Offering Details

Back

Under Review / Asta Energy Ltd.

Asta Energy Ltd.

Property Divestiture

Property DivestitureBid Deadline: June 15, 2023

12:00 PM

Download Full PDF - Printable

OVERVIEW

Sayer Energy Advisors has been engaged to assist Asta Energy Ltd. (“Asta” or the “Company”) with the sale of its thermal oil interests located in the Kerrobert area of Saskatchewan (the “Property”).

The Property consists of a 100% working interest in approximately 15 LSDs over two sections of land which was leased for petroleum and natural gas rights in the Mannville Group.

The Property is prospective for thermal oil development in the Waseca Formation of the Upper Mannville Group. Asta believes there is approximately 30 million barrels of thermal exploitable oil in place at Kerrobert. There is no current production and no liability associated with the Property.

Further details on the Property are available in the virtual data room for parties that execute a confidentiality agreement.

The Property consists of a 100% working interest in approximately 15 LSDs over two sections of land which was leased for petroleum and natural gas rights in the Mannville Group.

The Property is prospective for thermal oil development in the Waseca Formation of the Upper Mannville Group. Asta believes there is approximately 30 million barrels of thermal exploitable oil in place at Kerrobert. There is no current production and no liability associated with the Property.

Further details on the Property are available in the virtual data room for parties that execute a confidentiality agreement.

KERROBERT

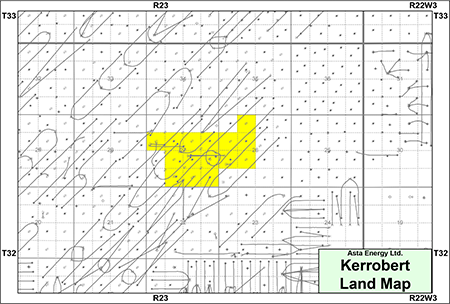

Township 32, Range 23 W3

The Property consists of three leases on 15 LSDs of land in Sections 26 & 27-032-23W3 with a 100% working interest. The leases are in primary term until June 2024 and September 2028.

The Property is 100% Freehold land. The lands in Section 26 have a 5% lessor royalty for the first six years of production for each enhanced oil recovery well, followed by 13% through to abandonment. The lands in Section 27 have a 5% lessor royalty for the first five years of production for each Cyclic Steam Stimulation (“CSS”) / Steam Assisted Gravity Drainage (“SAGD”) well, followed by 17.5% for the remaining life of the well.

There is no production from the Property. The Property is prospective for enhanced oil recovery through thermal oil development in the Waseca Formation of the Upper Mannville Group.

The Property consists of three leases on 15 LSDs of land in Sections 26 & 27-032-23W3 with a 100% working interest. The leases are in primary term until June 2024 and September 2028.

The Property is 100% Freehold land. The lands in Section 26 have a 5% lessor royalty for the first six years of production for each enhanced oil recovery well, followed by 13% through to abandonment. The lands in Section 27 have a 5% lessor royalty for the first five years of production for each Cyclic Steam Stimulation (“CSS”) / Steam Assisted Gravity Drainage (“SAGD”) well, followed by 17.5% for the remaining life of the well.

There is no production from the Property. The Property is prospective for enhanced oil recovery through thermal oil development in the Waseca Formation of the Upper Mannville Group.

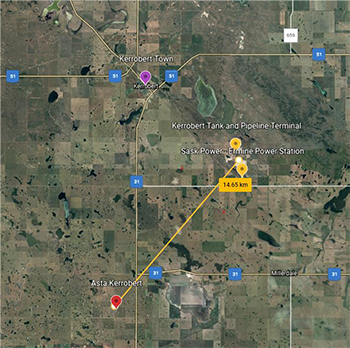

The Property is located on Freehold farmland with low environmental risk and extensive infrastructure in the area. There is an existing gravel road connecting to Highway 31 and the SaskPower grid is nearby. The Property is located 15 km from the Ermine Power Station and is in close proximity to the TransGas main natural gas line.

There are multiple options for the sale of oil from the Property. The Property is located approximately 15 km from the Kerrobert Terminal and 30 km from the Unity Terminal.

Raw water is available to be sourced from multiple formations in the area.

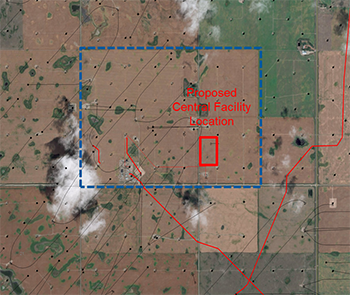

Asta has its proposed central facility location and first pad surface lease secured.

Raw water is available to be sourced from multiple formations in the area.

Asta has its proposed central facility location and first pad surface lease secured.

