Offering Details

Back

Under Review / KSV Restructuring Inc. - Blue Sky Resources Ltd.

KSV Restructuring Inc. - Blue Sky Resources Ltd.

Insolvency Sale

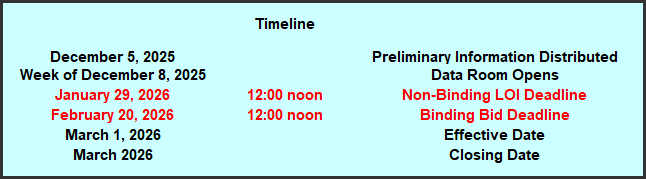

Insolvency SaleBid Deadline: January 29, 2026

12:00 PM

Download Full PDF - Printable

OVERVIEW

On September 24, 2025, Blue Sky Resources Ltd. (“Blue Sky” or the “Company”) filed a Notice of Intention to Make a Proposal pursuant to the Bankruptcy and Insolvency Act, RSC 1985, c. B-3, (the “NOI Proceedings”). KSV Restructuring Inc. (“KSV”) was appointed the proposal trustee (the “Proposal Trustee”) in the NOI Proceedings. On November 20, 2025, the Court of King’s Bench of Alberta granted an order to conduct a Sales and Investment Solicitation Process (the “SISP”). The Company has engaged Sayer Energy Advisors as sales agent to assist it with the SISP.

The SISP is intended to solicit offers for the business and the property of the Company, in whole or in part, or investments related thereto, subject to Court approval. The SISP is intended to find the highest and/or best offer for a restructuring and/or refinancing of the Company, a sale of the Company’s property on a going concern or piecemeal basis, or a combination thereof, or other similar transaction. A copy of the SISP can be found here.

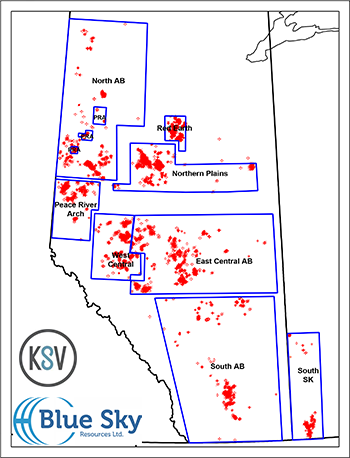

Blue Sky’s assets consist of both operated and non-operated interests located throughout Alberta and Saskatchewan (the “Properties”). For this offering, the Properties are separated into the following geographical packages: East Central AB, North AB, Northern Plains AB, Peace River Arch AB, Red Earth AB, South AB, West Central AB and South SK.

Average production net to Blue Sky from the Properties for the first eight months of 2025 was approximately 2,800 boe/d consisting of 8.8 MMcf/d of natural gas and 1,332 barrels of oil and natural gas liquids per day.

Details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

The SISP is intended to solicit offers for the business and the property of the Company, in whole or in part, or investments related thereto, subject to Court approval. The SISP is intended to find the highest and/or best offer for a restructuring and/or refinancing of the Company, a sale of the Company’s property on a going concern or piecemeal basis, or a combination thereof, or other similar transaction. A copy of the SISP can be found here.

Blue Sky’s assets consist of both operated and non-operated interests located throughout Alberta and Saskatchewan (the “Properties”). For this offering, the Properties are separated into the following geographical packages: East Central AB, North AB, Northern Plains AB, Peace River Arch AB, Red Earth AB, South AB, West Central AB and South SK.

Average production net to Blue Sky from the Properties for the first eight months of 2025 was approximately 2,800 boe/d consisting of 8.8 MMcf/d of natural gas and 1,332 barrels of oil and natural gas liquids per day.

Details relating to the Properties will be available in the virtual data room for parties that execute a confidentiality agreement.

