Offering Details

Back

Under Review / Long Run Exploration Ltd.

Long Run Exploration Ltd.

Receivership Sale

Receivership SaleBid Deadline: June 19, 2025

12:00 PM

Download Full PDF - Printable

OVERVIEW

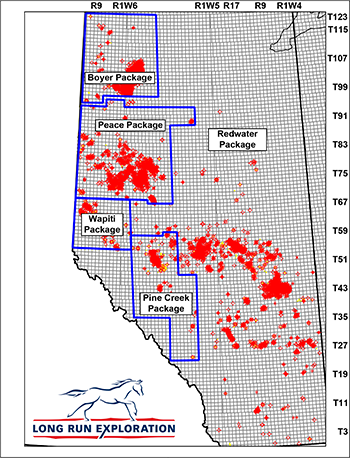

On March 5, 2025, pursuant to section 12(2) of the Judicature Act, RSA 2000, c J-2, section 99(a) of the Business Corporations Act, RSA 2000, c B-9 and section 106.1 of the Oil and Gas Conservation Act, RSA 2000, c O-6, further to an order application by the Orphan Well Association (“OWA”), PricewaterhouseCoopers Inc. LIT was appointed as Receiver and manager (the “Receiver”) of Long Run Exploration Ltd. (“Long Run” or the “Company”). Sayer Energy Advisors has been engaged to assist the Receiver with the sale of Long Run’s oil and natural gas properties (the “Properties”) located in Alberta.

The Properties consist of operated and non-operated working interests which are located throughout Alberta. For marketing purposes, the Properties are separated into the following geographical packages: Boyer, Peace, Pine Creek, Redwater and Wapiti.

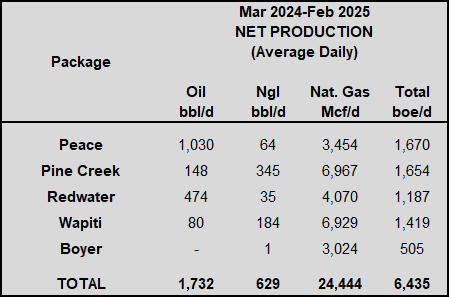

Average production net to Long Run from the Properties for the 12 months ended February 28, 2025 was 6,435 boe/d, consisting of 24.4 MMcf/d of natural gas and 2,361 barrels of oil and natural gas liquids per day.

As of April 1, 2025, the Properties had a deemed liability value of $474.8 million.

Long Run has identified numerous upside opportunities relating to the Properties including drilling opportunities at Pine Creek, multi-stack plays at Elmworth, waterflood potential at Snipe Lake, a liner pull project at Peace Montney and ample additional well repair projects and reactivation opportunities. The Company’s key upside drilling locations are in the Elmworth, Hanlan, Kakwa and Pine Creek areas of Alberta.

Further details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

The Properties consist of operated and non-operated working interests which are located throughout Alberta. For marketing purposes, the Properties are separated into the following geographical packages: Boyer, Peace, Pine Creek, Redwater and Wapiti.

Average production net to Long Run from the Properties for the 12 months ended February 28, 2025 was 6,435 boe/d, consisting of 24.4 MMcf/d of natural gas and 2,361 barrels of oil and natural gas liquids per day.

As of April 1, 2025, the Properties had a deemed liability value of $474.8 million.

Long Run has identified numerous upside opportunities relating to the Properties including drilling opportunities at Pine Creek, multi-stack plays at Elmworth, waterflood potential at Snipe Lake, a liner pull project at Peace Montney and ample additional well repair projects and reactivation opportunities. The Company’s key upside drilling locations are in the Elmworth, Hanlan, Kakwa and Pine Creek areas of Alberta.

Further details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

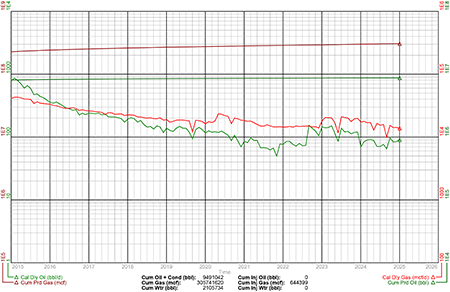

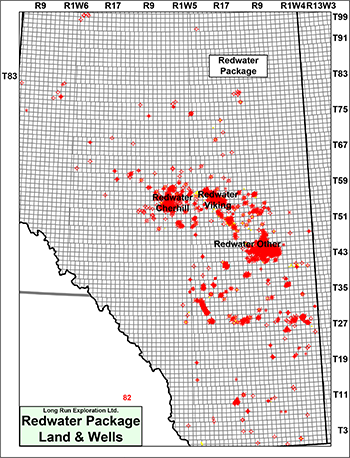

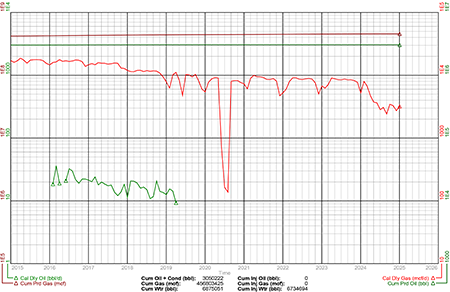

Production Overview

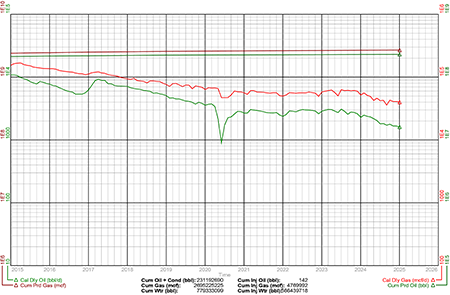

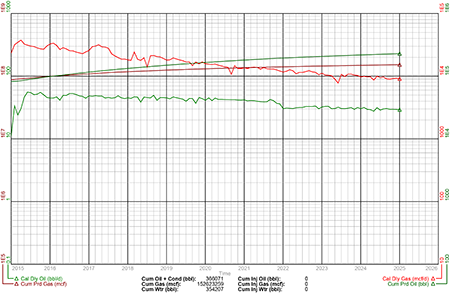

Average production net to Long Run from the Properties for the 12 months ended February 28, 2025 was 6,435 boe/d, consisting of 24.4 MMcf/d of natural gas and 2,361 barrels of oil and natural gas liquids per day.

Average production net to Long Run from the Properties for the 12 months ended February 28, 2025 was 6,435 boe/d, consisting of 24.4 MMcf/d of natural gas and 2,361 barrels of oil and natural gas liquids per day.

Gross Production Group Plot of Long Run's Wells

Liability Assessment Overview

As of April 1, 2025, the Properties had a deemed liability value of $474.8 million.

Facilities Overview

Long Run holds various working interests in facilities associated with the Properties. Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Marketing Overview

Long Run holds various marketing and transportation contracts relating to natural gas, and crude oil and natural gas liquids production associated with the Properties including Tidal Energy Marketing Inc., and TC Energy NGTL firm transportation service in the Wimborne North, Codesa, Eaglesham South, Edson, Lathrop Creek, Lisburn, Musreau Lake North, Paddle Prairie South, Peavine Creek and Webster areas of Alberta.

Summary information and details on Long Run’s marketing and transportation contracts are available in the virtual data room for parties that execute a confidentiality agreement.

Seismic Overview

The Company owns wide-ranging 2D and 3D seismic data associated with the Properties. Further details will be available in the virtual data room for parties that execute a confidentiality agreement.

