Offering Details

Back

Under Review / Tallahassee Exploration Inc.

Tallahassee Exploration Inc.

Receivership Sale

Receivership SaleBid Deadline: May 1, 2025

12:00 PM

Download Full PDF - Printable

OVERVIEW

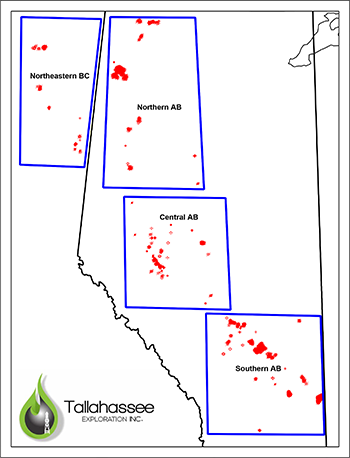

On October 23, 2024, pursuant to the Bankruptcy and Insolvency Act (“BIA”), further to an order application by the Orphan Well Association together with the British Columbia Energy Regulator, PricewaterhouseCoopers Inc. LIT was appointed as Receiver (the “Receiver”) of Tallahassee Exploration Inc. (“Tallahassee” or the “Company”). Sayer Energy Advisors has been engaged to assist the Receiver with the sale of Tallahassee’s oil and natural gas properties (the “Properties”) located in Alberta and British Columbia.The Properties consist of both operated and non-operated interests located throughout Alberta and British Columbia. For this offering, the Properties are separated into the following geographical packages: Southern Alberta, Central Alberta, Northern Alberta and Northeastern BC.

On June 5, 2024 the Alberta Energy Regulator (“AER”) issued a corporate abandonment order to Tallahassee, requiring the Company to decommission its sites and submit and implement an approved reclamation plan. Further to the closure order from the AER, Tallahassee licensed properties have been shut-in since June 2024.

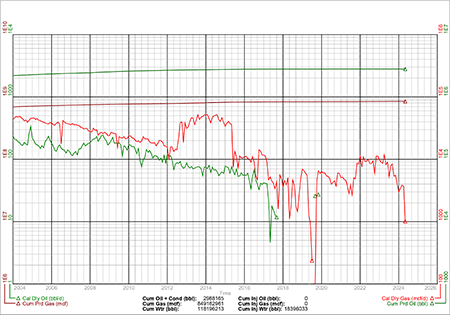

As a result, all production numbers stated herein reflect the production capability of the various wells and/or properties held by Tallahassee prior to being shut-in. Average gross production capability from the Properties is approximately 2,630 boe/d, consisting of 12.1 MMcf/d of natural gas and 611 bbl/d of oil and natural gas liquids.

Prior to the closure order, average gross production from Tallahassee’s interests in the Southern Alberta Package for April 2024 was approximately 300 boe/d, consisting of 1.6 MMcf/d of natural gas and 14 barrels of oil and natural gas liquids per day.

Prior to the closure order, average gross production from Tallahassee’s interests in the Central Alberta Package for April 2024 was approximately 126 boe/d, consisting of 700 Mcf/d of natural gas and 9 barrels of oil and natural gas liquids per day.

The Northern Alberta Package was shut-in in April, 2023. Average gross production from Tallahassee’s interests in the Northern Alberta Package for April 2023 was approximately 1,605 boe/d, consisting of 6.1 MMcf/d of natural gas and 588 barrels of oil and natural gas liquids per day.

Prior to the closure order, average gross production from Tallahassee’s interests in the Northeastern BC Package for April 2024 was approximately 617 boe/d, consisting of 3.7 MMcf/d of natural gas.

Further details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

All offers received at the bid deadline will be reviewed by the Receiver and the most acceptable offer or offers may be accepted by the Receiver, subject to Court approval.

