Offering Details

Back

Current Offerings / Archer Exploration Corp.

Archer Exploration Corp.

Property Divestiture

Property DivestitureBid Deadline: March 19, 2026

12:00 PM

Download Full PDF - Printable

OVERVIEW

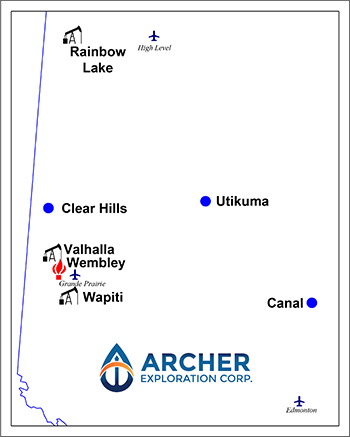

Archer Exploration Corp. (“Archer” or the “Company”) has engaged Sayer Energy Advisors to assist it with the sale of certain of its oil and natural gas properties located in the Canal, Clear Hills, Rainbow Lake, Utikuma, Valhalla, Wapiti and Wembley areas of Alberta (the “Properties”).

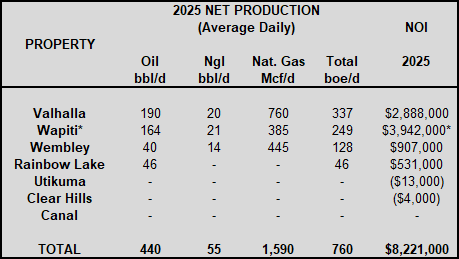

Average daily sales production net to Archer from the Properties for the year ended December 31, 2025 was approximately 760 boe/d, consisting of 495 barrels of oil and natural gas liquids per day and 1.6 MMcf/d of natural gas.

Operating income net to Archer from the Properties for the year ended December 31, 2025 was approximately $8.2 million.

As of January 1, 2026, the Properties had a deemed liability value of $8.5 million.

Average daily sales production net to Archer from the Properties for the year ended December 31, 2025 was approximately 760 boe/d, consisting of 495 barrels of oil and natural gas liquids per day and 1.6 MMcf/d of natural gas.

Operating income net to Archer from the Properties for the year ended December 31, 2025 was approximately $8.2 million.

As of January 1, 2026, the Properties had a deemed liability value of $8.5 million.

Production Overview

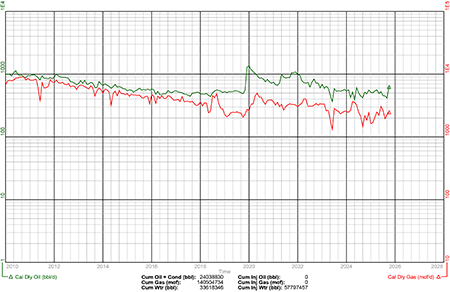

Average daily sales production net to Archer from the Properties for the year ended December 31, 2025 was approximately 760 boe/d, consisting of 495 barrels of oil and natural gas liquids per day and 1.6 MMcf/d of natural gas.

Operating income net to Archer from the Properties for the year ended December 31, 2025 was approximately $8.2 million.

Average daily sales production net to Archer from the Properties for the year ended December 31, 2025 was approximately 760 boe/d, consisting of 495 barrels of oil and natural gas liquids per day and 1.6 MMcf/d of natural gas.

Operating income net to Archer from the Properties for the year ended December 31, 2025 was approximately $8.2 million.

*Wapiti values from Q4 2025 – Current production estimated at ~230 boe/d

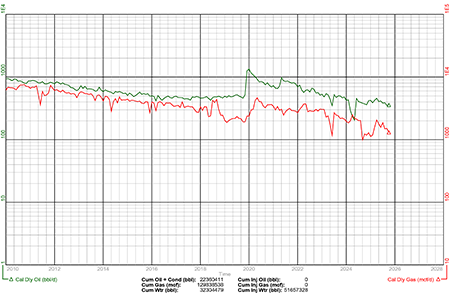

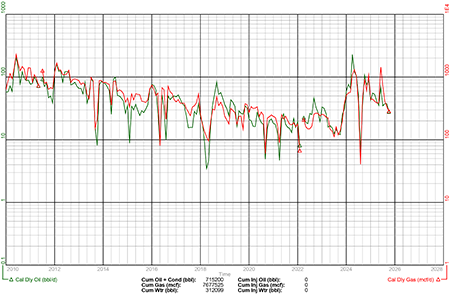

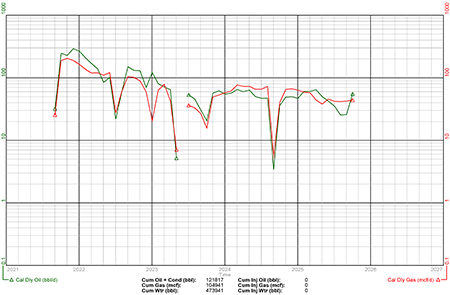

Gross Production Group Plot of the Properties

Reserves Overview

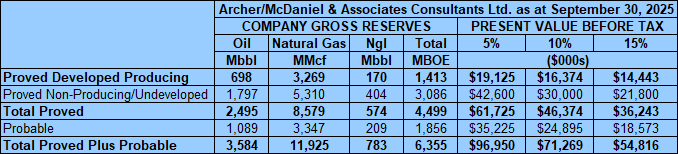

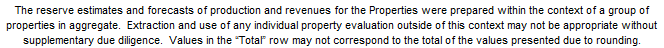

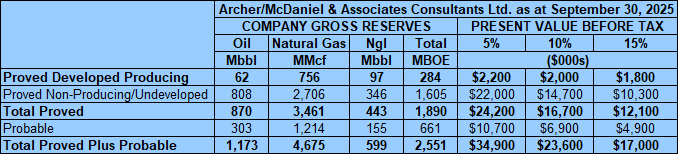

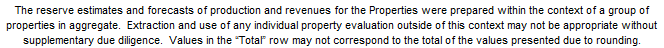

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties (the “McDaniel Report”) with the exception of Archer’s interests at Wapiti, which is a preliminary report as at December 31, 2025. The McDaniel Report is effective September 30, 2025 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at October 1, 2025.

Archer used the data from the McDaniel Report to prepare reports on the Properties. The economic runs prepared by McDaniel for the wells in the individual packages were grouped into the respective Properties by Archer.

Archer/McDaniel estimated that, as at September 30, 2025, the Properties contained remaining proved plus probable reserves of 4.4 million barrels of oil and natural gas liquids and 11.9 Bcf of natural gas (6.4 million boe), with an estimated net present value of $71.3 million using forecast pricing at a 10% discount. The reserve volumes and values associated with Archer’s interests at Wapiti are included above and in the table below.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties (the “McDaniel Report”) with the exception of Archer’s interests at Wapiti, which is a preliminary report as at December 31, 2025. The McDaniel Report is effective September 30, 2025 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at October 1, 2025.