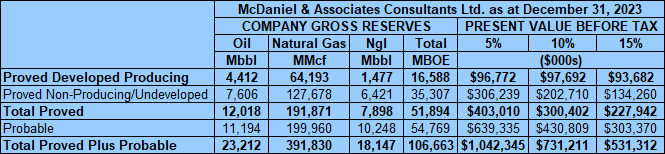

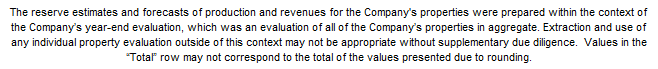

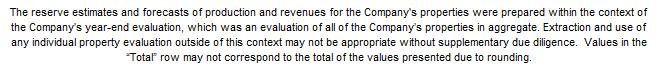

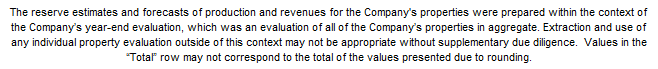

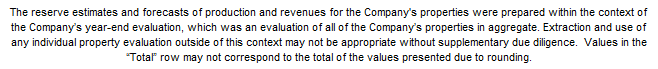

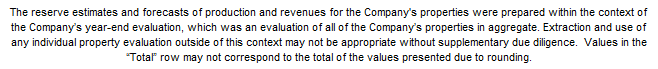

Reserves Overview

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Properties contained remaining proved plus probable reserves of 391.8 Bcf of natural gas and 41.4 million barrels of oil and natural gas liquids (106.7 million boe), with an estimated net present value of approximately $731.2 million using forecast pricing at a 10% discount.

As of April 1, 2025, the Properties had a deemed liability value of $474.8 million.

Facilities Overview

Long Run holds various working interests in facilities associated with the Properties. Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Marketing Overview

Long Run holds various marketing and transportation contracts relating to natural gas, and crude oil and natural gas liquids production associated with the Properties including Tidal Energy Marketing Inc., and TC Energy NGTL firm transportation service in the Wimborne North, Codesa, Eaglesham South, Edson, Lathrop Creek, Lisburn, Musreau Lake North, Paddle Prairie South, Peavine Creek and Webster areas of Alberta.

Summary information and details on Long Run’s marketing and transportation contracts are available in the virtual data room for parties that execute a confidentiality agreement.

Seismic Overview

The Company owns wide-ranging 2D and 3D seismic data associated with the Properties. Further details will be available in the virtual data room for parties that execute a confidentiality agreement.

Reserves Overview

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Properties contained remaining proved plus probable reserves of 391.8 Bcf of natural gas and 41.4 million barrels of oil and natural gas liquids (106.7 million boe), with an estimated net present value of approximately $731.2 million using forecast pricing at a 10% discount.

PEACE PACKAGE

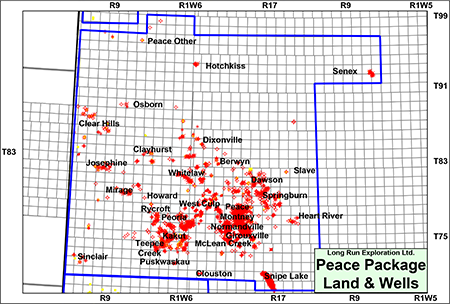

In the Peace Package, Long Run has various operated and non-operated working interests located in the Peace Montney and Peace Minor Other areas.

Peace Montney properties include the Girouxville and Normandville areas.

The Peace Minor Other properties includes Berwyn, Clayhurst, Clear Hills, Clouston, Dawson, Dixonville, Eaglesham, Fahler, Flood, Heart River, Hotchkiss, Howard, Josephine, Kakut, Kakut West, Lost - South Leddy, McLean Creek, Mirage, Osborn, Peace Other, Peoria, Pica/Jack, Puskwaskau, Rycroft, Senex, Sinclair, Slave, Snipe Lake, Springburn, Tangent, Teepee Creek, West Culp and Whitelaw areas as shown on the following map.

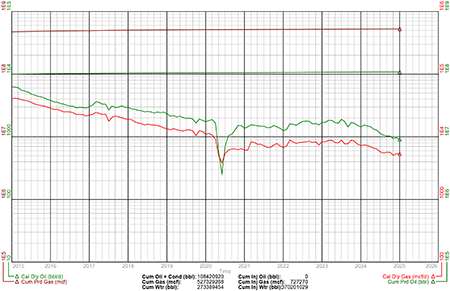

Average production net to Long Run from the Peace Package for the 12 months ended February 28, 2025 was 1,670 boe/d, consisting of 3.5 MMcf/d of natural gas and 1,094 barrels of oil and natural gas liquids per day.

Operating income net to Long Run from the Peace Package for the 12 months ended February 28, 2025 was approximately $582,000 per month.

Peace Montney properties include the Girouxville and Normandville areas.

The Peace Minor Other properties includes Berwyn, Clayhurst, Clear Hills, Clouston, Dawson, Dixonville, Eaglesham, Fahler, Flood, Heart River, Hotchkiss, Howard, Josephine, Kakut, Kakut West, Lost - South Leddy, McLean Creek, Mirage, Osborn, Peace Other, Peoria, Pica/Jack, Puskwaskau, Rycroft, Senex, Sinclair, Slave, Snipe Lake, Springburn, Tangent, Teepee Creek, West Culp and Whitelaw areas as shown on the following map.

Average production net to Long Run from the Peace Package for the 12 months ended February 28, 2025 was 1,670 boe/d, consisting of 3.5 MMcf/d of natural gas and 1,094 barrels of oil and natural gas liquids per day.

Operating income net to Long Run from the Peace Package for the 12 months ended February 28, 2025 was approximately $582,000 per month.

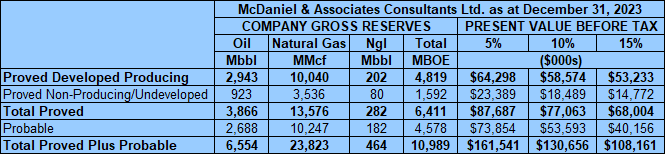

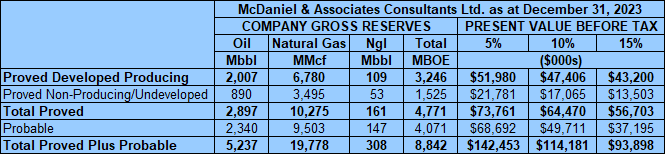

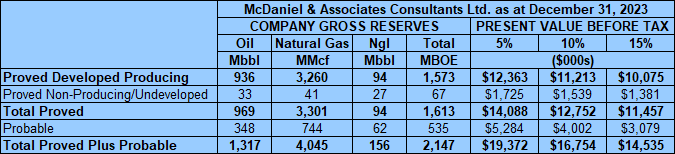

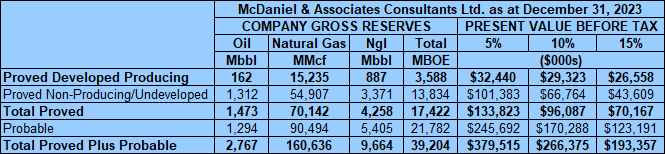

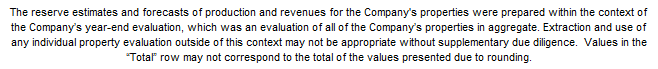

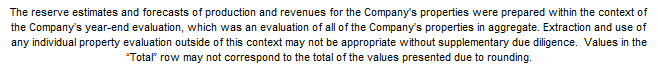

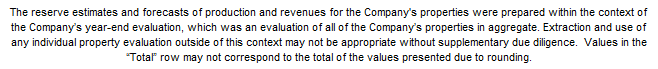

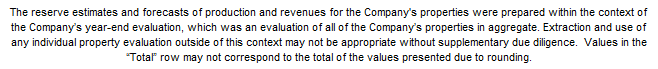

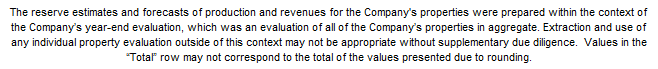

Peace Package Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Peace Package contained remaining proved plus probable reserves of 23.8 Bcf of natural gas and 7.0 million barrels of oil and natural gas liquids (11.0 million boe), with an estimated net present value of approximately $130.7 million using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Peace Package contained remaining proved plus probable reserves of 23.8 Bcf of natural gas and 7.0 million barrels of oil and natural gas liquids (11.0 million boe), with an estimated net present value of approximately $130.7 million using forecast pricing at a 10% discount.