Waseca Geology

There are active thermal projects in the region including the adjacent Kerrobert West project of Baytex Energy Corp. which is situated in the same Waseca channel as the Property. The geological and reservoir conditions of the Property are comparable to several producing thermal assets from the Lloydminster area such as Dee Valley, Edam, Meota, Pikes Peak and Vawn.

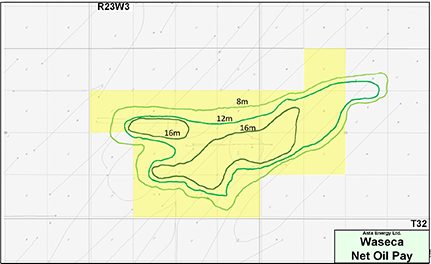

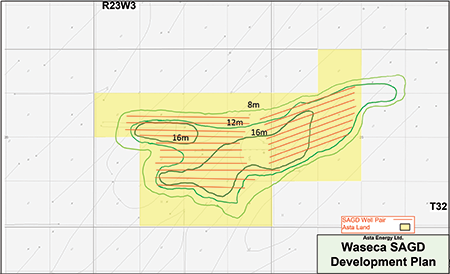

Asta has identified net pay in the Waseca Formation of eight metres and above in a continuous oil zone based on trade 3D seismic and multiple well controls on its lands. The following map shows the general net oil pay thickness of the Waseca reservoir associated with the Property.

There are active thermal projects in the region including the adjacent Kerrobert West project of Baytex Energy Corp. which is situated in the same Waseca channel as the Property. The geological and reservoir conditions of the Property are comparable to several producing thermal assets from the Lloydminster area such as Dee Valley, Edam, Meota, Pikes Peak and Vawn.

Asta has identified net pay in the Waseca Formation of eight metres and above in a continuous oil zone based on trade 3D seismic and multiple well controls on its lands. The following map shows the general net oil pay thickness of the Waseca reservoir associated with the Property.

The Company believes the net pay thickness and reservoir quality makes the Property a strong candidate for a SAGD project with expected final recovery of up to 65%, and possibly upwards of 70% to 80%.

Additional mapping, seismic interpretations and a technical presentation will be made available to parties that execute a confidentiality agreement.

Asta has identified the high-quality of the Waseca reservoir at Kerrobert by the following parameters. Average porosity of 32%, 85% oil saturation, average permeability of 6 Darcies. The oil viscosity is approximately 8,250 cp at a reservoir temperature of approximately 30°C.

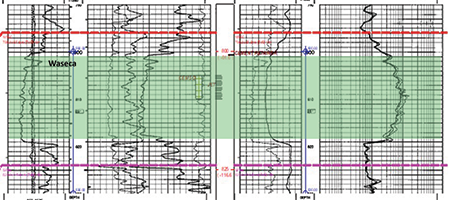

The following well logs from the well Beaumont Kerrobert D8 141/08-27-032-23W3 show the Waseca reservoir at Kerrobert.

Additional mapping, seismic interpretations and a technical presentation will be made available to parties that execute a confidentiality agreement.

Asta has identified the high-quality of the Waseca reservoir at Kerrobert by the following parameters. Average porosity of 32%, 85% oil saturation, average permeability of 6 Darcies. The oil viscosity is approximately 8,250 cp at a reservoir temperature of approximately 30°C.

The following well logs from the well Beaumont Kerrobert D8 141/08-27-032-23W3 show the Waseca reservoir at Kerrobert.

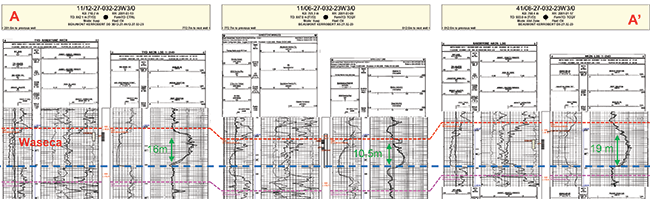

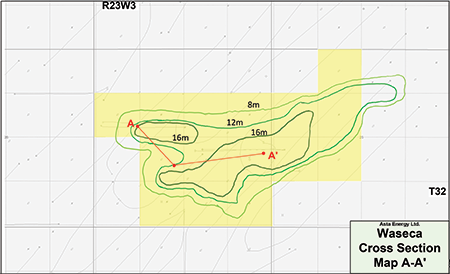

The following cross section shows the Waseca sand in the incised valley system. At Kerrobert, the Waseca reservoir has thick, continuous oil pay suitable for SAGD development.

Asta has 19 SAGD well pairs planned in the reservoir with effective pay thickness of over 10 metres. The development plan begins with three initial well pairs, sustained by drilling future SAGD well pairs.

The reservoir is also suitable for future development of CSS where pay thickness is less than eight metres. The CSS is in addition to the Company’s existing SAGD development and economic evaluation.