Archer used the data from the McDaniel Report to prepare reports on the Properties. The economic runs prepared by McDaniel for the wells in the individual packages were grouped into the respective Properties by Archer.

Archer/McDaniel estimated that, as at September 30, 2025, the Properties contained remaining proved plus probable reserves of 4.4 million barrels of oil and natural gas liquids and 11.9 Bcf of natural gas (6.4 million boe), with an estimated net present value of $71.3 million using forecast pricing at a 10% discount. The reserve volumes and values associated with Archer’s interests at Wapiti are included above and in the table below.

Liability Assessment as of January 1, 2026

As of January 1, 2026, the Properties had a deemed liability value of $8.5 million.

As of January 1, 2026, the Properties had a deemed liability value of $8.5 million.

VALHALLA

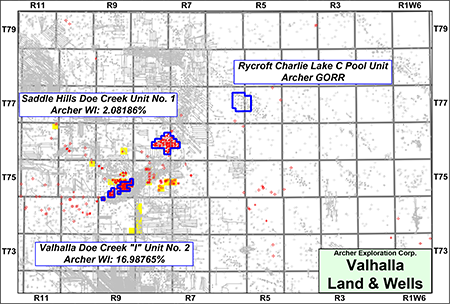

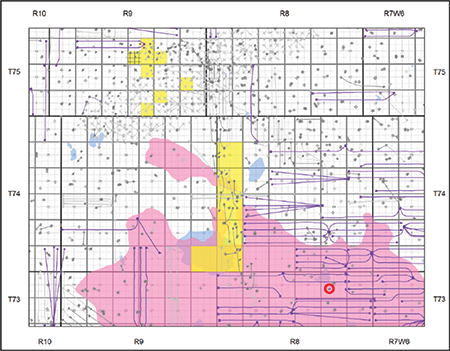

Township 73-79, Range 1-12 W6

At Valhalla, Archer holds various working interests including a 2.08% working interest in the Saddle Hills Doe Creek Unit No. 1 and a 16.99% working interest in the Valhalla Doe Creek “I” Unit No. 2, both operated by Canadian Natural Resources Limited. The Company also holds a GORR interest in the Rycroft Charlie Lake C Pool Unit operated by Spoke Resources Ltd.

Archer’s production at Valhalla is primarily from the Charlie Lake, Doe Creek, Dunvegan, Halfway and Montney formations.

Average daily sales production net to Archer from Valhalla for the year ended December 31, 2025 was approximately 337 boe/d, consisting of 210 bbl/d of oil and natural gas liquids and 760 Mcf/d of natural gas.

Operating income net to Archer from Valhalla for the year ended December 31, 2025 was approximately $2.9 million.

At Valhalla, Archer holds various working interests including a 2.08% working interest in the Saddle Hills Doe Creek Unit No. 1 and a 16.99% working interest in the Valhalla Doe Creek “I” Unit No. 2, both operated by Canadian Natural Resources Limited. The Company also holds a GORR interest in the Rycroft Charlie Lake C Pool Unit operated by Spoke Resources Ltd.

Archer’s production at Valhalla is primarily from the Charlie Lake, Doe Creek, Dunvegan, Halfway and Montney formations.

Average daily sales production net to Archer from Valhalla for the year ended December 31, 2025 was approximately 337 boe/d, consisting of 210 bbl/d of oil and natural gas liquids and 760 Mcf/d of natural gas.

Operating income net to Archer from Valhalla for the year ended December 31, 2025 was approximately $2.9 million.

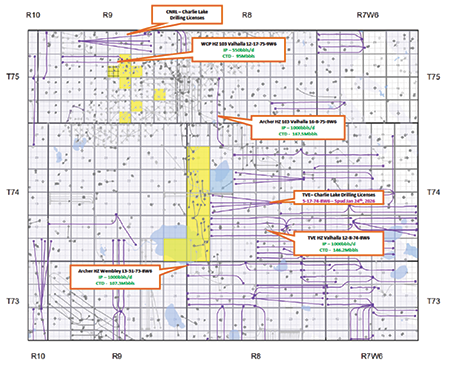

Charlie Lake Formation

The Charlie Lake Formation at Valhalla was deposited in a Sabka environment with interbedded dolomite and anhydrite. Lateral discontinuity within these beds leads to excellent reservoir conditions for horizontal multi-stage frac completions.

The target zone is found at depths between 1,900-2,050 metres.

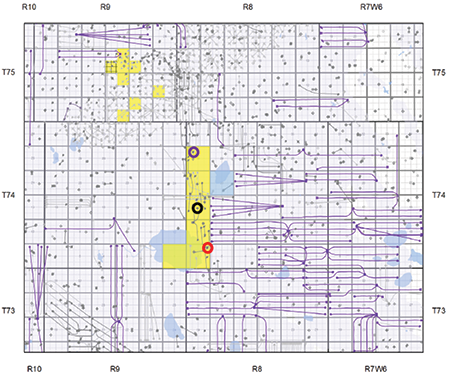

At Valhalla, Archer is targeting light oil within the Lower Charlie Lake Formation. There is abundant Charlie Lake oil production from offsetting producers including Canadian Natural, Tamarack Valley Energy Ltd., Whitecap Resources Inc. as well as Archer’s core Charlie Lake production as shown on the following map. Archer’s non-core Charlie Lake rights associated with the Valhalla property are shown in yellow.

The Charlie Lake Formation at Valhalla was deposited in a Sabka environment with interbedded dolomite and anhydrite. Lateral discontinuity within these beds leads to excellent reservoir conditions for horizontal multi-stage frac completions.

The target zone is found at depths between 1,900-2,050 metres.

At Valhalla, Archer is targeting light oil within the Lower Charlie Lake Formation. There is abundant Charlie Lake oil production from offsetting producers including Canadian Natural, Tamarack Valley Energy Ltd., Whitecap Resources Inc. as well as Archer’s core Charlie Lake production as shown on the following map. Archer’s non-core Charlie Lake rights associated with the Valhalla property are shown in yellow.