Peace Package Liability Assessment

As of April 1, 2025, the Peace Package had a deemed liability value of $165.3 million.

As of April 1, 2025, the Peace Package had a deemed liability value of $165.3 million.

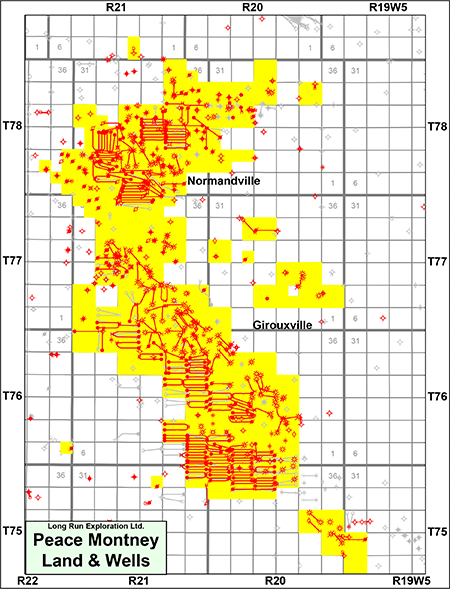

PEACE MONTNEY PROPERTIES

Township 75-79, Range 19-21 W5

At Peace Montney, Long Run holds a 100% working interest in the Girouxville and Normandville areas with oil and natural gas production primarily from Montney S and Montney R pools at Girouxville and Montney C/H pool at Normandville.

At Peace Montney, Long Run holds a 100% working interest in the Girouxville and Normandville areas with oil and natural gas production primarily from Montney S and Montney R pools at Girouxville and Montney C/H pool at Normandville.

Peace Montney Liability Assessment

As of April 1, 2025, the Peace Montney properties had a deemed liability value of $59.3 million.

Peace Montney Upside

Liner Pull Operation

At Peace Montney, the Company has identified low-risk pipeline projects that could restore approximately 150 boe/d production for an estimated cost of $498,000, as summarized below.

Normandville Liner Pull on pipeline 38304-104

As of April 1, 2025, the Peace Montney properties had a deemed liability value of $59.3 million.

Peace Montney Upside

Liner Pull Operation

At Peace Montney, the Company has identified low-risk pipeline projects that could restore approximately 150 boe/d production for an estimated cost of $498,000, as summarized below.

Normandville Liner Pull on pipeline 38304-104

- Cost: $335,000

- Rate: 93 boe/d

- Payout: 55 days

Normandville Liner Pull on pipeline 38304-34

- Cost: $145,000

- Rate: 39 boe/d

- Payout: 72 days

Normandville Engineering Assessment to return pipeline 38304-103 to service

- Cost: $18,000

- Rate: 10 boe/d

- Payout: 159 days

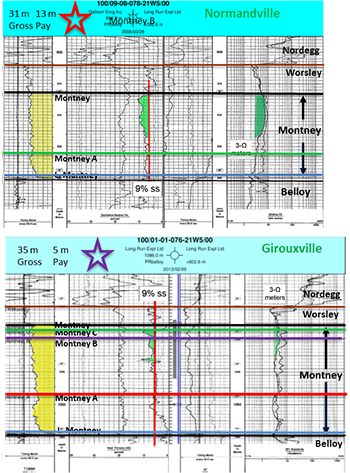

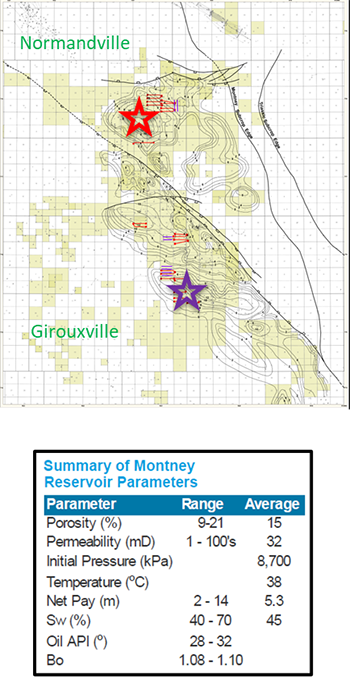

Montney Formation

Long Run’s lands at Normandville and Girouxville contain liquids rich natural gas production from interbedded oil-stained siltstone (30%) and shale (70%) in millimeter-scale wavy-parallel laminations.

The following well log shows the Montney reservoir at Peace Montney.

The following well log shows the Montney reservoir at Peace Montney.

The target reservoir has the following parameters.

Further details will be available in the virtual data room for parties that execute a confidentiality agreement.

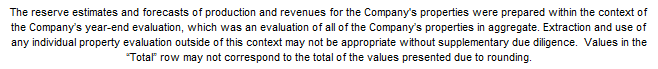

Peace Montney Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Peace Montney property contained remaining proved plus probable reserves of 19.8 Bcf of natural gas and 5.5 million barrels of oil and natural gas liquids (8.8 million boe), with an estimated net present value of approximately $114.2 million using forecast pricing at a 10% discount.

Peace Montney Facilities

Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Peace Montney Well List

Click here to download the complete well list in Excel.

Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Peace Montney Well List

Click here to download the complete well list in Excel.

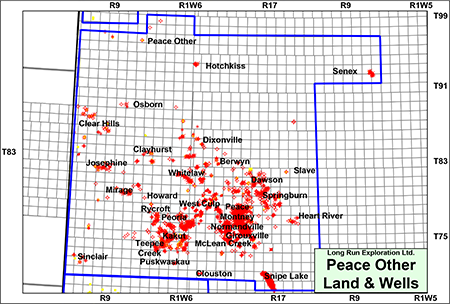

PEACE OTHER PROPERTIES

Township 75-98, Range 5 W5-12W6

The Peace Other properties include Long Run’s interests in the Berwyn, Clayhurst, Clear Hills, Clouston, Dawson, Dixonville, Eaglesham, Fahler, Flood, Heart River, Hotchkiss, Howard, Josephine, Kakut, Kakut West, Lost - South Leddy, McLean Creek, Mirage, Osborn, Peace Other, Peoria, Pica/Jack, Puskwaskau, Rycroft, Senex, Sinclair, Slave, Snipe Lake, Springburn, Tangent, Teepee Creek, West Culp and Whitelaw areas of Alberta as shown on the following map.

The Peace Other properties include Long Run’s interests in the Berwyn, Clayhurst, Clear Hills, Clouston, Dawson, Dixonville, Eaglesham, Fahler, Flood, Heart River, Hotchkiss, Howard, Josephine, Kakut, Kakut West, Lost - South Leddy, McLean Creek, Mirage, Osborn, Peace Other, Peoria, Pica/Jack, Puskwaskau, Rycroft, Senex, Sinclair, Slave, Snipe Lake, Springburn, Tangent, Teepee Creek, West Culp and Whitelaw areas of Alberta as shown on the following map.

Peace Other Liability Assessment

As of April 1, 2025, the Peace Other properties had a deemed liability value of $106.0 million.

Peace Other Upside

Kakut

At Kakut, Long Run has identified several reactivations in the Kakwa JJ Cardium pool.

Upside identified includes:

As of April 1, 2025, the Peace Other properties had a deemed liability value of $106.0 million.