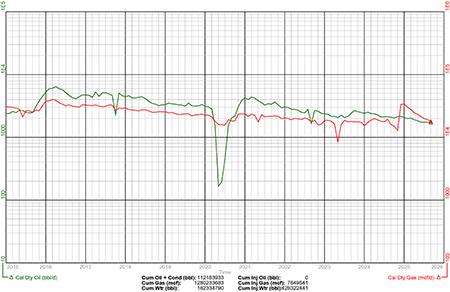

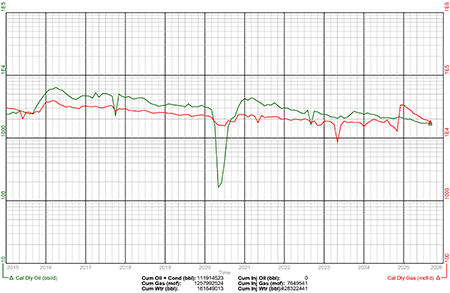

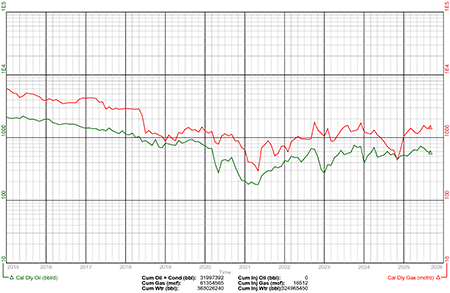

Production Overview

Average production net to Blue Sky from the Properties for the first eight months of 2025 was approximately 2,800 boe/d consisting of 8.8 MMcf/d of natural gas and 1,332 barrels of oil and natural gas liquids per day.

Average production net to Blue Sky from the Properties for the first eight months of 2025 was approximately 2,800 boe/d consisting of 8.8 MMcf/d of natural gas and 1,332 barrels of oil and natural gas liquids per day.

Liability Assessment Overview

Alberta

As of November 28, 2025, the Alberta properties had a deemed liability value of $230.7 million.

Saskatchewan

As of November 27, 2025, the South SK package had a deemed liability value of $156,900.

Facilities Overview

Blue Sky holds various working interests in facilities associated with the Properties. Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Marketing Overview

Blue Sky holds various marketing and transportation contracts relating to natural gas, crude oil and natural gas liquids production associated with the Properties including Macquarie Energy Canada Ltd. for various areas, Petrogas Energy Corp. and Phillips 66 Canada Ltd. for Red Earth (Senex), Petrogas Energy Corp. and Trafigura Canada General Partnership for Northern Plains AB (Utikuma, Slave Lake), Shell Trading Canada for Northern Plains AB (Utikuma), BP Canada Energy Group ULC for the Nova Gas Transmission Line.

Summary information and details on Blue Sky’s marketing and transportation contracts are available in the virtual data room for parties that execute a confidentiality agreement.

Seismic Overview

The Company holds wide-ranging proprietary and trade 2D and 3D seismic data associated with the Properties. Further details will be available in the virtual data room for parties that execute a confidentiality agreement.

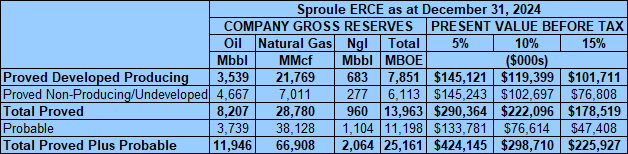

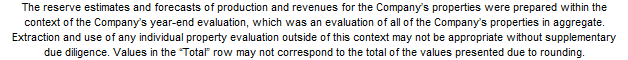

Reserves Overview

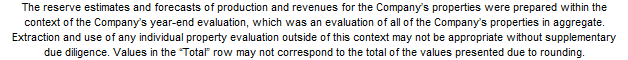

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Sproule estimated that as at December 31, 2024 the Properties contained remaining proved plus probable reserves of 14.0 million barrels of oil and natural gas liquids and 66.9 Bcf of natural gas (25.2 million boe), with an estimated net present value of approximately $298.7 million using forecast pricing at a 10% discount.

Alberta

As of November 28, 2025, the Alberta properties had a deemed liability value of $230.7 million.

Saskatchewan

As of November 27, 2025, the South SK package had a deemed liability value of $156,900.

Facilities Overview

Blue Sky holds various working interests in facilities associated with the Properties. Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Marketing Overview

Blue Sky holds various marketing and transportation contracts relating to natural gas, crude oil and natural gas liquids production associated with the Properties including Macquarie Energy Canada Ltd. for various areas, Petrogas Energy Corp. and Phillips 66 Canada Ltd. for Red Earth (Senex), Petrogas Energy Corp. and Trafigura Canada General Partnership for Northern Plains AB (Utikuma, Slave Lake), Shell Trading Canada for Northern Plains AB (Utikuma), BP Canada Energy Group ULC for the Nova Gas Transmission Line.

