Offering Details

Back

Under Review / Rand Resources Inc.

Rand Resources Inc.

Property Divestiture

Property DivestitureBid Deadline: October 30, 2025

12:00 PM

Download Full PDF - Printable

OVERVIEW

RAND HAS SOLD ITS INTERESTS IN THE BAPTISTE AND GOLD CREEK AREAS OF ALBERTA.

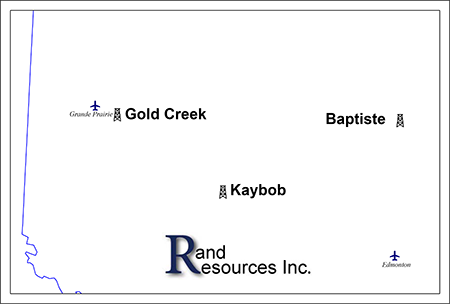

Rand Resources Inc. (“Rand” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale or farmout of its oil and natural gas interests located in the Baptiste, Gold Creek and Kaybob areas of Alberta (the “Properties”).

The Properties consist of predominantly 100% working interests in Crown mineral rights with prospective drilling locations for oil and natural gas primarily in the Montney, Duvernay, and Mannville formations.

At Gold Creek, Rand has a 100% working interest in 31 sections of land with Montney rights. These sections are highly prospective for multiple pay sequences in the Montney Formation that is within the volatile oil window.

At Baptiste, Rand has a 100% working interest in 5.5 sections of land. These lands are highly prospective for multiple pay sequences in the Mannville stack formations.

At Kaybob, Rand has a 100% working interest in 1.5 sections of land with P&NG rights to the Duvernay Formation. These lands are prospective for oil production from the Duvernay Formation.

Further geological details of the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

The Properties consist of predominantly 100% working interests in Crown mineral rights with prospective drilling locations for oil and natural gas primarily in the Montney, Duvernay, and Mannville formations.

At Gold Creek, Rand has a 100% working interest in 31 sections of land with Montney rights. These sections are highly prospective for multiple pay sequences in the Montney Formation that is within the volatile oil window.

At Baptiste, Rand has a 100% working interest in 5.5 sections of land. These lands are highly prospective for multiple pay sequences in the Mannville stack formations.

At Kaybob, Rand has a 100% working interest in 1.5 sections of land with P&NG rights to the Duvernay Formation. These lands are prospective for oil production from the Duvernay Formation.

Further geological details of the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

LMR Summary

Rand does not own an interest in any wells or facilities.

Seismic Overview

The Company does not have ownership in any seismic data relating to the Properties.

Reserves Overview

Rand does not have a third-party reserve report.

Rand does not own an interest in any wells or facilities.

Seismic Overview

The Company does not have ownership in any seismic data relating to the Properties.

Reserves Overview

Rand does not have a third-party reserve report.

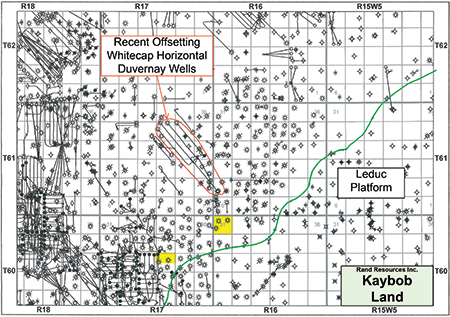

KAYBOB

Township 60, Range 16-17 W5

At Kaybob, Rand has a 100% working interest in 1.5 sections of land with P&NG rights to the Duvernay Formation. These lands are prospective for oil production from the Duvernay Formation and have remaining tenure of approximately 2.5 years.

These lands are situated in an area with prolific land activity and offsetting development in the Kaybob Duvernay by Canadian Natural and Whitecap.

Whitecap drilled a multi-well Duvernay pad in the volatile oil window in 2024 which it brought on at a peak 30-day production rate of approximately 1,550 boe/d per well (75% liquids) and has continued drilling with subsequent pads and further optimization of the completions design.

At Kaybob, Rand has a 100% working interest in 1.5 sections of land with P&NG rights to the Duvernay Formation. These lands are prospective for oil production from the Duvernay Formation and have remaining tenure of approximately 2.5 years.

These lands are situated in an area with prolific land activity and offsetting development in the Kaybob Duvernay by Canadian Natural and Whitecap.

Whitecap drilled a multi-well Duvernay pad in the volatile oil window in 2024 which it brought on at a peak 30-day production rate of approximately 1,550 boe/d per well (75% liquids) and has continued drilling with subsequent pads and further optimization of the completions design.

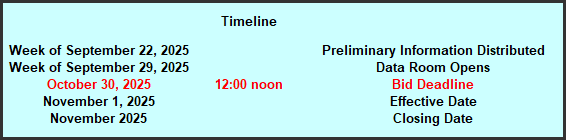

PROCESS & TIMELINE

Sayer Energy Advisors is accepting proposals relating to this process until 12:00 pm on Thursday October 30, 2025. Rand's preference would be a cash sale of the Properties.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process.

Sayer Energy Advisors is accepting proposals from interested parties until

noon on Thursday October 30, 2025.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: mineral property reports, geological and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.