Peace Other Upside

Kakut

At Kakut, Long Run has identified several reactivations in the Kakwa JJ Cardium pool.

Upside identified includes:

- The plant is located at 14-12-075-03W6 and consists of: Oil production from the Doig Formation and various natural gas zones including the Montney, Cadomin, Gething

- Potential to install field compression

- The oil wells would benefit significantly with reduced casing pressure, the natural gas wells would improve with unloading as well

- Significant upside has been identified in fracking 102/12-18-074-02W6/2, some reactivation, and significant gains to be had with installing field compression to benefit both the oil and natural gas wells

Production from the Kakut property is currently suspended awaiting required repairs. Further details on the work required to bring the Kakut property back on production will be available in the virtual data room for parties that execute a confidentiality agreement.

Snipe Lake

The Company has identified potential for a waterflood project at Snipe Lake.

Long Run believes the reservoir has many heterogeneities and the reservoir pressure will not vary greatly. The Company believes the property could benefit from stimulating injection wells selected from the east side of the pool.

Peace Other Facilities

Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

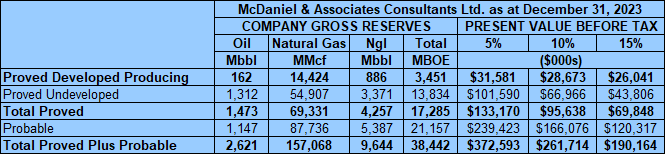

Peace Other Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Peace Other property contained remaining proved plus probable reserves of 4.0 Bcf of natural gas and 1.5 million barrels of oil and natural gas liquids (2.1 million boe), with an estimated net present value of approximately $16.8 million using forecast pricing at a 10% discount.

Snipe Lake

The Company has identified potential for a waterflood project at Snipe Lake.

Long Run believes the reservoir has many heterogeneities and the reservoir pressure will not vary greatly. The Company believes the property could benefit from stimulating injection wells selected from the east side of the pool.

Peace Other Facilities

Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Peace Other Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Peace Other property contained remaining proved plus probable reserves of 4.0 Bcf of natural gas and 1.5 million barrels of oil and natural gas liquids (2.1 million boe), with an estimated net present value of approximately $16.8 million using forecast pricing at a 10% discount.

Peace Other Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

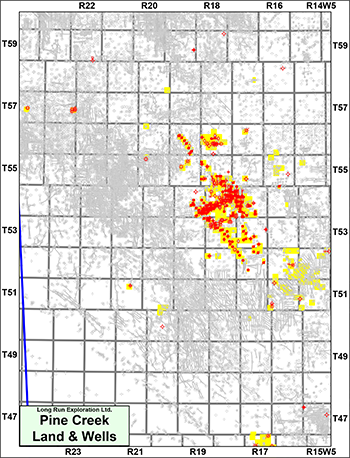

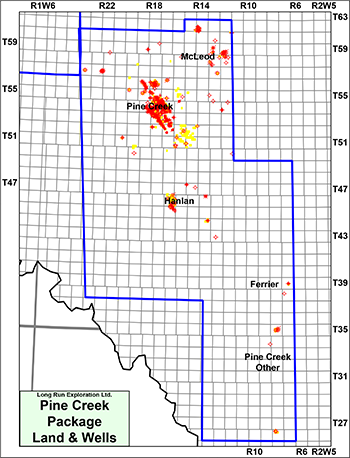

PINE CREEK PACKAGE

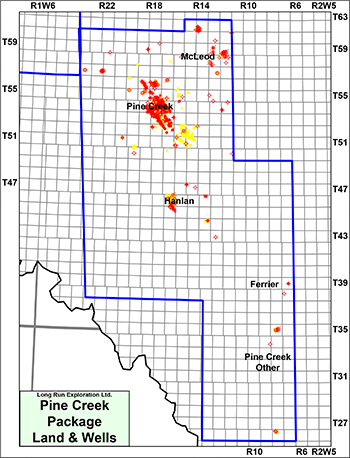

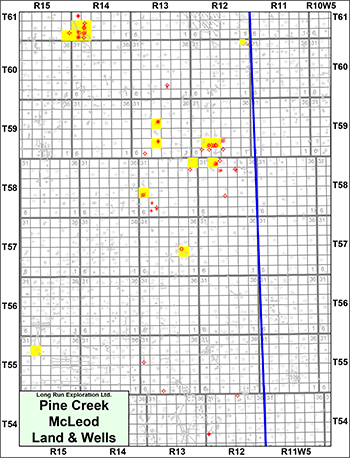

In the Pine Creek Package, Long Run has various operated and non-operated working interests located in the Pine Creek, Ferrier, Hanlan, McLeod and Pine Creek Other properties.

Average production net to Long Run from the Pine Creek Package for the 12 months ended February 28, 2025 was 1,654 boe/d, consisting of 7.0 MMcf/d of natural gas and 493 barrels of oil and natural gas liquids per day.

Operating income net to Long Run from the Pine Creek Package for the 12 months ended February 28, 2025 was approximately $317,000 per month.

Average production net to Long Run from the Pine Creek Package for the 12 months ended February 28, 2025 was 1,654 boe/d, consisting of 7.0 MMcf/d of natural gas and 493 barrels of oil and natural gas liquids per day.

Operating income net to Long Run from the Pine Creek Package for the 12 months ended February 28, 2025 was approximately $317,000 per month.

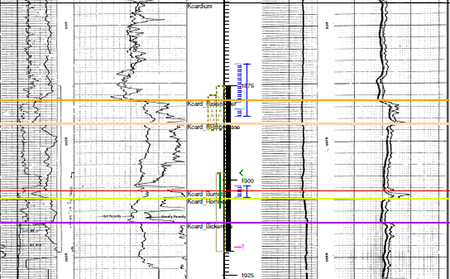

Pine Creek Upside

Cardium Formation

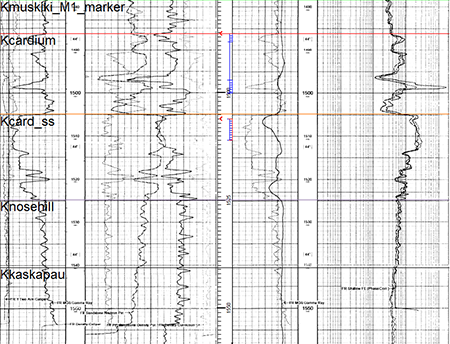

Long Run’s lands at Pine Creek contain liquids rich natural gas and oil production. The trend becomes progressively more oil bearing from south to north. The following well log shows the Cardium reservoir at Pine Creek.

Cardium Formation

Long Run’s lands at Pine Creek contain liquids rich natural gas and oil production. The trend becomes progressively more oil bearing from south to north. The following well log shows the Cardium reservoir at Pine Creek.

The Cardium Raven River Member at Pine Creek is an interbedded coarsening-upward sequence interpreted as an interbedded marine lower shoreface to upper offshore sandstone and shale found at a depth of 1,700-2,000 metres a which contains 42° API oil and net pay of 2-6 metres using a 6% porosity cutoff.

The target reservoir has the following parameters: average porosity of 9%, average permeability of 0.25-4.0 mD, water saturation of approximately 25%.

Reservoir Temp = 6,045°C

Reservoir Pressure = 18-22 Mpa

Average Gas in Place/Section = 3.5 BCF

Average Oil in Place/Section = 1.35 million bbls

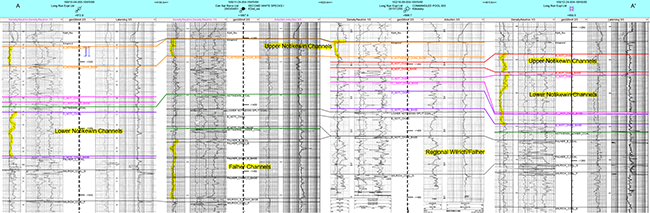

Notikewin Formation

At Pine Creek, Long Run has identified horizontal drilling potential within Notikewin channels of the Upper Mannville on its lands as shown in the following cross-section.