Summary information and details on Blue Sky’s marketing and transportation contracts are available in the virtual data room for parties that execute a confidentiality agreement.

Seismic Overview

The Company holds wide-ranging proprietary and trade 2D and 3D seismic data associated with the Properties. Further details will be available in the virtual data room for parties that execute a confidentiality agreement.

Reserves Overview

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Sproule estimated that as at December 31, 2024 the Properties contained remaining proved plus probable reserves of 14.0 million barrels of oil and natural gas liquids and 66.9 Bcf of natural gas (25.2 million boe), with an estimated net present value of approximately $298.7 million using forecast pricing at a 10% discount.

EAST CENTRAL AB

Township 44-66, Range 3 W4 - 16 W5

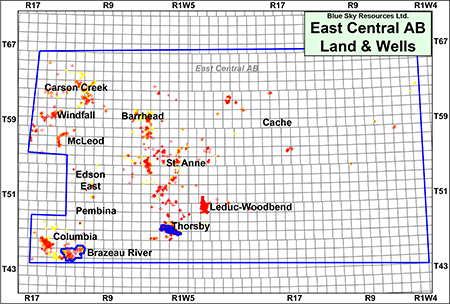

In the East Central AB package, Blue Sky’s main properties are in the Barrhead, Brazeau River, Cache, Carson Creek, Columbia, Edson East, Leduc-Woodbend, McLeod, Pembina, St. Anne, Thorsby and Windfall areas of Alberta, as shown on the following map.

In the East Central AB package, Blue Sky’s main properties are in the Barrhead, Brazeau River, Cache, Carson Creek, Columbia, Edson East, Leduc-Woodbend, McLeod, Pembina, St. Anne, Thorsby and Windfall areas of Alberta, as shown on the following map.

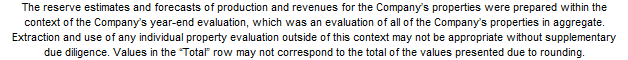

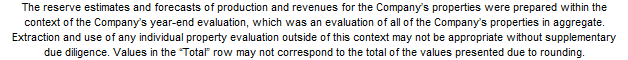

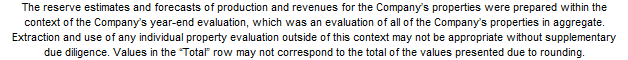

East Central AB Reserves

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Columbia Property

Sproule estimated that as at December 31, 2024 the Columbia property contained remaining proved plus probable reserves of 20.5 Bcf of natural gas and 3.8 million barrels of oil and natural gas liquids (7.2 million boe), with an estimated net present value of approximately $75.3 million using forecast pricing at a 10% discount.

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Columbia Property

Sproule estimated that as at December 31, 2024 the Columbia property contained remaining proved plus probable reserves of 20.5 Bcf of natural gas and 3.8 million barrels of oil and natural gas liquids (7.2 million boe), with an estimated net present value of approximately $75.3 million using forecast pricing at a 10% discount.

Central AB Misc. Property

Sproule estimated that as at December 31, 2024 the Central AB Misc. property contained remaining proved plus probable reserves of 16.0 Bcf of natural gas and 718,000 barrels of oil and natural gas liquids (3.4 million boe), with an estimated net present value of approximately $16.6 million using forecast pricing at a 10% discount.

The reserves associated with the Central AB Misc. property also includes reserves associated with the North AB, South AB and West Central AB packages.

Sproule estimated that as at December 31, 2024 the Central AB Misc. property contained remaining proved plus probable reserves of 16.0 Bcf of natural gas and 718,000 barrels of oil and natural gas liquids (3.4 million boe), with an estimated net present value of approximately $16.6 million using forecast pricing at a 10% discount.

The reserves associated with the Central AB Misc. property also includes reserves associated with the North AB, South AB and West Central AB packages.

East Central AB Liability Assessment

As of November 28, 2025, the East Central package had a deemed liability value of $34.2 million.

East Central AB Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

East Central AB Well List

Click here to download the complete well list in Excel.

As of November 28, 2025, the East Central package had a deemed liability value of $34.2 million.

East Central AB Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

East Central AB Well List

Click here to download the complete well list in Excel.