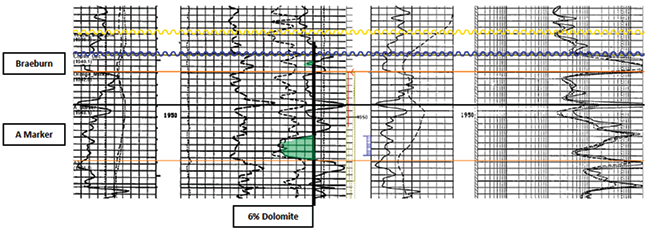

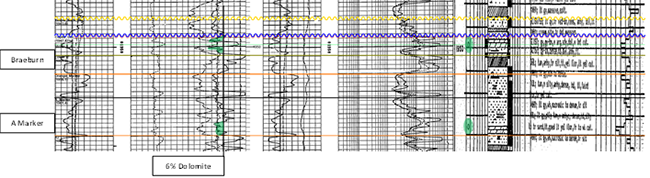

Charlie Lake Formation - Braeburn

Archer Valhalla 00/16-06-074-08W6/00

Charlie Lake Formation Type Log

Archer Valhalla 00/06-18-074-08W6/00

Charlie Lake Formation Type Log

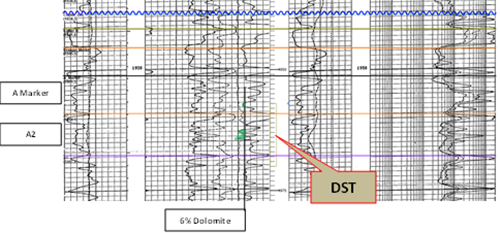

Charlie Lake Formation - A Marker

The A Marker reservoir within the Valhalla area is comprised of fine-grained dolomitic mudstone, with porosity ranges from 9-12%. One vertical producer has been tested in this area and has produced in excess of 114 Mbbl to date.

The A Marker reservoir within the Valhalla area is comprised of fine-grained dolomitic mudstone, with porosity ranges from 9-12%. One vertical producer has been tested in this area and has produced in excess of 114 Mbbl to date.

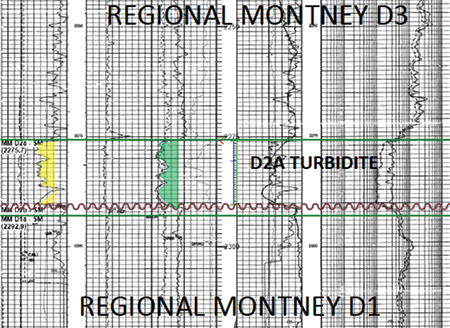

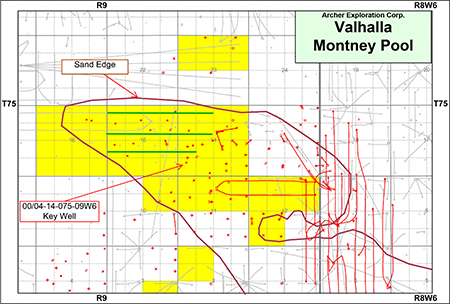

Montney Formation

The target reservoir within the Montney Formation at Valhalla is a turbidite deposit with average thickness of 17 metres. Porosity ranges between 9-15% with permeability greater than 1 mD.

The target reservoir within the Montney Formation at Valhalla is a turbidite deposit with average thickness of 17 metres. Porosity ranges between 9-15% with permeability greater than 1 mD.

As shown on the following map, the Company has identified potential for multi-lateral open hole wells on its lands at Valhalla. The pool has produced 3.8 MMbbl of oil to date with remaining oil in place of 3.2 MMbbl.

Archer is seeing excellent waterflood response in the Montney B Pool at Valhalla. The Company believes ample upside remains in optimizing the waterflood pattern. The Commingled Montney pool CMG Pool 009 – Montney C,LL,JJJ operated by Whitecap is an existing analogue immediately offsetting Archer’s lands to the north.

Archer is seeing excellent waterflood response in the Montney B Pool at Valhalla. The Company believes ample upside remains in optimizing the waterflood pattern. The Commingled Montney pool CMG Pool 009 – Montney C,LL,JJJ operated by Whitecap is an existing analogue immediately offsetting Archer’s lands to the north.

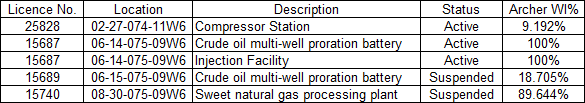

Valhalla Facilities

The Company holds working interests in the following facilities at Valhalla.

The Company holds working interests in the following facilities at Valhalla.

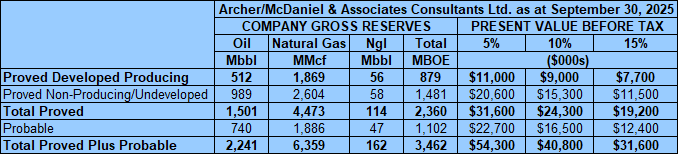

Valhalla Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties (the “McDaniel Report”). The McDaniel Report is effective September 30, 2025 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at October 1, 2025.

Archer used the data from the McDaniel Report to prepare reports on the Properties. The economic runs prepared by McDaniel for the wells in the individual packages were grouped into the respective Properties by Archer.

Archer/McDaniel estimated that, as at September 30, 2025, the Valhalla property contained remaining proved plus probable reserves of 2.4 million barrels of oil and natural gas liquids and 6.4 Bcf of natural gas (3.5 million boe), with an estimated net present value of $40.8 million using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties (the “McDaniel Report”). The McDaniel Report is effective September 30, 2025 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at October 1, 2025.

Archer used the data from the McDaniel Report to prepare reports on the Properties. The economic runs prepared by McDaniel for the wells in the individual packages were grouped into the respective Properties by Archer.

Archer/McDaniel estimated that, as at September 30, 2025, the Valhalla property contained remaining proved plus probable reserves of 2.4 million barrels of oil and natural gas liquids and 6.4 Bcf of natural gas (3.5 million boe), with an estimated net present value of $40.8 million using forecast pricing at a 10% discount.

Valhalla Liability Assessment

As of January 1, 2026, the Valhalla property had a deemed liability value of $5.5 million.

Valhalla Well List

Click here to download the complete well list in Excel.

As of January 1, 2026, the Valhalla property had a deemed liability value of $5.5 million.

Valhalla Well List

Click here to download the complete well list in Excel.

WAPITI

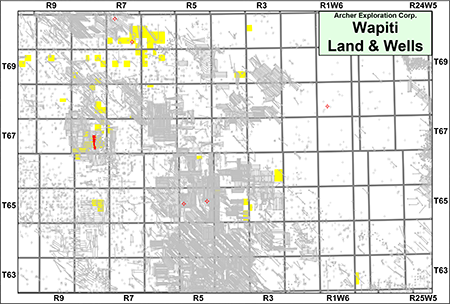

Township 63-70, Range 25 W5 - 10 W6

At Wapiti, Archer has various working interests in several sections of land. The Wapiti property is productive from the Doe Creek Formation.

In 2025 Archer drilled the multi-lateral open hole horizontal well Archer 4Hz 105 Wapiti 05/16-15-067-08W6/02 at Wapiti South. The 16-15 well was brought on production in September of 2025 and is tied into Whitecap’s multi-well battery at 13-05-067-08W6.

Archer sees a path to grow the Wapiti property from its current production to over 4,000 boe/d (2,300 boe/d of oil) by 2031 through drilling between 2 to 4 wells per year (using the 2-mile frac’d model).

Average daily sales production net to Archer from Wapiti for the year ended December 31, 2025 was approximately 249 boe/d, consisting of 185 bbl/d of oil and natural gas liquids and 385 Mcf/d of natural gas. The average production from Wapiti is annualized from the fourth quarter of 2025.