The target reservoir has the following parameters: average porosity of 9%, average permeability of 0.25-4.0 mD, water saturation of approximately 25%.

Reservoir Temp = 6,045°C

Reservoir Pressure = 18-22 Mpa

Average Gas in Place/Section = 3.5 BCF

Average Oil in Place/Section = 1.35 million bbls

Notikewin Formation

At Pine Creek, Long Run has identified horizontal drilling potential within Notikewin channels of the Upper Mannville on its lands as shown in the following cross-section.

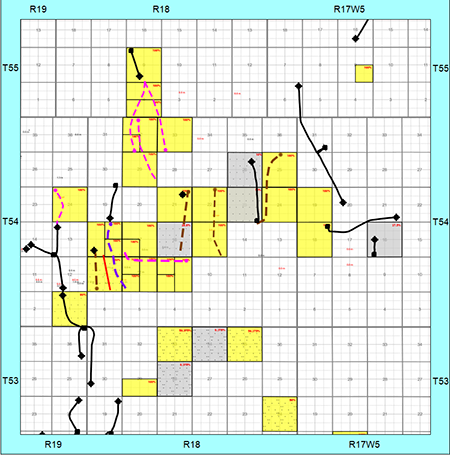

The following map shows 8 2-mile lateral horizontal locations and two 1.5-mile lateral locations identified by Long Run. The tier 1 wells are shown in pink, followed by tier 2 in brown and tier 3 in purple.

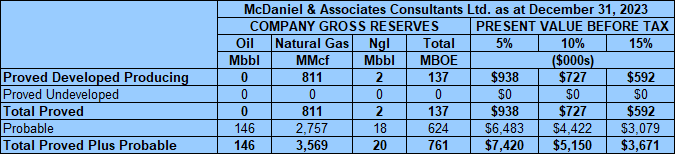

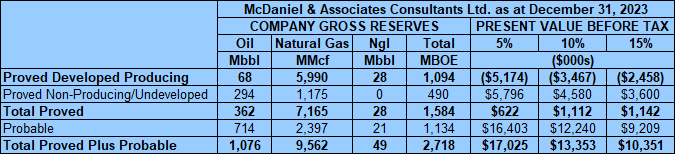

Pine Creek Package Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Pine Creek Package contained remaining proved plus probable reserves of 160.6 Bcf of natural gas and 12.4 million barrels of oil and natural gas liquids (39.2 million boe), with an estimated net present value of approximately $266.4 million using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Pine Creek Package contained remaining proved plus probable reserves of 160.6 Bcf of natural gas and 12.4 million barrels of oil and natural gas liquids (39.2 million boe), with an estimated net present value of approximately $266.4 million using forecast pricing at a 10% discount.

Pine Creek Package Liability Assessment

As of April 1, 2025, the Pine Creek Package had a deemed liability value of $38.1 million.

As of April 1, 2025, the Pine Creek Package had a deemed liability value of $38.1 million.

PINE CREEK PROPERTY

Township 46-59, Range 13-24 W5

At Pine Creek, Long Run holds various operated and non-operated working interests in oil and natural gas wells producing from various formations, most notably the Cardium.

At Pine Creek, Long Run holds various operated and non-operated working interests in oil and natural gas wells producing from various formations, most notably the Cardium.

Pine Creek Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Pine Creek Property contained remaining proved plus probable reserves of 157.1 Bcf of natural gas and 12.3 million barrels of oil and natural gas liquids (38.4 million boe), with an estimated net present value of approximately $261.7 million using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Pine Creek Property contained remaining proved plus probable reserves of 157.1 Bcf of natural gas and 12.3 million barrels of oil and natural gas liquids (38.4 million boe), with an estimated net present value of approximately $261.7 million using forecast pricing at a 10% discount.

Pine Creek Liability Assessment

As of April 1, 2025, the Pine Creek property had a deemed liability value of $34.8 million.

Pine Creek Well List

Click here to download the complete well list in Excel.

As of April 1, 2025, the Pine Creek property had a deemed liability value of $34.8 million.

Pine Creek Well List

Click here to download the complete well list in Excel.

PINE CREEK OTHER PROPERTIES

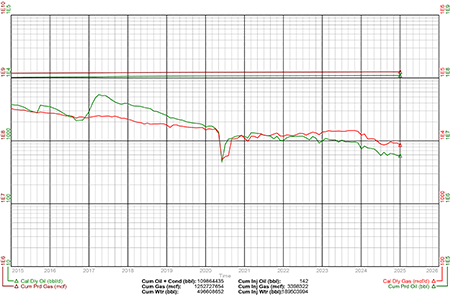

At Pine Creek Other, Long Run holds various operated and non-operated working interests at Ferrier, Hanlan, McLeod and Pine Creek Other properties.

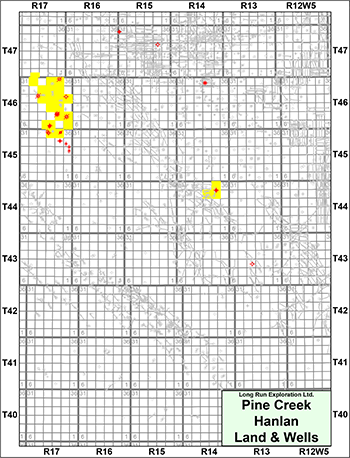

Hanlan Property

At Hanlan, Long Run has mainly a 40% working interest in natural gas wells targeting the Viking Formation. The Company believes there is potential for horizontal drilling in the Belly River Formation.

At Hanlan, Long Run has mainly a 40% working interest in natural gas wells targeting the Viking Formation. The Company believes there is potential for horizontal drilling in the Belly River Formation.

Hanlan Liability Assessment

As of April 1, 2025, the Hanlan property had a deemed liability value of $1.8 million.

McLeod Property

At McLeod, Long Run holds various working interests in natural gas wells targeting the Rock Creek, Glauconitic, Ellerslie and Gething formations of the Mannville Group.

As of April 1, 2025, the Hanlan property had a deemed liability value of $1.8 million.

McLeod Property

At McLeod, Long Run holds various working interests in natural gas wells targeting the Rock Creek, Glauconitic, Ellerslie and Gething formations of the Mannville Group.

McLeod Liability Assessment

As of April 1, 2025, the McLeod property had a deemed liability value of $905,801.

Ferrier Property

At Ferrier, Long Run holds minor royalty and working interests in Cardium and Viking wells.

As of April 1, 2025, the McLeod property had a deemed liability value of $905,801.

Ferrier Property

At Ferrier, Long Run holds minor royalty and working interests in Cardium and Viking wells.

Ferrier Liability Assessment

As of April 1, 2025, the Ferrier property had a deemed liability value of $543,750.

Pine Creek Other Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Pine Creek Others property contained remaining proved plus probable reserves of 3.6 Bcf of natural gas and 166,000 barrels of oil and natural gas liquids (761,000 boe), with an estimated net present value of approximately $5.2 million using forecast pricing at a 10% discount.

As of April 1, 2025, the Ferrier property had a deemed liability value of $543,750.

Pine Creek Other Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Pine Creek Others property contained remaining proved plus probable reserves of 3.6 Bcf of natural gas and 166,000 barrels of oil and natural gas liquids (761,000 boe), with an estimated net present value of approximately $5.2 million using forecast pricing at a 10% discount.

Pine Creek Other Well List

Click here to download the complete well list in Excel.

Click here to download the complete well list in Excel.