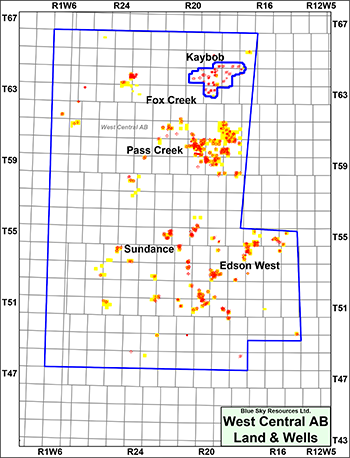

WEST CENTRAL AB

Township 48-65, Range 15 W5 - 1 W6

In the West Central AB package, Blue Sky’s main properties are in the Edson West, Fox Creek, Kaybob, Pass Creek and Sundance areas of Alberta, as shown on the following map.

In the West Central AB package, Blue Sky’s main properties are in the Edson West, Fox Creek, Kaybob, Pass Creek and Sundance areas of Alberta, as shown on the following map.

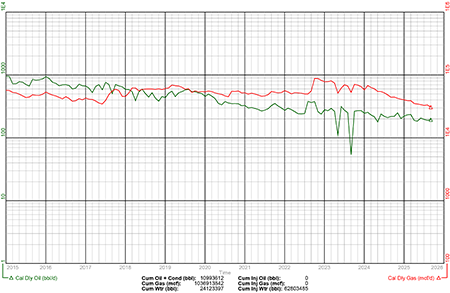

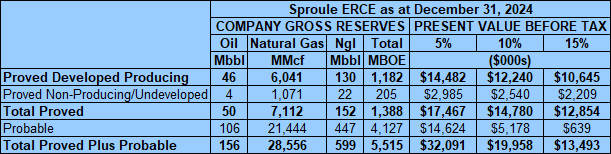

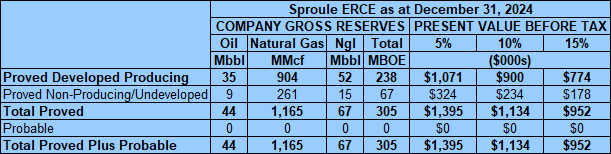

West Central AB Reserves

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Pass Creek Property

Sproule estimated that as at December 31, 2024 the Pass Creek property contained remaining proved plus probable reserves of 28.6 Bcf of natural gas and 755,000 barrels of oil and natural gas liquids (5.5 million boe), with an estimated net present value of approximately $20.0 million using forecast pricing at a 10% discount.

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Pass Creek Property

Sproule estimated that as at December 31, 2024 the Pass Creek property contained remaining proved plus probable reserves of 28.6 Bcf of natural gas and 755,000 barrels of oil and natural gas liquids (5.5 million boe), with an estimated net present value of approximately $20.0 million using forecast pricing at a 10% discount.

West AB Misc. Property

Sproule estimated that as at December 31, 2024 the West AB Misc. property contained remaining proved plus probable reserves of 1.2 Bcf of natural gas and 111,000 barrels of oil and natural gas liquids (305,000 boe), with an estimated net present value of approximately $1.1 million using forecast pricing at a 10% discount.

Sproule estimated that as at December 31, 2024 the West AB Misc. property contained remaining proved plus probable reserves of 1.2 Bcf of natural gas and 111,000 barrels of oil and natural gas liquids (305,000 boe), with an estimated net present value of approximately $1.1 million using forecast pricing at a 10% discount.

West Central AB Liability Assessment

As of November 28, 2025, the West Central package had a deemed liability value of $17.2 million.

West Central AB Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

West Central AB Well List

Click here to download the complete well list in Excel.

As of November 28, 2025, the West Central package had a deemed liability value of $17.2 million.

West Central AB Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

West Central AB Well List

Click here to download the complete well list in Excel.

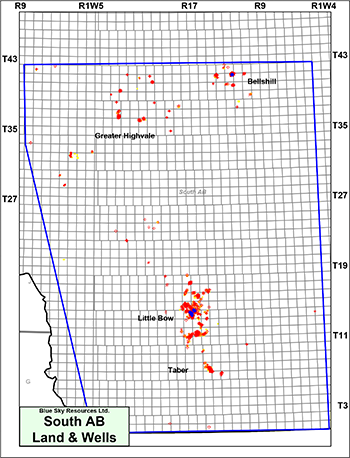

SOUTH AB

Township 1-42, Range 3 W4 - 8 W5

In the South AB package, Blue Sky’s main properties are in the Bellshill, Greater Highvale, Little Bow and Taber areas of Alberta, as shown on the following map.