Operating income net to Archer from Wapiti for the quarter ended December 31, 2025 was approximately $3.9 million on an annualized basis.

At Wapiti, Archer has various working interests in several sections of land. The Wapiti property is productive from the Doe Creek Formation.

In 2025 Archer drilled the multi-lateral open hole horizontal well Archer 4Hz 105 Wapiti 05/16-15-067-08W6/02 at Wapiti South. The 16-15 well was brought on production in September of 2025 and is tied into Whitecap’s multi-well battery at 13-05-067-08W6.

Archer sees a path to grow the Wapiti property from its current production to over 4,000 boe/d (2,300 boe/d of oil) by 2031 through drilling between 2 to 4 wells per year (using the 2-mile frac’d model).

Average daily sales production net to Archer from Wapiti for the year ended December 31, 2025 was approximately 249 boe/d, consisting of 185 bbl/d of oil and natural gas liquids and 385 Mcf/d of natural gas. The average production from Wapiti is annualized from the fourth quarter of 2025.

Operating income net to Archer from Wapiti for the quarter ended December 31, 2025 was approximately $3.9 million on an annualized basis.

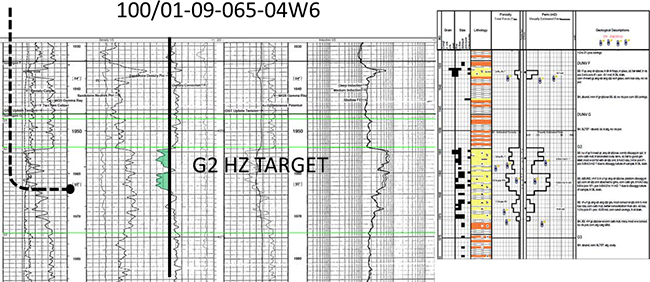

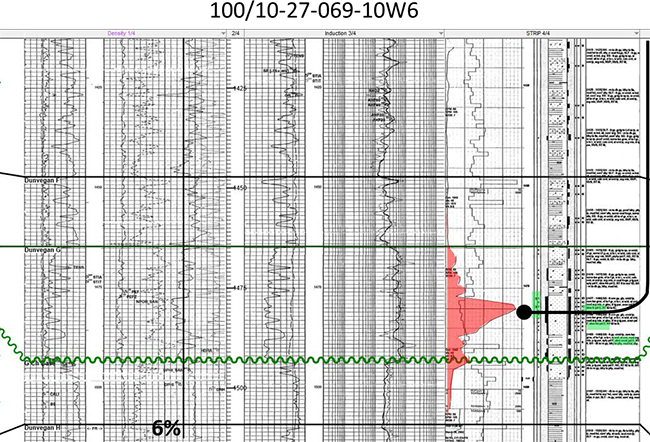

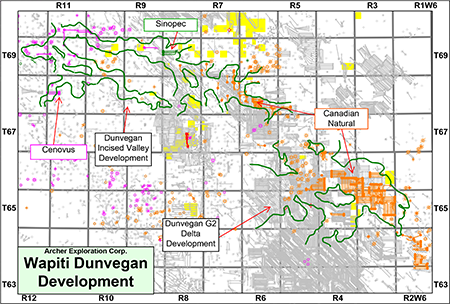

Dunvegan Upside

Archer has identified Dunvegan potential in incised valley development offsetting its lands at Wapiti North and Dunvegan G2 Delta near its lands in Township 65-66, Range 3-5W6.

Archer has identified Dunvegan potential in incised valley development offsetting its lands at Wapiti North and Dunvegan G2 Delta near its lands in Township 65-66, Range 3-5W6.

Several operators including Canadian Natural, Cenovus Energy Inc. and Sinopec Canada Energy Ltd. are developing the Dunvegan offsetting the Company’s lands as shown on the following map.

Wapiti South Upside

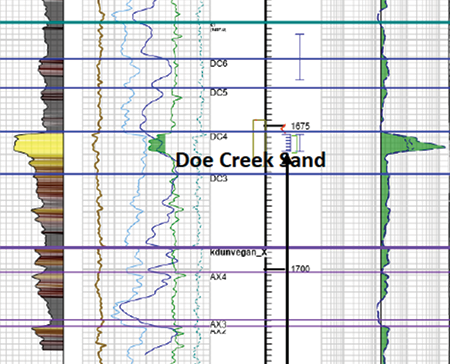

Logs from the key well Husky Wapiti 00/06-14-067-08W6/00 show the Doe Creek Formation at Wapiti South is found at depths between 1,650-1,700 metres TVD.

The reservoir is a high energy shoreface sand with between 3-4 metres of net pay. Porosity ranges between 9-15% and permeability ranges from 1-10 mD. The target zone contains light, sweet 42° API oil.

Logs from the key well Husky Wapiti 00/06-14-067-08W6/00 show the Doe Creek Formation at Wapiti South is found at depths between 1,650-1,700 metres TVD.

The reservoir is a high energy shoreface sand with between 3-4 metres of net pay. Porosity ranges between 9-15% and permeability ranges from 1-10 mD. The target zone contains light, sweet 42° API oil.

The Company drilled the Archer 4Hz 105 Wapiti 05/16-15-067-08W6/02 discovery well as a multi-lateral open hole test proving a new light oil pool horizon with less than 1% water cut.

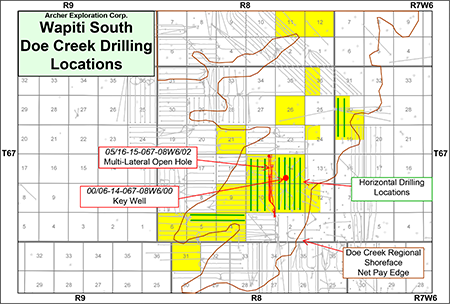

Archer has identified 12 drilling locations on its lands at Wapiti South, as shown on the following map.

The future wells are planned as single lateral, 2 mile, frac’d horizontals. The Company also believes there is potential for waterflood in the Doe Creek pool.

Archer has identified 12 drilling locations on its lands at Wapiti South, as shown on the following map.

The future wells are planned as single lateral, 2 mile, frac’d horizontals. The Company also believes there is potential for waterflood in the Doe Creek pool.

Wapiti North Upside

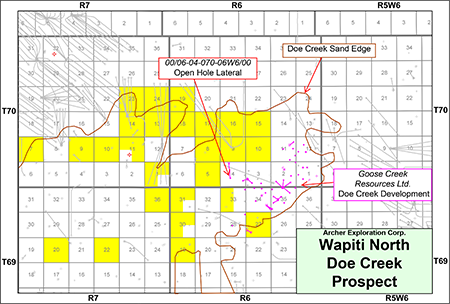

The Company has identified drilling potential in the Doe Creek Formation in over 13 low-risk sections of land at Wapiti North. The reservoir is found at depths of approximately 1,100 -1,150 m TVD with net pay of 1.5 – 2.5 m. Porosity ranges between 9-15% and permeability ranges from 1-10 mD. The target zone is prospective for light, sweet oil.