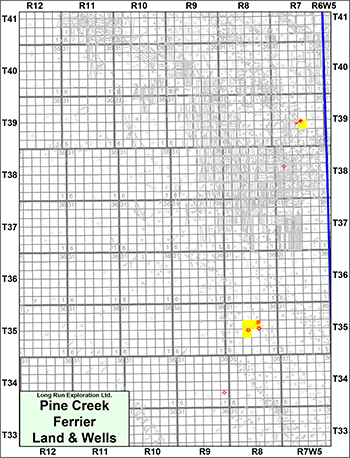

REDWATER PACKAGE

In the Redwater Package, Long Run has various operated and non-operated working interests located in the Redwater Cherhill, Redwater Viking and Redwater Other properties.

Average production net to Long Run from the Redwater Package for the 12 months ended February 28, 2025 was 1,187 boe/d, consisting of 4.1 MMcf/d of natural gas and 509 barrels of oil and natural gas liquids per day.

Operating income net to Long Run from the Redwater Package for the 12 months ended February 28, 2025 was approximately ($120,000) per month.

Average production net to Long Run from the Redwater Package for the 12 months ended February 28, 2025 was 1,187 boe/d, consisting of 4.1 MMcf/d of natural gas and 509 barrels of oil and natural gas liquids per day.

Operating income net to Long Run from the Redwater Package for the 12 months ended February 28, 2025 was approximately ($120,000) per month.

Redwater Package Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Redwater Package contained remaining proved plus probable reserves of 13.2 million barrels of oil and natural gas liquids and 22.6 Bcf of natural gas (17.0 million boe), with an estimated net present value of approximately $205.7 million using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Redwater Package contained remaining proved plus probable reserves of 13.2 million barrels of oil and natural gas liquids and 22.6 Bcf of natural gas (17.0 million boe), with an estimated net present value of approximately $205.7 million using forecast pricing at a 10% discount.

Redwater Package Liability Assessment

As of April 1, 2025, the Redwater Package had a deemed liability value of $165.0 million.

As of April 1, 2025, the Redwater Package had a deemed liability value of $165.0 million.

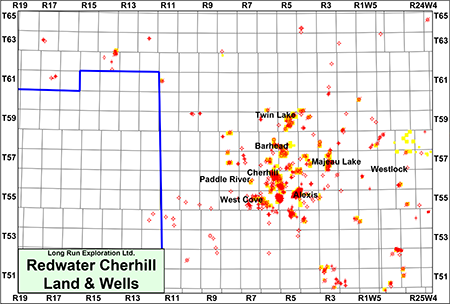

REDWATER CHERHILL PROPERTIES

Township 50-65, Range 24 W4-17 W5

Redwater Cherhill Properties includes the Alexis, Barhead, Cherhill, Majeau Lake, Paddle River, Princess, Twin Lake, and Westlock areas of Alberta.

Redwater Cherhill Properties includes the Alexis, Barhead, Cherhill, Majeau Lake, Paddle River, Princess, Twin Lake, and Westlock areas of Alberta.

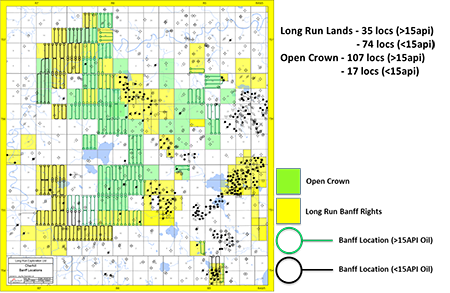

Redwater Cherhill Upside

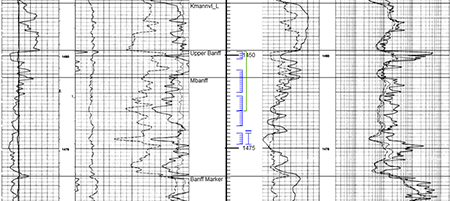

Banff Formation

Long Run’s lands at Cherhill contain oil production from the Banff Formation. The Company has identified 35 horizontal drilling locations targeting oil greater than 15° API and up to 74 locations targeting oil less than 15° API in the Banff Formation on its lands.

Banff Formation

Long Run’s lands at Cherhill contain oil production from the Banff Formation. The Company has identified 35 horizontal drilling locations targeting oil greater than 15° API and up to 74 locations targeting oil less than 15° API in the Banff Formation on its lands.

The following well log shows the Banff reservoir at Cherhill.

The Banff Formation at Cherhill is at a depth of 1,450 metres and contains 10-22° API oil and net pay of 10-20 metres using a 3% porosity cutoff.

The target reservoir has the following parameters: average porosity of 18%, average permeability of 10 mD, water saturation of approximately 40%.

Reservoir Temp = 50°C

Reservoir Pressure = 13 Mpa

Alexis Banff A Pool Unit

Long Run has a 34.48% working interest in the Alexis Banff A Pool Unit operated by Spoke Resources Ltd. The unit has an approved waterflood but the Company believes some wells do show support from water disposal. Pressure data from 2015 and beyond shows the north and south pool pressure aligned but remained low despite water disposal/injection.

Further details relating to the waterflood upside will be available in the virtual data room for parties that execute a confidentiality agreement.

Redwater Cherhill Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Redwater Cherhill properties contained remaining proved plus probable reserves of 5.4 Bcf of natural gas and 447,000 barrels of oil and natural gas liquids (1.3 million boe), with an estimated net present value of approximately $2.7 million using forecast pricing at a 10% discount.

The target reservoir has the following parameters: average porosity of 18%, average permeability of 10 mD, water saturation of approximately 40%.

Reservoir Temp = 50°C

Reservoir Pressure = 13 Mpa

Alexis Banff A Pool Unit

Long Run has a 34.48% working interest in the Alexis Banff A Pool Unit operated by Spoke Resources Ltd. The unit has an approved waterflood but the Company believes some wells do show support from water disposal. Pressure data from 2015 and beyond shows the north and south pool pressure aligned but remained low despite water disposal/injection.

Further details relating to the waterflood upside will be available in the virtual data room for parties that execute a confidentiality agreement.

Redwater Cherhill Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Redwater Cherhill properties contained remaining proved plus probable reserves of 5.4 Bcf of natural gas and 447,000 barrels of oil and natural gas liquids (1.3 million boe), with an estimated net present value of approximately $2.7 million using forecast pricing at a 10% discount.

Redwater Cherhill Liability Assessment

As of April 1, 2025, the Redwater Cherhill property had a deemed liability value of $30.3 million.

Redwater Cherhill Facilities

Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Redwater Cherhill Well List

Click here to download the complete well list in Excel.

As of April 1, 2025, the Redwater Cherhill property had a deemed liability value of $30.3 million.

Redwater Cherhill Facilities

Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Redwater Cherhill Well List

Click here to download the complete well list in Excel.

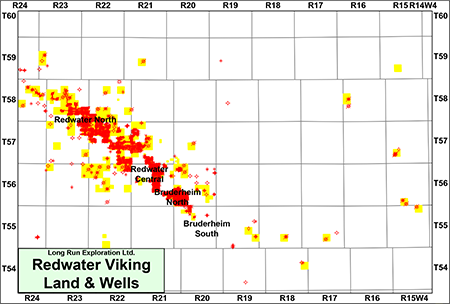

REDWATER VIKING PROPERTIES

Township 54-59, Range 15-24 W4

Redwater Viking includes Long Run’s interests in Bruderheim North, Bruderheim South, Redwater Central and Redwater North. Long Run’s Redwater Viking property includes primarily 100% working interest in light oil production from the Viking Formation.

Redwater Viking includes Long Run’s interests in Bruderheim North, Bruderheim South, Redwater Central and Redwater North. Long Run’s Redwater Viking property includes primarily 100% working interest in light oil production from the Viking Formation.