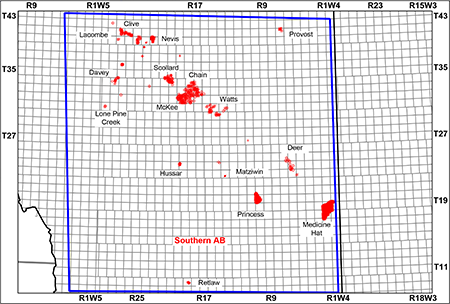

SOUTHERN ALBERTA PACKAGE

Township 10-43, Range 1 W4 – 3 W5In the Southern Alberta Package, Tallahassee has various operated and non-operated working interests in the Chain, Clive, Davey, Deer, Hussar, Lacombe, Lone Pine Creek, Matziwin, McKee, Medicine Hat, Nevis, Princess/Jenner, Provost, Retlaw, Scollard and Watts areas.

Average gross production from Tallahassee’s interests in the Southern Alberta Package for April 2024 was approximately 300 boe/d, consisting of 1.6 MMcf/d of natural gas and 14 barrels of oil and natural gas liquids per day.

Southern Alberta Facilities

Details of all of Tallahassee’s facilities are available in the virtual data room for parties that execute a confidentiality agreement.

Southern Alberta Deemed Liability

As of January 16, 2025, Tallahassee’s deemed liability value for the Southern Alberta Package was $28.0 million.

Southern Alberta Well List

Click here to download the complete well list in Excel.

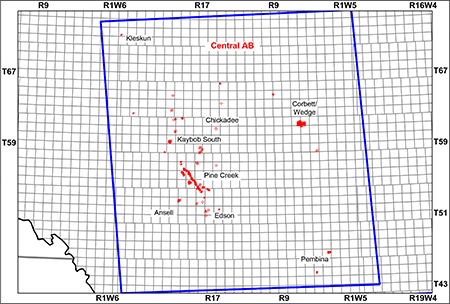

CENTRAL ALBERTA PACKAGE

Township 45-73, Range 4-26 W5In the Central Alberta Package, Tallahassee has various operated and non-operated working interests in the Ansell, Breton (Pembina), Chickadee, Edson, Kleskun, Minnehik-Buck Lake (Pembina), Pine Creek, and Wedge areas.

Average gross production from Tallahassee’s interests in the Central Alberta Package for April 2024 was approximately 126 boe/d, consisting of 700 Mcf/d of natural gas and 9 barrels of oil and natural gas liquids per day.

Central Alberta Facilities

Details of all of Tallahassee’s facilities are available in the virtual data room for parties that execute a confidentiality agreement.

Central Alberta Deemed Liability

As of January 16, 2025, Tallahassee’s deemed liability value for the Central Alberta Package was $3.6 million.

Central Alberta Well List

Click here to download the complete well list in Excel.

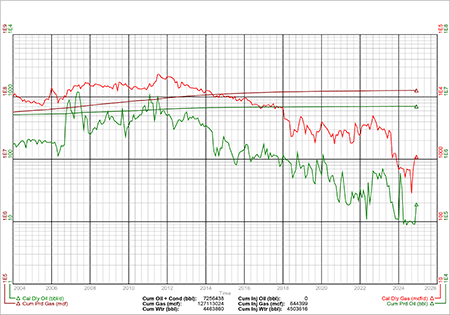

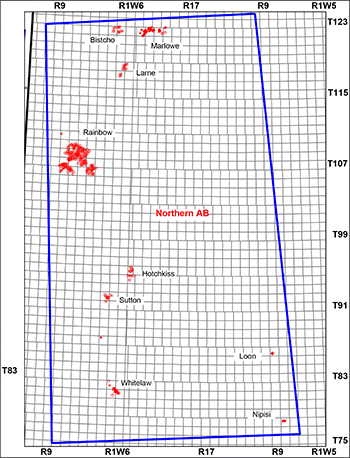

NORTHERN ALBERTA PACKAGE

Township 77-122, Range 8 W5-8 W6In the Northern Alberta Package, Tallahassee has various operated and non-operated working interests in the Bistcho, Hotchkiss, Marlowe, Nipisi, Larne, Loon, Rainbow, Sutton, and Whitelaw areas.