As shown on the following map, the Doe Creek pool offsetting the Company’s lands at Wapiti has been developed with vertical wells by Goose Creek Resources Ltd. Goose Creek acquired the sweet, Doe Creek oil pool in 2020. The pool is currently under waterflood.

The Company has identified drilling potential in the Doe Creek Formation in over 13 low-risk sections of land at Wapiti North. The reservoir is found at depths of approximately 1,100 -1,150 m TVD with net pay of 1.5 – 2.5 m. Porosity ranges between 9-15% and permeability ranges from 1-10 mD. The target zone is prospective for light, sweet oil.

As shown on the following map, the Doe Creek pool offsetting the Company’s lands at Wapiti has been developed with vertical wells by Goose Creek Resources Ltd. Goose Creek acquired the sweet, Doe Creek oil pool in 2020. The pool is currently under waterflood.

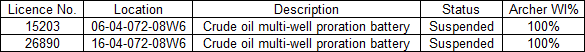

Wapiti Facilities

The Company does not have an interest in any facilities at Wapiti.

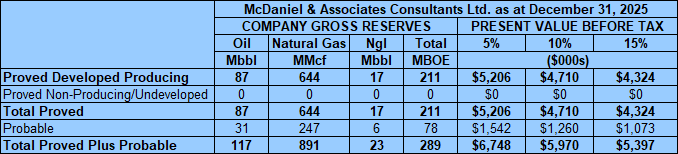

Wapiti Reserves

The McDaniel Report related to Wapiti is preliminary. McDaniel estimated that, as at December 31, 2025, using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at January 1, 2026, the Wapiti property contained remaining proved plus probable reserves of 140,000 barrels of oil and natural gas liquids and 891 MMcf of natural gas (289,000 boe), with an estimated net present value of $6.0 million using forecast pricing at a 10% discount.

The Company does not have an interest in any facilities at Wapiti.

Wapiti Reserves

The McDaniel Report related to Wapiti is preliminary. McDaniel estimated that, as at December 31, 2025, using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at January 1, 2026, the Wapiti property contained remaining proved plus probable reserves of 140,000 barrels of oil and natural gas liquids and 891 MMcf of natural gas (289,000 boe), with an estimated net present value of $6.0 million using forecast pricing at a 10% discount.

Wapiti Liability Assessment

As of January 1, 2026, the Wapiti property had a deemed liability value of $181,363.

Wapiti Well List

Click here to download the complete well list in Excel.

As of January 1, 2026, the Wapiti property had a deemed liability value of $181,363.

Wapiti Well List

Click here to download the complete well list in Excel.

WEMBLEY

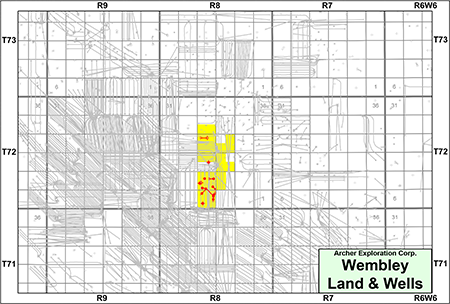

Township 72, Range 8 W6

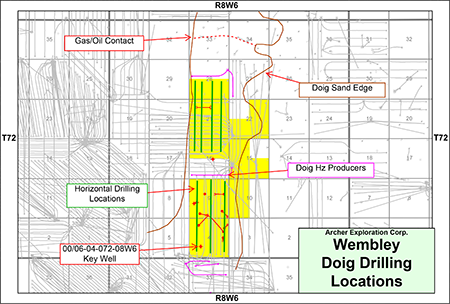

At Wembley, Archer holds a 100% working interest in the Doig G Pool. The Wembley property is productive from the Doig Formation. The Company also has approval for a waterflood in the Wembley Doig G Pool.

Average daily sales production net to Archer from Wembley for the year ended December 31, 2025 was approximately 128 boe/d, consisting of 445 Mcf/d of natural gas and 54 bbl/d of oil and natural gas liquids.

Operating income net to Archer from Wembley for the year ended December 31, 2025 was approximately $907,000.

At Wembley, Archer holds a 100% working interest in the Doig G Pool. The Wembley property is productive from the Doig Formation. The Company also has approval for a waterflood in the Wembley Doig G Pool.

Average daily sales production net to Archer from Wembley for the year ended December 31, 2025 was approximately 128 boe/d, consisting of 445 Mcf/d of natural gas and 54 bbl/d of oil and natural gas liquids.

Operating income net to Archer from Wembley for the year ended December 31, 2025 was approximately $907,000.

Wembley Upside

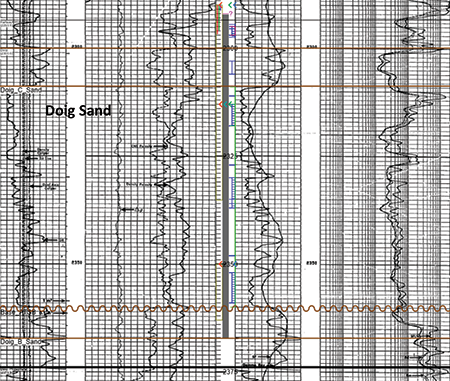

The target reservoir within the Doig Formation at Wembley consists of bars or channel sands with between 15-30 metres of net pay. Porosity ranges between 6-12% and permeability ranges from 0.1-10 mD. There is oil production from the Doig channel on offsetting lands.

The target reservoir within the Doig Formation at Wembley consists of bars or channel sands with between 15-30 metres of net pay. Porosity ranges between 6-12% and permeability ranges from 0.1-10 mD. There is oil production from the Doig channel on offsetting lands.

As shown on the following map, the Company has 6 sections of land on the Doig G Pool where it has identified 7 drilling locations on its lands, including 3 PUD locations and 4 unbooked locations.

Wembley Facilities

The Company holds working interests in the following facilities at Wembley.

The Company holds working interests in the following facilities at Wembley.

Wembley Reserves

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties (the “McDaniel Report”). The McDaniel Report is effective September 30, 2025 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at October 1, 2025.

Archer used the data from the McDaniel Report to prepare reports on the Properties. The economic runs prepared by McDaniel for the wells in the individual packages were grouped into the respective Properties by Archer.

Archer/McDaniel estimated that, as at September 30, 2025, the Wembley property contained remaining proved plus probable reserves of 1.8 million barrels of oil and natural gas liquids and 4.7 Bcf of natural gas (2.6 million boe), with an estimated net present value of $23.6 million using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties (the “McDaniel Report”). The McDaniel Report is effective September 30, 2025 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at October 1, 2025.