Redwater Viking Upside

The Company has identified several wells that it believes could be re-activated at Bruderheim North and South.

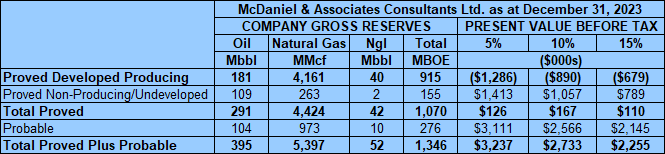

Redwater Viking Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Redwater Viking properties contained remaining proved plus probable reserves of 11.6 million barrels of oil and natural gas liquids and 7.7 Bcf of natural gas (12.9 million boe), with an estimated net present value of approximately $190.1 million using forecast pricing at a 10% discount.

The Company has identified several wells that it believes could be re-activated at Bruderheim North and South.

Redwater Viking Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Redwater Viking properties contained remaining proved plus probable reserves of 11.6 million barrels of oil and natural gas liquids and 7.7 Bcf of natural gas (12.9 million boe), with an estimated net present value of approximately $190.1 million using forecast pricing at a 10% discount.

Redwater Viking Liability Assessment

As of April 1, 2025, the Redwater Viking properties had a deemed liability value of $77.4 million.

Redwater Viking Facilities

Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Redwater Viking Well List

Click here to download the complete well list in Excel.

As of April 1, 2025, the Redwater Viking properties had a deemed liability value of $77.4 million.

Redwater Viking Facilities

Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Redwater Viking Well List

Click here to download the complete well list in Excel.

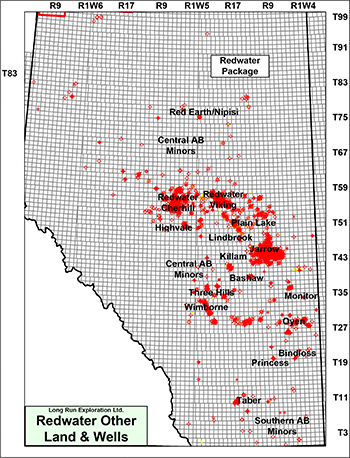

REDWATER OTHER PROPERTIES

The Redwater Other group includes Long Run’s interests at Bashaw, Bremner, Central AB Minors, Drumheller, Highvale, Jarrow, Killam, Lindbrook, Monitor, Oyen, Partridge, Plain Lake, Provost, Red Earth/Nipisi, Redwater Other, Southern AB Minors, Taber, Three Hills, West Cove, and Wimborne.

Redwater Other Upside

The Company has identified several wells that it believes could be re-activated at Jarrow.

In addition, the Company’s CBM wells have opportunities at Three Hills and Wimborne.

Redwater Other Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Redwater Other properties contained remaining proved plus probable reserves of 9.6 Bcf of natural gas and 1.1 million barrels of oil and natural gas liquids (2.7 million boe), with an estimated net present value of approximately $13.4 million using forecast pricing at a 10% discount.

The Company has identified several wells that it believes could be re-activated at Jarrow.

In addition, the Company’s CBM wells have opportunities at Three Hills and Wimborne.

Redwater Other Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Redwater Other properties contained remaining proved plus probable reserves of 9.6 Bcf of natural gas and 1.1 million barrels of oil and natural gas liquids (2.7 million boe), with an estimated net present value of approximately $13.4 million using forecast pricing at a 10% discount.

Redwater Other Liability Assessment

As of April 1, 2025, the Redwater Other properties had a deemed liability value of $57.3 million.

Redwater Other Well List

Click here to download the well list in Excel.

As of April 1, 2025, the Redwater Other properties had a deemed liability value of $57.3 million.

Redwater Other Well List

Click here to download the well list in Excel.

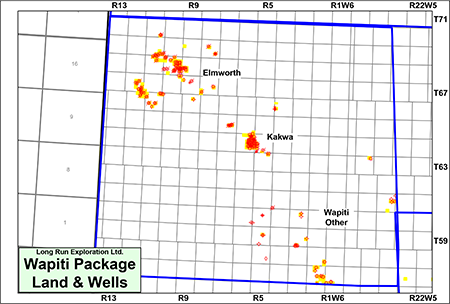

WAPITI PACKAGE

In the Wapiti Package, Long Run has various working interests located in the Elmworth, Kakwa and Wapiti Other areas as shown on the following map.

Average production net to Long Run from the Wapiti Package for the 12 months ended February 28, 2025 was 1,419 boe/d, consisting of 6.9 MMcf/d of natural gas and 264 barrels of oil and natural gas liquids per day.

Operating income net to Long Run from the Wapiti Package for the 12 months ended February 28, 2025 was approximately ($402,000) per month.

Historical negative operating income numbers net to Long Run associated with the Kakwa property were due to a take-or-pay contract which has now been disclaimed. With this change, Long Run is projecting an increase of approximately $600,000 per month, or $7.2 million on an annualized basis.

Average production net to Long Run from the Wapiti Package for the 12 months ended February 28, 2025 was 1,419 boe/d, consisting of 6.9 MMcf/d of natural gas and 264 barrels of oil and natural gas liquids per day.

Operating income net to Long Run from the Wapiti Package for the 12 months ended February 28, 2025 was approximately ($402,000) per month.

Historical negative operating income numbers net to Long Run associated with the Kakwa property were due to a take-or-pay contract which has now been disclaimed. With this change, Long Run is projecting an increase of approximately $600,000 per month, or $7.2 million on an annualized basis.

Wapiti Package Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Wapiti Package contained remaining proved plus probable reserves of 173.8 Bcf of natural gas and 8.7 million barrels of oil and natural gas liquids (37.7 million boe), with an estimated net present value of approximately $144.5 million using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Wapiti Package contained remaining proved plus probable reserves of 173.8 Bcf of natural gas and 8.7 million barrels of oil and natural gas liquids (37.7 million boe), with an estimated net present value of approximately $144.5 million using forecast pricing at a 10% discount.

Wapiti Package Liability Assessment

As of April 1, 2025, the Wapiti Package had a deemed liability value of $14.6 million.

As of April 1, 2025, the Wapiti Package had a deemed liability value of $14.6 million.

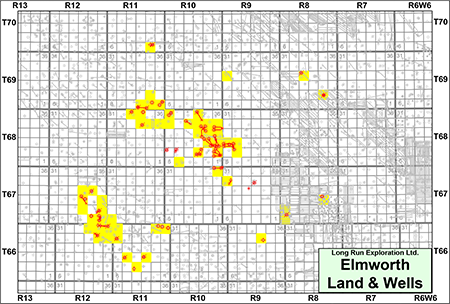

ELMWORTH PROPERTY

Township 66-70, Range 8-12 W6

At Elmworth, Long Run holds primarily 100% working interests with oil and natural gas production from the Cardium Formation along with certain minor working interests in natural gas wells operated by Gran Tierra Energy Inc. and Tourmaline Oil Corp.

At Elmworth, Long Run holds primarily 100% working interests with oil and natural gas production from the Cardium Formation along with certain minor working interests in natural gas wells operated by Gran Tierra Energy Inc. and Tourmaline Oil Corp.

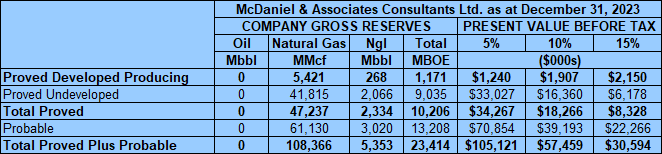

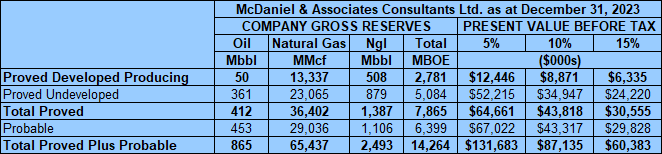

Elmworth Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Elmworth property contained remaining proved plus probable reserves of 108.4 Bcf of natural gas and 5.4 million barrels of oil and natural gas liquids (23.4 million boe), with an estimated net present value of approximately $57.5 million using forecast pricing at a 10% discount.