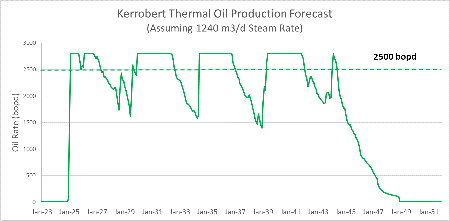

The following chart shows the projected full production life of the project spanning over more than 20 years with estimated production maintained between approximately 2,000-2,800 barrels of oil per day.

The following chart shows the projected full production life of the project spanning over more than 20 years with estimated production maintained between approximately 2,000-2,800 barrels of oil per day.

The planned central production facility could include a battery with capacity of 2,800 bbl/d of oil and steam injection capability of 1,248 m3/d.

Further details of the Company’s economic evaluation of the SAGD project are available in the virtual data room for parties that execute a confidentiality agreement.

Kerrobert Reserves

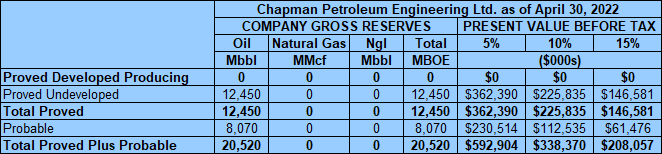

Chapman Petroleum Engineering Ltd. (“Chapman”) prepared an independent reserves evaluation of the Property (the “Chapman Report”). The Chapman Report is effective April 30, 2022 using Chapman’s May 1, 2022 forecast pricing.

Chapman estimates that, as of April 30, 2022, the Kerrobert property contained remaining proved plus probable reserves of 20.5 million barrels of heavy oil with an estimated net present value of $338.4 million using forecast pricing at a 10% discount.

Further details of the Company’s economic evaluation of the SAGD project are available in the virtual data room for parties that execute a confidentiality agreement.

Kerrobert Reserves

Chapman Petroleum Engineering Ltd. (“Chapman”) prepared an independent reserves evaluation of the Property (the “Chapman Report”). The Chapman Report is effective April 30, 2022 using Chapman’s May 1, 2022 forecast pricing.

Chapman estimates that, as of April 30, 2022, the Kerrobert property contained remaining proved plus probable reserves of 20.5 million barrels of heavy oil with an estimated net present value of $338.4 million using forecast pricing at a 10% discount.

Kerrobert Wells

The Company does not have ownership in any wells associated with the Property.

The Company does not have ownership in any wells associated with the Property.

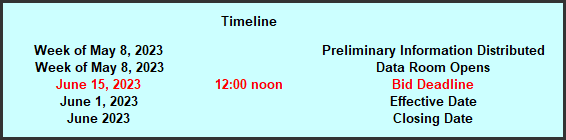

PROCESS & TIMELINE

Sayer Energy Advisors is accepting cash offers relating to acquire the Property until 12:00 pm on Thursday June 15, 2023.

Sayer Energy Advisors does not conduct a "second-round" bidding process; the intention is to attempt to conclude a

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

transaction with the party submitting the most acceptable proposal at the conclusion of the process.

Sayer Energy Advisors is accepting cash offers from interested parties until

noon on Thursday June 15, 2023.

NOTE REGARDING A SAYER PROCESS

On each and every offering brochure generated by Sayer, you will note the sentence “Sayer Energy Advisors does not conduct a “second-round” bidding process; the intention is to attempt to conclude a sale of the Property with the party submitting the most acceptable proposal at the conclusion of the process.” What this means is that Sayer will not go back to multiple parties at the same time after bids are received, asking them all for a second bid. We determine which party submitted the most acceptable proposal and then we attempt to negotiate acceptable terms with that party in a “one-off” situation.

If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

In the extremely rare circumstance where two or more parties submit virtually identical proposals, we will contact all parties, we will advise them of this situation and we will ask them to submit a revised proposal. Once these are received, we will work with the party which has submitted the most acceptable proposal.If the process involves a cash sale of a property or company and the party which submitted the most acceptable proposal has met our client’s threshold value, that offer will be accepted. If this proposal does not meet our client’s threshold value, then we will advise that party that the offer is not quite what our client was expecting, and we will ask them to increase the offer. If that offer is not acceptable to our client, we will then move down to the party which submitted the next most acceptable proposal and we will then work with that party to attempt to meet our client’s threshold value.

CONFIDENTIALITY AGREEMENT

Parties wishing to receive access to the confidential information with detailed information relating to this opportunity should execute the Confidentiality Agreement and return one copy to Sayer Energy Advisors by courier, email (brye@sayeradvisors.com) or fax (403.266.4467).Included in the confidential information is the following: summary land information, the Chapman Report and other relevant technical information.

Download Confidentiality Agreement

To receive further information on the Property please contact Ben Rye, Tom Pavic or Sydney Birkett at 403.266.6133.