Archer used the data from the McDaniel Report to prepare reports on the Properties. The economic runs prepared by McDaniel for the wells in the individual packages were grouped into the respective Properties by Archer.

Archer/McDaniel estimated that, as at September 30, 2025, the Wembley property contained remaining proved plus probable reserves of 1.8 million barrels of oil and natural gas liquids and 4.7 Bcf of natural gas (2.6 million boe), with an estimated net present value of $23.6 million using forecast pricing at a 10% discount.

Wembley Liability Assessment

As of January 1, 2026, the Wembley property had a deemed liability value of $2.0 million.

Wembley Well List

Click here to download the complete well list in Excel.

As of January 1, 2026, the Wembley property had a deemed liability value of $2.0 million.

Wembley Well List

Click here to download the complete well list in Excel.

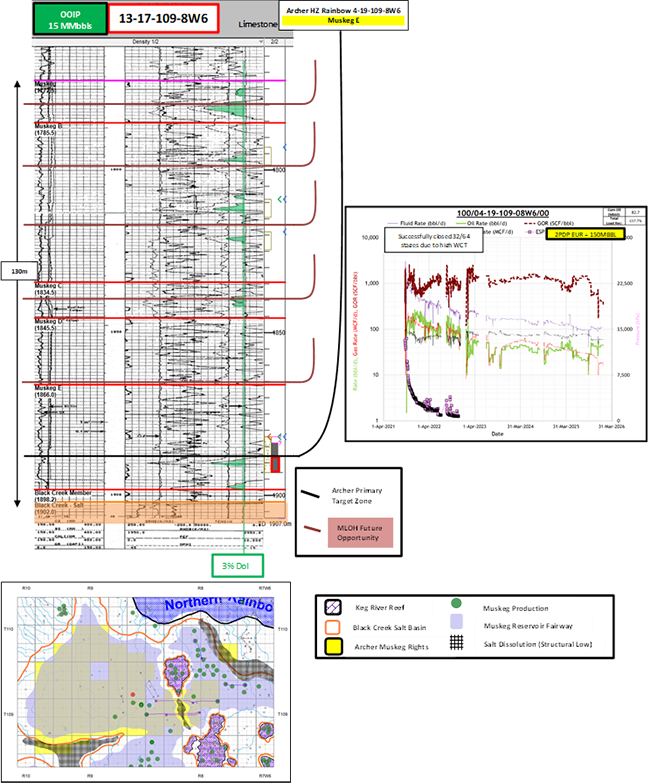

RAINBOW LAKE

Township 109-110, Range 7-9 W6

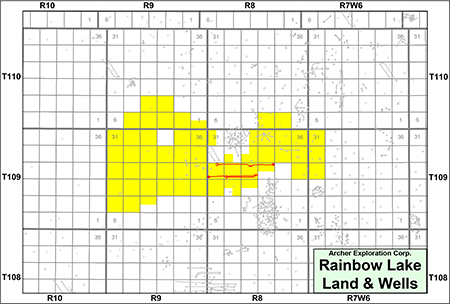

At Rainbow Lake, Archer holds a 100% working interests in 50 sections of land on which there are seven wells. Oil and natural gas production at Rainbow Lake is from the Muskeg Formation. Archer is currently producing light oil from two horizontal multi-stage frac’d Muskeg wells and one drilled uncompleted well at 102/15-19-109-08W6. Emulsion from Rainbow Lake is tied into the multi-well battery operated by Cenovus at 10-10-109-08W6.

Average daily sales production net to Archer from Rainbow Lake for the year ended December 31, 2025 was approximately 46 bbl/d of oil.

Operating income net to Archer from Rainbow Lake for the year ended December 31, 2025 was approximately $531,000.

At Rainbow Lake, Archer holds a 100% working interests in 50 sections of land on which there are seven wells. Oil and natural gas production at Rainbow Lake is from the Muskeg Formation. Archer is currently producing light oil from two horizontal multi-stage frac’d Muskeg wells and one drilled uncompleted well at 102/15-19-109-08W6. Emulsion from Rainbow Lake is tied into the multi-well battery operated by Cenovus at 10-10-109-08W6.

Average daily sales production net to Archer from Rainbow Lake for the year ended December 31, 2025 was approximately 46 bbl/d of oil.

Operating income net to Archer from Rainbow Lake for the year ended December 31, 2025 was approximately $531,000.

Rainbow Lake Upside

Archer has identified drilling and completion upside in the Muskeg, Jean Marie and Keg River formations within the Black Creek Salt basin.

Jean Marie Formation

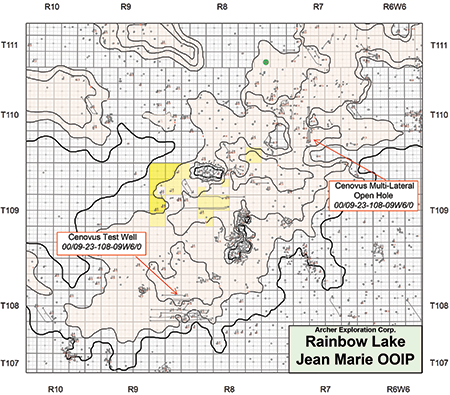

The Jean Marie Formation consists of a regional shallow water platform reservoir that is 8 m to 10 m thick. The target zone is found at depths between 800-1,100 m and contains estimated oil in place of between 1 MMbbl to 4 MMbbl per section as shown on the following map.

Cenovus has analogous operations near Archer’s lands. A horizontal Rainbow test well was drilled, Husky Hz Rainbow 00/09-23-108-09W6/0, which has produced 24.5 Mbbl to date. The multi-lateral open hole well at Husky Rainbow 08-08-110-07W6 was also drilled and tested in the Jean Marie, as shown on the following map.

Archer has identified drilling and completion upside in the Muskeg, Jean Marie and Keg River formations within the Black Creek Salt basin.

Jean Marie Formation

The Jean Marie Formation consists of a regional shallow water platform reservoir that is 8 m to 10 m thick. The target zone is found at depths between 800-1,100 m and contains estimated oil in place of between 1 MMbbl to 4 MMbbl per section as shown on the following map.

Cenovus has analogous operations near Archer’s lands. A horizontal Rainbow test well was drilled, Husky Hz Rainbow 00/09-23-108-09W6/0, which has produced 24.5 Mbbl to date. The multi-lateral open hole well at Husky Rainbow 08-08-110-07W6 was also drilled and tested in the Jean Marie, as shown on the following map.

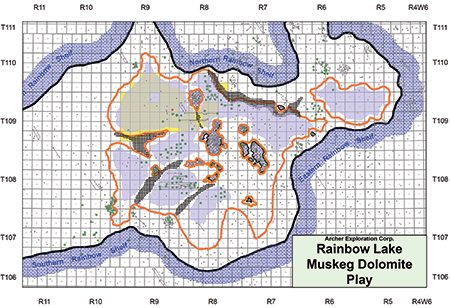

Muskeg Formation

The Company’s existing oil production at Rainbow Lake is from the Muskeg Formation. Archer has one drilled uncompleted location at 100/15-19-109-08W6. Archer has also identified upside in the existing inventory and there is also multiple zone upside utilizing multi-lateral open hole wells off existing surfaces.