Elmworth Liability Assessment

As of April 1, 2025, the Elmworth property had a deemed liability value of $7.5 million.

Elmworth Facilities

Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Elmworth Well List

Click here to download the complete well list in Excel.

As of April 1, 2025, the Elmworth property had a deemed liability value of $7.5 million.

Elmworth Facilities

Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Elmworth Well List

Click here to download the complete well list in Excel.

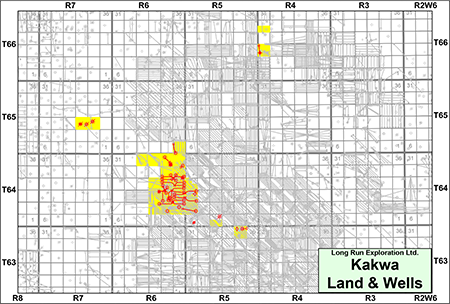

KAKWA PROPERTY

Township 63-66, Range 4-7 W6

At Kakwa, Long Run holds primarily 100% working interests with oil and natural gas production from the Cardium Formation along with certain minor working interests in natural gas wells operated by various companies including ARC Resources Ltd., Cenovus Energy Inc., and Peyto Exploration & Development Corp.

Historical negative operating income numbers net to Long Run associated with the Kakwa property were due to a take-or-pay contract which has now been disclaimed. With this change, Long Run is projecting an increase of approximately $600,000 per month, or $7.2 million on an annualized basis.

At Kakwa, Long Run holds primarily 100% working interests with oil and natural gas production from the Cardium Formation along with certain minor working interests in natural gas wells operated by various companies including ARC Resources Ltd., Cenovus Energy Inc., and Peyto Exploration & Development Corp.

Historical negative operating income numbers net to Long Run associated with the Kakwa property were due to a take-or-pay contract which has now been disclaimed. With this change, Long Run is projecting an increase of approximately $600,000 per month, or $7.2 million on an annualized basis.

Kakwa Upside

Cardium Formation

Long Run’s lands at Kakwa contain liquids rich natural gas production. The trend becomes progressively more oil bearing moving off a structural nose. The following well log shows the Cardium reservoir at Kakwa.

Cardium Formation

Long Run’s lands at Kakwa contain liquids rich natural gas production. The trend becomes progressively more oil bearing moving off a structural nose. The following well log shows the Cardium reservoir at Kakwa.

The Cardium Raven at Kakwa is mature shoreface that grades from offshore interbedded muds and silts into a high energy upper shoreface sandstone capped by a backshore lagoonal/terrestrial system. The shoreface sands are texturally mature and found at a depth of 1,600 metres, which contains 40° API oil and net pay of 9 metres using a 6% porosity cutoff.

The target reservoir has the following parameters: average porosity of 9%, average permeability of 0.5 mD, water saturation of approximately 25%.

Reservoir Temp = 45°C

Reservoir Pressure = ~15 Mpa

Lithology = Sandstone

Gas in Place/Section = 4-12 BCF

Kakwa Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Kakwa property contained remaining proved plus probable reserves of 65.4 Bcf of natural gas and 3.4 million barrels of oil and natural gas liquids (14.3 million boe), with an estimated net present value of approximately $87.1 million using forecast pricing at a 10% discount.

The target reservoir has the following parameters: average porosity of 9%, average permeability of 0.5 mD, water saturation of approximately 25%.

Reservoir Temp = 45°C

Reservoir Pressure = ~15 Mpa

Lithology = Sandstone

Gas in Place/Section = 4-12 BCF

Kakwa Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Kakwa property contained remaining proved plus probable reserves of 65.4 Bcf of natural gas and 3.4 million barrels of oil and natural gas liquids (14.3 million boe), with an estimated net present value of approximately $87.1 million using forecast pricing at a 10% discount.

Kakwa Liability Assessment

As of April 1, 2025, the Kakwa property had a deemed liability value of $7.2 million.

Kakwa Facilities

Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Kakwa Well List

Click here to download the complete well list in Excel.

As of April 1, 2025, the Kakwa property had a deemed liability value of $7.2 million.

Kakwa Facilities

Details on Long Run’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Kakwa Well List

Click here to download the complete well list in Excel.

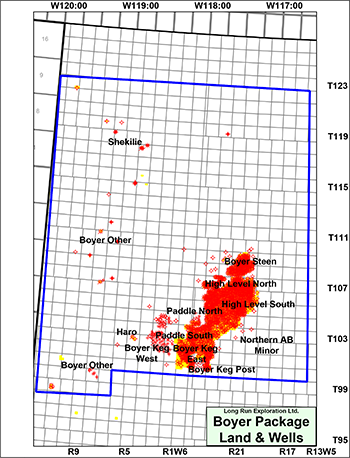

BOYER PACKAGE

In the Boyer Package, Long Run has various working interests primarily in the Boyer Keg Post, Boyer Other, Boyer Steen, High Level North and High Level South areas as shown on the following map. Additionally, Boyer includes Boyer Keg East, Boyer Keg West, Haro, Northern AB Minor, Paddle North, Paddle South, and Shekilie.

Long Run’s interests are primarily 100% operated working interests with oil production from the Bluesky and Gething formations.

Average production net to Long Run from the Boyer Package for the 12 months ended February 28, 2025 was 505 boe/d, consisting of 3.0 MMcf/d of natural gas and 1 barrel of oil and natural gas liquids per day.

Operating income net to Long Run from the Boyer Package for the 12 months ended February 28, 2025 was approximately ($477,000) per month.

Long Run’s interests are primarily 100% operated working interests with oil production from the Bluesky and Gething formations.

Average production net to Long Run from the Boyer Package for the 12 months ended February 28, 2025 was 505 boe/d, consisting of 3.0 MMcf/d of natural gas and 1 barrel of oil and natural gas liquids per day.

Operating income net to Long Run from the Boyer Package for the 12 months ended February 28, 2025 was approximately ($477,000) per month.

Boyer Package Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Boyer Package contained remaining proved plus probable reserves of 10.9 Bcf of natural gas (1.8 million boe), with an estimated net present value of approximately ($5.2 million) using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “McDaniel Report”). The McDaniel Report is effective December 31, 2023, using an average of GLJ Ltd., McDaniel and Sproule Associates Limited’s January 1, 2024 forecast pricing.

McDaniel estimated that as at December 31, 2023 the Boyer Package contained remaining proved plus probable reserves of 10.9 Bcf of natural gas (1.8 million boe), with an estimated net present value of approximately ($5.2 million) using forecast pricing at a 10% discount.

Boyer Package Liability

Assessment

As of April 1, 2025, the Boyer properties had a deemed liability value of $91.7 million.

Boyer Package Well List

Click here to download the complete well list in Excel.

As of April 1, 2025, the Boyer properties had a deemed liability value of $91.7 million.

Boyer Package Well List

Click here to download the complete well list in Excel.

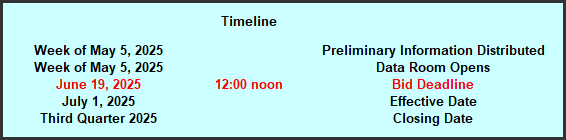

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Properties until 12:00 pm on Thursday June 19, 2025. All offers received at the bid deadline will be reviewed by the Receiver and the most acceptable offer or offers may be accepted by the Receiver, subject to Court approval.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday June 19, 2025.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, most recent net lease operating statements, the McDaniel Report, liability assessment information and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.