In the South AB package, Blue Sky’s main properties are in the Bellshill, Greater Highvale, Little Bow and Taber areas of Alberta, as shown on the following map.

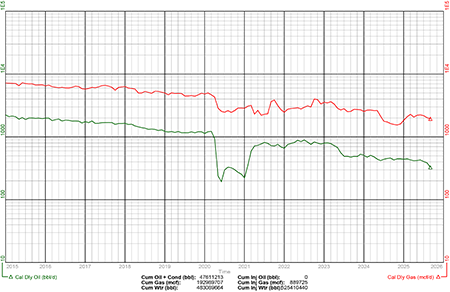

South AB Reserves

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Sproule estimated that as at December 31, 2024 the South AB package contained remaining proved plus probable reserves of 1.2 million barrels of oil and natural gas liquids and 763 MMcf of natural gas (1.3 million boe), with an estimated net present value of approximately $13.6 million using forecast pricing at a 10% discount.

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Sproule estimated that as at December 31, 2024 the South AB package contained remaining proved plus probable reserves of 1.2 million barrels of oil and natural gas liquids and 763 MMcf of natural gas (1.3 million boe), with an estimated net present value of approximately $13.6 million using forecast pricing at a 10% discount.

South AB Liability Assessment

As of November 28, 2025, the South AB package had a deemed liability value of $34.8 million.

South AB Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

South AB Well List

Click here to download the complete well list in Excel.

As of November 28, 2025, the South AB package had a deemed liability value of $34.8 million.

South AB Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

South AB Well List

Click here to download the complete well list in Excel.

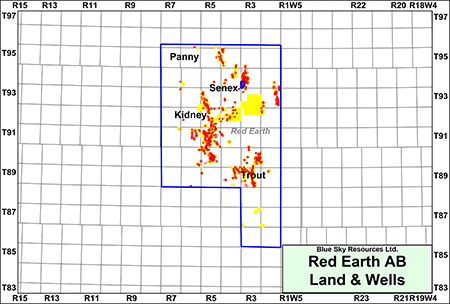

RED EARTH AB

Township 56-96, Range 2-7 W5

In the Red Earth AB package, Blue Sky’s main properties are in the Kidney, Panny, Senex and Trout areas of Alberta, as shown on the following map.

In the Red Earth AB package, Blue Sky’s main properties are in the Kidney, Panny, Senex and Trout areas of Alberta, as shown on the following map.

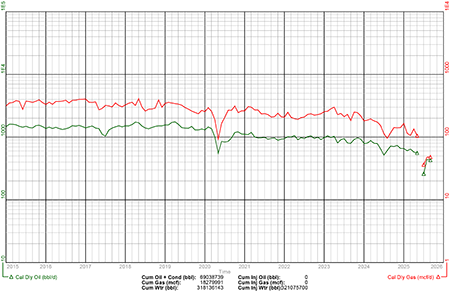

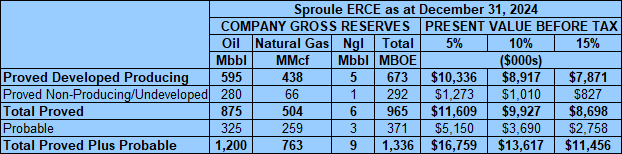

Red Earth AB Reserves

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Sproule estimated that as at December 31, 2024 the Red Earth package contained remaining proved plus probable reserves of 3.1 million barrels of oil (3.1 million boe), with an estimated net present value of approximately $75.0 million using forecast pricing at a 10% discount.

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Sproule estimated that as at December 31, 2024 the Red Earth package contained remaining proved plus probable reserves of 3.1 million barrels of oil (3.1 million boe), with an estimated net present value of approximately $75.0 million using forecast pricing at a 10% discount.

Red Earth AB Liability Assessment

As of November 28, 2025, the Red Earth package had a deemed liability value of $60.0 million.

Red Earth AB Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Red Earth AB Well List

Click here to download the complete well list in Excel.

As of November 28, 2025, the Red Earth package had a deemed liability value of $60.0 million.

Red Earth AB Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Red Earth AB Well List

Click here to download the complete well list in Excel.