The Muskeg Formation consists of five to seven stacked prospective development intervals 140 m thick which overlies the Black Creek Salt.

The Company’s existing oil production at Rainbow Lake is from the Muskeg Formation. Archer has one drilled uncompleted location at 100/15-19-109-08W6. Archer has also identified upside in the existing inventory and there is also multiple zone upside utilizing multi-lateral open hole wells off existing surfaces.

The Muskeg Formation consists of five to seven stacked prospective development intervals 140 m thick which overlies the Black Creek Salt.

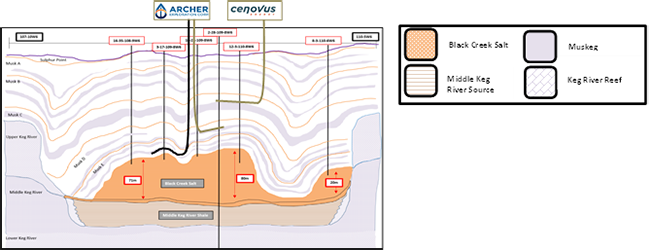

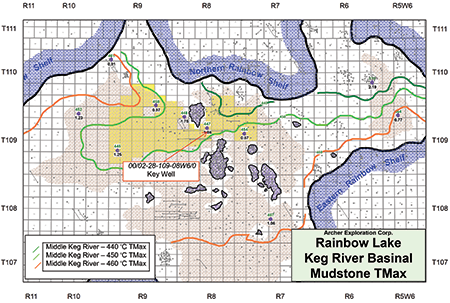

Keg River Formation

Archer has identified an exploration prospect existing in the Keg River Sub Basin. The basin possesses analogous reservoir characteristics to the East Shale Duverney. The Pre-Salt reservoir is an unconventional hybrid resource play targeting a low porosity carbonate within a self sourced system.

The Middle Keg River basinal mudstone with anoxic organic rich (carbonate 1-3% total organic content) was deposited within the Rainbow Sub-basin.

The well Husky Mobil Rainbow 100/02-28-109-08W6/0 is a key oil test as shown on the following map.

Archer has identified an exploration prospect existing in the Keg River Sub Basin. The basin possesses analogous reservoir characteristics to the East Shale Duverney. The Pre-Salt reservoir is an unconventional hybrid resource play targeting a low porosity carbonate within a self sourced system.

The Middle Keg River basinal mudstone with anoxic organic rich (carbonate 1-3% total organic content) was deposited within the Rainbow Sub-basin.

The well Husky Mobil Rainbow 100/02-28-109-08W6/0 is a key oil test as shown on the following map.

Rainbow Lake Facilities

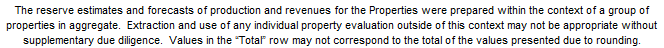

The Company holds working interests in the following facilities at Rainbow Lake.

The Company holds working interests in the following facilities at Rainbow Lake.

Rainbow Lake Reserves

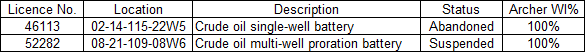

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties (the “McDaniel Report”). The McDaniel Report is effective September 30, 2025 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at October 1, 2025.

Archer used the data from the McDaniel Report to prepare reports on the Properties. The economic runs prepared by McDaniel for the wells in the individual packages were grouped into the respective Properties by Archer.

McDaniel estimated that, as at September 30, 2025, the Rainbow Lake property contained remaining proved plus probable reserves of 53,000 barrels of oil, with an estimated net present value of $899,000 using forecast pricing at a 10% discount.

McDaniel & Associates Consultants Ltd. (“McDaniel”) prepared an independent reserves evaluation of the Properties (the “McDaniel Report”). The McDaniel Report is effective September 30, 2025 using an average of GLJ Ltd., McDaniel, and Sproule ERCE’s forecast pricing as at October 1, 2025.

Archer used the data from the McDaniel Report to prepare reports on the Properties. The economic runs prepared by McDaniel for the wells in the individual packages were grouped into the respective Properties by Archer.

McDaniel estimated that, as at September 30, 2025, the Rainbow Lake property contained remaining proved plus probable reserves of 53,000 barrels of oil, with an estimated net present value of $899,000 using forecast pricing at a 10% discount.

Rainbow Lake Liability Assessment

As of January 1, 2026, the Rainbow Lake property had a deemed liability value of $745,467.

Rainbow Lake Well List

Click here to download the complete well list in Excel.

As of January 1, 2026, the Rainbow Lake property had a deemed liability value of $745,467.

Rainbow Lake Well List

Click here to download the complete well list in Excel.

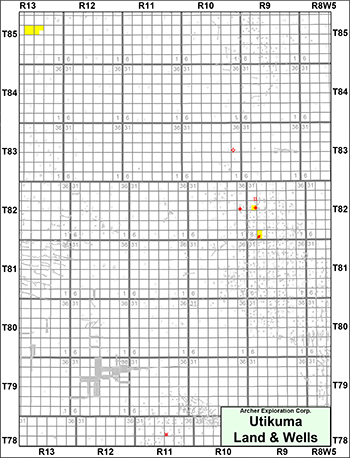

UTIKUMA

Township 78-85, Range 9-13 W5

At Utikuma, Archer holds various, non-operated, working interests in two sections of land and a GORR interest in the well 100/03-24-082-10W5/00. Archer’s wells at Utikuma are operated by Blue Sky Resources Ltd., Clear North Energy Corp., Canadian Natural and Crimson Oil & Gas Ltd. In addition, Archer operates and holds a 100% working interest in one abandoned well at 100/04-24-083-10W5/00.

There is currently no production net to Archer from Utikuma.

Operating income net to Archer from Utikuma for the year ended December 31, 2025 was approximately ($13,000).

At Utikuma, Archer holds various, non-operated, working interests in two sections of land and a GORR interest in the well 100/03-24-082-10W5/00. Archer’s wells at Utikuma are operated by Blue Sky Resources Ltd., Clear North Energy Corp., Canadian Natural and Crimson Oil & Gas Ltd. In addition, Archer operates and holds a 100% working interest in one abandoned well at 100/04-24-083-10W5/00.

There is currently no production net to Archer from Utikuma.

Operating income net to Archer from Utikuma for the year ended December 31, 2025 was approximately ($13,000).