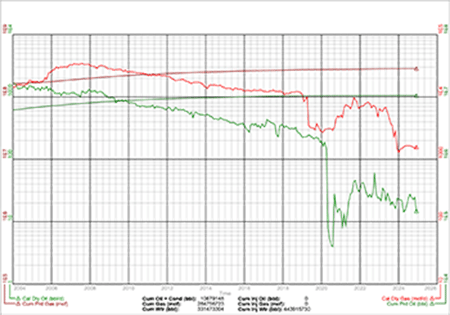

Production from the Northern Alberta Package was shut-in in April, 2023 due to the wildfires in the area.

Average gross production from Tallahassee’s interests in the Northern Alberta Package for April 2023 was approximately 1,605 boe/d, consisting of 6.1 MMcf/d of natural gas and 588 barrels of oil and natural gas liquids per day.

Northern Alberta Facilities

Details of all of Tallahassee’s facilities are available in the virtual data room for parties that execute a confidentiality agreement.

Northern Alberta Deemed Liability

As of January 16, 2025, Tallahassee’s deemed liability value for the Northern Alberta Package was $57.0 million.

Northern Alberta Well List

Click here to download the complete well list in Excel.

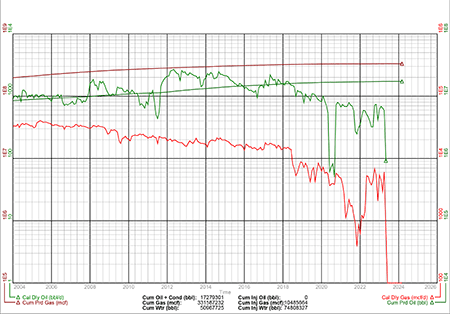

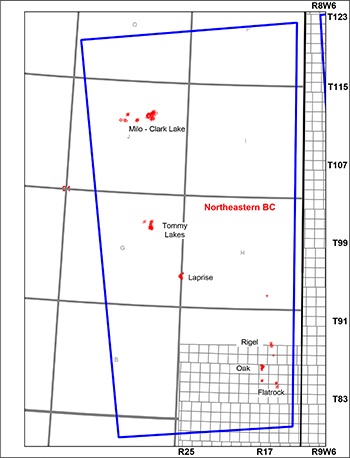

NORTHEASTERN BC PACKAGE

Township 84, Range 16 W6- NTS 94-O-07In the Northeastern BC Package, Tallahassee has various operated and non-operated working interests in the Laprise, Milo-Clark Lake, Oak, Paradise-Regal-Flatrock and Tommy Lakes areas.

Average gross production from Tallahassee’s interests in the Northeastern BC Package for April 2024 was approximately 3.7 MMcf/d of natural gas (617 boe/d).

Northeastern BC Facilities

Details of all of Tallahassee’s facilities are available in the virtual data room for parties that execute a confidentiality agreement.

Northeastern BC Deemed Liability

As of February 12, 2025, Tallahassee’s deemed liability value for the Northeastern BC Package was $9.5 million.

Northeastern BC Well List

Click here to download the complete well list in Excel.

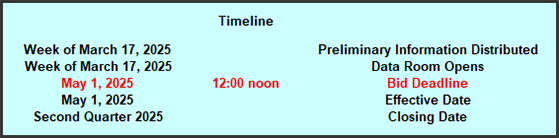

PROCESS & TIMELINE

Sayer Energy Advisors is accepting offers to acquire the Properties until 12:00 pm on Thursday May 1, 2025.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transactions with the parties submitting the most acceptable proposals at the conclusion of the process.

transactions with the parties submitting the most acceptable proposals at the conclusion of the process.

Sayer Energy Advisors is accepting offers from interested parties until

noon on Thursday May 1, 2025.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, mail (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, deemed liability information, most recent net operations summary and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.