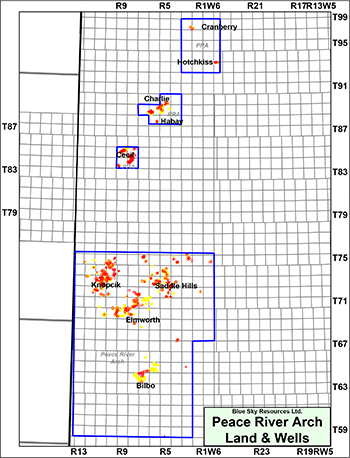

PEACE RIVER ARCH AB

Township 59-97, Range 28 W5 - 13 W6

In the Peace River Arch AB package, Blue Sky’s main properties are in the Bilbo, Cecil, Charlie, Cranberry, Elmworth, Habay, Hotchkiss, Knopcik and Saddle Hills areas of Alberta as well as certain minor interests, as shown on the following map.

In the Peace River Arch AB package, Blue Sky’s main properties are in the Bilbo, Cecil, Charlie, Cranberry, Elmworth, Habay, Hotchkiss, Knopcik and Saddle Hills areas of Alberta as well as certain minor interests, as shown on the following map.

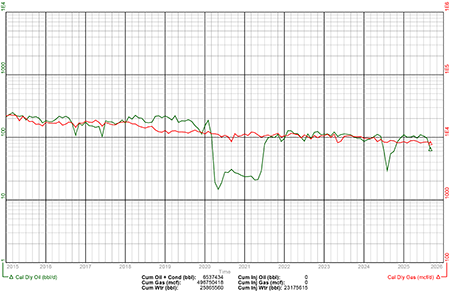

Peace River Arch AB Reserves

The Peace River Arch AB package was not evaluated as part of the Sproule Report.

Peace River Arch AB Liability Assessment

The Peace River Arch AB package was not evaluated as part of the Sproule Report.

Peace River Arch AB Liability Assessment

As of November 28, 2025, the Peach River Arch AB package had a deemed liability value of $11.7 million.

Peace River Arch AB Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Peace River Arch AB Well List

Click here to download the complete well list in Excel.

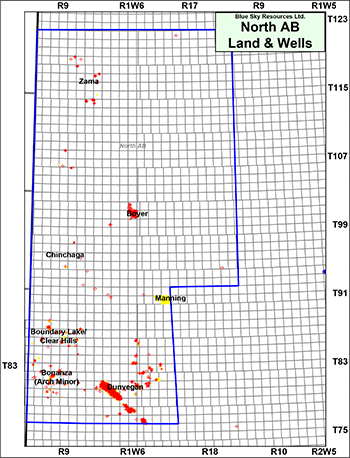

NORTH AB

Township 77-121, Range 15 W5 - 13 W6

Within the North AB package, Blue Sky’s main properties are in the Boundary Lake/Clear Hills, Bonanza (Arch Minor), Boyer, Chinchaga, Manning, Dunvegan and Zama areas of Alberta, as shown on the following map.

Within the North AB package, Blue Sky’s main properties are in the Boundary Lake/Clear Hills, Bonanza (Arch Minor), Boyer, Chinchaga, Manning, Dunvegan and Zama areas of Alberta, as shown on the following map.

North AB Reserves

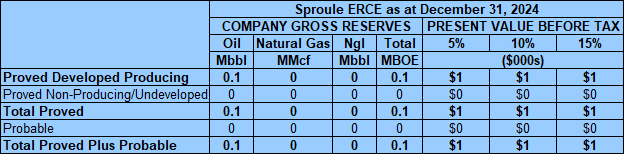

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Sproule estimated that as at December 31, 2024 the North AB package contained remaining proved plus probable reserves of 100 barrels of oil (100 boe), with an estimated net present value of approximately $1,000 using forecast pricing at a 10% discount.

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Sproule estimated that as at December 31, 2024 the North AB package contained remaining proved plus probable reserves of 100 barrels of oil (100 boe), with an estimated net present value of approximately $1,000 using forecast pricing at a 10% discount.

North AB Liability Assessment

As of November 28, 2025, the North AB package had a deemed liability value of $5.6 million.

North AB Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

North AB Well List

Click here to download the complete well list in Excel.

As of November 28, 2025, the North AB package had a deemed liability value of $5.6 million.

North AB Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

North AB Well List

Click here to download the complete well list in Excel.