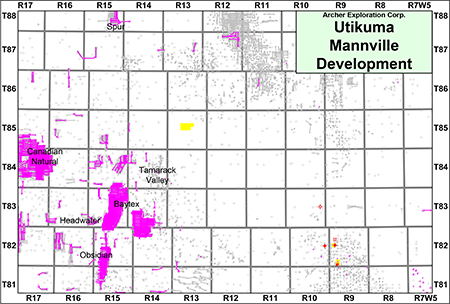

The Mannville Group is being developed primarily with multi-lateral open hole wells near the Company’s lands in Township 85-13W5 by several operators including Baytex Energy Ltd., Canadian Natural, Headwater Exploration Inc., Obsidian Energy Ltd., Spur Petroleum Ltd. and Tamarack Valley, as shown on the following map.

Utikuma Facilities

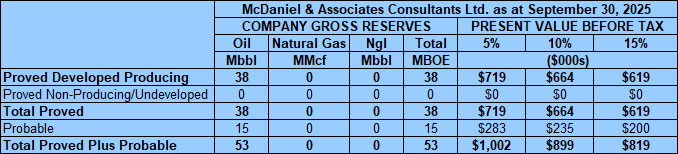

At Utikuma, the Company holds a 17.5% working interest in a suspended crude oil multi-well proration battery at 11-20-082-09W5.

Utikuma Reserves

Archer does not have a current third-party reserve report relating to the Utikuma property.

Utikuma Liability Assessment

As of January 1, 2026, the Utikuma property had a deemed liability value of $23,875.

Utikuma Well List

Click here to download the complete well list in Excel.

At Utikuma, the Company holds a 17.5% working interest in a suspended crude oil multi-well proration battery at 11-20-082-09W5.

Utikuma Reserves

Archer does not have a current third-party reserve report relating to the Utikuma property.

Utikuma Liability Assessment

As of January 1, 2026, the Utikuma property had a deemed liability value of $23,875.

Utikuma Well List

Click here to download the complete well list in Excel.

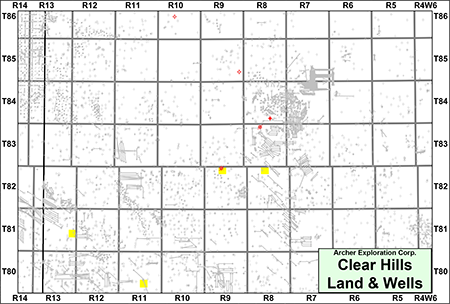

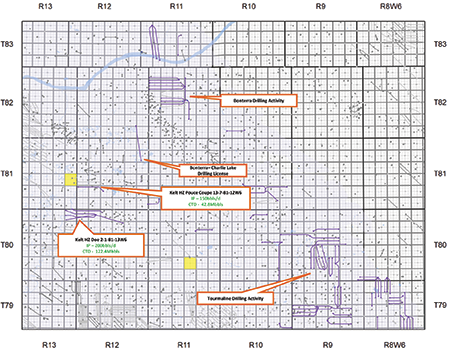

CLEAR HILLS

Township 80-86, Range 8-13 W6

At Clear Hills, Archer holds various working interests in 4 sections of land including P&NG rights in the Charlie Lake Formation in 2 sections. The Clear Hills property is prospective for light oil from the Lower Charlie Lake.

There is currently no production net to Archer from Clear Hills.

Operating income net to Archer from Clear Hills for the year ended December 31, 2025 was approximately ($4,000).

At Clear Hills, Archer holds various working interests in 4 sections of land including P&NG rights in the Charlie Lake Formation in 2 sections. The Clear Hills property is prospective for light oil from the Lower Charlie Lake.

There is currently no production net to Archer from Clear Hills.

Operating income net to Archer from Clear Hills for the year ended December 31, 2025 was approximately ($4,000).

As shown on the following map, there is recent Charlie Lake oil development from offsetting operators including Bonterra Energy Corp., Kelt Exploration Ltd., and Tourmaline Oil Corp.

Clear Hills Facilities

The Company does not own any facilities at Clear Hills.

Clear Hills Reserves

Archer does not have a current third-party reserve report relating to the Clear Hills property.

Clear Hills Liability Assessment

As of January 1, 2026, the Clear Hills property had a deemed liability value of $154,996.

Clear Hills Well List

Click here to download the complete well list in Excel.

The Company does not own any facilities at Clear Hills.

Clear Hills Reserves

Archer does not have a current third-party reserve report relating to the Clear Hills property.

Clear Hills Liability Assessment

As of January 1, 2026, the Clear Hills property had a deemed liability value of $154,996.

Clear Hills Well List

Click here to download the complete well list in Excel.

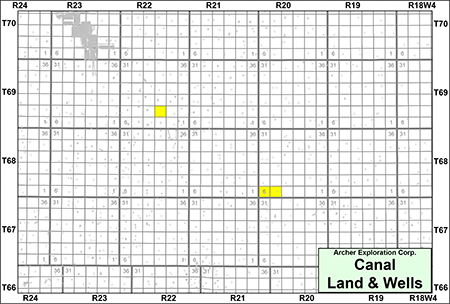

CANAL

Township 67-69, Range 20-22 W4

At Canal, Archer holds a 100% working interest in a P&NG mineral license from surface to the base of the Wabamun Group in 3 sections of land. The mineral licenses expire on October 19, 2026.

At Canal, Archer holds a 100% working interest in a P&NG mineral license from surface to the base of the Wabamun Group in 3 sections of land. The mineral licenses expire on October 19, 2026.

Canal Facilities

The Company does not have an interest in any facilities at Canal.

Canal Reserves

Archer does not have a current third-party reserve report relating to the Canal property.

Canal Liability Assessment

The Company does not operate any wells or facilities at Canal.

Canal Well List

The Company does not hold an interest any wells or facilities at Canal.

The Company does not have an interest in any facilities at Canal.

Canal Reserves

Archer does not have a current third-party reserve report relating to the Canal property.

Canal Liability Assessment

The Company does not operate any wells or facilities at Canal.

Canal Well List

The Company does not hold an interest any wells or facilities at Canal.

PROCESS & TIMELINE

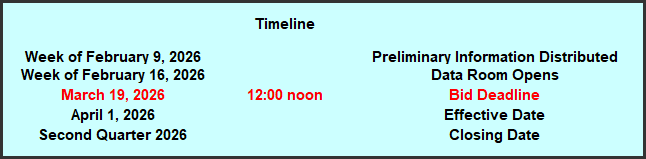

Sayer Energy Advisors is accepting cash offers to acquire the Properties until 12:00 pm on Thursday March 19, 2026.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude

transactions with the parties submitting the most acceptable proposals at the conclusion of the process.

transactions with the parties submitting the most acceptable proposals at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday March 19, 2026.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Properties with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed technical information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (tpavic@sayeradvisors.com) or fax (403.266.4467).

Included in the confidential information is the following: summary land information, the McDaniel Report, deemed liability information, most recent net operations summary, detailed facilities information and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Properties please contact Tom Pavic, Ben Rye or Sydney Birkett at 403.266.6133.