation timing.

The Basal Slave Point play at Prestville continues further to the northeast of the Property and falls within the Caribou Protection Plan area.

Analog data implies that production within each waterflood area will start trending upwards when certain voidage thresholds are achieved. The upward trend in production in Phase 1 is occurring at Prestville.

The waterflood project area conservatively represents 15.7 million barrels of OOIP with a reserve life index exceeding 15 years.

Basal reservoir is mapped to both the east and west of the Prestville pool using vertical well control.

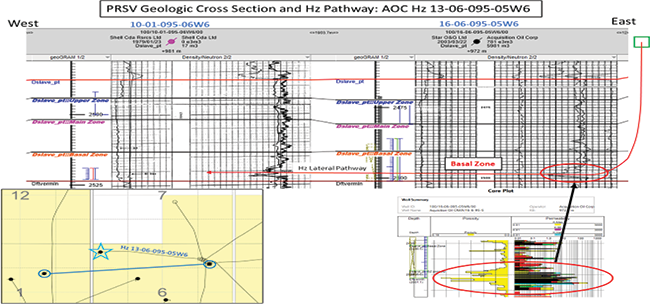

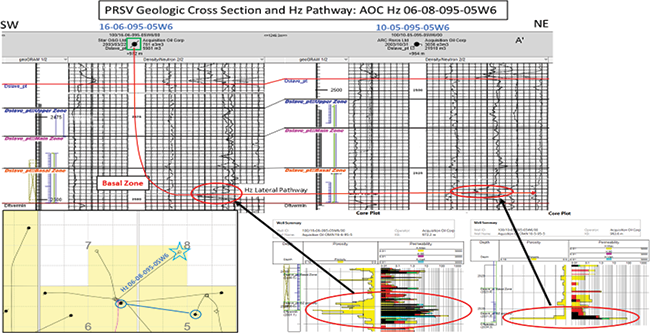

The following logs show the horizontal pathway and placement of wells in the Basal Slave Point Formation at Prestville.

The following logs show the horizontal pathway and placement of wells in the Basal Slave Point Formation at Prestville.

Internal seismic interpretation geologically aligns with the vertical control points concurrent with strip log data from the drilling operations.

The pool boundaries, oil in place, and response expectations of both the waterflood and stimulations become low risk and definable based on the amount of data that has been extracted through the seismic, logging and drilling operations.

Prestville Reserves

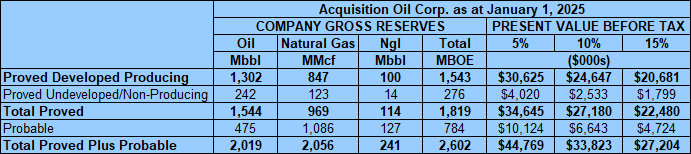

AOC prepared an internal reserves evaluation of the Property (the “Reserve Report”) as part of the Company’s year end reporting. The Reserve Report is effective January 1, 2025 using flat Edmonton oil par pricing of $86/bbl and natural gas pricing of $2.25/MMbtu inflated to $3.50/MMbtu by 2031.

AOC estimates that, as at January 1, 2025, the Property contains remaining proved plus probable reserves of 2.3 million barrels of oil and natural gas liquids and 2.1 Bcf of natural gas (2.6 million boe), with an estimated net present value of $33.8 million using forecast pricing at a 10% discount.

Prestville Reserves

AOC prepared an internal reserves evaluation of the Property (the “Reserve Report”) as part of the Company’s year end reporting. The Reserve Report is effective January 1, 2025 using flat Edmonton oil par pricing of $86/bbl and natural gas pricing of $2.25/MMbtu inflated to $3.50/MMbtu by 2031.

AOC estimates that, as at January 1, 2025, the Property contains remaining proved plus probable reserves of 2.3 million barrels of oil and natural gas liquids and 2.1 Bcf of natural gas (2.6 million boe), with an estimated net present value of $33.8 million using forecast pricing at a 10% discount.

Prestville Facility

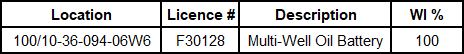

At Prestville, AOC owns an interest in the following facility:

The Company has a multi-well battery at 100/10-36-094-06W6 which includes a main treater, test treater, free water knock out, sales compression and both natural gas dehydration and a JT plant. The 10-36 facility has capacity for 10,000 bbl/d of emulsion handling and 5 MMcf/d of natural gas.

AOC also has water injection wells at Acquisition Oil Cran 100/03-05-095-05W6/00 and Acquisition Oil 16-6 Hz Cran 100/07-07-095-05W6/00.

Further details on the Company’s facility will be made available to parties that execute a confidentiality agreement.

Prestville Marketing

AOC has a monthly crude oil purchase contract in place with Plains Midstream Canada ULC. AOC’s oil production from Prestville is currently trucked from the multi-well battery at 10-36-094-06W6 to the Kemp River Truck Terminal.

Condensate is sold to Canadian Natural Resources Limited at the Nipisi Condensate Terminal from the Chinchaga Gas Plant 01-24-096-05W6.

Natural gas is sold into the NOVA Gas Transmission Ltd. line at 01-24-096-05W6.

The Company has remaining C* royalty credits of approximately $8.7 million as of January 2024.

Seismic Overview

The Company has a seismic licensing agreement for 3D seismic data as well as interests in minor jointly owned proprietary 2D data at Prestville.

Prestville LMR as of October 5, 2024

As of October 5, 2024, the Property had a deemed net asset value of $9.0 million (deemed assets of $13.0 million and deemed liabilities of $3.9 million), with an LMR ratio of 3.29.

As of October 5, 2024, the Property had a deemed net asset value of $9.0 million (deemed assets of $13.0 million and deemed liabilities of $3.9 million), with an LMR ratio of 3.29.

Prestville Well List

Click here to download the complete well list in Excel.

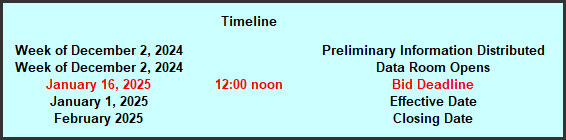

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Property until 12:00 pm on Thursday January 16, 2025.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday January 16, 2025.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Property with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, mail (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, the Reserves Report, LMR information, most recent net operations summary, and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Property please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.