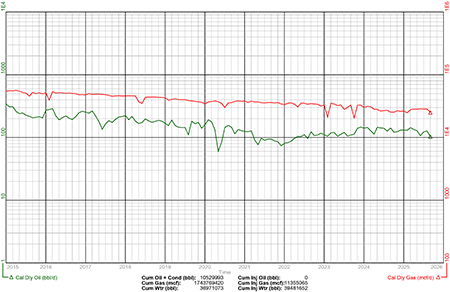

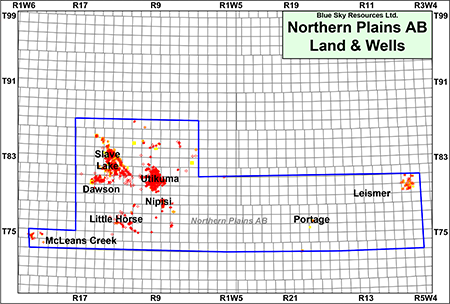

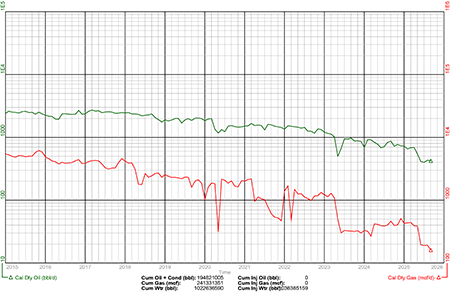

NORTHERN PLAINS AB

Township 74-87, Range 5 W4 - 22 W5

Within the Northern Plains AB package, Blue Sky’s main properties are in the Dawson, Little Horse, Leismer, McLeans Creek, Nipisi, Portage, Slave Lake and Utikuma areas of Alberta, as shown on the following map.

Within the Northern Plains AB package, Blue Sky’s main properties are in the Dawson, Little Horse, Leismer, McLeans Creek, Nipisi, Portage, Slave Lake and Utikuma areas of Alberta, as shown on the following map.

Northern Plains AB Reserves

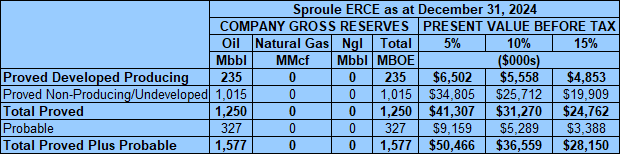

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Nipisi Property

Sproule estimated that as at December 31, 2024 the Nipisi property contained remaining proved plus probable reserves of 1.6 million barrels of oil (1.6 million boe), with an estimated net present value of approximately $36.6 million using forecast pricing at a 10% discount.

Sproule ERCE (“Sproule”) prepared an independent reserves evaluation of the Properties as part of the Company’s year-end reporting (the “Sproule Report”). The Sproule Report is effective December 31, 2024, using an average of GLJ Ltd., McDaniel & Associates Consultants Ltd. and Sproule’s December 31, 2024 forecast pricing.

Nipisi Property

Sproule estimated that as at December 31, 2024 the Nipisi property contained remaining proved plus probable reserves of 1.6 million barrels of oil (1.6 million boe), with an estimated net present value of approximately $36.6 million using forecast pricing at a 10% discount.

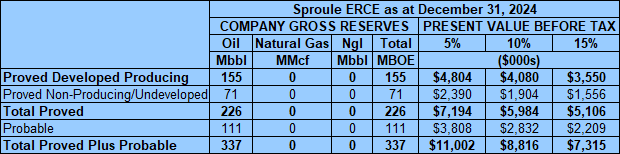

Utikuma Property

Sproule estimated that as at December 31, 2024 the Utikuma property contained remaining proved plus probable reserves of 337,000 barrels of oil (337,000 boe), with an estimated net present value of approximately $8.8 million using forecast pricing at a 10% discount.

Sproule estimated that as at December 31, 2024 the Utikuma property contained remaining proved plus probable reserves of 337,000 barrels of oil (337,000 boe), with an estimated net present value of approximately $8.8 million using forecast pricing at a 10% discount.

