Offering Details

Back

Under Review / Integrity Oil Operations Ltd.

Integrity Oil Operations Ltd.

Property Divestiture

Property DivestitureBid Deadline: November 27, 2025

12:00 PM

Download Full PDF - Printable

OVERVIEW

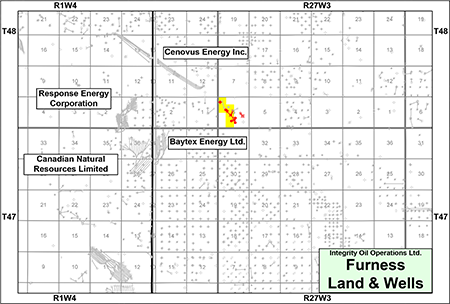

Integrity Oil Operations Ltd., the operating entity of Integrity Oil & Gas Ltd. (“Integrity” or the “Company”) has engaged Sayer Energy Advisors to assist the Company with the sale of its oil and natural gas interests located in the Furness area of Saskatchewan (the “Property”).The Company holds a 100% working interest in P&NG rights from surface to the base of the Mannville Group in approximately 3 quarter sections (13 LSDs) of land in Section 06-048-27W3.

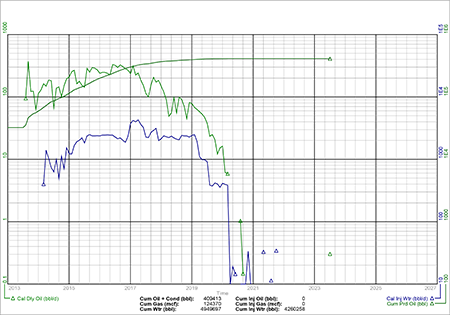

There is no current production from the Property. Prior to being shut-in, production from the Property averaged as high as approximately 115 boe/d, consisting of 80 bbl/d of oil and 200 Mcf/d of natural gas.

FURNESS

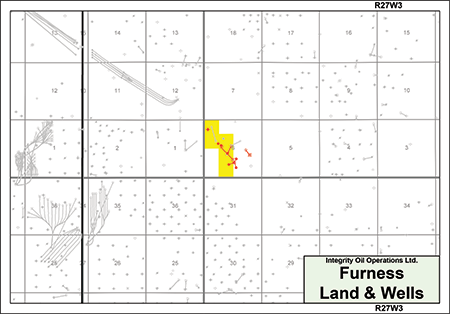

Township 48, Range 27 W3In the Furness area of Saskatchewan, the Company holds a 100% working interest in P&NG rights from surface to the base of the Mannville Group in approximately 3 quarter sections (13 LSDs) of land in Section 06-048-27W3.

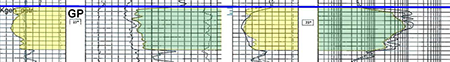

The Property has been developed primarily in the GP Member of the Mannville Group. Integrity has an interest in 9 non-producing wells on its lands.

The Company has a saltwater disposal facility located at 121/06-06-048-27W3/02 and a water handling and injection facility located at 121/11-06-048-27W3 with three-phase electrical power.

There is no current production from the Property. Prior to being shut-in, production from the Property was approximately 80 bbl/d of oil.

The following production plot shows historical gross production from the Property. Prior to being shut-in, production from the Property averaged as high as approximately 115 boe/d, consisting of 80 bbl/d of oil and 200 Mcf/d of natural gas.

The Company has identified two separate GP channels (north and south channels) oriented northwest-southeast over its lands at Furness. Total original oil in place was calculated to be over 8.5 million barrels with a low recovery factor to date in both channels.

The Property is also equipped for a waterflood in the north channel, including a water source well at 191/06-06-048-27W3/00 and an inactive disposal well at 191/08-06-048-27W3/02. All wells in the north channel are equipped as single well batteries and have water transfer pumps that transfers produced water to the 121/11-06 water facility via flowline.

The north GP channel ranges from 10 metres to 12 metres thick, with average porosity in excess of 33% and is approved for waterflooding. Once pressure maintenance operations begin, the two shut-in wells which are fully equipped with single well batteries, can be re-started.

The following well logs show the GP reservoir in the north channel.

The south GP channel ranges from 11 metres to 13 metres thick, with average porosity in excess of 33%. Two wells which were directionally drilled from a single wellsite are currently shut-in and require remedial work to restart.

The following well logs show the GP reservoir in the south channel. The two wells in the south channel are fully equipped for production and water transferring to the 121/06-06-048-27W3/02 salt water disposal facility.

There is offsetting production in the Mannville from various operators including Baytex Energy Ltd., Canadian Natural Resources Limited, Cenovus Energy Inc. and Response Energy Corporation.

Furness Facilities

The Company has a saltwater disposal facility in the south channel located at 121/06-06-048-27W3/02 and a salt water disposal facility in the north channel at 121/11-06-048-27W3 which has all required equipment for water handling and water injection:

2 - 1,000 barrel Coated Water Tanks

1 - Multi-stage Horizonal Water Pump

1 - 100 HP Electric Motor

1 - 25 HP Centrifugal Charge Pump

Housed in steel building. All gauges and sensors are equipped with remote access (SCADA).

Furness Reserves

Integrity does not have a current third-party reserve report relating to the Property.

Furness Liability Assessment as of September 11, 2025

As of September 11, 2025, the Property had a deemed net asset value of ($362,925) (deemed assets of $0 and deemed liabilities of $362,925), with an LMR ratio of 0.00.

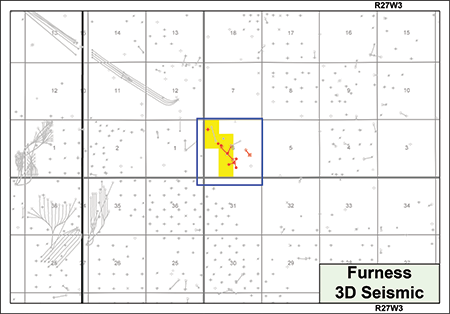

Furness Seismic

When Integrity acquired the Property from the previous operator, Sojourn Energy Inc., Sojourn retained its interests in the proprietary 3D seismic associated with Furness, as illustrated on the following plat.

Sojourn is willing to entertain offers for its interests in the seismic data at Furness. Further details on the seismic will be available for parties that execute a confidentiality agreement.

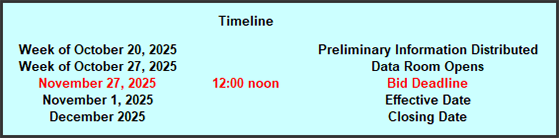

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers to acquire the Property until 12:00 pm on Thursday, November 27, 2025.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday November 27, 2025.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Property with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, equipment listing, and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Property please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.