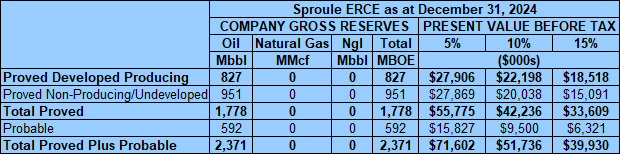

Slave Lake Property

Sproule estimated that as at December 31, 2024 the Slave Lake property contained remaining proved plus probable reserves of 2.4 million barrels of oil (2.4 million boe), with an estimated net present value of approximately $51.7 million using forecast pricing at a 10% discount.

Sproule estimated that as at December 31, 2024 the Slave Lake property contained remaining proved plus probable reserves of 2.4 million barrels of oil (2.4 million boe), with an estimated net present value of approximately $51.7 million using forecast pricing at a 10% discount.

Northern Plains AB Liability Assessment

As of November 28, 2025, the Northern Plains property had a deemed liability value of $65.4 million.

Northern Plains AB Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

Northern Plains AB Well List

Click here to download the complete well list in Excel.

SOUTH SK

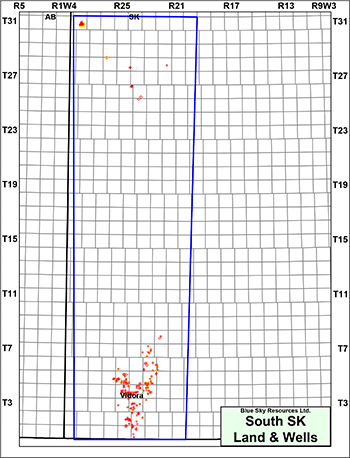

Township 1-31, Range 22-28 W3

Within the South SK package, Blue Sky’s main properties are in the Vidora and certain miscellaneous areas of Saskatchewan, as shown on the following map. Blue Sky’s interests in Saskatchewan consist of primarily non-operated, shallow natural gas wells.

Within the South SK package, Blue Sky’s main properties are in the Vidora and certain miscellaneous areas of Saskatchewan, as shown on the following map. Blue Sky’s interests in Saskatchewan consist of primarily non-operated, shallow natural gas wells.

South SK Reserves

The South SK package was not evaluated as part of the Sproule Report.

South SK Liability Assessment

The South SK package was not evaluated as part of the Sproule Report.

South SK Liability Assessment

As of November 27, 2025, the South SK package had a deemed liability value of $156,900.

South SK Well List

Click here to download the complete well list in Excel.

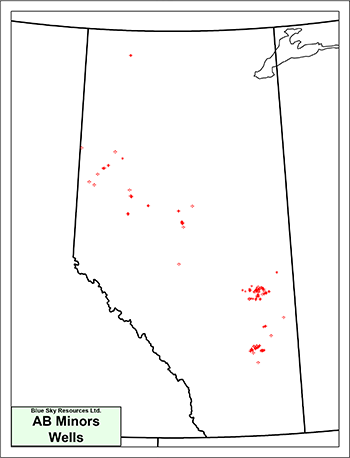

AB MINORS

Blue Sky has an interest in various minor interests in Alberta, as shown on the following map which are not included in any of the packages described previously.

There is no current production from the AB Minors package.

There is no current production from the AB Minors package.

AB Minors Reserves

The AB Minors package was not evaluated as part of the Sproule Report.

AB Minors Liability Assessment

As of November 28, 2025, the Minors properties had a deemed liability value of $1.9 million.

AB Minors Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

AB Minors Well List

Click here to download the complete well list in Excel.

The AB Minors package was not evaluated as part of the Sproule Report.

AB Minors Liability Assessment

As of November 28, 2025, the Minors properties had a deemed liability value of $1.9 million.

AB Minors Facilities

Details on Blue Sky’s facility interests are available in the virtual data room for parties that execute a confidentiality agreement.

AB Minors Well List

Click here to download the complete well list in Excel.

PROCESS & TIMELINE

Sayer Energy Advisors is accepting offers, as outlined in the SISP, until 12:00 pm on Thursday January 29, 2026.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process,

subject to the terms outlined in the SISP.

transaction(s) with the party(ies) submitting the most acceptable proposal(s) at the conclusion of the process,

subject to the terms outlined in the SISP.

Sayer Energy Advisors is accepting offers, as outlined in the SISP,

until noon on Thursday January 29, 2026.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (brye@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, most recent net lease operating statements, the Sproule Report, deemed liability information, and other relevant corporate, financial and technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Ben Rye, Tom Pavic or Sydney Birkett at 403.266.6133.